Deposits And Withdrawals On Hive Engine | Historical data

Hive Engine started its operation on the Hive blockchain shortly after the creation of the chain, in April 2020. A

The second layer on Hive has been building and developing since introducing some new and interesting things including a witness system to decentralize its operations.

Here we will be looking at the volume that Hive Engine does in terms of deposits and withdrawals on the platform. It is a nice indicator of the state of the platform.

At the moment there are three major gateways for deposits and withdrawals on Hive Engine:

- Hive Engine (@honey-swap)

- LeoDex (@leodex)

- BeeSwap (@hiveswap)

There are fees for deposits and withdrawals, 1% on Hive Engine and 0.25% on LeoDex and BeeSwap.

All the projects build on top of Hive are made possible by the custom_json data and Hive Engine. Splinterlands, dCity, Rising Star, CryptoBrewMaster and all the other games. Next the tribes, LeoFinance, Palnet, Neoxian, Sports, Weed etc. The NFT platforms, NFTShowroom, Lensy. Some other specific tokens like SPI, BRO etc. as well. Without a doubt Hive will be a much more boring place without Hive Engine and we should be grateful for it. This just shows the importance of the second layer.

The period that we will be looking at here is May 1st 2020 – March 13, 2021.

Deposits

For deposits we will be looking at the transfers to the Hive Engine @honey-swap account, @leodex and @hiveswap for BeeSwap.

