Can DEGO make investing in DeFi as simple as building with Lego?

DeFi firing on all engines

The DeFi space is like a spaceship that is racing away to the moon.

Every day there are more and more projects being launched and this means a lot of things happening in the defi space.

It is like a magnet that is getting stronger and attracting more and more people to invest in the defi space.

There seem to be many opportunities however for an investor the funds are limited so you can as an investor can invest in only so many projects.

Limitations of individual retail investors

Individual investors have limited funds and not an infinite amount of financial resources so in the process of having a share of as many top performing projects as possible one ends up distributing finances into as many projects as possible.

Too much diversification can be bad.

If you are a retail investor with limited funds then though it may seem to be profitable to be invested in as many projects as possible and have a diversified approach.

This approach may be viable in other asset classes however this logical investment strategy this does not works well in the DeFi space.

This is on account of two reasons.

I) Every time you are investing in the DeFi space or indulging in providing liquidity you are paying Gas fee which is a direct function of the Ethereum price.

So every time the ethereum price goes up so does the gas fee.

This gas fee goes towards validating your transaction as most DeFi projects are built over the Ethereum network and involve a transaction or gas fee.

This greatly limits small investments in the DeFi space.

II) Another drawback is that most people make profits in the DeFi space by providing liquidity to the liquidity pool.

For an investor putting liquidity into the pool the returns on investment are proportional to the amount of liquidity you put in .

So that an investor A who provides 40% liquidity to the pool earns a lot more than a small investor B who puts in 1% of liquidity.

DEGO is here to fix this all

If you notice the word DEGO sounds similar to the word Lego. The same game we all are familiar as the tile game where one can use simple unassuming tiles to build complex structures.

DEGO is the Lego of the DeFi space.

Just like lego DEGO uses a tiled or modular approach to help build a DeFi project in a modular manner.

You keep adding modules and come up with more complex DeFi solutions with ease.

By doing this DEGO helps better design and build projects in the DeFi space.

From the investors perspective it gives a more level playing field.

DEGO says small investors should earn as well

To see how DEGO resolves this issue first we need to see how a return is calculated in a conventional liquidity pool.

Here is how the daily earning is calculated for a conventional DeFi liquidity mining pool.

Daily output per user = daily output of the mining pool X staked amount/total staked amount

So clearly it can be seen that the big whales who invest more money would get more returns.

This means the rich fat whales keep getting richer and the small players who provide the bulk of the liquidity in a small chunks may not be getting much because of the way the returns are calculated and distributed.

Another aspect is that since the whales get more returns they also would control the selling price and this can have a detrimental effect on the small players who are at an disadvantage at all levels.

The DEGO balanced approach

The DEGO projects takes a very different approach.

Here

DEGO uses a deterministic algorithms for liquidity mining.

Here the LP tokens staked by a user converted into Power that can be seen similar to the hash power of Bitcoin mining.

The Daily mining per user is calculated as follows

Daily output per user = daily output of the mining pool X POWER / total POWER

In this algorithm the Power is calculated as

POWER = staked LP token amount X coefficient of correspondence

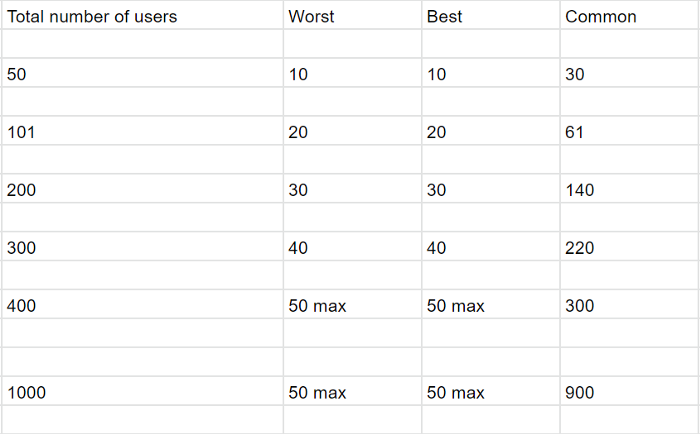

The calculation of power is done by dividing the users in three groups according to their level of stake.

Accordingly the groups are a s follows.

- Worst range: These users with the most stakes

for them the powers is calculated as

POWER=1 X the staked amount

- Best Range : Users with intermediate staked amount

here

POWER=5 X the staked amount - The Common range: Users with smallest range.

Here

POWER= 3 X the staked amount

For example, User A staked 10 LP Tokens and is currently in the common range, then his POWER is 10 X 3 = 30 POWER

The numbers of the initial three ranges are, [10, 10, total number-20]

As the total number of users increases by 100 people, the worst range and the best range increase by 10 slots, up to a maximum of 50 people.

The below chart shows how things stack up.

