Passive Crypto Earnings March 2021 (Lending/Dividends/Staking)

I will only cover mostly passive earnings in these posts not including earnings that take more effort like blogging, Gaming, Sports Betting & Poker or Affiliates on platforms like Hive | Publish0x | Leofinance | Steemit | Splinterlands | Nitrogensports | ...

How much exactly is needed to get to these numbers can perfectly be calculated along with the risk it involves, so do your own research on that if you intend to get in on any of the ones that I am using to get passive returns!

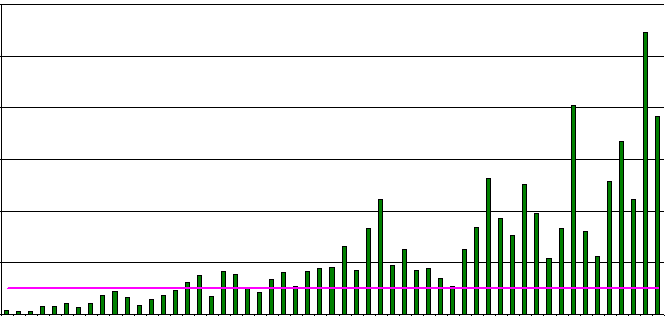

I started putting some work into getting passive returns back in may last year (See First Report when it earned ~25$). Ever since, I moved more of my crypto onto different lending platforms, continued to earn, accumulate, hodl, compound, diversify, and so on while prices on the market continued to go up. It looks like we have entered the bubble zone and from here on out, I will be more focused on making some profit from trading having a proper exit strategy to make sure to partially put some of the profit safe instead of having everything locked up making passive returns. I might end this series of posts having done it for an entire year and maybe restart one day if there is another crypto winter.

Crypto Lending Earnings

I'm still using the 4 big Crypto Lending platforms (Celsius.network | BlockFi | Nexo.io | Crypto.com) as a way to both get the best rates and also spread the risk. I'm also looking to explore Voyager which seems to be another big platform that gives passive lending returns.1. BlockFi

BlockFi heavily reduced their lending rates for bigger accounts that hold 1> BTC since one of the ways they were able to give the 6% APY (The Grayscale Premium) now longer seems to be something they can rely on. It certainly is an orange flag and I have been thinking of reducing my exposure a bit even though I don't see funds being in danger. Rates eventually will come down with more people coming in looking to get a good yield on their crypto holdings. So far I have never had any issues with BlockFi and I'm looking forward to continuing using them for hopefully a long time to come as they still are the easiest and cleanest lending platform which also allows trading.

BlockFi is also giving a 10$ worth in BTC to everyone that signs up and deposits at least 100$ in Crypto on their interest account when they sign up with a Referral link. Feel free to use mine or the one from a friend that already has a BlockFi account.