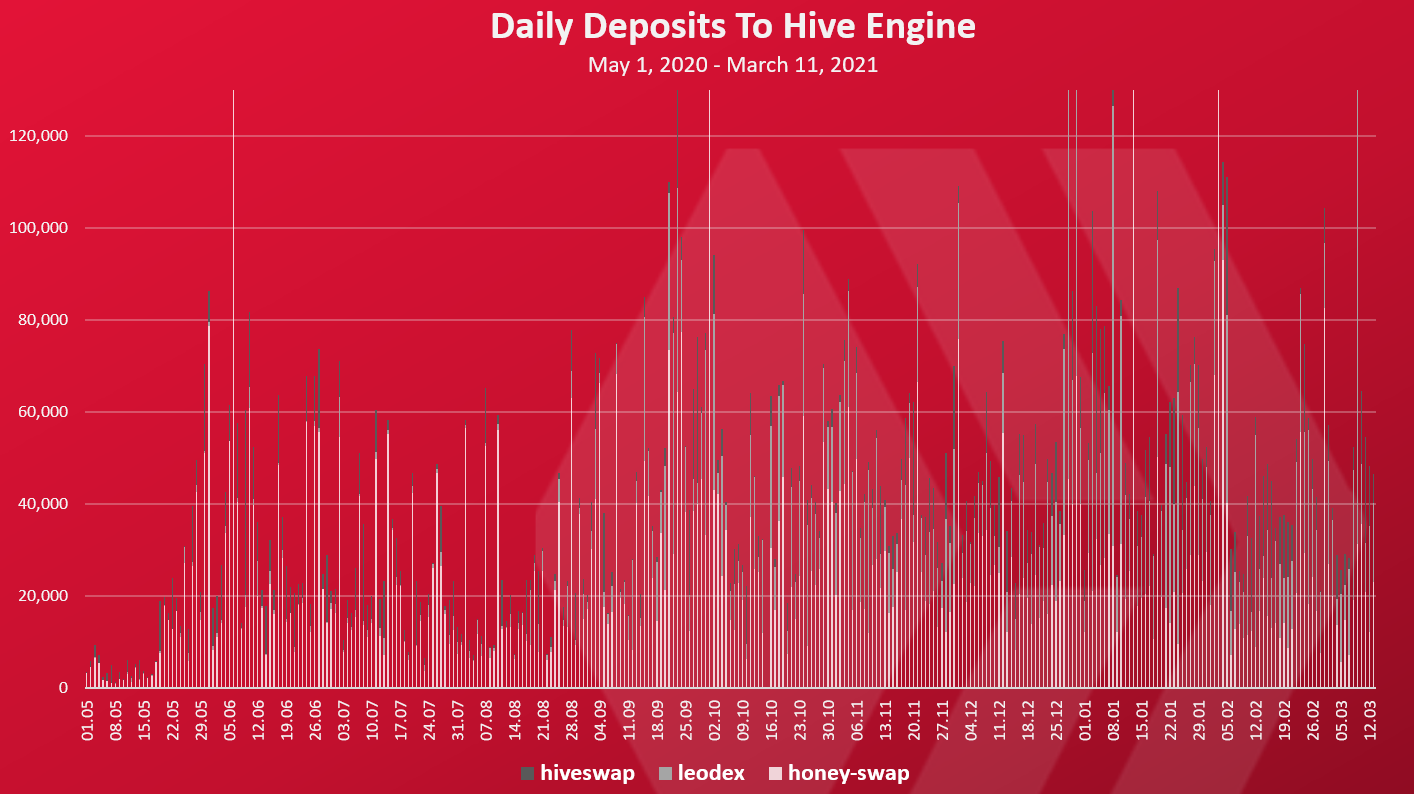

Here is the chart.

The Hive blockchain was created at the end of March 2020, and Hive Engine started operating a bit later in April.

The daily chart is a bit messy with a lot of spikes and ups and downs. But overall it seems that there is an uptrend in the deposits.

