🗞 Daily Crypto News, June, 16th 💰

- Bitcoin Prices Closely Linked to Big US Tech Stock?;

- $930M in Bitcoin Options Expire Next Friday — Time to Worry?;

- Bitcoin Price Drop to $8.9K Caused by Whales Selling at Major Exchanges;

- Search Interest for Bitcoin Highest in Africa and South America;

- UK Fintech Bank Revolut Will Give Customers ‘Legal’ Ownership Over Cryptos – But With a Caveat

- 🗞 Daily Crypto Calendar, June, 16th 💰

Welcome to the Daily Crypto News: A complete Press Review, Coin Calendar and Trading Analysis. Enjoy!

🗞 Bitcoin Prices Closely Linked to Big US Tech Stock?

A fund manager has opined that there is a strong correlation between bitcoin (BTC) prices and the value of stocks in some of the United States most powerful IT giants – but warned that, like big tech stock, BTC might have to wait until the coronavirus pandemic has died down before its next big upward movement.

Charlie Morris, a fund manager at Atlantic House, shared data that appears to demonstrate a close relationship between the price of bitcoin and the share price of tech companies often referred to as FAANG (Facebook, Apple, Amazon, Netflix, Google).

In the analyst’s view, however, the current macro backdrop is now more favorable to traditional value stocks than it is to growth-focused tech stocks, which have outperformed in the stock market for some time.

And as bitcoin trades a lot like a tech stock, it may not be time for BTC to break above the key USD 10,000 mark just yet, Morris opined.

He wrote,

“I suspect we will get the bitcoin breakout, but not until the post-COVID recovery is complete, and the FANGS resume their upward journey. […] There is no rush. As the market saying goes, the longer the wait, the bigger the break.”

🗞 $930M in Bitcoin Options Expire Next Friday — Time to Worry?

Much attention has been paid to the Bitcoin options and futures market and each week crypto media reports on new record open interest figures being achieved. As the date of another futures and options expiry approaches, traders are becoming anxious due to the fact that the Bitcoin (BTC) price has consistently failed to surpass the $10K mark.

To date more than 100,000 Bitcoin options totaling $930 million are set to expire on June 26 totaling and this figure represents nearly 70% of its entire open interest. On June 15 Bitcoin price pulled back to $8,900 and this led investors to question whether professional traders have turned bearish as the June 26 expiry date approaches.

Although open interest doesn’t allow one to predict a market trend, it is possible to gain more insight by analyzing additional data such as the put/call ratio. This indicator provides a clear picture of investors’ sentiment as call options are mostly used for bullish strategies.

🗞 Bitcoin Price Drop to $8.9K Caused by Whales Selling at Major Exchanges

As the weekly open commenced Bitcoin price dropped below $9,000 in a rapid pullback, liquidating $30 million in longs on BitMEX alone. According to market data, part of the sell off was the movement of crypto whales closing positions which led to panic selling among retail investors.

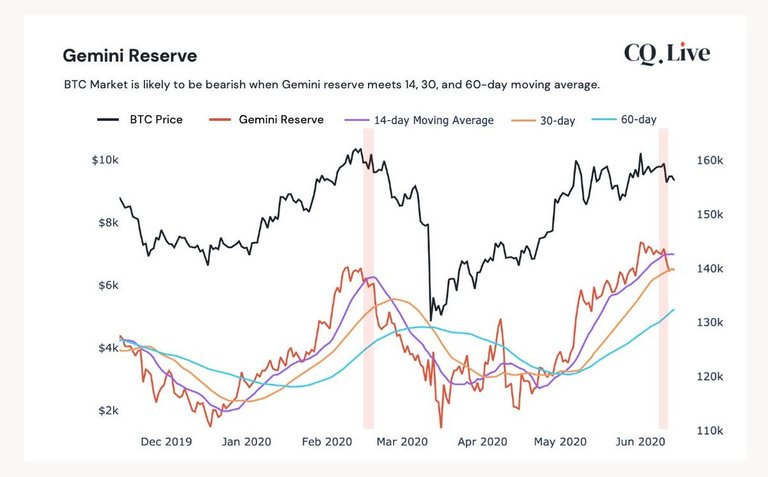

Whales—individual investors that hold an immense amount of Bitcoin—have the ability to significantly impact the price of BTC and according to on-chain data provider CryptoQuant, the recent selling is indicative of the start of a bear trend within the market.