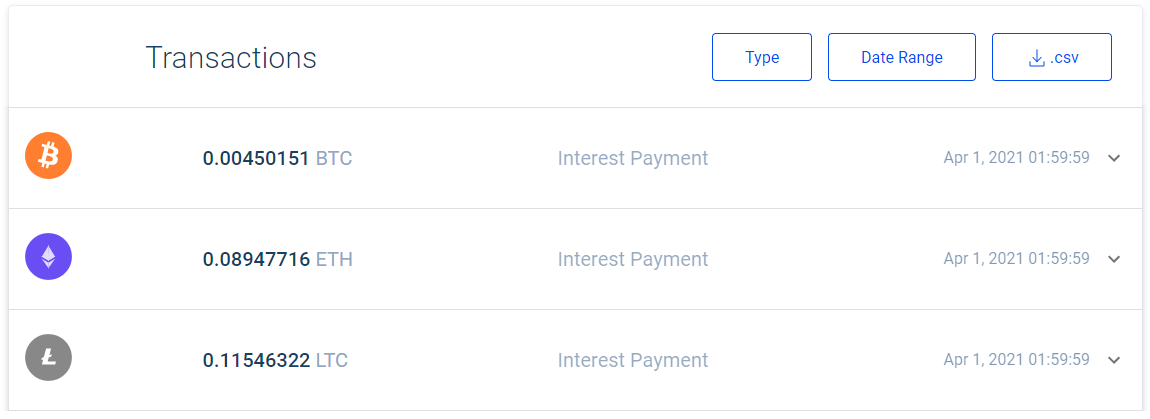

BlockFi Passive Earnings

0.00450151 BTC (289.21$)

0.08947716 ETH (211.66$)

0.11546322 LTC (31.38$)

2. Crypto.com Earn / Cashback

What I love the most about Crypto.com is their mobile app and the Visa Depit Card which gives a 2% cashback on all my purchases. I have put money aside for my expenses this year keeping most of it in BTC/ETH/LINK using that to top up my card each month with EURO. Even doing all my needed purchases, my overall available balance in EURO still went up basically making me eat for free. I also used it to do some bigger purchases (a Chromebook) on behalf on my mom which increased the cashback earnings. Some of the Crypto holdings are also in a flexible stake earning 1.5% allowing me to get them out at any given time.

They are still offering a nice sign-up deal for everyone that gets on using a referral link (code: e7xe283zea) giving a free 25$ worth in CRO when meeting certain requirements.

Crypto.com Passive Earnings

0.0001079 BTC (6.96$)

187.165 CRO (43.50$)

3. Celsius.network

Celsius.network just remains a sold source of passive earnings with many options for coins to earn interest on and they allow a free monthly withdraw. With the crypto market heating up and the ETH gas fees being high, I have been rather reluctant to get more coins on there as the cost doesn't justify it knowing I will want to get them out again to take some profit at some point this year.

Celcius.network is still offering a sign-up bonus up to 20$ in BTC for everyone that signs up with a Referral link depositing 200$ or more keeping it in place for at least 30 days.

Celsius.network Passive Earnings

10.20018 LINK (382.91$)

1.6886 EOS (13.12$)

4.89971 ZRX (10.73$)

0.00861 DASH (2.63$)

0.0000 BTC (0.61$)

4. Nexo.io

I still keep 500 EOS on Nexo who lowered the returns from 5% to 4% and see it mostly as another way to spread the exposure. For now, the plan continues to be to just hodl and rake in some earnings on nexo. EOS finallt started to go up in price also

Nexo.io Passive Earnings

1.7156 EOS (13.26$)

Crypto Dividend Earnings

These are dividends paid from projects that have actual revenue and share it with tokenholders.1. Wink.org (WIN)

It has been quite the crazy ride on Wink.org accumulating the WIN token during the entire year as the price never really seemed to be adjusted to the potential growth giving excellent returns. The price recently pumped like crazy and I started to reduce my position a bit taking profit.

Wink.org Passive Earnings

WIN 1695.09 TRX (247.14$)

RAKE 11.92 TRX (1.73$)

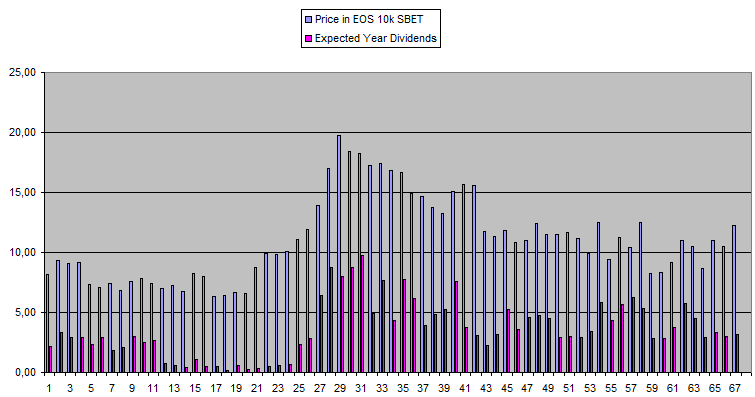

2. Sportbet.one (SBET)

I used part of the money I got out of Wink after the price pump to increase my position even more in SBET (sportbet.one). Dividends continue to be paid out weekly and they also added a casino platform. Last month I wrote a post (Reasons I Bought More SBET) back when the price was at 0.002831$, by now it has increased to 0.007986$ and happy to hold my current stack at these prices as returns are great and they have much more potential to grow in their user base even though it won't be easy.

