Grayscale re-opened: the purchase of more than 2,000 in a single day, Bitcoin strongly rebounded to 38,000 US dollars

market data shows that Bitcoin price is gradually rebounding after the lows fell to the first line of US $ 31,000 on the 11th, and is currently rebounding above US $ 37,000, with intraday gains approaching 8%.

According to the market channel, Bitcoin fell sharply on the 11th, fell more than US $ 8,000 on the day, fell 20%, and closed at US $ 31,578. After stabilizing at the $ 30,000 mark, market buying increased, and bitcoin price rose above $ 35,000 for a few days, and finally rose strongly to around $ 38,150 today.

At the same time, "Gray", an important indicator of the market, started to continue buying encrypted trust funds (except ETH and XRP). On January 12, Michael Sonnenshein, the managing director of Grayscale, tweeted that eligible investors could already buy stock funds online. "This means Grayscale is once again open to accepting new investment after a 20 day suspension."

Recent data shows that as of January 13, Eastern Time, Grayscale BTC Trust holdings increased by 2,172.39 per day, and the accumulated holdings of bitcoin reached 600,000, with a market value of around US $ 22.8 billion.

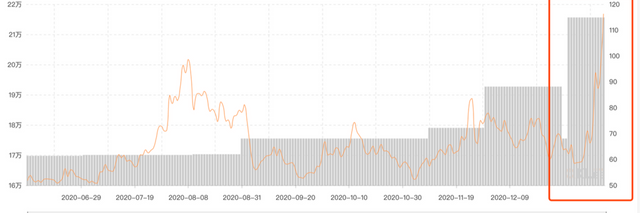

In fact, since the second half of 2020, Grayscale has started increasing ownership of crypto assets such as BTC, ETH, LTC, and BCH. Its total holdings increased by more than 200% from June to mid-December, and its asset management scale has doubled 20 times during the year. . To date, the company's asset management scale has reached US $ 24.7 billion.

From a Grayscale ownership perspective, the company has the largest Bitcoin purchases. Data shows that in December 2020 alone, Bitcoin Grayscale purchases totaled 72,950, which is almost three times the miners' output in the same period (28,112).

Under the influence of the gray scale, a large number of Wall Street institutions entered the cryptocurrency market, and the Bitcoin price also rose sharply, driven by "Old Money". For example, the listed company MicroStrategy (founded for more than 30 years, mainly involved in business intelligence and mobile software) has bought a lot of bitcoins, and currently holds 70,470 bitcoins with a total value of about 1.1 billion US dollars.

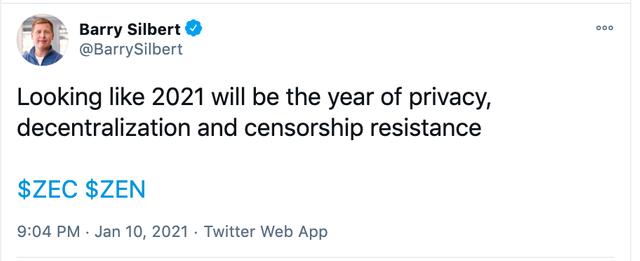

Apart from Bitcoin, the price of other tokens on the grayscale list also rose under the influence of the company. Among them, the ZEC price rose from 70 US dollars in early December to around 113 US dollars, an increase of more than 50%. On January 10, the ZEC rose significantly, with prices up 20%.

It was reported that on January 10, Grayscale founder and former CEO Barry Silbert tweeted that "it looks like 2021 will be the year of privacy, decentralization and censorship resistance", and listed ZEC and ZEN two types of tokens.

Source of plagiarism

Plagiarism is the copying & pasting of others' work without giving credit to the original author or artist. Plagiarized posts are considered fraud and violate the intellectual property rights of the original creator.

Fraud is discouraged by the community and may result in the account being Blacklisted.

If you believe this comment is in error, please contact us in #appeals in Discord.