🗞 Daily Crypto News, July, 4th 💰

- Bitcoin’s Price Correlation With S&P 500 Hits Record Highs;

- Ethereum DeFi Broke Records in June, But Other Categories Are Suffering;

- How CBDCs Might Change Our Daily Payments;

- Ripple Likely Sold XRP in an Unregistered Securities Offering;

- Coinbase Custody to Support Secure Cardano Staking This Year;

- 🗞 Daily Crypto Calendar, July, 4th 💰

Welcome to the Daily Crypto News: A complete Press Review, Coin Calendar and Trading Analysis. Enjoy!

🗞 Bitcoin’s Price Correlation With S&P 500 Hits Record Highs

An on-chain metric which has been declining since 2017 is now signaling a bullish trend, analysts from Stack Funds say.

Ever since its inception, bitcoin has been dubbed “digital gold,” given it is durable, fungible, divisible and scarce like the precious metal.

However, while gold has a strong track record of rallying in times of stress in the global equity markets, bitcoin is yet to build a similar reputation as a safe-haven asset.

In fact, in recent months, the cryptocurrency has been increasingly correlated with the S&P 500, Wall Street’s equity index and benchmark for global stock markets. Now, data suggests that relationship is stronger than ever, likely denting its appeal as digital gold.

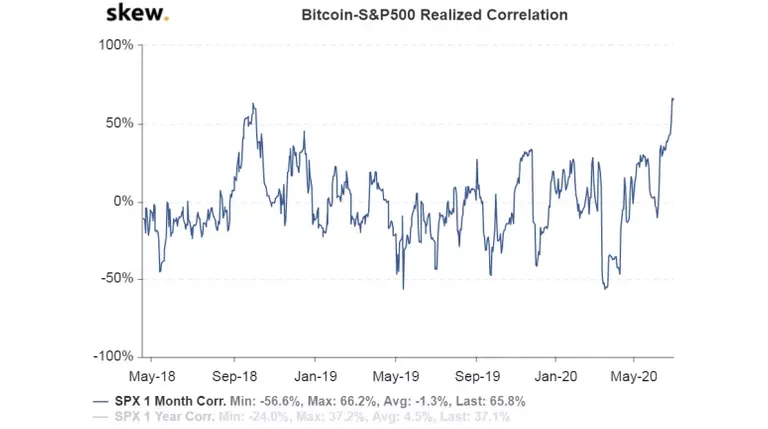

The one-month bitcoin-S&P 500 realized correlation rose to a record high of 66.2% on June 30 and stood at 65.8% on Thursday, according to crypto derivatives research firm Skew, which began tracking the data in April 2018.

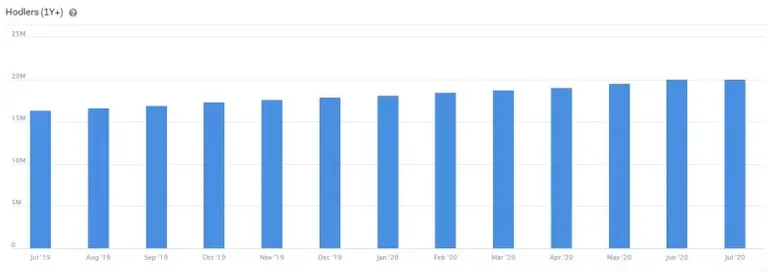

HODLing keeps rising

“HODLers” or long-term holders of bitcoin, as gauged by the number of addresses storing bitcoin for at least 12 months, rose to a lifetime high of 20.3 million in June. That surpassed the previous high of 19.52 million reached in May, as per IntoTheBlock, a blockchain intelligence company.

🗞 Ethereum DeFi Broke Records in June, But Other Categories Are Suffering

Ethereum’s 2020 DeFi boom came at the cost of its gaming ecosystem.

Results for the second quarter of 2020 show tremendous growth for decentralized applications across all ecosystems, primarily spearheaded by Ethereum (ETH) decentralized finance, or DeFi.

Decentralized exchanges were at the frontlines of the rise as Compound token mining activity trickled down to on-chain swapping solutions.

According to Our Network, Curve was one of the biggest beneficiaries of yield farming as it helped users switch between different stablecoins to maximize yield

Ethereum’s vibrant gaming DApp ecosystem suffered as fees came to represent a significant portion of each transaction. DappRadar reported a staggering 79% decline of gaming-related activity on-chain over the previous quarter.

🗞 How CBDCs Might Change Our Daily Payments

- "The only advantage of having a bank account is that it enables digital payments."

- "For regular people CBDC wallets will be treated as alternatives for card payments."

- Traceability may not be desirable for more privacy-minded consumers.

Central bank digital currencies (CBDCs) could provide consumers with cheaper and faster payments, according to experts in the cryptocurrency and blockchain industry. They’ll sidestep the need for an account with a commercial bank, and in the process will reduce many of the costs and risks that come with the commercial payment system.

In fact, CBDCs might bring more than just cheaper and more secure payments for consumers. They could also speed up cross-border payments and settlements, as well as improve money de-anonymity.

