[DeFi] Description of SUSHI tokens and DeFi forks listed on Binance

Today , I will briefly summarize the SUSHI token of Swap, which is going directly to Binance Exchange and is receiving a lot of attention from the community .

Currently, Swap has exceeded the total lock-up value (TVL) of $700 million in three days of launch, and SUSHI token, the governance token, is showing a tremendous price increase, and the price is maintained at around $10 on Binance.

#One. What is SUSHI swap?

In order to introduce swap, it is necessary to briefly explain Uniswap. Uniswap is the most successful DeFi protocol that provides liquidity to exchange tokens without having to go through an exchange on the Ethereum network as a DeFi protocol made with open source code by a team of enthusiastic developers .

As mentioned above , since the code is open source, anyone can fork Uniswap if they want, and the version that appeared through the fork is actually swap.

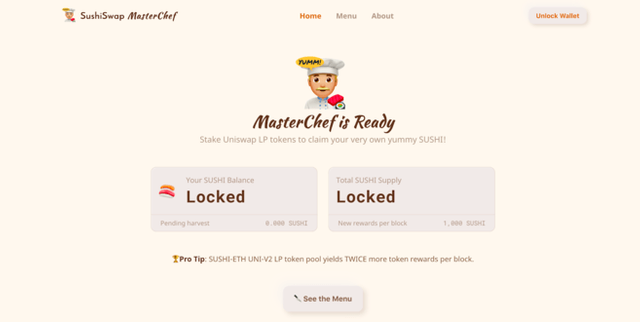

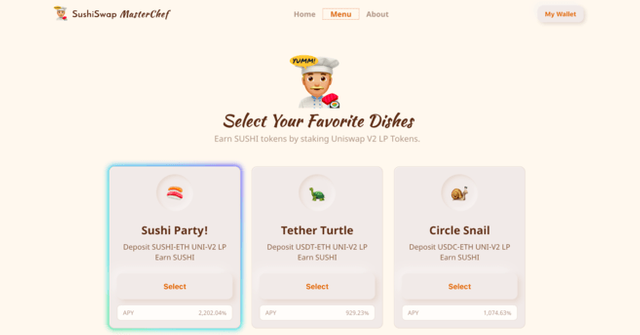

However, unlike Uniswap , which does not issue a separate governance token, there is only a difference in that all LPs (liquidity providers) that supply liquidity receive SUSHI tokens .

It can be said that the liquidity of the same quantity and the same type of tokens is supplied, but the fact that SUSHI tokens can be additionally received in addition to the commission income from liquidity supply is attracting many LPs.

Swap is a decentralized exchange protocolthat operates without an order book like Uniswap . Instead of an order book, we use a model called Automated Market Making (AMM), in which liquidity providers put tokens in a pool.

#2. Is SUSHI swap safe?

In conclusion, as of September 1, 2020, as of the posting date, SUSHI Swap is a project that has not received a code audit .

In fact, Certic, a blockchain network audit company, has pointed out that there are a number of security flaws in the swap smart contract.Even if it has been verified by a number of third-party auditors, all DeFi platforms have unexpected holes and risks. Can exist .

#3. DeFi Fork's Judgment

Using a very simple analogy, Uniswap is Bitcoin, and Swap is Bitcoin Cash . DeFi Fork Swap, which appeared by forking Uniswap, begins full-fledged testing after the initial two-week deployment period.

The real value of the DeFi platform is the volume of total trading assets, the token swap volume, the actual governance utility of the governance token, the expected price of the token, and the security and safety of smart contracts. Movement is faster than ever.

In the current situation, I think the habit of investing in tokens that can be understood and judged by themselves after studying and learning more and more is the most important time.

Posted Using LeoFinance

@tipu curate :)

Upvoted 👌 (Mana: 0/21)