Budgeting Your Way To Financial Freedom

Financial Freedom

How do you define financial freedom? Does it mean not having to work but still have a steady flow of income trickling into your account? Or does it mean being debt-free? How about being able to disconnect from the rest of the world and still be self-sustaining?

We can put it in many ways. For me, it all boils down to being able to take actions as you please without heavily taking into consideration financial implications to ourselves and our families.

Fattening Thy Purse

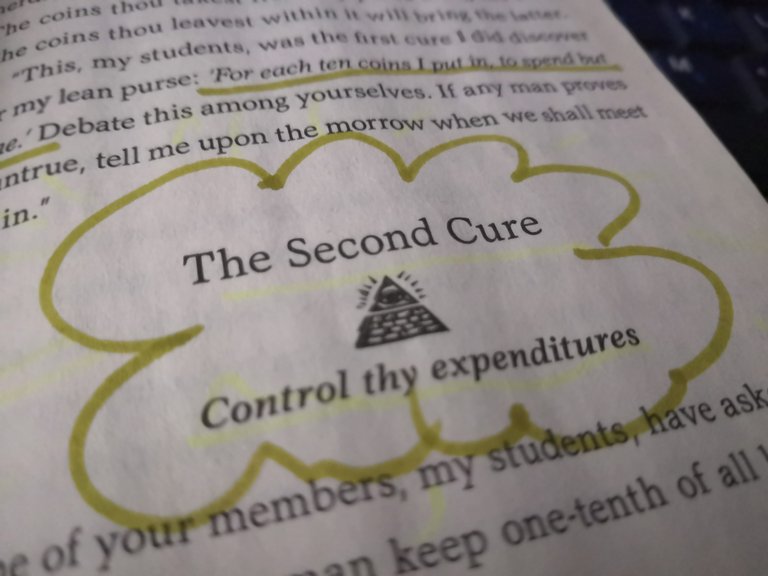

Have you come across the book, The Richest Man in Babylon? If not, I highly recommend that you add that to your reading list. A part of the book discusses the Seven Cures for a Lean Purse.

Let me jump to the second cure.

Second Cure: Control thy expenditures.

The book shares lots of timeless nuggets of wisdom to keep, or should I say, apply to our lives. It was applicable then, still useful until now.

How many of us get into the rabbit hole of having their expenditures increase as their income increases, too?

That what each of us calls our "necessary expenses" will always grow to equal our incomes unless we protest to the contrary.

Hence, the need to budget; the need to be able to distinguish between our needs and wants. When we are able to successfully determine what we truly desire than just casual wishes, then we may be well on our way to purse fattening.

How Do You Budget?

I've seen finance gurus share different budgeting tips. It's definitely not a one-size-fits-all solution, but there's always something that we can take away from these tips.

Keeping a spreadsheet. There are those who keep a spreadsheet to track their finances. All the cash flow - income, expenses, savings, investments, etc. are being recorded to an electronic spreadsheet that can range from a simple excel spreadsheet to exhaustive, paid ones.

Mobile applications. Most of us would want something that can be easily accessible with just a flick of a thumb. There are lots of budgeting mobile apps that can be downloaded that can ultimately help us to track our finances. Some would even show you a pie chart of your spending. Now that could help you visualize adjustments you can make in order to improve your financial standing.

Written budget planner. The more conservative ones perhaps would prefer to keep manual tabs on their finances. You know, writing down what comes in, and goes out?

Not at all? I certainly hope not. It's a complete recipe for disaster. We have to, in one way or another, start taking control of our expenditure. Remember the second cure!

Personally, I do not like to complicate our budget. We do it on a monthly basis, with immediate foresight to the next 3 months, then for the rest of the year. I used to have a mobile app to track our budget, but I found that to be too complicated for me so I just settled to making my own personalized spreadsheet that I can access through both my phone and laptop.

How about you? Have you already started the journey to fatten your purse? What steps do you take to follow the second cure?

Cheers to a fatter purse! 🥂

❤️Arlyn

Cover Image credit: Canva.

Posted Using LeoFinance Beta