Psyber-x: Why Diesel Pool SWAP.HIVE:LVL was a great investment! Profit and Impermanent Loss Calculation (ENG/ITA)

La versione in italiano è subito dopo la versione in inglese - The Italian version is immediately after the English version

La versione in italiano è subito dopo la versione in inglese - The Italian version is immediately after the English version

Psyber-X: Why Diesel Pool SWAP.HIVE:LVL was a great investment! Profit and Impermanent Loss Calculation

I have many interests and many passions in my life, and two of my passions are Hive and blockchain-based games.

My first blockchain-based game I played was Spinterlands and it was almost love at first sight.

Then as time went on, I started playing other games as well and today I am an active player on Splinterlands, Rising Star, Hashkings, Dcrops, Dcity, Ape Mining Club, BANG! Defense and Farming Tales.

In addition to the games I listed above, at the end of 2021, I began investing in gaming projects at an early stage of development, and among these projects is Psyber-X.

Psyber-X is not a playable game yet but the development of the project is progressing well and at the following link you can see one of the three demonstration videos published by @psyberx in a recent post:

To date I have invested 300 HIVE in Psyber-X's project with which I have purchased:

- 200000 LVL tokens (the native tokens of Psyber-X).

- 1 Founder Starter Kit.

In one of my previous posts I calculated the profit I made up to the month of July by investing in Psyber-X.

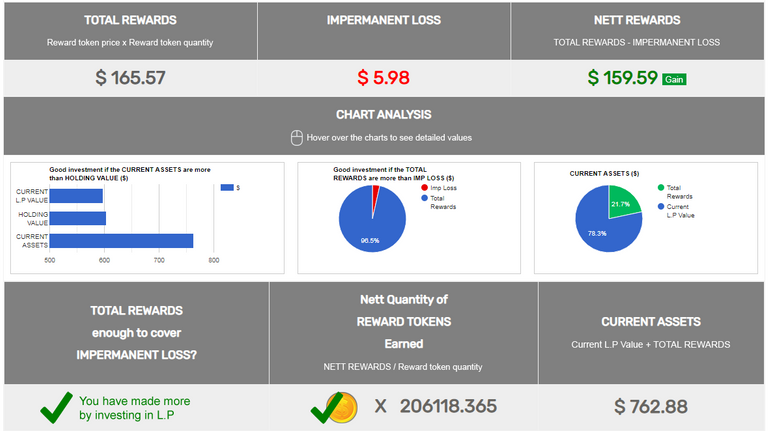

In today's post I want to share the financial analysis of my investment in the Diese Pool SWAP.HIVE:LVL.

Hive's blockchain has many utilities is one of them is the possibility to add liquidity in one of its Diesel Pools.

With the 200000 LVL tokens I had purchased in November 2021, I had two options to choose from:

- keep the LVL tokens in my wallet (Hodl)

- use the LVL tokens to add liquidity in the SWAP.HIVE:LVL pool.

I decided to use LVL tokens to add liquidity to the SWAP.HIVE:LVL pool and on March 3, 2022, I added the following liquidity:

- 57.84 SWAP.HIVE

- 13763.01 LVL

When I started adding liquidity the SWAP.HIVE:LVL pool had an APR above 100% and the daily reward for liquidity providers was several second level tokens from the Hive blockchain including LVL tokens.

I was immediately satisfied with the first daily reward I had received and the next day I added more liquidity and repeated the same operation several times afterwards.

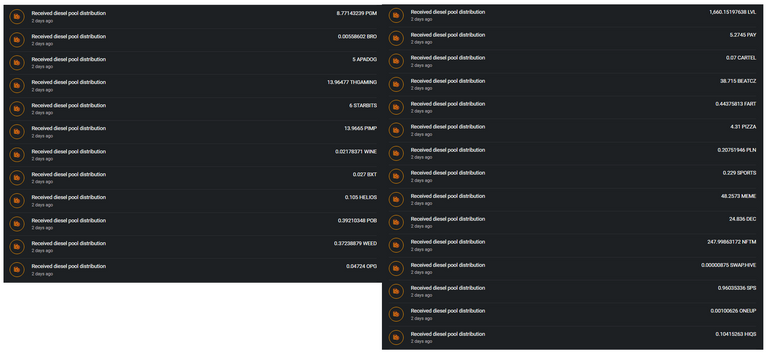

In the following image you can see all the transactions I have made to date on the SWAP.HIVE:LVL pool.