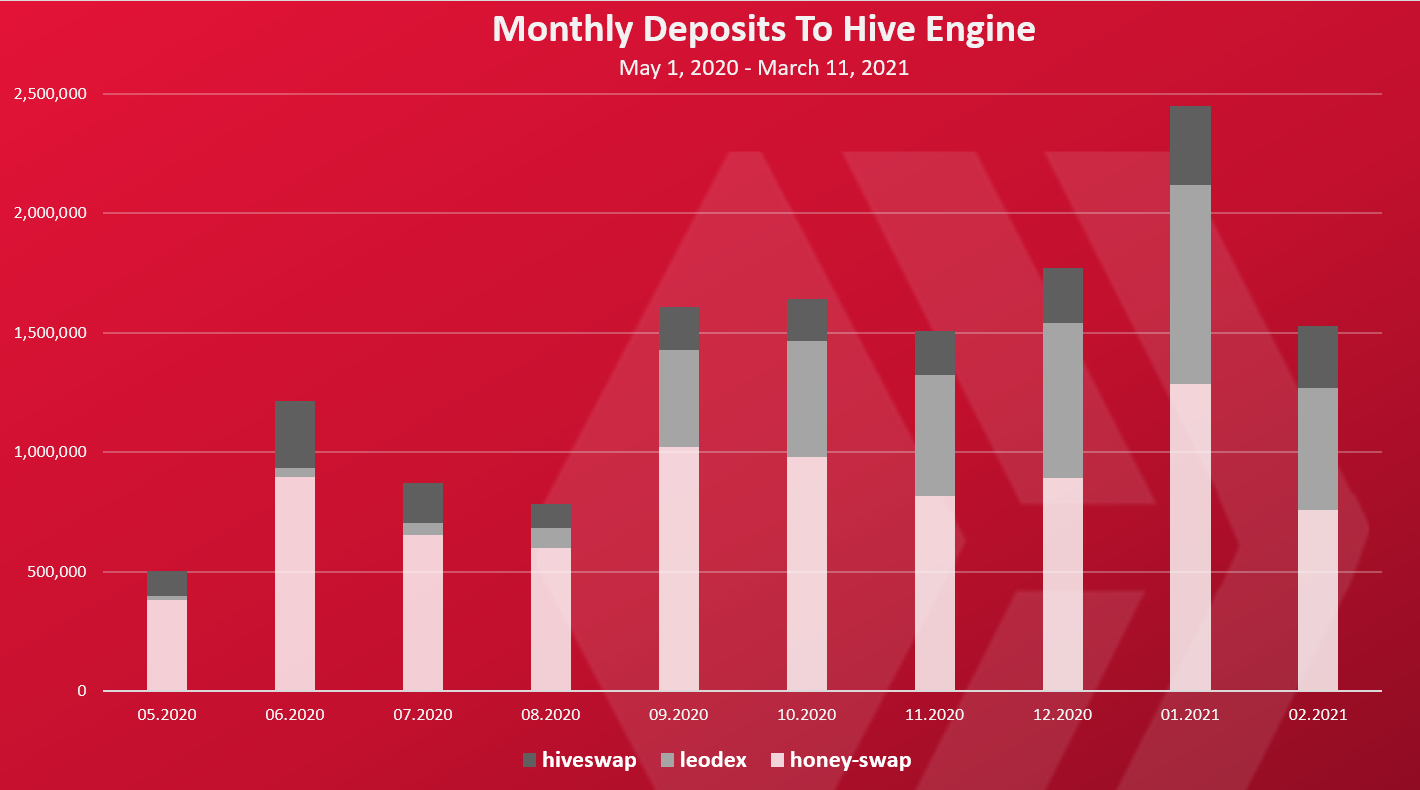

A more reveling representation can be made if we look at deposits on a monthly level.

A better representation here. We can see a spike in June 2020, then a down trend and again up movement from September 2020. January has a record high amount of deposits with almost 2.5M HIVE in the month.

It is interesting to see that the @leodex share has been increased significantly from the beginning. The BeeSwap gate has also a decent share.

Who has deposited the most?

