Overview Of The Key Metrics On The Binance Smart Chain | Wallets, Transactions, Tokens, Contracts | March 2021

The Binance Smart Chain has seen a significant growth in the last few months. I have made a post on the topic two months ago.

Since then the growth of BSC has contend even faster. Let’s take a look how are thing now.

Just a quick remined of some of the features of the Binance Smart Chain.

- It is a standalone chain running separately from the Binance chain,

- Its is a copy of the Ethereum blockchain, but with proof of stake concept,

- It has a low fees in the range of a few cents,

- Its not a 100% decentralized and some users might have issues using it depending on the location, especially on withdrawal and deposits

The data is extracted from https://bscscan.com/, for the period September 1, 2020 – March 20, 2021.

The Binance Smart Chain [BSC] started with operation at the end of August 2020.

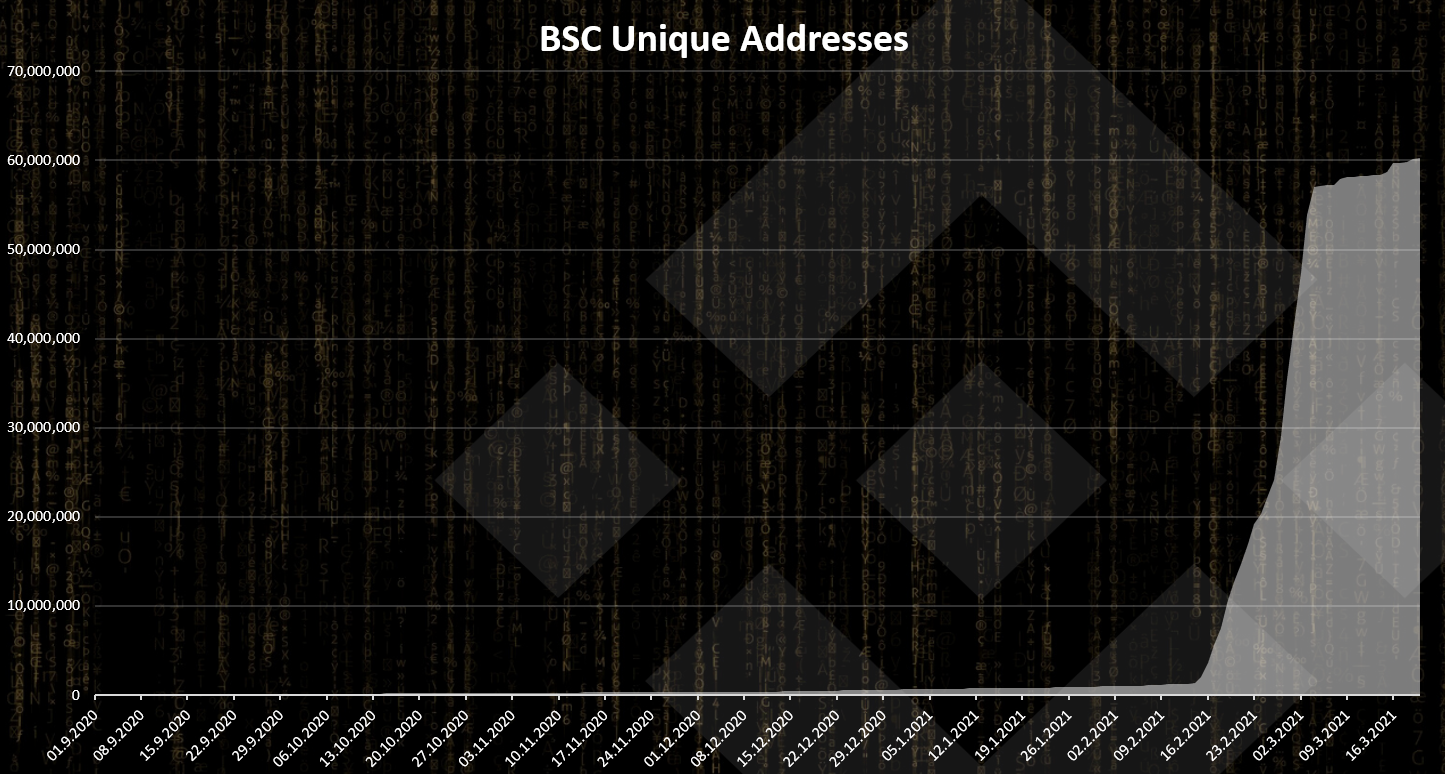

Number of Unique Addresses

Here is the chart for the number of Unique addresses on BSC.

