Their 1% Funds Can Push Bitcoin Price to Over $50,000

At this time when Bitcoin prices are heading South and almost all short term predictions indicating its further fall, here comes a Research that instills optimism in Bitcoin.

A Research Report by Messari's Ryan Watkins states that a fund allocation from institutional investors of as low as 1% can spur the Bitcoin market cap over 1 trillion resulting in a price of over $50K per Bitcoin.

The research was based on the example of billionaire hedge fund manager Paul Tudor Jones investing a small ("low single digit") percentage of his investment in Bitcoin. Analyst states that only 1% of fund allocation towards Bitcoin by mutual funds, endowments & foundations, sovereign wealth funds, family offices and pension funds will infuse about $480 billion of "new money" in the Bitcoin markets.

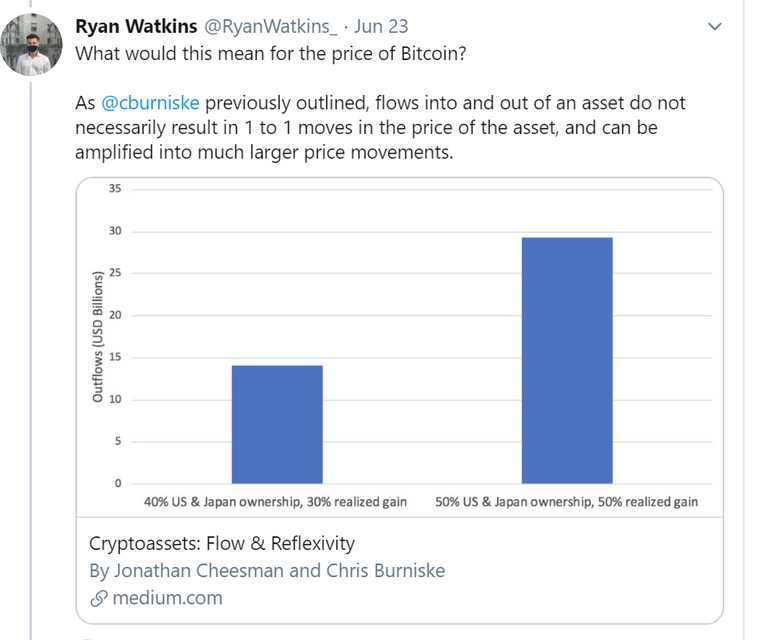

It cites a previous research by Chris Berniske that found the flow of fiat ("new money") into the markets, during last bull run of 2017, was responsible for price gains of between 2 & 25 times. This phenomenon is referred to as the “fiat amplifier.”

Watkins also predict that hedge funds will take the lead to invest in crypto.

On the contrary, Ryan Radloff, the CEO of the multi-billion Kingdom Trust, prdicted that first mover won't be some hedge fund but US$28 billion US pension industry as consumer demand an option to allocate digital assets towards their retirement portfolios.

For me, it doesn't matter who will be the first mover, what matters is the adoption of crypto 😀. According to Watkins:

if Bitcoin is to become a globally adopted non-sovereign store of value, it will need to convince institutional investors to transfer wealth into the asset.

Well, Bitcoin has already done enough by living up to its expectation for over a decade now. It seems institutional investors are beginning to get convince now. A friendly regulatory infrastructure will help this transition quicker.

So are you ready with your bags of Bitcoin?

What would it look like if institutional investors followed Paul Tudor Jones and allocated a “low single-digit percentage” to #Bitcoin?

— Ryan Watkins (@RyanWatkins_) June 23, 2020

Here’s what we found using our best estimates of global inst. investor AUM.

TL;DR?

Hundreds of billions if not trillions $ in inflows

1/ pic.twitter.com/mk6lEiI0UE

Well, I ain't.

Since BTC is the gateway to crypto, funds will most likely route through it even if someone wants to invest in other crypto than BTC. But now a days, seveeral other market pairs are available and some funds can channel through different routes too. So I think all of that 1% or whatever allocation may not go into BTC but some will drip into Alts too :)

Let's see.

Yep. Price follows volume. We need more institutional ownership.

It will be followed too :D

Great point. What do think think about Chainlink? I've been hearing about it from different sources and I keep adding in more.

You are good at picking gems. LINK as I see is though highly volatile but it has a constant upward trend. So it seems good for hodl as well as trade. It enhances Ethereum smart contract with its Oracle service which has increased the utility of Ethereum chain greatly. Although there are some other projects claiming to provide better options than LINK, LINK will do better due to its massive partnerships and acceptance by the industry.

I did some trading in it and exited in the last pump around 45000. Now I'm still waiting for its return ...lol! So it's always better to hodl it.

thanks for the info 👍