Ki Young Ju, CEO of CryptoQuant, said:

“The BTC reserve at Gemini hit a year-high a few days ago, and then it started to decrease. This could be a local buying opportunity in the short-term, but in the macro-view, the reserve trend seems to go downward.”

🗞 Search Interest for Bitcoin Highest in Africa and South America

Google Trends data compiled by Blockchaincenter.net shows search interest in Bitcoin is highest in Kenya and Brazil.

An interactive map showing the level of cryptocurrency interest worldwide reveals that Bitcoin searches are most concentrated in countries in Africa and South America.

According to the map published at Blockchaincenter.net, Google Trends data shows that Bitcoin (BTC) dominates search interest in Africa. 94.7% of all searches related to cryptocurrencies—including BTC, Bitcoin Cash (BCH), Cardano (ADA), Dogecoin (DOGE), Ethereum (ETH), IOTA, Litecoin (LTC), Monero (XMR), XRP, and Tron (TRX)—in Kenya are for Bitcoin, while Nigeria and South Africa had high percentages of 89.4% and 89%, respectively.

🗞 UK Fintech Bank Revolut Will Give Customers ‘Legal’ Ownership Over Cryptos – But With a Caveat

Fintech bank Revolut will give its users legal control of their cryptocurrencies on July 27, but the U.K.-based bank is tightening its hold on how they can actually wield it.

Revealing twin policy changes in an email sent to users and obtained by CoinDesk Monday, the mobile bank said it will cede its status as the “legal owner” of Revolut’s five available cryptos – bitcoin, ether, litecoin, XRP and bitcoin cash – over to its clients who purchase them next month.

There is a catch, though: that crypto still cannot leave Revolut’s client ecosystem.

Users “can’t transfer cryptocurrency to anyone who is not a Revolut customer,” the updated terms and conditions read, detailing that while users “have complete control” of their crypto, they “will not be able to carry out transactions” themselves.

🗞 Daily Crypto News, June, 16th💰

- TRON (TRX)

"#TRON Core Devs Meeting 7 will be held on Tuesday, 16 Jun 2020, 9:00 AM UTC."

- Bancor (BNT)

"Attention Devs: In prep for #BancorV2, Bancor v0.6 contracts will be deployed to Mainnet Tues. June 16, 2020 12pm GMT."

- Grin (GRIN)

Release of grin, grin-wallet, grin-miner binaries.

- Ardor (ARDR)

"Ardor v2.3.0e will be released next Tuesday!"

- Zilliqa (ZIL)

"Get read y India! @maqstik will be joining the @bitbns community for an #AMA this Tuesday!"

Last Updates

- 🗞 Daily Crypto News, June, 14th💰

- 🗞 Daily Crypto News, June, 14th💰

- 🗞 Daily Crypto News, June, 13th💰

- 🗞 Daily Crypto News, June, 12th💰

- 🗞 Daily Crypto News, June, 11th💰

- 🗞 Daily Crypto News, June, 10th💰

- 🗞 Daily Crypto News, June, 9th💰

- 🗞 Daily Crypto News, June, 8th💰

- 🗞 Daily Crypto News, June, 7th💰

- 🗞 Daily Crypto News, June, 6th💰

- 🗞 Daily Crypto News, June, 5th💰

➡️ Publish0x

➡️ UpTrennd

➡️ Minds

➡️ Hive

➡️ Twitter

➡️ Facebook

➡️ Be paid daily to browse with Brave Internet Browser

Proud member of:

Helps us by delegating to @hodlcommunity

Make a good APR Curation by following our HIVE trail here

What??? There's a bear coming?

Do not make fun of me 🤣. It did not come as expected because the FED printed even more money yesterday and decided to buy corporate bonds now.

I am astonished haha

Wow.....they have totally screwed up with the principle of Law of demand and supply. Its all good hopefully a tad bit of that flows into crypto. Crypto needs new money

Yeah but this mid of march 2020 showed the correlation was broken and btc alone moved up, i think now sell off by whales might be over, i am lookin to rebuy btc now

Indeed, but overall I shown in graphs and R2 numbers, correlation between financial markets and cryptocurrencies as strengthened on a 1 year rolling basis 😞