Sportbet.one Passive Earnings

25.3105 EOS (196.16$)

101.9 SBET (0.81$)

0.61068 mBTC (39.35$)

3.9696 USDT (3.97$)

Crypto Staking Earnings

From what I understand, staking is all about locking up coins getting rewards for it that most of the time comes from inflation.

1. Band Protocol Staking Rewards

Band Protocol (BAND) Passive Earnings

2.833 BAND (47.83$)

2. Tron (TRX)

I still have 10k TRX in frozen voting for Super Representatives which brings in some passive earnings. All these small things do add up and it's easy to have them in place letting them ride right now.

TRON Passive Earnings

41.723 TRX (6.00$)

3. Binance Staking Rewards

Binance allows staking of a lot of different coins to be staked even though it's quite a mess as there are so many different options. Some of my staking periods ended and I was quite sloppy on renewing them so I waited to do it all at the start of this month for 30-day periods, I also moved my ICX to Binance to get good returns there. They do provide passive returns for a lot of different coins (TOMO | ARK | EOS | ARPA | LIST | THETA | LOOM | KAVA | TEZOS | ATOM | TRON | ALGO | ONE | FET | STRAT | QTUM | KMD | VET | ONT | NEO | TROY | ERD | XLM | YFI | KNC | ...). Signing up with my Referral Link will also give you a 0.10% cashback on all your trading fees.

4. LEO Miner Rewards

LEO Miner Passive Earnings

19.08 LEO (18.70$)

5. SPT Delegation

SPT Delegation Passive Earnings

31320.830 SPT (12.84$)

6. Cub DeFi

CUB Staking Passive Earnings

10 CUB (38.70$) -> Airdrop

1.85 CUB (7.16$) -> Staking Rewards

Please let me know in the comments what your personal favorite ways are to earn passive earnings and feel free to include your Affiliate link!

Previous Passive Earning Results 2020 (Link)

A summary of the Month of March

| Platform | Jan | Feb | Mar |

|---|---|---|---|

| BlockFi | 372.58$ | 494.19$ | 532.25$ |

| Crypto.com | 13.27$ | 81.52$ | 50.46$ |

| Celsius.network | 456.51$ | 394.29$ | 410.00$ |

| Nexo.io | 8.87$ | 7.81$ | 13.26$ |

| Wink.org | 143.72$ | 88.24$ | 248.87$ |

| Sportbet.one | 85.58$ | 66.60$ | 240.29$ |

| PRPS/DUBI | - | 534$ | - |

| Tron | 2.37$ | 2.67$ | 6.00$ |

| Binance Staking | 10.10$ | 18.27$ | - |

| Band Staking | 40.00$ | 37.91$ | 47.83$ |

| ICON Staking | 27.51$ | 45.14$ | - |

| LEO Miner | 13.60$ | 19.65$ | 18.70$ |

| SPT Delegation | 9.17$ | 7.12$ | 12.84$ |

| Cubdefi.com | - | - | 45.86$ |

| Total | 1183$ | 1797$ | 1626$ |

|

|

|

Posted Using LeoFinance Beta

The motivating post is here

I have low methods to earn passive income So I don't try to do statistics like this so as not to be frustrated

Posted Using LeoFinance Beta

It actually works quite motivating seeing it all go up regardless of the amounts. It really worked addictive this past year to systematically add to the passive earnings. Keep it up and good luck !

Posted Using LeoFinance Beta

Thanks for the post! I love that you're sharing how much you're earning on each of these platforms, but I'm not sure what it all means without knowing how much you have invested. Would be great to see how much you have staked of each of the tokens on each of the platforms.

This series of posts is not so much about the investment itself and more about different ways to get some passive returns. All the percentages are there or in other posts I have been making around some of the coins I'm holding. So it is perfectly possible to backwards calculate how much investment is needed.

I hope that makes sense.

Posted Using LeoFinance Beta

I have two favourite just now. First LP in Uniswap and quickswap. It feels easier to get money from it then trying trading. Like my ETH-USDC most becuase it is a pretty stable pool - with a lot activity when the market goes crazy.

Second - I like AAve lending platform. You get some passive income but also farming matic-token just now.

Of course - celsius is always nice!

Posted Using LeoFinance Beta