Two days ago the distribution of rewards ended, distribution that lasted many days, and I decided to remove the liquidity from the pool SWAP.HIVE:LVL.

I have been using the SWAP.HIVE:LVL pool for more than six months and after removing the liquidity I wanted to do a financial analysis of my investment, an analysis that I want to share in this post of mine.

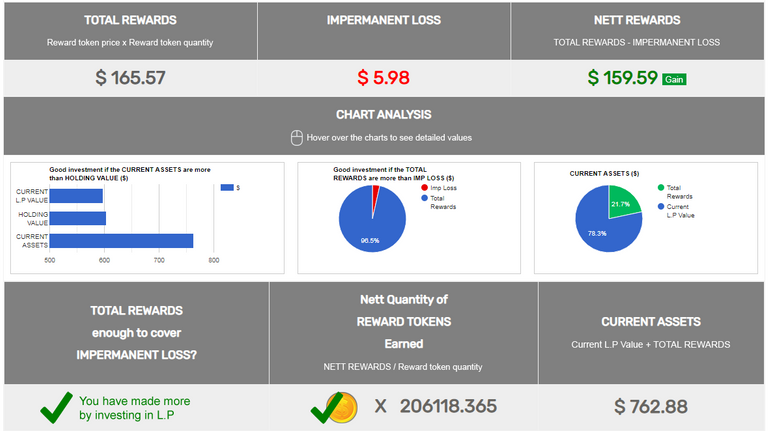

To do the financial analysis of an investment in a liquidity pool you need to:

- calculate the value of the Impermanent Loss

- calculate the value of the reward obtained

The Impermanent Loss is the loss that occurs only when liquidity is removed from a pool and when, at the time liquidity is removed, the ratio of the value of the tokens put into the pool has changed from the time liquidity was added.

This means that if the two tokens put into the pool had an equal change in value, there is no impermanent loss as in the following example:

- token A = +50%

- token B = +50%

If, on the other hand, the situation at the time of removing liquidity is as follows:

- token A = +20%

- token B = -10%

there will always be a loss and in this case the impermanent loss will be 1.03%.

The impermanent loss is basically the answer to the question:

Would I have been better off keeping the tokens liquid (Hodling) or would I have been better off investing them in a pool?

Calculating the Impermanent Loss in an investment that has only one liquidity adding transaction and one liquidity removing transaction is a relatively simple calculation to do while it is a more complex calculation when there are multiple liquidity adding transactions as in the case of my investment in the SWAP.HIVE:LVL pool.

