Understanding about financial health

Today I had a conversation with @ralexandria that taught me a lot about financial health, and I want to share a little bit of the conversation that I had.

Safe money

The first question he asked me was if there was a catastrophe, how much safe money would I have, and at the time I didn't know how to answer, and not really understand what safe money would be. After all, if I needed something I could withdraw some money and pay. Only he brought me extreme situations like, if I was arrested, run over or lost contact with the internet for a few days, how would I be able to resolve the situation.

It took me a while to understand at first, but by viewing the examples and not having the abstract form in my mind anymore, I could understand the point he would like to make.

So I opened a spreadsheet and started detailing my balance in both fiat and crypto currency. Then I noticed that the values in% were very ungoverned, and most of them dollarized, where in fact if there were any problems in the short term it would be an obstacle since things are not sold in dollars in my country.

So he told me to keep an emergency reserve in local currency based on the expenses that I would have in 6 months, in case something happened I had a relief. And believe me, every day something new happens in Brazil. (I even think I could make a post about for you to understand the dimension of the clowning that this country is, with all respect to the clowns that are much more ethical than some politicians)

I started calculating the amounts and to my surprise I didn't even have 5% of my receipts reserved for emergencies. At the time, I realized that I would need to devise a strategy throughout May so that this could be corrected.

Resource allocation

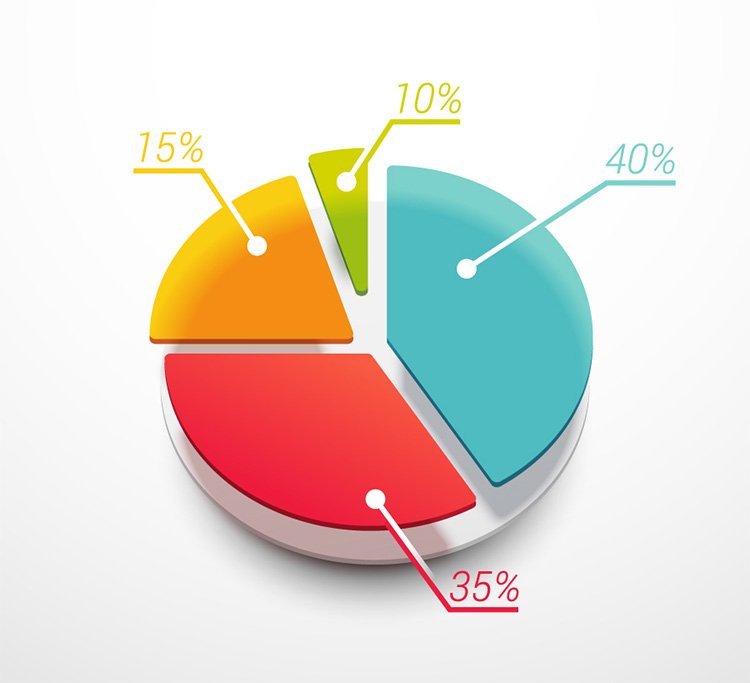

So he brought me another point after we defined the first strategy, which would be how to allocate the resources that I am accumulating. Currently I did it adding up in my head without writing it down anywhere, and this is obviously very confusing in the long run, because you won't be memorizing the values of everything.

In this way, a new strategy was devised, which, after the emergency reserve was active, began to diversify investments. It is much safer to have a range of crypts than to leave all your money in one. I always knew that advice, but I had never been able to put it into practice. And I believe that this spreadsheet will help me a lot in this, after all I would be seeing how much% of my capital would be more secure and how much would be invested in assets with greater gain and greater risk.

That way, I can focus throughout the month on distributing small amounts, with the intention of diversification, in currencies that in my view are long-term, such as BTC, BNB. LTC, DOGE, who I believe in 5 years are worth more than now.

By making the right allocation of resources, it also allows me to grow in HIVE and other tribes, like LEO and probably CINE, which can also enter the investment radar in the medium term.

And for short-term investments, I continue with POB, giving PowerUp to 100% of my curatorship and 80% of the authorship.

Retirement

I never imagined that a spreadsheet could calculate retirement at the age of 30. But again he explained to me that it is possible to calculate that. We didn't do it because the two steps above still need to be done first, but he explained it to me and I will try to explain it here, and if I said something wrong, correct me @ralexandria.

When we already have a secure income, and resources allocated to various assets, we begin to understand which asset is being fed back. And in that way we can understand how this allocation of resources can diversify to the point that assets passively yield value so that you don't have to actively have to produce something in order to pay your bills.

That way I would have a stability, since obviously I will not stop producing, at least not anytime soon, I have a taste for it and even more when it is rewarded, which happens daily with all of us here at Hive and its tribes. The future is being traced, and now I have put my train on the correct route.

I would like to thank you so much for this help, and I believe that with a lot of discipline I may not get lost in what I have to do. If someone wants some help on finance, don't hesitate to contact him, he is very receptive and can help a lot.

Hoje eu tive uma conversa com o @ralexandria que me ensinou muito sobre saúde financeira, e eu quero compartilhar um pouco da conversa que tive.

Dinheiro seguro

A primeira pergunta que ele me fez foi se acontecesse alguma catastrofe quanto de dinheiro seguro eu teria, e na hora eu não soube responder, e nem muito entender o que seria dinheiro seguro. Afinal se eu precisasse de algo eu poderia sacar um dinheiro e pagar. Só que ele me trouxe situações extremas como, se eu fosse preso, atropelado ou perdesse o contato com a internet por alguns dias, como eu conseguiria resolver a situação.

