Are We In A Bubble Or Is It Incorrect Measurements

Hey Jessieconomists

I often rant and rave about bubbles in the economy, and do I think there are bubbles? Yes, I think there is a gross misallocation of resources in plenty of sectors of the world economy. What I didn't account for, however, is that with the debasement of the currency, there's also a new floor price for everything.

Even if the air deflates out of these bubbles, there is so much currency creation that the nominal price of something will be more than what it was priced at in the past. Yes, I know it seems like a pretty basic conclusion, but it's hard to understand when we think of currency.

Many of us see real terms and nominal terms as the same thing, when in fact, they continue to drift apart.

Keeping the public bullish

In times of economic uncertainty, I feel like narratives count more than fundamentals, and as long as the sound of the story is bullish, that's all that matters.

I recently read an article about Sweden housing market being as hot as it's ever been with a 17% rise in home prices over the last year. Now I got nothing against the Swedes, but who is overpaying to live in that icebox is my first thought. On the off, it sounds super bullish for the country, but then I started thinking.

A country with a tiny ass population of 11 million and a pretty mature economy shouldn't have a housing boom short of having a population boom.

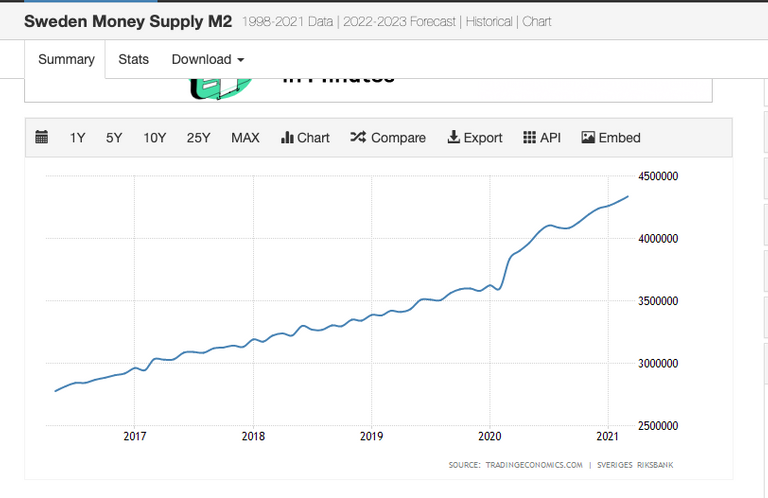

My next thought was, well, Sweden is a European country with currency sovereignty, so I thought, let's see what their central bank is doing with the SEK. Looking at the chart below, I wasn't surprised to see that the money supply over the same time has inflated by over 20%, which makes total sense.

So that headline is misleading; Swedish house prices are the same; how you measure it just got a whole lot weaker in one year.

Source: Sweden M2 money supply - tradingeconomics

Same same but different

I applied the same calculations to my own country and a few G7 nations, and it's all pretty much the same. It's harder to see with nations using the Euro since none of these countries has financial sovereignty. Yes, the ECB is printing like never before, but it's harder to find the allocations to which countries bonds and where that capital tends to flow once the local banks accept the new reserves.

Making it harder to find value

All this money printing happens at such a rapid rate, yet the effects are slow and insidious for the rest of us. Those who get the money first get to react, first, acquire assets and consolidate cash flow through debt finance. Once that currency filters through to wages, it's lost so much value than the assets that it pushes wage earners further down the pecking order.

We all live in a fiat money world; our assets are priced in fiat, we trade in fait, we exchange time and labour for fiat, but as it's debased, we "feel" richer by acquiring more when in fact, we could either be marginally better off, we could be breaking even, or making a loss.

This all depends on the debasement rate in your country, but you can see the problem I'm edging towards. The more units of fiat, the more everything else around it needs to be repriced.

Even if we have deflation, even if we have a debt jubilee, even if we have a recession, there are so many currency inits in the system that using the fiat price as a indicator of value will tend to mislead you.

Have your say

What do you good people of HIVE think?

So have at it, my Jessies! If you don't have something to comment, "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem, and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Safely Store Your Crypto | Deposit $100 & Earn $10 | Earn Interest On Crypto |

|---|---|---|

|  |  |

Posted Using LeoFinance Beta

What u sed about housing is crazy and happening in Greece to.