Ripple Likely Sold XRP in an Unregistered Securities Offering

The former CFTC chair’s analysis stating that Ripple’s XRP is not a security might be wrong.

In recent months, a number of class-action lawsuits have been filed against Ripple for selling its XRP token in an unregistered securities offering. So far, the United States Securities and Exchange Commission has not published any official statement on this, which has kept everyone guessing.

To help put an end to the uncertainty, Chris Giancarlo, former chairman of the Commodity Futures Trading Commission, published a paper last week arguing that Ripple’s XRP is not a security. Giancarlo is famous for helping establish the CFTC’s stance that Bitcoin (BTC) and Ether (ETH) are not securities. So, it would seem that he is the right person to be making this case.

🗞 Coinbase Custody to Support Secure Cardano Staking This Year

Cardano holders will soon be able to stake tokens securely at Coinbase Custody.

- At the Cardano Virtual Summit Friday, chief developer house IOHK announced it had signed an agreement with Coinbase Custody.

- From Q4 2020, users will be able to stake their ADA tokens from inside Coinbase's cold storage.

- In proof-of-stake blockchains, like Cardano, blocks are verified by token holders (rather than miners as with blockchains like Bitcoin), who receive rewards in return.

- Cardano's staking protocol, Shelley, is expected to come online later this month with staking rewards beginning in mid-August.

- Sam McIngvale, Coinbase Custody's head of product said their regulated product would help projects, like Cardano, find more mainstream acceptance.

- Tezos inked a similar staking agreement with Coinbase Custody in November 2019.

🗞 Daily Crypto News, July, 4th💰

- Steem (STEEM)

"Update: Blurt will launch as a newchain/airdrop to all Steem asset holders on a 1:1 basis per a snapshot of the chain..."

- Elrond (ERD)

"On the 4th of July, the precise date of the @ElrondNetwork mainnet launch will be announced & genesis staking 2.0 will begin."

- Dragonchain (DRGN)

"A groundbreaking documentary series about the rise of Dragonchain... is set to premiere on @ScienceChannel starting July 4."

"Pssst.. We have a podcast! Listen to the latest Dragonchain updates, what to expect from @opensrcmoneytv this Saturday..."

- Blockstack (STX), Bytom (BTM), Chainlink (LINK), General Event (CRYPTO), dForce (DF), Maker (MKR), Nervos Network (CKB), Qtum (QTUM), Sentinel Chain (SENC), SmartMesh (SMT), VeChain (VET)

China-Singapore Blockchain Leaders Summit 2020 from 9:30 AM - 5:20 PM on SUSS official YouTube account.

- CCUniverse (UVU)

"The show will also have the character of AMA where we will talk about our project in an interesting form."

Last Updates

- 🗞 Daily Crypto News, July, 3rd💰

- 🗞 Daily Crypto News, July, 2nd💰

- 🗞 Daily Crypto News, July, 1st💰

- 🗞 Daily Crypto News, June, 30th💰

- 🗞 Daily Crypto News, June, 29th💰

- 🗞 Daily Crypto News, June, 28th💰

- 🗞 Daily Crypto News, June, 27th💰

- 🗞 Daily Crypto News, June, 26th💰

- 🗞 Daily Crypto News, June, 25th💰

- 🗞 Daily Crypto News, June, 24th💰

- 🗞 Daily Crypto News, June, 23rd💰

- 🗞 Daily Crypto News, June, 22nd💰

- 🗞 Daily Crypto News, June, 21st💰

- 🗞 Daily Crypto News, June, 20th💰

- 🗞 Daily Crypto News, June, 19th💰

➡️ Publish0x

➡️ UpTrennd

➡️ Minds

➡️ Hive

➡️ Twitter

➡️ Facebook

➡️ Be paid daily to browse with Brave Internet Browser

➡️ A secure and easy wallet to use: Atomic Wallet

Proud member of:

Helps us by delegating to @hodlcommunity

Make a good APR Curation by following our HIVE trail here

Ethereum is trying to break bounds really I think it'll be huge. I hope hive can begin to up the ante soon

I believe this whole DeFi thing is good for adoption and innovation but it took a toll on ETH's network before it moved to PoS and the network is suffering.

The game I used to play on ETH (Gods Unchained) does not allow you to transact/make new cards for the past 6 weeks ! Can you imagine? This is also slowing other parts of the ETH ecosystem.

Let's hope the end of July ETH 2.0 will fix this

this correlation between btc and s&p 500 was always there but now it is really increasing i think that'a a good sign now it will be easier for us to predict both markets together, and bitcoin will also establish same repute like gold very soon

Easier to predict indeed, but therefore Bitcoin's narrative about "digital gold" and anti-fragile assets (as opposed to stock markets) is dying.

I believe this is the WORST thing that could have happened to BTC. It makes it useless if it is totally correlated with Financial Markets.

This is just my opinion :D

Hum, that doesn't seem to be true, it's actually very recent:

No, the whole value proposition of BTC is to be a safe haven asset that's uncorrelated to other assets (like gold)...

Interesting, DeFi definitely stole the limelight there

Indeed, quite worrisome actually...

Worrisome, how so?