Demorei um pouco para entender a primeiro momento, mas visualizando os exemplos e não tendo mais a forma abstrata na minha mente pude entender o ponto que ele gostaria de chegar.

Então abri uma planilha e comecei a detalhar meu saldo tanto de moeda fiat como de cripto. Então notei que os valores em % estavam muito desgovernado, e a sua maioria dolarizado, onde de fato se acontecesse algum problema a curto prazo seria um empecilho uma vez que as coisas não são vendidas em dolar no meu país.

Então ele me indicou manter na moeda local uma reserva de emergência com base nos gastos que eu teria em 6 meses, para caso acontecesse algo eu ter um alívio. E acreditem, todo dia acontece algo novo no brasil. (Inclusive acho que eu poderia fazer uma postagem sobre para vocês entenderem a dimensão da palhaçada que é esse país, com todo respeito aos palhaços que são bem mais éticos que alguns políticos)

Comecei a calcular os valores e para minha surpresa eu não tinha nem 5% das minhas receitas reservada para emergência. Na hora notei que eu precisaria traçar uma estratégia ao longo de Maio para que isso pudesse ser corrigido.

Alocação de recursos

Então ele me trouxe outro ponto após definirmos a primeira estratégia, que seria como alocar os recursos que estou acumulando. Atualmente eu fazia somando na minha cabeça sem anotar em nenhum lugar, e isso obviamente é muito confuso no longo prazo, porque você não vai ficar decorando os valores de tudo.

E dessa maneira uma nova estratégia foi traçada, que após a reserva de emergência estar ativa, começar a diversificar os investimentos. É muito mais seguro você ter uma gama de criptos do que deixar todo dinheiro em uma só. Eu sempre soube desse conselho, mas nunca tinha conseguido colocar na prática. E creio que essa planilha irá me ajudar muito nisso, afinal eu estaria vendo quanto % do meu capital estaria mais seguro e quanto estaria investido em ativos de ganho maior e risco maior.

Dessa forma, posso focar ao longo do mês em distribuir pequenas quantias, na intenção de diversificação, em moedas que na minha visão são de longo prazo, como BTC, BNB. LTC, DOGE, que acredito em 5 anos estarem valendo mais do que agora.

Ao fazer a alocação certa de recursos, me permite também crescer no HIVE e em outras tribos, como LEO e provavelmente CINE que também pode entrar no radar de investimento a médio prazo.

E para investimentos de curto prazo, continuo com o POB, dando PowerUp em 100% da minha curadoria e 80% da autoria.

Aposentadoria

Eu nunca imaginei que uma planilha pudesse calcular aposentadoria aos meus 30 anos de idade. Mas novamente ele me explicou que é possível sim calcular isso. Não fizemos pois ainda os dois passos acima precisam ser feitos primeiros, mas ele me explicou e eu vou tentar explicar aqui, e se eu falei alguma coisa errada me corrija @ralexandria.

Quando já temos uma renda segura, e recursos alocados em diversos ativos, começamos a perceber qual ativo está se retroalimentando. E dessa maneira podemos entender como essa alocação de recursos pode diversificar a ponto de ativos renderem passivamente um valor para que você não precise ativamente ter que produzir algo para que possa pagar suas contas.

Dessa maneira eu teria uma estabilidade, vez que obviamente eu não vou parar de produzir, pelo menos não tão cedo, eu tenho gosto por isso e ainda mais quando é recompensado, o que acontece diariamente com todos nós aqui no Hive e suas tribos. O futuro esta sendo trilhado, e agora eu coloquei o meu trem na rota correta.

Queria agradecer imensamente essa ajuda que tive, e creio que com muito disciplina eu possa não me perder no que eu devo fazer. Se alguem quiser alguma ajuda sobre finanças, não hesite em contata-lo, ele é muito receptivo e pode ajudar bastante.

Very good text and I fully agree. Understanding money is even more important than knowing how to earn money without it you won't keep what you've earned.

How many famous celebs/sports people went broke ?:D

Posted Using LeoFinance Beta

Very useful article sir, savings and allocating wealth to investment really help us in future, moreover in retirement age's. Also diversification asset very important to reduce the risk on investment. Thanks for the article this reminds me to allocated more asset into saving and investment :)

Thank you very much for the quote @vempromundo, it is a pleasure to be able to help, I have a lot of fun and I am very happy to be able to help with financial education, and it is even more rewarding when the guy learns everything right, and I am available to anyone here in the community need help to consult how your financial health just call me, any questions I am available.

Never too early to plan for retirement and if there's one thing I've learned from the old folks around me it is that in retirement, people prefer to have income producing assets than price appreciating assets.

in the long run I want to have this option as a priority too

It is necessary to diversify your money into different asset classes. Some money should be parked in the digital currencies considering that this is just one of the asset class. You should also have other sources of income. The income from #pob is dependent on the market prices and hence is volatile and uncertain. You should also have some stability in income from other sources like rent, interest, salary, dividends.

As POB became my full-time job, I’m going to depend on it a little bit to build these diversified allocations

Its a great piece of advice. The financial planning is essential for the future of the human health. You have already made a successful stint at POB. You should go on investing a portion of it in btc, bnb, ltc or even doge now. But the same should at some point go back to fiat in at least small percent to meet the daily needs

@ralexandria helped me to set goals for how to diversify and at the same time save a reserve in fiat, during this month I will try to put everything in order

Boas explanações sobre o tema. Sem disciplina, nenhum planejamento funciona.