Smart contract: the rule maker in the Web3.0 era

With the emergence of Ethereum in 2014, Smart Contract has gradually become well-known in the circle. And because of the popularity of DeFi in recent years, the application of smart contracts has also been greatly promoted. But as early as 1995, legal scholar Nick Sabo proposed the concept of smart contracts, that is, a smart contract is a set of commitments defined in digital form, "including agreements on which contract participants can execute these commitments."

Nick Sabo

We can give a simple example. For example, two people A and B bet 100 yuan. As a result, A wins, but B does not admit it, and A can only be depressed alone. There are countless such examples in real life, just as the programmer world has a common perception: Compared with automated programs, people are untrustworthy.

If A and B bet through the smart contract of the blockchain, both parties need to put 100 assets in the smart contract at the same time, and the smart contract will automatically execute according to the result and return the winner's principal and the winning reward to the winner. By. In this process, there is no need to worry about who will deny, and there is no need to bring in a third party for arbitration, which minimizes the occurrence of malicious and accidental situations and can also reduce costs.

In essence, a smart contract is a set of commitments defined in digital form, defined by code and enforced by code. Therefore, the advantages of smart contracts are high certainty, tamper-proof, inability to interfere, and the efficiency of automated procedures can be significantly improved.

The decentralization, traceability, tamper resistance and other characteristics of the blockchain naturally fit with smart contracts, and smart contracts have also opened up the application scenarios of blockchain technology. So, what are the specific application scenarios that can take advantage of smart contracts?

Application scenarios of smart contracts

financial

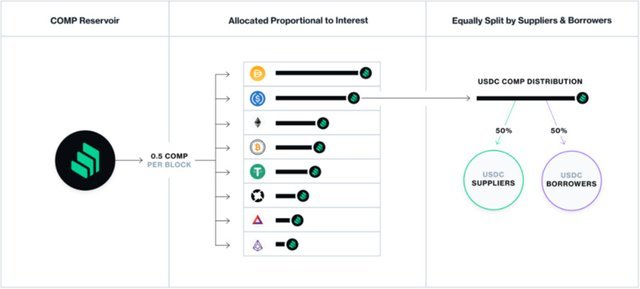

In June 2020, Compound launched "Lending is Mining", which ignited the DeFi (decentralized finance) market. "Encrypted asset investors use stablecoins, ETH and other encrypted assets as collateral for liquidity mining, that is, they can earn interest and obtain governance tokens. This can be said to be the most suitable for investors with hoarding needs. Way of financial management."

With the continuous influx of investors, DeFi projects for lending, DEX and other financial derivatives have also sprung up. The price and interest rate, mortgage lending, order matching, etc. related to the DeFi project are all realized by smart contracts, allowing participants to enjoy a license-free and efficient service experience.

Insurance

One of the pain points in the insurance industry is trust. Insurance companies will expend huge manpower and material resources to verify the insurance materials of the insurer to avoid losses caused by malicious fraud such as insurance fraud. And the insurer will always wonder whether the insurance I purchased will refuse it for various reasons.

In this case, smart contracts can partially automate the insurance process. Insurance institutions can write the insurance policy as a smart contract and upload it to the chain. When the specific execution conditions are met, the insurance contract can be automatically executed, which will reduce the cost and loss of both parties due to trust issues.

supply chain

The supply chain is a very complex system, just like computer production, each part will come from different suppliers, which involves complicated transaction procedures. Restricted by traditional paper contracts, the entire transaction process will be handled by many people, which is prone to errors or fraud. Through smart contracts, a safe and transparent digital version can be provided to all parties, and transaction tasks can be performed automatically. Combining smart contracts with Internet of Things technology can efficiently monitor the layers of the supply chain and reduce additional risks.

Digital identity

Privacy and data leakage have always been issues of concern to us. The use of personal private data for profit has become an inherent business model for oligarchs, but the ownership of data should belong to individuals.

A well-developed smart contract can enable individuals to manage and control personal information, and decide whether to authorize companies to use private data to obtain revenue. It is also possible to integrate digital identity information on different chains through smart contracts to break data islands and create a unique identity system.

Challenges of smart contracts at this stage

Smart contract is essentially a technical means, a tool that can improve productivity when used properly, and can be applied to all aspects of production and life. But smart contracts are not a magic weapon, and they are all disadvantageous. In fact, at the current stage, smart contracts have also exposed some problems.

Code vulnerabilities lead to damage to assets. Based on the smart contract built on the blockchain, the security of the bottom of the platform is guaranteed. However, because smart contracts are still in the development and practice stage, they are still not mature enough in terms of rule making and code implementation. For example, the early TheDAO coin theft incident and the recent COVER token issuance incident were caused by loopholes in the code protocol.

In addition, there are teams that specialize in various types of smart contracts, using business logic loopholes to "sweep the wool", which also caused some harm to the project party and the community. The current solution is to be audited by a third-party security audit agency before the smart contract code is released. But to ensure the impeccability of smart contracts, more practical experience is needed.

Insufficient TPS has led to restrictions on large-scale commercial use. Because of the limitations of the "impossible triangle" theory of blockchain, TPS (System Throughput) once became a powerful obstacle to the masses of blockchain. For example, at this stage, Bitcoin's TPS can only process 7 transactions per second, and Ethereum can only process more than a dozen transactions per second.

When the business volume is large, Ethereum-based DeFi projects need to pay expensive Gas fees when they need to put messages on the chain before they can be packaged in blocks, which is not conducive to the participation of users. Of course, the current blockchain industry also has corresponding solutions to this, such as block expansion, side chains, and sharding.

The development of any emerging technology was not smooth in the early days. Blockchain, as the cornerstone of Web3.0, is gradually becoming mature, and technical barriers are being overcome by the influx of developers one by one. It is believed that in the near future, smart contracts will become the rule-makers of the new network era.

Posted Using LeoFinance Beta

@tipu curate 4 :)

Upvoted 👌 (Mana: 26/78) Liquid rewards.