I mean everything is down from the health crisis , plus we have 10 years economic crisis and really the housing values especially in Rent are not getting down

Posted Using LeoFinance Beta

I think it’s happening in all counties around the world since they all following the same policies as the US, gotta keep printing and that cash naturally finds its way to assets

Posted Using LeoFinance Beta

I really found your little investigation about inflation and price increase of houses in Sweden to be interesting! And by the way, who would ever pay that much for a house in cold Sweden? Think about it... it is cold outside, you have a warm house... social distancing and COVID is no longer a threat!! :)

Lol sure yes I get that we all need shelter what Im saying is if my house price continues to inflate I could sell up and then go somewhere else, like get a nice house in the south of France or somewhere warmer and still have cash to spare

Posted Using LeoFinance Beta

This is true that as we are printing more and more money this have effect of price of these things. But in the specific example about housing market there are other factors as well. Specially if I talk about similar housing situation in my own country - Ireland.

House prices are crazy these days not just because of reason you mentioned above but because of lockdown:

These are a few reasons why housing market is booming here.

I find that more of a post rationalisation, yes some people are upgrading their homes, yes some people are moving out of cities, yes some people are refinancing, but those to me are at the margins and don't warrant a 17% increase in price in a year. there is no population or migration boom, as far as I can see since many countries are on lock down and as you mention travel is restricted.

In theory, housing prices should be coming down as debt is defaulted on which is typical of a recession and supply comes on to the market.

That's why I'm conflicted like is it just money printing keeping the debts rolling over and artificially holding back supply from entering the market or are we just measuring in something that's so fucked up we cant tell up from down anymore

Posted Using LeoFinance Beta

Well we could be in a bubble and I personally do think we are in one. Nothing was really that safe in the stock market and crypto. The problem with trying to measure things is that there are too many things that changed since last year. We had lock downs, small businesses closed, political turmoil and massive printing of money printing. So at this point in time, I don't know.

Posted Using LeoFinance Beta

I agree with your sentiments, but what I am thinking is that even if the air is let out of the markets there is so much currency already around that the new base would still be way higher in nominal terms than it was previously as numerator of currency has gotten so much bigger.

Posted Using LeoFinance Beta

It's the same case for Nigeria. The value of the currency is going down and increasing the pay in the same currency is not making up for the devaluation. In all I guess the government has failed us. I hope I can accrue a lot of crypto before the debasement of the Naira

Posted Using LeoFinance Beta

they broke the social contract long ago and they have to keep it up to maintain the status quo so I doubt they are going to reverse course, I see Bitcoin as the free markets solution to the problem and with every great solution there are copy cats trying to take it down. I don't have much faith in greater crypto but a lot of faith in Bitcoin

Posted Using LeoFinance Beta

Our housing market is blowing up here too in the US. Houses that would normally sell for just over $100k are going for close to $200K or more. It is nuts. The value you are getting for what you are paying is just not there. I would guess there has to be a direct correlation between that and the amount of money they are pumping out, but people just aren't seeing it. Or they don't care. Who knows!

Posted Using LeoFinance Beta

WOw 100% uplifts in some areas that must be nuts, you're pricing people into homelessness how many jobs allow people to set aside 200k in their lifetime these days? It all doesn't make any sense, you're just going to force people into desperation.

Posted Using LeoFinance Beta

Yeah, it is pretty ridiculous. It makes us almost tempted to put our house on the market, but supply is so low right now we might find ourselves out on the street!

Posted Using LeoFinance Beta

why do that? why not use the equity in your house to acquire another property and then let that property pay itself down, I think that's the real game here

Posted Using LeoFinance Beta

Problem is there are no properties available here either. Everything is dried up.

I believe we are, housing prices are becoming insanely high. Luckily I already own my place.

!BEER

Posted Using LeoFinance Beta

You are very lucky indeed, I don't get where all this leads if prices continue to go up eventually you run out of buyers, I mean are we really going to make 100 year mortgages a thing?

Posted Using LeoFinance Beta