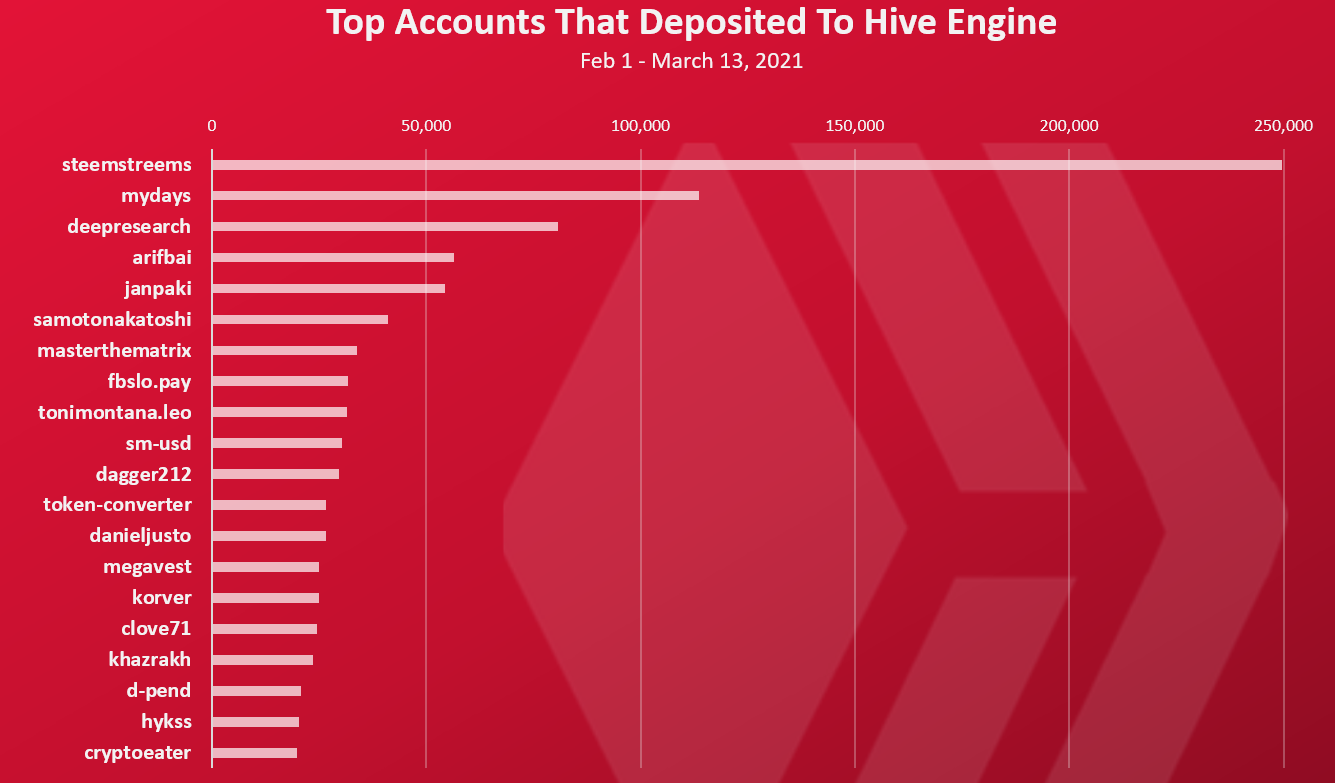

Here is the chart for the top accounts that deposited for February and the first days of March 2021.

@steemstreems is dominating the no.1 with 250k deposited. Next is @mydays with around 110k deposits followed by @deepresearch.

