Ponzi SCHEME!

One of the most famous financial scams that causes the most victims in the world is the so-called “Ponzi Scheme”. This scheme leads investors to allocate their money to institutions that, in reality, do not exist.

Recruiters who are part of the Ponzi scheme seek to attract people and give them money by promising high returns in the short term. In addition, they present as an “opportunity” to earn easy money. However, in practice the money given to recruiters does not become an investment, but becomes profit for the organizers of the coup.

When one of the “investors” in the Ponzi scheme asks for his money back, the organizers use the money from new victims to pay this person, so as not to report the fraud.

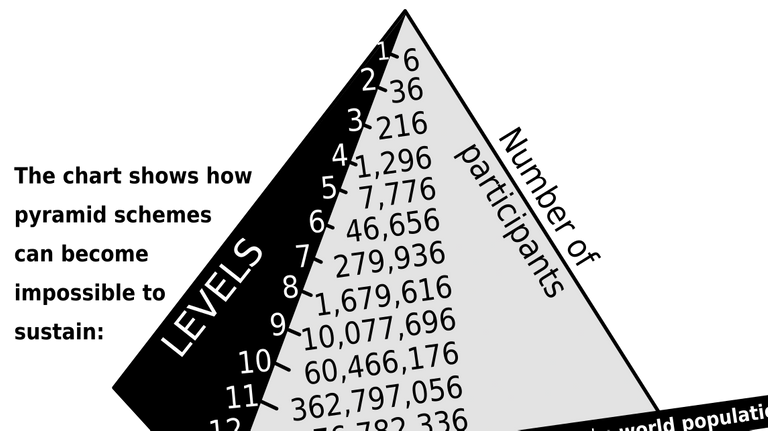

The scheme takes place while new victims invest in fraud and guarantee money to organizers and those investors who demand a return on their investments. When new victims stop entering or many investors demand their money back, the scheme is no longer sustainable.

Since the scheme is no longer viable, the organizers pocket their profits and flee, leaving huge losses to the victims, who end up losing all of their invested money.

These schemes are named after Charles Ponzi, an Italian-American immigrant who was one of the precursors of this type of financial scam.

In the 1920s, Ponzi carried out a huge financial fraud in the USA, promising investors high returns on their invested capital.

He told his investors that he got his high returns by buying postage stamp coupons on the international market and selling them in the United States at higher prices.

Thus, rumors that Ponzi was capable of obtaining astronomical returns in his stamp business began to increase and attract those who wished to invest.

The Italian-American promised returns of approximately 50% in 45 days. At the beginning of his fraud, Ponzi was able to honor his investment pledges and attract more investors.

The reality is that Ponzi did not buy international stamps, in fact (in total, Ponzi bought the equivalent of US $ 30 in stamps). His real business was to use the money of new investors to remunerate his former investors who asked for their money back. In this way, he used the fame of his business to feed back fraud and get more and more capital invested.

As, inevitably, occurs in any of these schemes, Ponzi's fraud fell apart after analyzing that there were not a number of stamps in the world to justify the money he obtained. The fiasco of his fraud, then, brought Charles Ponzi to jail and many of his victims went bankrupt.

Despite Ponzi being considered the founder of this type of financial fraud, Bernard Madoff was the one who really took the Ponzi scheme to another level, generating billionaire losses for his victims.

Bernard Madoff worked as chief coordinator of the famous American Nasdaq exchange. He was a member of the National Association of Securities Dealers (NASD) and president of an investment company, Bernard Madoff Investment Securities LLC.

Madoff used his popularity on Wall Street to create a Ponzi Scheme. He promised his clients investment opportunities with high returns and, from that blow, managed to raise a large amount.

About $ 65 billion of customer assets were managed in his company. This system has worked for decades with new investors fueling the returns of active investors, with no real investment strategy in place.

However, with the 2008 global financial crisis, Madoff's scheme collapsed, resources became scarce and his business was no longer sustainable, leading to its demise - and caused billions in losses to victims.

Madoff was sentenced in 2009 to 150 years in prison for his financial crimes. Recently, on April 14, 2021, he died inside the prison he had been sentenced to for the rest of his life.

With the two practical examples cited, we see that these schemes repeat their modus operandi a lot: the promise of getting rich easily in the short term, which attracts many investors. These end up becoming victims of these scams.

As seen, the human being hardly learns from history. As Friedrich Hegel rightly said: "We learn from history that we don't learn from history".

Understanding how the so-called Ponzi scheme works is very important so that investors, their friends and family are not victims of these scams, which promise quick and easy money. The truth is that successful investors don't get carried away by unrealistic promises, but instead focus on consistent and honest earnings in the long run.

Posted Using LeoFinance Beta

There have been multiple attempts with Pyramid schemes in the market.

They are looks very attractive in the start but as the numbers grow, people only at the top get the benefits and late joiners always suffer.

This is a matter of taking money from one party and giving some part of that money to someone else.

All such scheme that i have seen had ended up miserably.