In this system if a user stakes less than 3 days so a 10% deduction is made from his earnings.

This deduction is transferred to the liquidity pool.

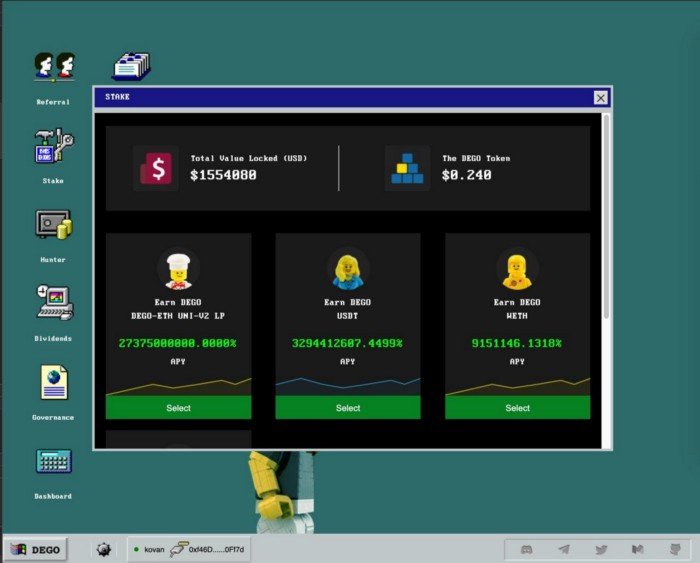

DEGO Liquidity Mining Pool

- The DEGO Liquidity Mining Pool opens to the public on 16th September 1 PM UTC

- DEGO total supply :

21 Million

80% Minted out by liquidity mining.

Total Token supply: 21, 000, 000 DEGO

Mining supply: 16,800,000 DEGO

Halving period: 1 week

Diego Mining pools

Pool 1

- USDT

miners can stake USDT using yje Dego Dapp dego.finance.

The resulting rewards are paid in DEGO tokens.

525,000 DEGO will be released during the first week. a 50% weekly halving mechanism will be implemented from the second week.

USDT address : 0xdAC17F958D2ee523a2206206994597C13D831ec7

- WETH

This is the Wrap ETH or WETH pool where users stake WETH to farm DEGO

5% of the Mining pool (1,050,000 DEGO)

DEGO will be released during the first week. a 50% weekly halving mechanism will be implemented from the second week.

WETH address: 0xC02aaA39b223FE8D0A0e5C4F27eAD9083C756Cc2

Pool 2

Users would first obtain the UNI-V2 LP tokens by swapping ETH & DEGO and stake LP tokens to get DEGO rewards.

20% of the Mining Pool that is 4200000 DEGO would be released within the first week and 50% weekly halving gets implemented from week 2.

Uniswap address

Uniswap V2 address: 0x23f7D99C169dEe26b215EdF806DA8fA0706C4EcC

For info about mining mechanism refer

- 5% of mining reward goes to team and 10% allocated to promoter (referral program)

- For users claiming rewards within 3 days the time gets recalculated and 10% of mining rewards are deducted and get transferred to the mining pool.

- A user can use the transfer interface for initiating a smart contract.

For this a 5% trading fee gets deducted.

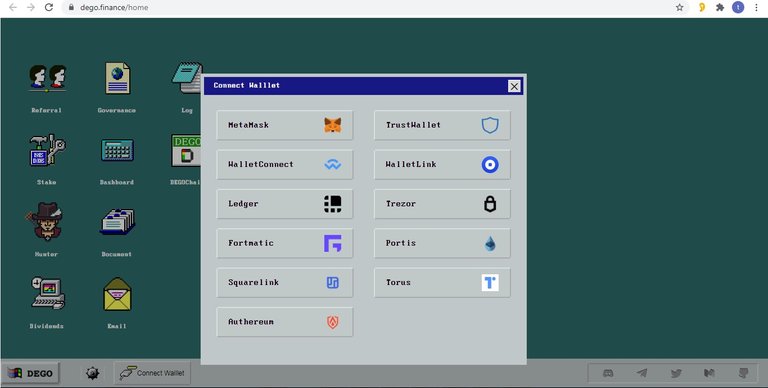

2.5% of this gets destroyed and 2.5% goes to the dividend pool. - To participate one can visit the project site https://dego.finance and and click stake to start the process.

For more info refer the links

https://dego.finance/home

https://twitter.com/Dego_Fi

https://t.me/dego_finance

https://medium.com/@Dego.finance

https://discord.com/invite/xJjSJrd

https://github.com/dego-labs

Disclaimer

Please do your own due diligence and research before making an investment.

The purpose of this post is for education purpose only. It is not financial advice.

If you are interested in earning some extra income

Easy free Crypto money site method even grandma can do

Or wanna try your luck?

Win a lambo Get free crypto or More?