Withdrawals

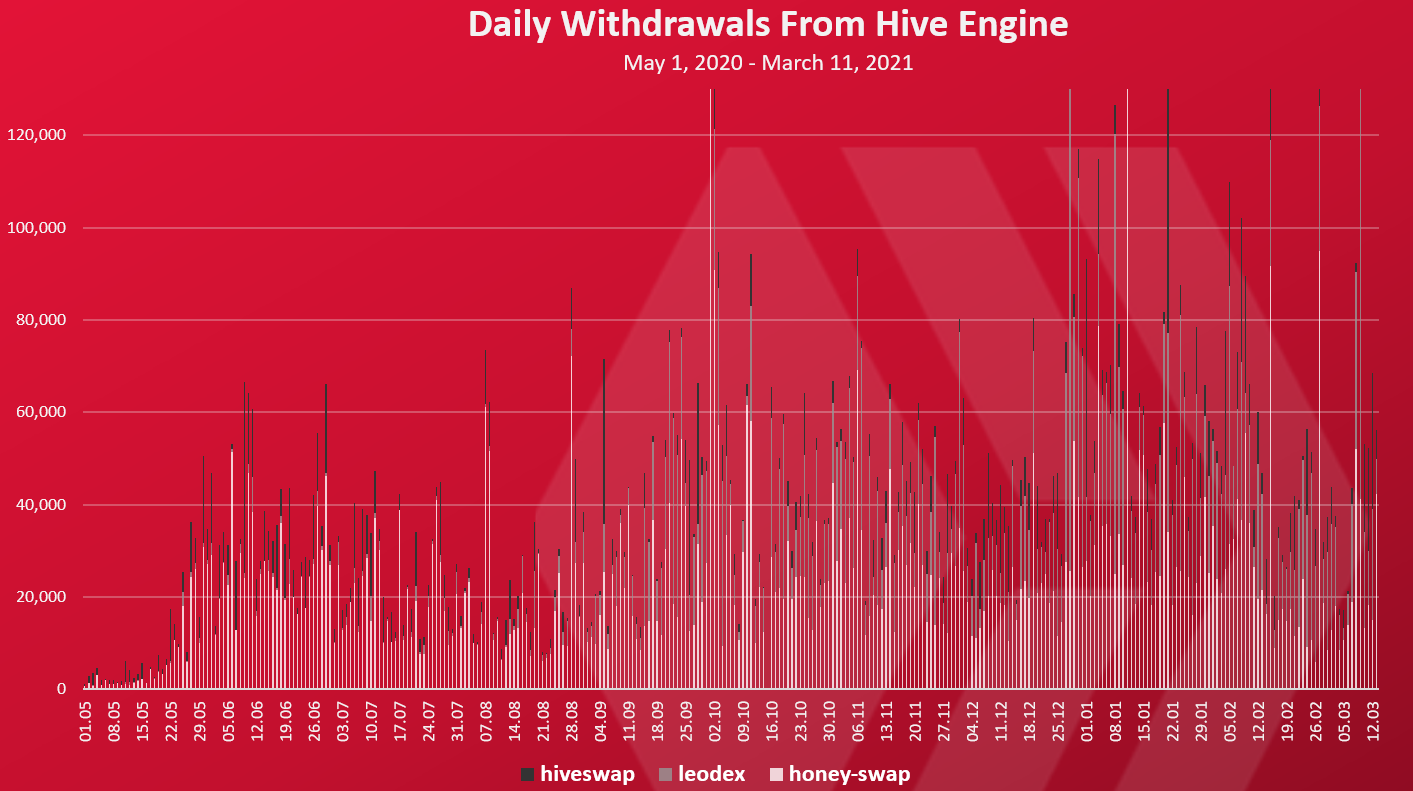

Here is the chart.

This chart seems to be following the deposits.

