In 2020, 17 major events that profoundly affect the encrypted digital asset industry

The cryptocurrency industry is about to enter a new year. What new stories will happen in 2021? What new species are born? What new trends are emerging?

The best way to predict the future is to look back at history. The Mars Finance app has selected 17 events that have profoundly affected the progress of the cryptocurrency industry in the past year, hoping to help you find answers to the future from history.

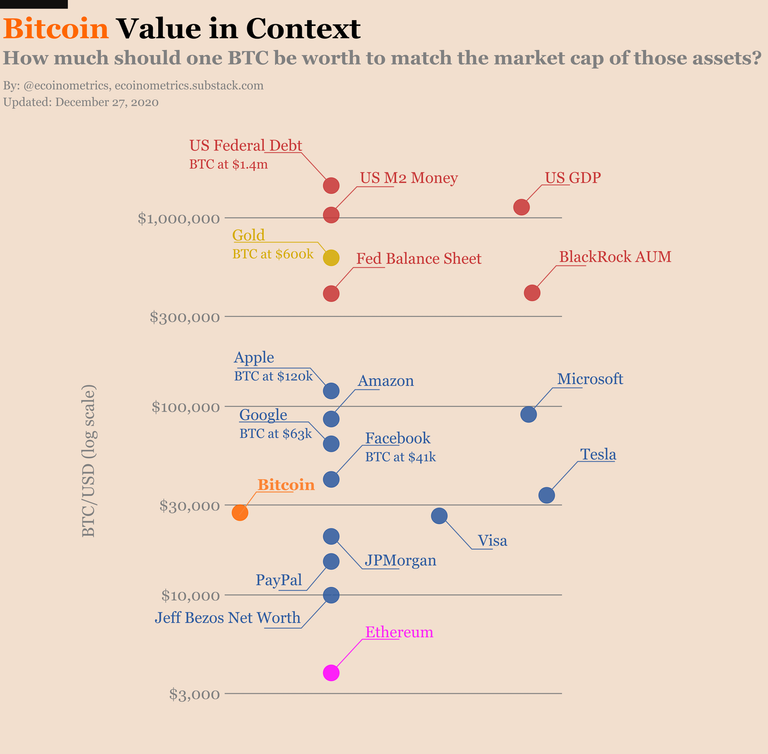

1. Bitcoin breaks through all-time highs and stands above $28,000

While most people are still guessing when Bitcoin will break through its historical highs next year, it began to show a strong upward trend, breaking everyone's imagination. After easily crossing to $20,000 on December 16, the "Great Leap Forward" began: 21,000, 22,000, 23,000, 24,000, 25,000... On December 27, Bitcoin finally jumped above 28,000 U.S. dollars, and its market value was approaching 500 billion U.S. dollars, surpassing Visa.

2. 312: The global epidemic escalated, the financial market was fuse, and Bitcoin plummeted to $3,800

The new crown epidemic continues to spread, the global financial market has encountered a liquidity crisis, the stock markets of many countries have melted, and the price of oil and gas has plummeted... Crypto assets are also bloody, and panic has intensified. On March 12, Bitcoin began to plummet from $8,000, a single-day drop of more than 20%. It fell further the next day, as low as US$3,800, a record low since February 2019. Many mining machines have been broken down at their cost prices, and the USDT stable currency has a premium of 9.86%.

3. PayPal supports cryptocurrency transactions, Visa starts USDC payment

On October 21, payment giant PayPal announced that it would allow customers to use the company's online wallet to buy, sell and hold BTC, ETH, BCH, LTC and other cryptocurrencies. Starting in early 2021, users will also be supported to use cryptocurrency to shop at 26 million merchants on its network.

Another payment giant Visa also announced this year to provide services related to crypto assets. On December 2, Visa announced a cooperation with Circle to integrate USDC and support 60 million merchants to pay through the token. At the same time, Circle has also joined the Visa Fast Track Program to support any merchant using Visa credit cards to conduct USDC transactions.

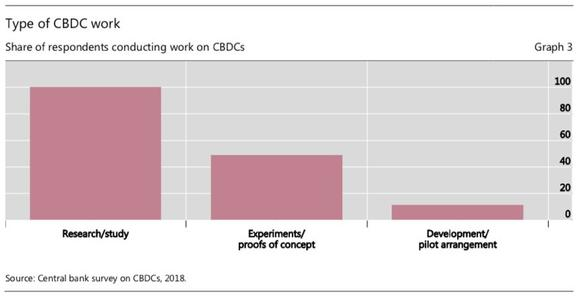

4. Global central banks launch digital currency competition

Since the beginning of the year, the People's Bank of China has been actively accelerating the central bank's digital currency (DC/EP) test. Shenzhen, Suzhou, Xiong'an, and Chengdu have successively conducted trials. On December 29, Beijing also announced to join the DC/EP pilot test team, and the first central bank digital currency application scenario settled in Fengtai Lize.