The numbers of wallets has literally exploded on BSC!

In the period from mid December 2020 to the end of February it has grown from 400k to almost 60M.

There is no daily active wallets chart on bscscan, but from the apps charts it look like the number of daily active wallets is somewhere from 50k to 100k.

Now if we compare these numbers with ETH, where there is more than 140M wallets and more than 500k daily active ones, we can tell that the above are still lower. But the trend in the number of wallets is obviously up and it looks like BSC has been taking advantage of the DeFi boom.

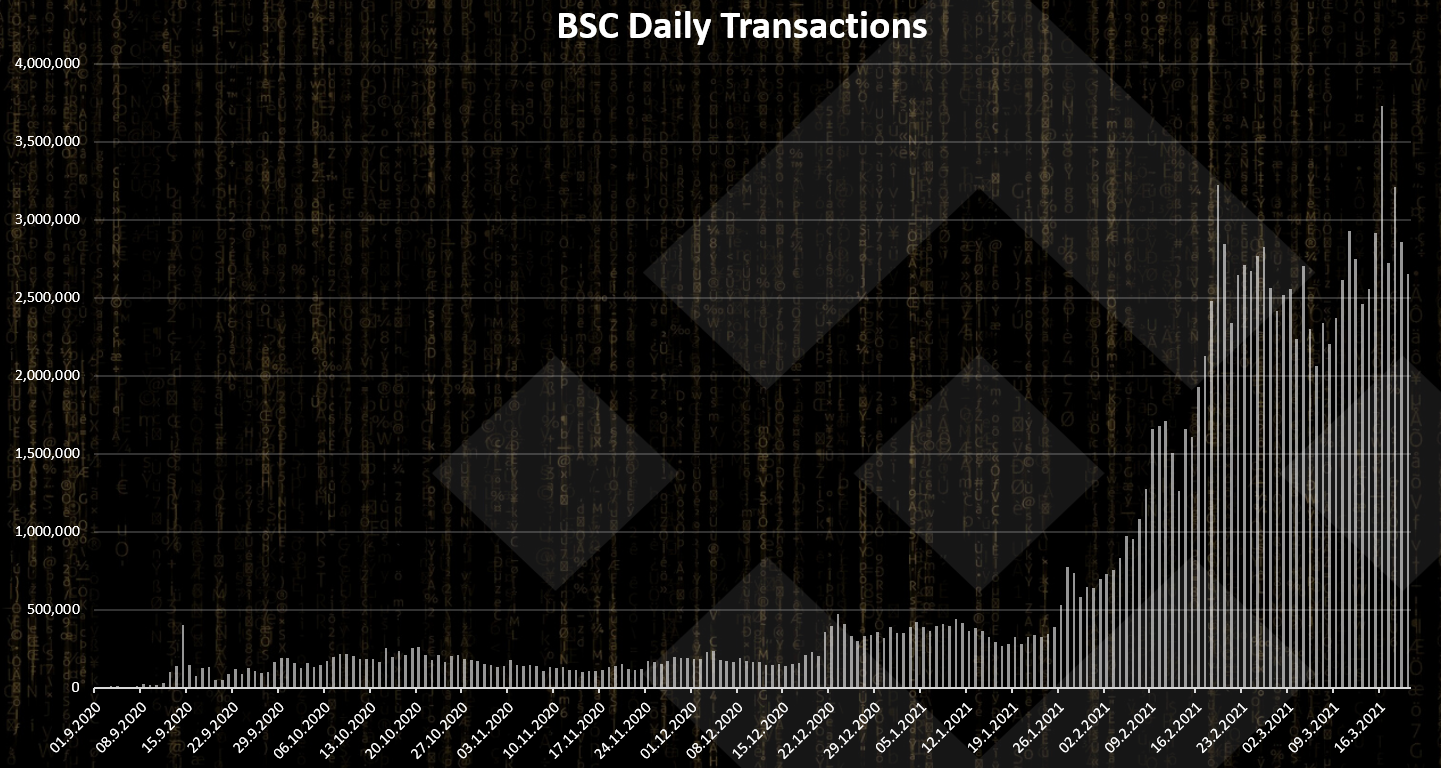

Number of Daily Transactions

Here is the chart for the number of daily transactions on BSC.

There is a significant growth here as well reaching 3M transactions per day. BSC has flipped ETG in this metric. On ETH there is around 1.3M transactions. BSC is doing more than double from the daily transactions on ETH.

Tokens transfers

The chart for the tokens transfers looks like this.

As mentioned BSC is a proof of stake copy of ETH so there are tokens and smart contracts.

The chart for the tokens transfers looks very similar to the overall transactions chart, only with more transactions in the first spike. In the last period the number of tokens transfers has reached 4M.

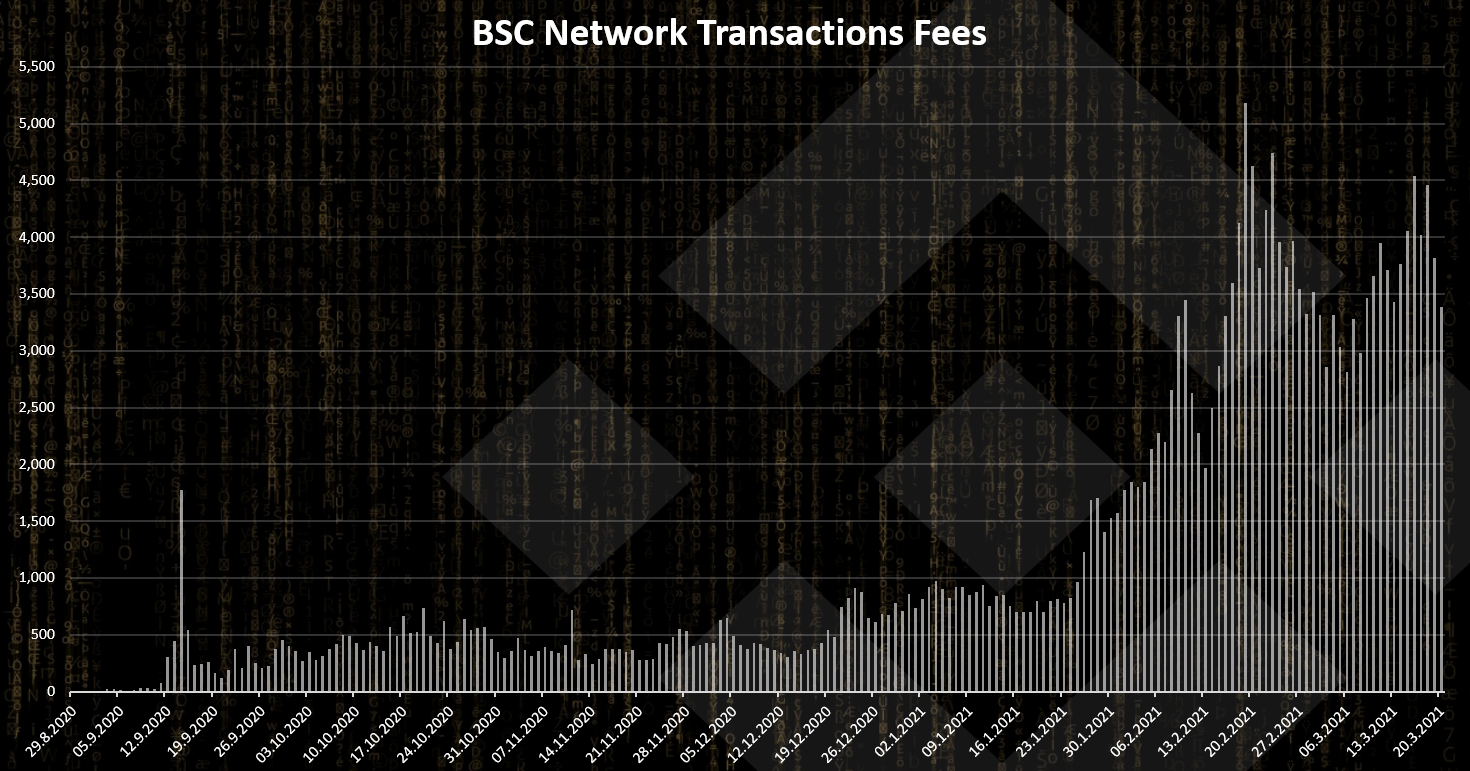

Fees

The chart for the fees looks like this.

Fees can be very high on the ETH network and the BSC network is aiming to take advantage of this.

The above are the overall fees generated in the network per day in BNB. The network validators are paid only from these fees, as there is no mining for BNB.

As the network grows the fees are increasing as well and in the last period, they are in the range of 3k to 4k BNB per day. This is around 1M USD per day in fees for the validators. If we compare this with the 10 to 20 million generated in fees on ETH (sometimes much more), the difference is quite a big one. Although here only the 21 validators are paid from the fees.

The above are the overall fees per day. In terms of fees per transactions, BSC has a low fees in the range of few cents (0.05 to 0.10$) for regular transactions and maybe up to 1$ for a smart contract transaction depending on the activity of the network.

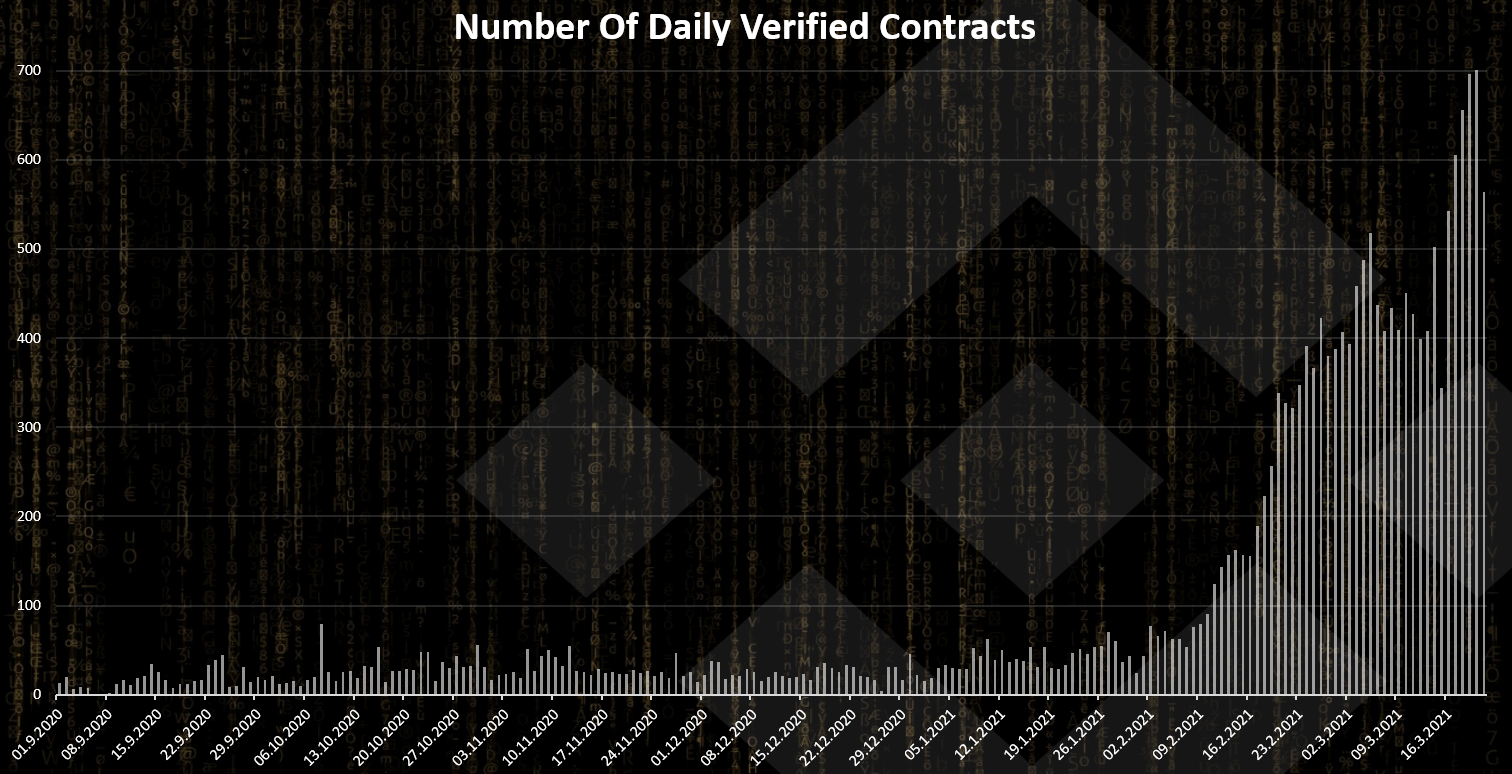

Number of Daily Verified Contracts

Here is the chart for daily verified contracts.

Since BSC is a smart contract platform the number of verified contracts is also and important metric. We can see that there is a significant growth in the last period for this as well.

Interesting in the last month the numbers have grown even more indicating more different dapps activity.

The number of contracts is in the range of 400 to 700 per day in the last period.

Top Apps on BSC

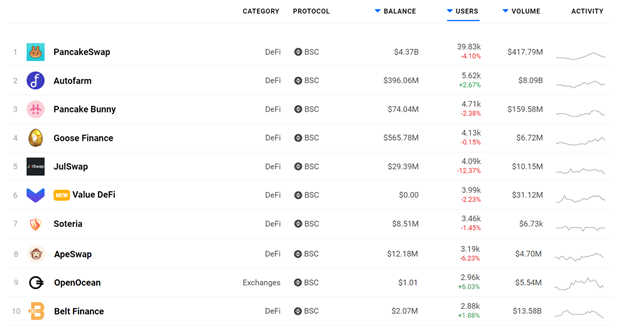

Here are the top 10 apps by number of users on BSC according to dappradar stats.

(Dappradar](https://dappradar.com/rankings/protocol/binance-smart-chain)

As we can see the majority of these projects are DeFi.

The top project is PancakeSwap that is a Uniswap clone on the Binance Chain. It has 40k active daily wallets. There are some few more additions to the platform then the Uniswap, like staking LP tokens, but the basics are the same.

Apart from the above there is the autofarm.network, Pancake Bunny and Goose. Then there is the Venus project that is a type of Maker DAO on the Binance chain.

DeFi was the main hype that is happening in 2020. The Binance Smart Chain is basically leveraging this trend. From what I can see they have probably done the best job from all the other chains that are trying to compete with ETH.

No other platform like EOS or TRON has come close to ETH or even created a decent DeFi product that has gained traction. The PancakeSwap platform has started all, but now more defi apps are coming out very fast. The incentives for LPs are almost unbelievable. Are they going to be sustainable?

The DeFi trend is far from over and probably we will see more type of products created in the future. In my view the Binance Smart Chain, even a few months old have managed to gain some small share of this hype onto their platform. The approach of totally compatible with ETH and a form of extension and not a competitor to ETH seems to be working for now.

All the best

@dalz

Posted Using LeoFinance Beta

Very interesting information. I really wasn't aware of the BSC until I started using CUB. I thought the majority of stuff was happening over on ETH. It makes sense that they would find some kind of solution to avoid the large fees that people are paying for transactions.

Posted Using LeoFinance Beta

Thanks!

BSC has went literally parabolic in the last few months. Will see where it goes from here.

Posted Using LeoFinance Beta

They are definitely doing a lot of things right!

Posted Using LeoFinance Beta

https://twitter.com/Dalz19631657/status/1374054536940257295

More info why you see this.

Posted Using LeoFinance Beta

Thanks alfa!

Posted Using LeoFinance Beta

Very good @dalz. No question BSC is an impressive feat of "engineering," given how effectively it has established itself as an ETH substitute in such a short time frame. Vitalik and "crew" better "get their act" together!

One key question. Perhaps an even more basic question is can they be trusted? Very sad how many of these are set-up as scams from the outset, i.e. they are not "real" and were never intended to be.

I think a great future post would be on any experience / confidence you have gained in how you have determined which can be trusted.

Onward and upward! 🦁🚀

Posted Using LeoFinance Beta

I think your content brings value to the ecosystem.

My support.

Posted Using LeoFinance Beta

Thanks!

Posted Using LeoFinance Beta

Proof of stake for the win! :)

But why want some devs a proof of work version for BSC fork for Hive? Do I miss something?

Posted Using LeoFinance Beta

Would love to see Cub Finance in the top 10 APPs. BSC has taken over the DeFi market by storm and this data is the proof of it. Great timing of CubDeFi Launch. We are in this early!!

Posted Using LeoFinance Beta

I need to say I really have trust issues. According to data, Venus and other top Dapps on BSC generate more volume (in usd) than ehtereum projects like uniswap. Top 3 Dapps per volume are on BSC chain and Uniswap only have the 4th place. It almost look like these volumes are faked, which is possible on a centralized chain with low fees.

Posted Using LeoFinance Beta

Interesting and detailed post, I didn't know about Defi and BSC before the birth of Cubfinance.

Hope to see Cub Finance in the top 10 dapps ranking soon :)

!BEER

Posted Using LeoFinance Beta

View or trade

BEER.Hey @dalz, here is a little bit of

BEERfrom @libertycrypto27 for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.https://twitter.com/JohnDoe04915899/status/1374423857843507203

Thanks that's a really well written, easy to understand basics, I've been meaning to learn more and haven't.

Posted Using LeoFinance Beta

I hope CUBs will make it to the top 10 in the next few months.

Posted Using LeoFinance Beta