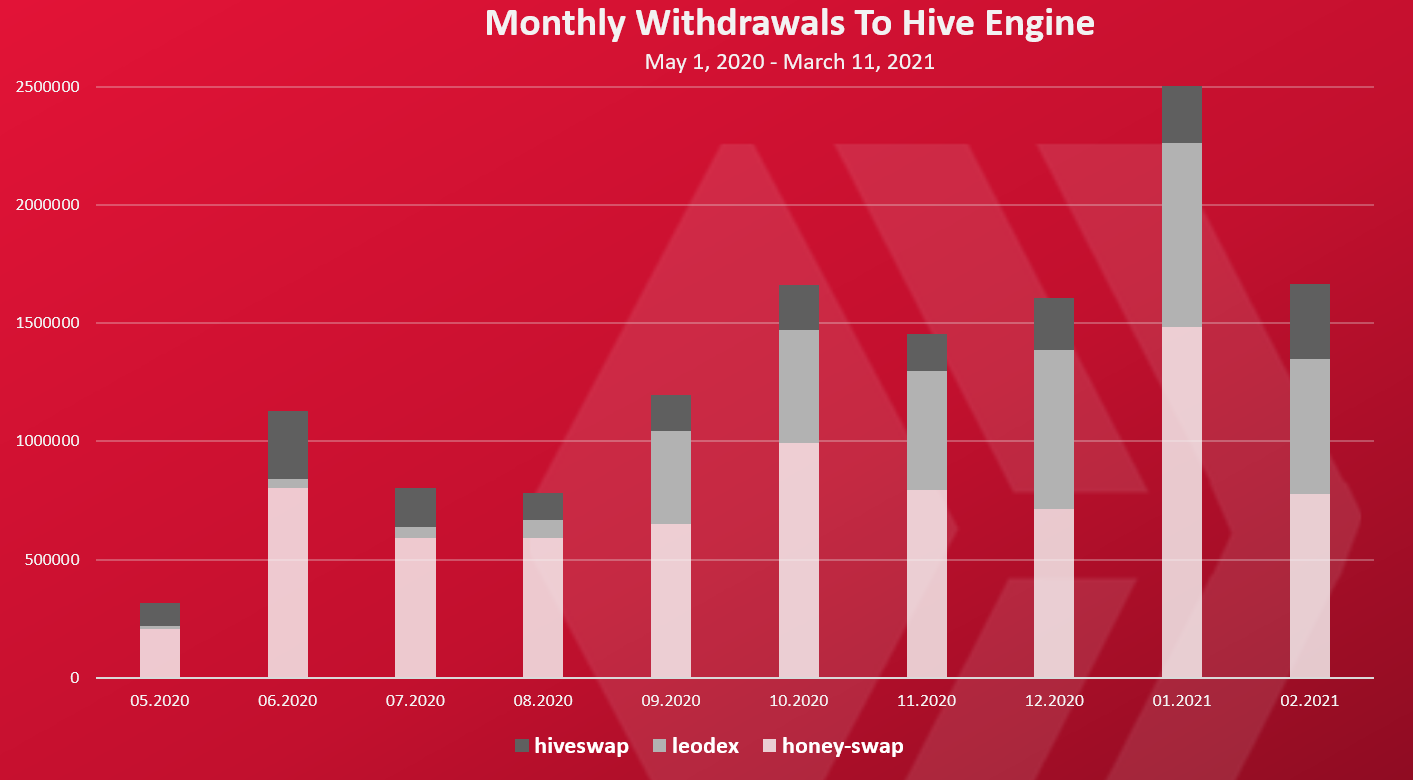

The monthly chart for withdrawals looks like this.

A similar pattern as for the deposits. A record high withdrawals in January 2021 with 2.5M.

A total of 14.6M HIVE deposited and 13.9M withdrawn in the period.

This is for all the three gateways.

Who has withdrawn the most?

Here is the chart for the top accounts that withdrew in the period.

@tonimontana.leo is on the top with 170k HIVE withdrawn in the period, followed by @samotonakatoshi with around 100k and the @leo.bank.