Since then, the European Union, Australia, Canada, South Korea and other countries and regions have taken further actions to lead the development of CBDC. The Bahamas became the first country to fully deploy a central bank digital currency.

According to data released by the Bank for International Settlements, among the 66 central banks in the world, 80% are studying digital currencies, and 10% of them are about to issue digital currencies. 2020 is defined as the "first year of legal digital currency".

5. The third Bitcoin halving was completed, and the block reward was reduced to 6.25 BTC

At around 3:23 on May 12, Bitcoin completed the third halving since its birth at a block height of 630,000, and the block was dug out by the Ant Pool. So far, the Bitcoin block reward has been reduced from 12.5 BTC to 6.25 BTC. According to the market, the price of BTC reached 8541 US dollars when it was halved.

According to the Bitcoin issuance mechanism, every 210,000 blocks, the Bitcoin block reward will be halved. Therefore, under the influence of this mechanism, Bitcoin once completed the first and second halvings on November 28, 2012 (block height 210,000) and July 10, 2016 (block height 420,000). Block rewards It has been reduced from 50 BTC to 12.5 BTC.

After the halving is completed, it is expected that the fourth Bitcoin block halving will take place in 2024, when the block reward will be officially reduced to 3.125 BTC.

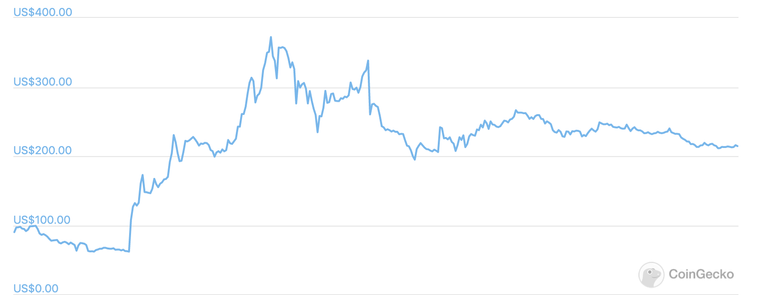

6. Compound launched the governance token COMP, igniting the first fire of liquidity mining

On June 16, Compound announced the launch of the governance token COMP, which can be obtained by platform depositors and borrowers. This model was originally called "borrowing is mining" and later extended to "liquid mining".

Under the influence of incentive measures, Compound surpassed the established lending project MakerDAO and ranked first in terms of locked positions. At the same time, the number of daily active users of DeFi DApp has also increased. According to data at the beginning of July, before June 15th, the average daily active users of Ethereum DeFi DApp reached 7,682, and since the issuance of COMP tokens on June 16, this number has increased by 48%, reaching 11230 daily active users.

In addition, the COMP token also rose 400% in its first week of launch, reaching a high of $372. At the same time, DeFi DApp transaction volume reached its peak. As of June 21, the transaction volume of DeFi DApp hit a record high of US$608 million.

The impact of Compound's launch of COMP goes far beyond that. From mid-June to early September, inspired by the “borrowing is mining” model, a large number of new liquid mining projects emerged in the DeFi market. The entire DeFi market began to explode with unprecedented power, and new projects and new gameplay blossomed everywhere.

7. "DeFi farmers" became popular

Inspired by Compound's "borrowing is mining" model, a large number of liquid mining projects with food as the token name appeared in the DeFi market. These projects attract users to inject capital by distributing tokens and provide liquidity. This process is called "income farming", and investors participating in income farming are called "DeFi farmers."

The first DeFi project to start income farming was Yam Finance (sweet potato). At 3 o'clock on August 12th, Yam Finance started liquid mining, and it was online for one hour to attract 76 million U.S. dollars, and the asset scale was approaching 400 million U.S. dollars within 24 hours.

Since then, there have been numerous mining projects named after bread, pizza, kimchi, sushi, hot dogs, and pickles in the DeFi market. Among them, SushiSwap is the most popular in the market. It once “preempted” a large amount of Uniswap's liquidity and forced the latter to issue UNI tokens and start mobile mining.

Recommended topic: A day as a DeFi farmer: What to dig? What to sell?

8. YFI price surpasses BTC, "fair start" becomes the focus

"Earnings farming" is popular. At the same time, Andre Cronje (AC) launched the revenue aggregation protocol yEarn.Finance, which can maximize revenue across protocols. yEarn.Finance native tokens YFI create " no pre-dug, no investor share tokens only be obtained by liquidity mining" distribution model, for "fair start" ( Fair Launch ).