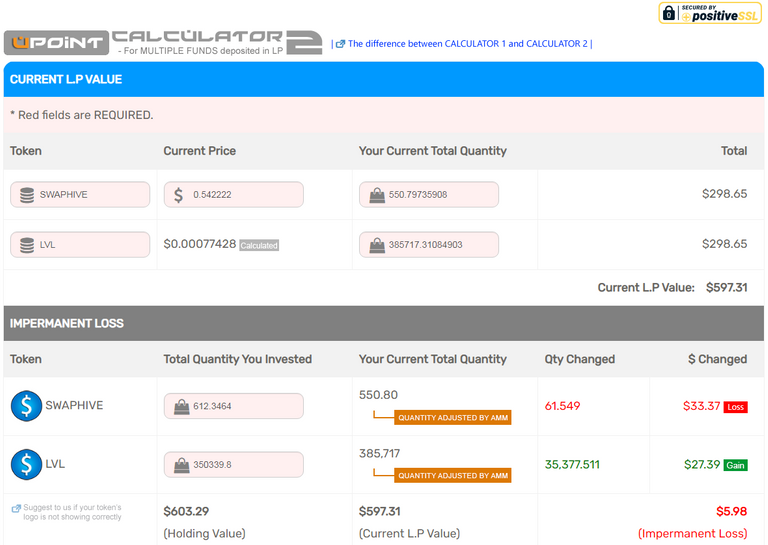

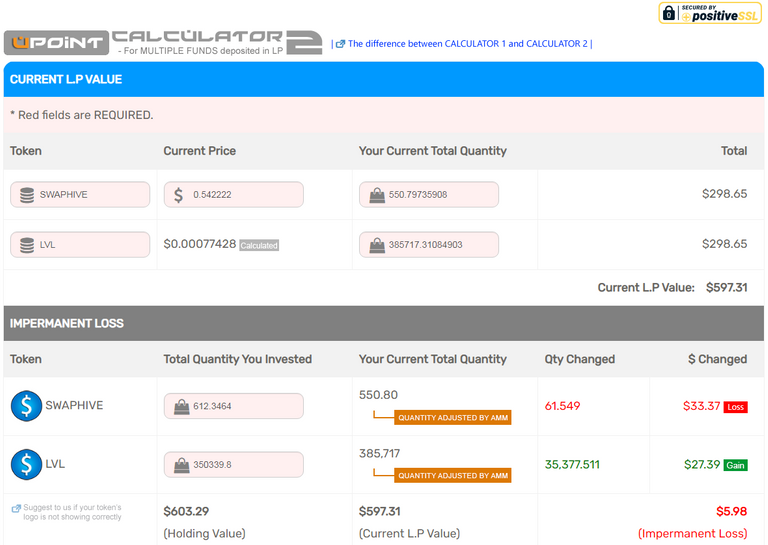

Fortunately, there are useful calculators that perform impermanent loss calculations, and I to calculate the impermanent loss of my investment in the SWAP.HIVE:LVL pool, I used the calculator number 2 on the website: https://upoint.info/

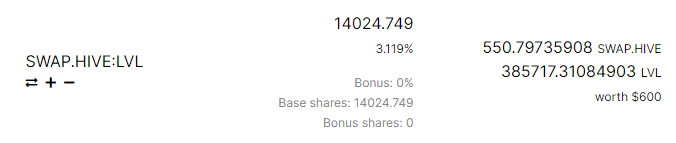

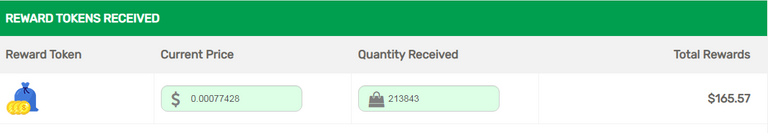

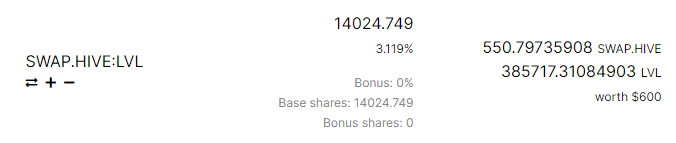

When I removed liquidity from the SWAP.HIVE:LVL pool I received:

- 550.79735908 SWAP.HIVE

- 385717.31084903 LVL

The calculator at https://upoint.info/ calculated for me that the impermanent loss was $5.98.

I lost 61.54 SWAP.HIVE and gained 35377.51 LVL with a loss of 5.98$ (impermanent loss).

This means that if I had chosen not to put liquidity into the pool today I would have a value of +$5.98.

At this point it might seem that investing in the SWAP.HIVE:LVL pool was not a profitable choice but instead it is quite the opposite because the impermanent loss calculation does not take into consideration the rewards I received in six months.

I purchased only 200000 LVL tokens and in later stages I also put into the pool the LVL tokens I received as daily rewards.

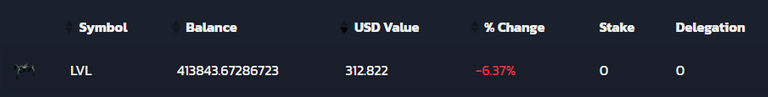

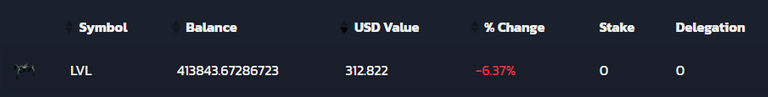

I purchased 200000 LVL tokens in November 2021 and today August 29, 2022 I have in my wallet at https://tribaldex.com/ a total of 413843.67 LVL tokens.

Investing in the SWAP.HIVE:LVL pool caused me to lose 5.98$ but gained me 213843 more LVL tokens whose value is $165.57.

The profit I earned in a little over 6 months was thus +$159.59

If I had chosen to hold steady my 200000 LVL tokens today I would not have realized this profit.