Individual platforms share

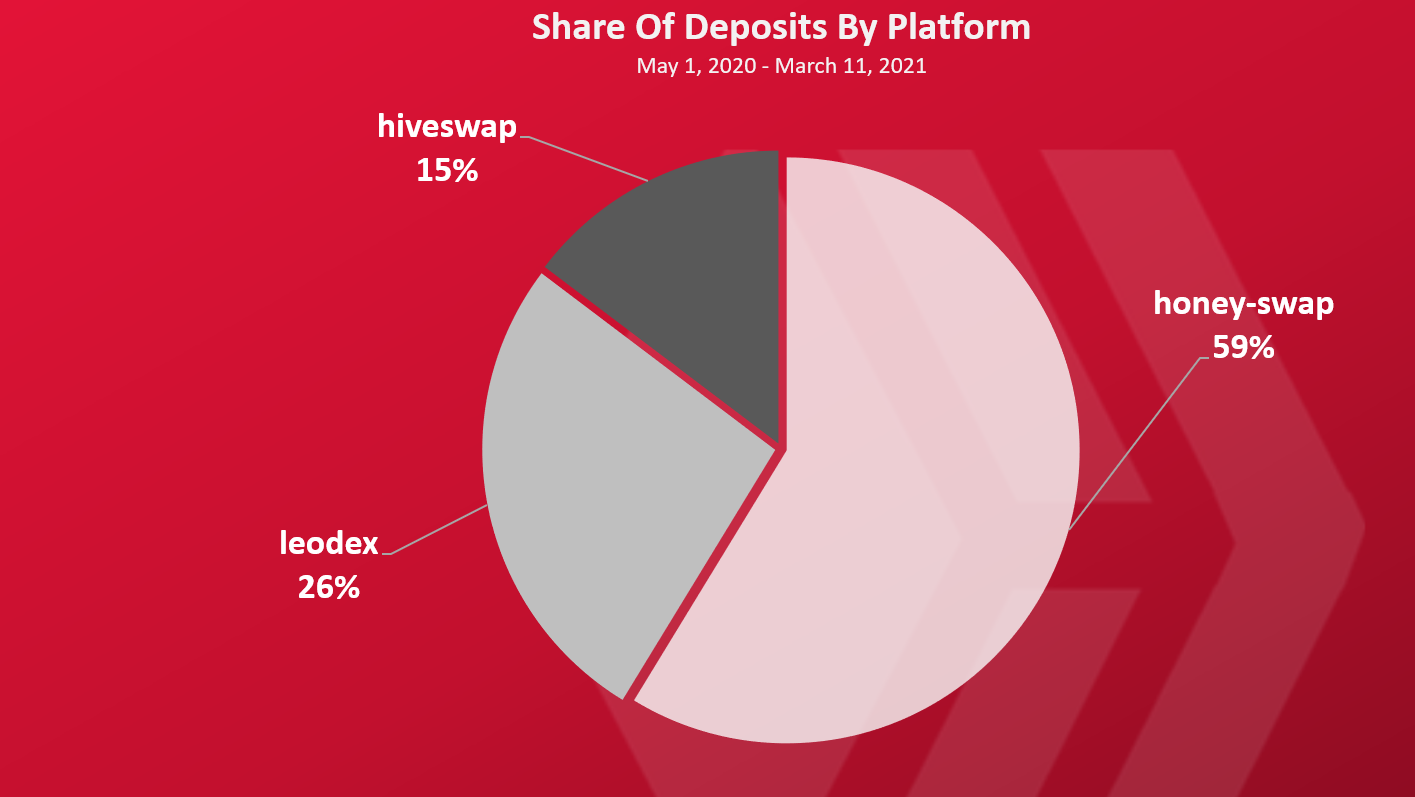

Here is the chart for the share of the deposits of Hive Engine, LeoDex and BeeSwap.

The Hive Engine account @honey-swap has 59% share of the deposits, followed by @leodex with 26% and then the BeeSwap @hiveswap account with 15% share of the deposits.

All the best

@dalz

Posted Using LeoFinance Beta

https://twitter.com/Dalz19631657/status/1371097039912701958

For one second I got scared I lost control over my H-E addiction but it just counts unsuccessful transfers refunded by leodex immediately.

Oh ... yea that as well ... it includes all the transfers ... cant tell is it a refund or withdrawall

For me I use leodex for low withdrawal and deposit fees

It is pretty good

Posted Using LeoFinance Beta

Hive-engine has been pretty useful lately

in helping tribes move funds around.

Leofinance is leading the pack in all of these.

Glad to have many avenues to access Hive.

!BEER

Posted Using LeoFinance Beta

View or trade

BEER.Hey @dalz, here is a little bit of

BEERfrom @pouchon for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.I love seeing these stats! Thank you @dalz

Posted Using LeoFinance Beta

I always find it interesting how much hostility toward hive-engine there is out there considering HIVE and STEEM before it would most likely be worthless without it. Yea that's just my opinion, but looking at things like the when the DAO can shell out 60k for an image server and all the other garbage and vaporware we've funded for people that go MIA and comparing that to hive-engine constantly developing regardless of the one proposal they made never getting funded... it's pretty telling who's here for the long haul and who's just trying to grab a few bucks out of the system.

I think it's pretty impressive LEO is doing as much as it's done without DAO funding too and I got a lot of love for anybody that's been developing out of pocket through the insane price ride we've been on with STEEM and HIVE. Anyways, great read and some really interesting stats. I actually didn't realize LEODEX had a lower deposit fee. Guess I know where I'll be converting from now on lol.

Posted Using LeoFinance Beta

Thanks!

Hive Engine has enabled a lot of development for sure. As for the DAO goes it looks like it always going to be a hot topic :)

I hope we learn from this initial phase and improve going forward. It will be great that projects ask for funding after the job is done, not before.

Posted Using LeoFinance Beta

Cool report again. I just wonder what might have happened in January to have this big spike. Stimulus? Increase in crypto value?

Posted Using LeoFinance Beta

Thanks!

LEO is driving a lot of volume to Hive Engine, so the growth of LEO is one of the main reasons for this.

Posted Using LeoFinance Beta

LEO is the main driver for the chain at this point. Even if people don't like to read this, this is the case.

Posted Using LeoFinance Beta

Truer words have never been spoken

Posted Using LeoFinance Beta