"Fair Start" is popular in the DeFi market, and the price of YFI tokens soared, reaching as high as $ 43,678, becoming the first single token whose price exceeds BTC. Since then, many projects such as YAM and Swerve have followed suit.

9. Grayscale buys Bitcoin on a large scale, and mainstream Wall Street institutions actively embrace encrypted assets

The long-awaited institutional funding is finally here in 2020.

According to the data, the scale of encrypted assets managed by Grayscale at the beginning of the year was less than US$4 billion, and reached US$18.8 billion by December 29, and the company’s CEO tweeted on December 30, “You obviously want to make Grayscale in 2020. The total asset management scale (AUM) of the company has reached 20 billion U.S. dollars. Let me figure it out.” It implies that it will continue to increase its holdings of encrypted assets.

In addition to grayscale, companies such as Microstrategy, Galaxy Digital, and BlockFi are also buying bitcoin on a large scale. Statistics show that currently 29 large companies around the world hold 5.48% of the total supply of bitcoins, holding a total of 1.15 million bitcoins.

At the same time, the world's top rich and well-known individual investors have also begun to show their preference for Bitcoin and buy the asset into their investment portfolio. It is reported that Wall Street billionaire and legendary investor Paul Tudor Jones bought Bitcoin in May of this year with slightly more than 1% of his assets, and said in August that he “regrets not to buy more Bitcoin”. In addition, Ricardo Salinas Pliego, the third richest man in Mexico, has invested 10% of his current assets in Bitcoin.

10. The Ethereum 2.0 beacon chain was launched, and the price of ETH rose nearly 500% during the year

On December 1, the Ethereum beacon chain , which has attracted much attention from the industry, was launched at the block height of 1606824000 . At this point, Ethereum has taken the first step towards the 2.0 stage.

With the launch of the beacon chain, the number of tokens injected into the Ethereum deposit contract began to increase. Initially, to activate the " beacon chain", 16384 validators must deposit 524288 ETH into the deposit contract to trigger the genesis block, and each validator needs to deposit 32 ETH . By the end of December, the number of ETH deposited in the contract increased from over 500,000 to 2 million.

With the launch of the beacon chain, the number of tokens injected into the Ethereum deposit contract began to increase. Initially, to activate the " beacon chain", 16384 validators must deposit 524288 ETH into the deposit contract to trigger the genesis block, and each validator needs to deposit 32 ETH . By the end of December, the number of ETH deposited in the contract increased from over 500,000 to 2 million.

The price of ETH has risen by nearly 500% this year, with the highest increase of 759% during the year. The price has soared from around US$130 at the beginning of the year to above US$700. In addition, the Chicago Board of Trade announced that it will launch Ethereum futures on February 8, 2021. The contract will be settled in cash and is currently awaiting regulatory review.

11. Polkadot started the on-chain transfer function, and the total amount of DOT split was changed to 1 billion

At 0:39 on August 19th, Polkadot started the on-chain transfer function. At this point, DOT can be circulated on the Polkadot network, and DOT holders can trade spot tokens on exchanges. On August 21, DOT began to split, that is, 1 DOT will be split into 100 DOT, and the total number of tokens will be changed to 1 billion.

PolkaWorld statistics show that there are more than 100 chains ready to connect to Polkadot this year, and more than 60 testnets have been launched. In addition, by the end of the year, there were more than 550 validator nodes and 7,000 nominators in the network, and over 60% of DOT was in mortgage.

12. Uniswap issued coins and airdropped UNI to early users

On September 17, Uniswap announced the launch of its liquidity mining plan and the issuance of governance token UNI. At the same time, it airdropped tokens to early users, which triggered huge discussions. After the online trading, UNI rose 5 times in a single day, and the subsequent trading day reached a maximum of US$8.6, which simultaneously drove Uniswap's lock-up volume to return to the rising channel, from US$1.3 billion in mid-September to nearly US$3 billion in mid-October. Doubled in size.

Uniswap's airdrop method of tokens is imitated by Tokenlon and 1inch:

On September 26, Tokenlon announced the issuance of 200,000,000 LON tokens. Users can get token airdrops through the invitation code;

On December 25, 1inch announced the release of the governance and utility token 1INCH (1.5 billion in total), and airdropped tokens to 55,200 addresses. The maximum single-person profit amounted to US$20 million.

Recommended topics: DEX dark horse Uniswap issuance of coins, UNI can be expected in the future?