Investing in a liquidity pool always has a main risk to consider and evaluate which is called Impermanent Loss (it is not the only risk to consider) but the impermanent loss can be compensated by the rewards that the pool distributes to the liquidity providers and the Diesel Pool SWAP.HIVE:LVL was definitely a very good investment for me.

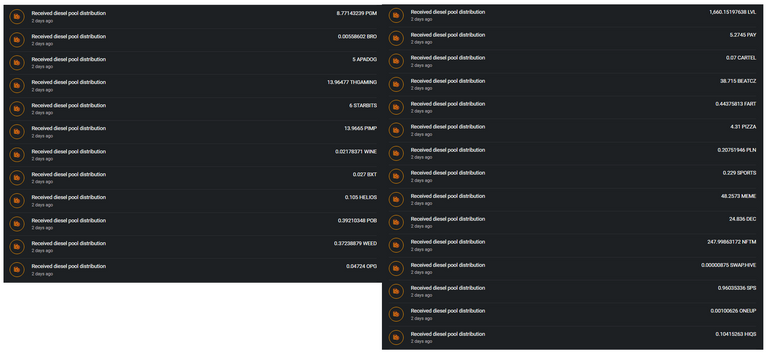

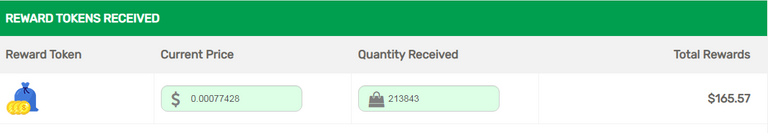

For ease of calculation, I only considered the total value of the amount of LVL tokens that the SWAP.HIVE:LVL pool allowed me to earn in six months but my profit was actually higher because the rewards I received consisted not only of the LVL tokens but also of several second level tokens of the Hive blockchain and in the following image you can see the last daily reward I received before the distribution of rewards ended.

Psyber-X is not yet a playable game, but so far it has given me some good satisfaction financially.

If Psyber-X becomes a playable game and if it is successful in the future my investment will also increase in value considerably, otherwise I will have to record a loss but for the time being I am very happy that I chose to invest in Psyber-X and from the beginning.

Important Note:

In any type of investment there is always a risk factor to evaluate and consider.

I am not a financial advisor and the information in this post is not financial advice.

Before investing in a blockchain-based project you should always do your own research and personal assessment first.

Psyber-X References and Links

Marketplace site: https://psyberxmarket.com/

Account on Hive: @psyberx

Discord channel: https://discord.gg/hJZNSadsUP

Twitter account: https://twitter.com/psyberxofficial

https://peakd.com/oneup/@psyberx/official-white-paper-for-psyber-x-and-the-psyber-x-metaverse

What is Psyber-X: https://peakd.com/psyberx/@psyberx/what-is-psyber-x

The Psyber-X Origin Story: https://peakd.com/psyberx/@psyberx/the-psyber-x-origin-story

Il mio investimento nella Pool SWAP.HIVE:LVL: Calcolo del Profitto e dell'Impermanent Loss

Nella mia vita ho tanti interessi e tante passioni e due delle mie passioni sono Hive e i giochi basati su blockchain.

Il mio primo gioco basato su blockchain a cui ho giocato è stato Spinterlands ed è stato quasi un amore a prima vista.

Poi con il passare del tempo ho iniziato a giocare anche ad altri giochi e oggi sono un giocatore attivo su Splinterlands, Rising Star, Hashkings, Dcrops, Dcity, Ape Mining Club, BANG! Defense e Farming Tales.

Oltre ai giochi che ho elencato prima, alla fine del 2021, ho iniziato ad investire in progetti di gaming in una fase di sviluppo iniziale e tra questi progetti c'è Psyber-X.

Psyber-X non è un gioco ancora giocabile ma lo sviluppo del progetto sta procedendo bene e al seguente link puoi vedere uno dei tre video dimostrativi pubblicati da @psyberx in un suo recente post:

Fino ad oggi ho investito 300 HIVE nel progetto di Psyber-X con i quali ho acquistato:

- 200000 token LVL (i token nativi di Psyber-X)

- 1 Founder Starter Kit

In un mio precedente post ho calcolato il profitto che ho ottenuto fino al mese di luglio investendo su Psyber-X.

Nel post di oggi voglio condividere l'analisi finanziaria del mio investimento nella Diese Pool SWAP.HIVE:LVL.

La blockchain di Hive ha tante utilità è una di queste è la possibilità di aggiungere liquidità in una delle sue Diesel Pools.

Con i 200000 token LVL che avevo acquistato a novembre 2021 avevo due possibilità tra cui scegliere:

- conservare i token LVL nel mio wallet (Hodl)

- utilizzare i token LVL per aggiungere liquidità nella pool SWAP.HIVE:LVL

Ho deciso di utilizzare i token LVL per aggiungere liquidità alla pool SWAP.HIVE:LVL e il 3 marzo 2022 ho aggiunto la seguente liquidità:

- 57.84 SWAP.HIVE

- 13763.01 LVL

Quando ho iniziato ad aggiungere liquidità la pool SWAP.HIVE:LVL aveva un APR superiore al 100% e la ricompensa giornaliera per i liquidity providers era costituita da diversi token di secondo livello della blockchain di Hive tra cui i token LVL.

Sono stato subito soddisfatto della prima ricompensa giornaliera che avevo ricevuto e il giorno dopo ho aggiunto altra liquidità e ho ripetuto la stessa operazione più volte anche in seguito.

Nell'immagine seguente puoi vedere tutte le transazioni che ho effettuato fino ad oggi sulla pool SWAP.HIVE:LVL.

Due giorni fa è terminata la distribuzione delle ricompense, distribuzione che è durata molti giorni e io ho deciso di rimuovere la liquidità dalla pool SWAP.HIVE:LVL.

Ho utilizzato la pool SWAP.HIVE:LVL per più di sei mesi e dopo aver rimosso la liquidità ho voluto fare un'analisi finanziaria del mio investimento, analisi che voglio condividere in questo mio post.

Per fare l'analisi finanziaria di un investimento in una liquidity pool è necessario:

- calcolare il valore dell'Impermanent Loss

- calcolare il valore delle ricompense ottenute

L'Impermanent Loss è la perdita che si verifica solo quando si rimuove liquidità da una pool e quando, nel momento in cui si rimuove la liquidità, il rapporto del valore dei tokens immessi nella pool è cambiato rispetto al momento in cui si è aggiunta liquidità.

Questo significa che se i due token immessi nella pool hanno avuto una variazione di valore uguale non si ha l'impermanent loss come nell'esempio seguente:

- token A = +50%

- token B = +50%

Se invece la situazione al momento di rimuovere la liquidità è la seguente:

- token A = +20%

- token B = -10%

ci sarà sempre una perdita e in questo caso l'impermanent loss sarà dell'1.03%.

L'impermanent loss è in pratica la risposta alla domanda:

Avrei fatto meglio a tenere i token liquidi (Hodling) o avrei fatto meglio a investirli in una pool?

Calcolare l'Impermanent Loss in un investimento che ha una sola operazione di aggiunta di liquidità e una sola operazione di rimozione di liquidità è un calcolo relativamente semplice da fare mentre è un calcolo più complesso quando ci sono più operazioni di aggiunta di liquidità come nel caso del mio investimento nella pool SWAP.HIVE:LVL.

Fortunatamente ci sono degli utili calcolatori che eseguono il calcolo dell'impermanent loss e io per calcolare l'impermanent loss del mio investimento nella pool SWAP.HIVE:LVL ho utilizzato il calcolatore numero 2 del sito: https://upoint.info/

Quando ho rimosso liquidità dalla pool SWAP.HIVE:LVL ho ricevuto:

- 550.79735908 SWAP.HIVE

- 385717.31084903 LVL

Il calcolatore del sito https://upoint.info/ mi ha calcolato che l'impermanent loss è stato di 5.98$.

Ho perso 61.54 SWAP.HIVE e ho guadagnato 35377.51 LVL con una perdita di 5.98$ (impermanent loss).

Questo vuol dire che se avessi scelto di non immettere liquidità nella pool oggi avrei un valore di +5.98$.

A questo punto potrebbe sembrare che investire nella pool SWAP.HIVE:LVL non sia stata una scelta profittevole ma invece è proprio il contrario perchè il calcolo dell'impermanent loss non tiene conto delle ricompense che ho ricevuto in sei mesi.

Io ho acquistato solo 200000 token LVL e in fasi successive ho immesso nella pool anche i token LVL che ho ricevuto come ricompense giornaliere.

Ho acquistato 200000 token LVL a novembre 2021 e oggi 29 agosto 2022 ho nel mio wallet su https://tribaldex.com/ un totale di 413843.67 token LVL.

Investire nella pool SWAP.HIVE:LVL mi ha fatto perdere 5.98$ ma mi ha fatto guadagnare 213843 token LVL in più il cui valore è di 165.57$.

Il profitto che ho ottenuto in poco più di 6 mesi è stato quindi di +159.59$

Se avessi scelto di tenere fermi i miei 200000 token LVL oggi non avrei realizzato questo profitto.

Investire in una liquidity pool ha sempre un rischio principale da considerare e valutare che si chiama Impermanent Loss (non è l'unico rischio da considerare) ma l'impermanent loss può essere ricompensato dalle ricompense che la pool distribuisce ai liquidity providers e la Diesel Pool SWAP.HIVE:LVL è stata decisamente un ottimo investimento per me.

Per semplicità di calcolo ho considerato solo il valore totale del quantitativo di token LVL che la pool SWAP.HIVE:LVL mi ha permesso di guadagnare in sei mesi ma il mio profitto in realtà è stato maggiore perchè le ricompense che ho ricevuto non erano costituite solo dai token LVL ma anche da diversi token di secondo livello della blockchain di Hive e nell'immagine seguente puoi vedere l'ultima ricompensa giornaliera che ho ricevuto prima che finisse la distribuzione delle ricompense.

Psyber-X non è ancora un gioco giocabile ma fino ad oggi mi ha dato delle belle soddisfazioni dal punto di vista finanziario.

Se Psyber-X diventerà un gioco giocabile e se avrà successo in futuro anche il mio investimento aumenterà in modo considerevole il suo valore, nel caso contrario dovrò registrare una perdita ma per il momento sono molto contento di aver scelto di investire su Psyber-X e fin dall'inizio.

Nota Importante:

In ogni tipologia di investimento c'è sempre un fattore di rischio da valutare e considerare.

Io non sono un consulente finanziario e le informazioni contenute in questo post non sono consigli finanziari

Prima di investire in un progetto basato su blockchain devi sempre fare prima le tue ricerche e le tue personali valutazioni.

Il mio consiglio è di investire sempre e soltanto quello che puoi permetterti di perdere a cuor leggero!

Riferimenti e Link di Psyber-X

Marketplace site: https://psyberxmarket.com/

Account on Hive: @psyberx

Discord channel: https://discord.gg/hJZNSadsUP

Twitter account: https://twitter.com/psyberxofficial

https://peakd.com/oneup/@psyberx/official-white-paper-for-psyber-x-and-the-psyber-x-metaverse

What is Psyber-X: https://peakd.com/psyberx/@psyberx/what-is-psyber-x

The Psyber-X Origin Story: https://peakd.com/psyberx/@psyberx/the-psyber-x-origin-story

Youre a straight beast as always Liberty. A beast post from a beast man. Im holding onto my small pile of LVL, the liq pools are pretty cool, but im not doing the pool. Game looks promising, hoping i can arrange some funds to prep.

!LOL

!MEME

Credit: sportsbuddy

Earn Crypto for your Memes @ hiveme.me!

lolztoken.com

One is hard up, the other is soft down.

Credit: reddit

@libertycrypto27, I sent you an $LOLZ on behalf of @captainquack22

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

(6/6)

thanks a lot captain :)

There are many liquidity pools on Hive, and many have interesting APRs.

I agree with you psyberx promises to be a nice game and also a good investment ;)

!PGM

!LOL

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-2.5 BUDS-0.01 MOTA-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

@tipu curate

Upvoted 👌 (Mana: 35/45) Liquid rewards.

Grazie mille per il supporto

!PGM

!LOL

https://twitter.com/Cloudsystem83/status/1564231039236595714

https://twitter.com/libertycrypto27/status/1564241850545983488

https://twitter.com/YanPatrick_/status/1564254016334340097

https://twitter.com/redCown/status/1564647972465684480

https://twitter.com/RinaldiCosimo/status/1565351738185764864

The rewards earned on this comment will go directly to the people( @claudio83, @libertycrypto27, @shiftrox, @falcout, @arc7icwolf ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Great work sharing on Twitter, we love to see onboarding and Posh! !PGM

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-2.5 BUDS-0.01 MOTA-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

nice post

!hiqvote

thanks a lot :)

!PGM

!LOL

If you have at least 10 HIQS staked, then juicy votes will follow!

Delegate [HP to @hiq.hive], [BEE to @hiq.bee], [PHOTO to @hiq.photo], [FUN to @hiq.fun] or [PIMP to @hiq.pimp] to support the HiQ Smart Bot and its trails.

For any further questions, please feel free to contact @hiq.redaktion via comment or Discord.

(This is a

semiautomaticaly created manual curation. Currently I am in the testing phase though !LOL)Check out HiQ - The Hivestyle Magazine, fomo into HiQs - The Support Token & vote our fuckingWitness!

Yay! 🤗

Your content has been boosted with Ecency Points, by @libertycrypto27.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

thanks for the support

!PGM

It has so far been a nice ride, so I'm still on it !PIMP

!PGM

Aw man @operahoser, you are out of PIMP to slap people.

Go Stake some more and increase your PIMP power.

(We will not send this error message for 24 hours).

Read about some PIMP Shit or Look for the PIMP District

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-2.5 BUDS-0.01 MOTA-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

Yes I agree.

I have removed liquidity from the pool now that there are no more liquidity provider rewards but part of the gain I got from the pool I will reinvest to buy more LVL tokens ;)

!PGM

!CTP

Great to see some math for the pool. The Cartel put all its LVL at some point into the pool, after receiving many free crates for hodling the token. Ever since we went into the pool, we actually gained some nice HIVE, although lost LVL to impermanent loss. We aren't in there for six months yet, so still plenty of time to earn many more LVL rewards. !1UP

At the moment, the distribution of rewards for liquidity providers has ended, so I have removed my liquidity.

I don't know if they will put the rewards back but if they do I will put the liquidity back into the pool.

I plan to use some of the profit I made from the pool to buy more LVL tokens.

The SWAP.HIVE:LVL pool is one of the demonstrations of how much potential Hive has even in DEFI since it has no transaction costs ;)

Thanks as always for the comment and support my friend

!PGM

!PIZZA

!CTP

You have received a 1UP from @flauwy!

@oneup-curator, @leo-curator, @ctp-curator, @bee-curator, @pimp-curator, @thg-curator, @neoxag-curator, @cent-curator

And they will bring !PIZZA 🍕.

Learn more about our delegation service to earn daily rewards. Join the Cartel on Discord.

!PGM

!LOLZ

!PIMP

You must be killin' it out here!

@entrepidus just slapped you with 5.000 PIMP, @libertycrypto27.

You earned 5.000 PIMP for the strong hand.

They're getting a workout and slapped 2/2 possible people today.

Read about some PIMP Shit or Look for the PIMP District

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-2.5 BUDS-0.01 MOTA-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

lolztoken.com

I was litteraly beside myself.

Credit: reddit

@libertycrypto27, I sent you an $LOLZ on behalf of @entrepidus

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

(2/10)

thanks

!PGM

!LOLZ

!PIMP

You must be killin' it out here!

@libertycrypto27 just slapped you with 1.000 PIMP, @entrepidus.

You earned 1.000 PIMP for the strong hand.

They're getting a workout and slapped 1/1 possible people today.

Read about some PIMP Shit or Look for the PIMP District

!PGM !lolz !meme !pizza

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-2.5 BUDS-0.01 MOTA-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

Credit: memess

Earn Crypto for your Memes @ hiveme.me!

Thanks

!PGM

!lolz

!PIZZA

Thanks for being so transparent and I am glad that the returns from the pool were enough to offset your IL. It's something a lot of people don't consider as much when entering these pools.

Posted Using LeoFinance Beta

Yes I agree often IL is an aspect that many do not consider and in other cases it is an aspect that others consider too much as a negative but when the token pair has potential value and when the APR is high enough IL becomes an element of little importance and little risk as it was for example for the SWAP.HIVE:LVL pool ;)

!PGM

!CTP

!PIZZA

thanks and !PIZZA :)

PIZZA Holders sent $PIZZA tips in this post's comments:

@der-prophet(1/5) tipped @libertycrypto27 (x1)

Please vote for pizza.witness!