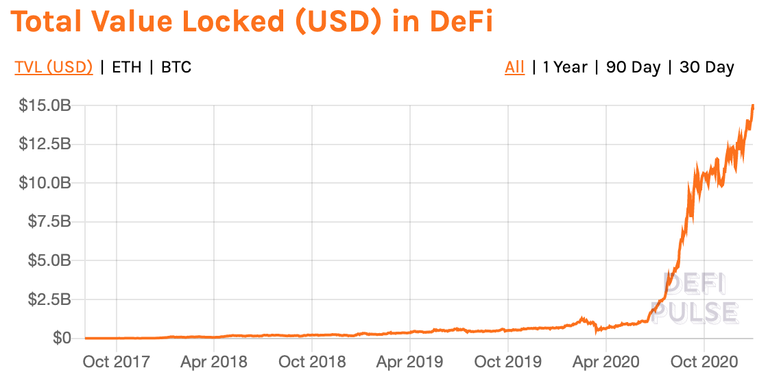

13. The total amount of DeFi locked up increased by 2300%, and the number of active addresses increased by up to 250%

DeFi has made great progress this year. At the beginning of the year, the total locked-up volume of DeFi agreements exceeded 600 million U.S. dollars and reached 1 billion U.S. dollars by the middle of the year. Since then, the inflow of funds into the DeFi market has continued to increase, approaching $15 billion by the end of the year. In 2020, the amount of DeFi locked positions will increase by 2300%.

At the same time, the number of DeFi active addresses has also increased. At the beginning of the year, the number was about 99,000 and reached 230,000 by the middle of the year. After that, it exceeded 350,000 in mid-December and is currently about 260,000.

14. The total value of the stablecoin market exceeded US$250 billion, and algorithmic stablecoins emerged

Since the beginning of the year, the stablecoin market has grown substantially. In mid-May, the total value of the stablecoin market exceeded the $10 billion mark, an increase of 79% from the beginning of February. Driven by the DeFi boom, it currently exceeds $250 billion.

On the other hand, the algorithmic stablecoins ushered in the spring, APML, ESD, Basis, etc. are gaining eyeballs, and investors have heard the news. The so-called algorithmic stable currency means that the stable currency does not have any assets as collateral. Its stability depends on the smart contract to increase or decrease the tokens based on the market price, thereby controlling the total amount of tokens in circulation, thereby affecting the price and making it stable . However, most projects are used by speculators for arbitrage, and prices are difficult to stabilize.

15. Trump signs US$2.3 trillion new crown epidemic relief and spending bill

On December 27, US President Trump signed a US$2.3 trillion new crown epidemic relief and expenditure bill, planning to provide domestic enterprises and individuals with relief funds and avoid government shutdown. Affected by this news, US stocks skyrocketed.

It is reported that the bill will allocate 1.4 trillion US dollars to support the operation of government agencies until September 30 next year, and another 900 billion US dollars will assist various industries that have been hit hard by the epidemic.

At the beginning of this year, affected by the epidemic, the U.S. government once "released water," and many central banks around the world printed money madly. At that time, the industry believed that the government's large-scale money printing provided an opportunity for the cryptocurrency market to rise, because many local people chose to buy Bitcoin with depreciated U.S. dollars.

16. S&P Dow Jones announces the launch of cryptocurrency indexes

On December 3, S&P Dow Jones announced that it will launch a cryptocurrency index in 2021, which is another important development for Bitcoin and other crypto assets to enter the mainstream market.

According to reports, S&P Dow Jones will cooperate with Lukka, a cryptocurrency company in New York. Lukka will provide cryptocurrency price data, and S&P Dow Jones will provide brands, custom indexes and other benchmark tools. In addition, the index to be launched will process more than 550 cryptocurrencies with the highest trading volume.

17. BitMEX and Ripple have been "encircled and suppressed" by regulatory authorities, and compliance has received unprecedented attention

This year, the U.S. Department of Justice and the SEC respectively launched a "encirclement and suppression" campaign against BitMEX and Ripple.

In mid-October, the US Department of Justice accused BitMEX of violating the Bank Secrecy Act and arrested its CTO. As of late December, the US SEC announced that it would sue Ripple and its two executives, claiming that XRP is an unregistered securities, and that the two raised $1.3 billion through token sales , and used the method of sitting in the bank to manipulate the currency price to make more than 6 One hundred million U.S. dollars. Affected by this news, the price of XRP plummeted, with the price falling from $0.48 to around $0.17, a drop of over 60%.

On December 3, members of the US Congress drafted a bill related to stablecoins to require comprehensive supervision of stablecoin issuers. The bill states, “Anyone who issues stablecoins or stablecoin-related products, provides any stablecoin-related services, or otherwise engages in any stablecoin-related commercial activities, including those related to the issuance of stablecoins by others, without written approval Currency activities are illegal."

Posted Using LeoFinance Beta

Congratulations @chilok! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz: