Uniswap VS PancakeSwap | Data on TVL, trading volume and users | June 2022

Lets take a look how are the top DEXs doing under these market conditions. Uniswap and Pancake are now doubt the top DEX on Ethereum and BSC.

Uniswap has started it all, but Pancake has made it accessible for a lot of small users and account. The fees for a swap are usually more expensive then a regular transaction. In the last year Uniswap fees were insanely high at some point making it almost unusable for smaller accounts. Pancake has been feeling up this gap ever since.

It has been a bumpy road for the crypto industry in the last month so let’s take a look how these two main apps are doing.

The pro and cons of these two are clear, Uniswap build on top of Ethereum is more decentralized (more secure) but expensive in terms of fees, while Pancake is cheep in fees at a cost of centralization, built on the Binance Smart Chain. BSC and Pancake has shown a steady level of reliability though, without any major issues in the past.

Here we will be looking at:

- Total Value Locked TVL

- Trading Volume

- Numbers of users

- Top pairs

- Price

The period that we will be looing at is form September 2020 to June 2022.

Last time I compared these two was a year ago here.

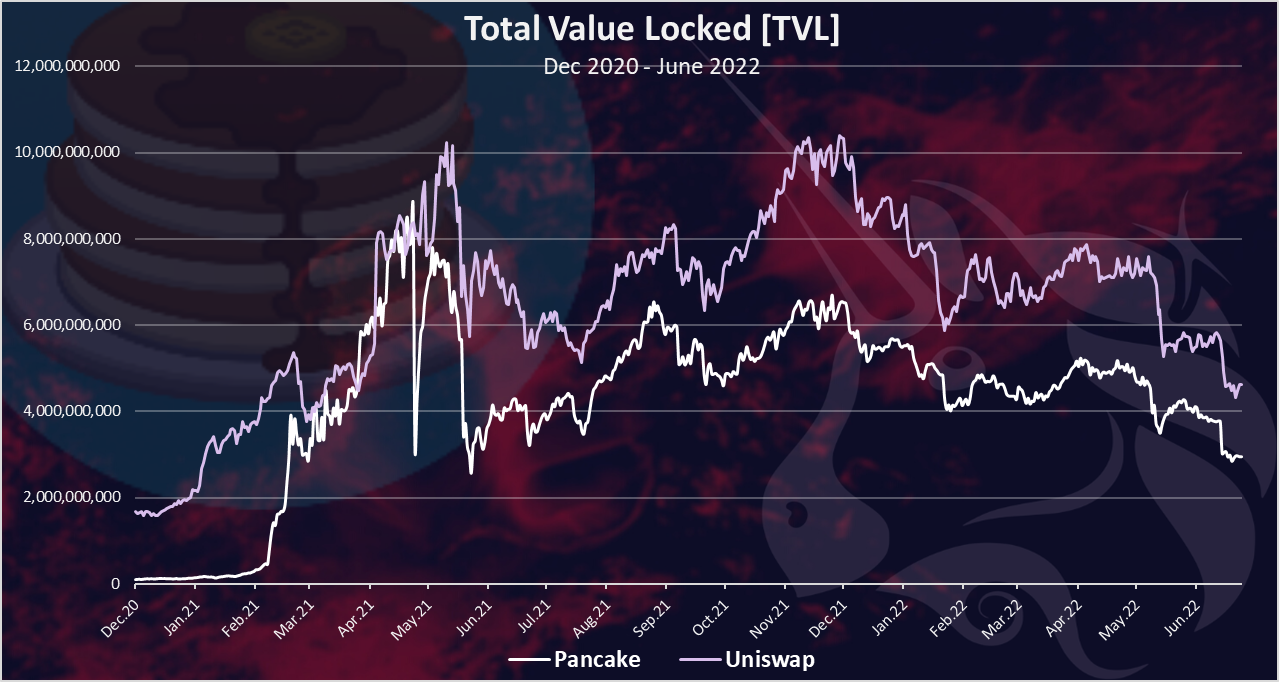

Total Value Lock on Uniswap VS Pancake

Here is the chart.

At first in December 2020, Uniswap was leading by a lot with more than 2 billions in TVL, while Pancake was under a 100M. Then in February 2021 Pancake started to grow a lot and at the end of April 2021 it had the same amount of TVL as Uniswap, around 8B.

Next there was a drop in the TVL for both of the project in the summer of 2021, with Pancake dropping more than Uniswap. Since then, the projects are following a very similar pattern for the TVL with Uniswap leading in front of Pancake.

With the recent crypto drop in prices both of the project loose TVL, with Uniswap now standing at 4.5B in TVL and Pancake at 3B.

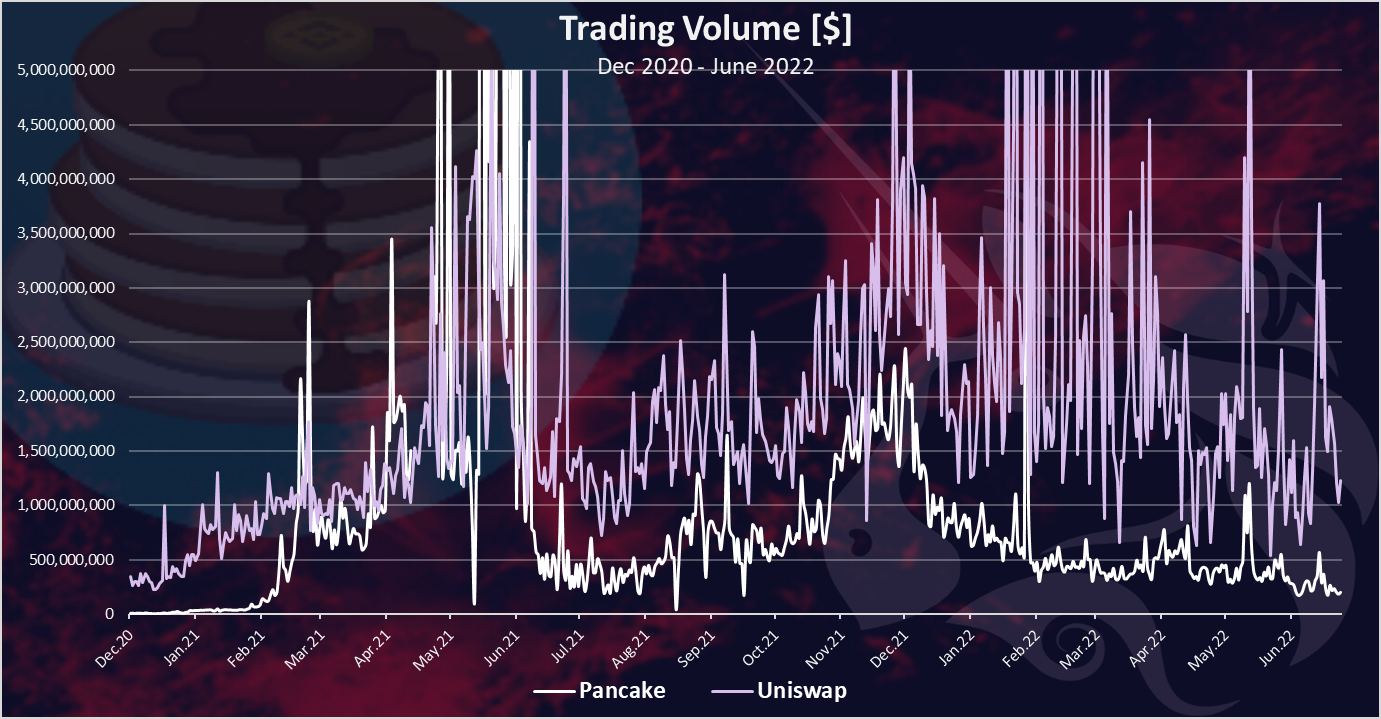

Trading Volume

The trading volume is usually one of the most important metrics for an exchanged. Here is the chart for the DEXs trading volume.

A lot of volatility here, especially from Uniswap.

Here again we can see that Uniswap has the first mover advantage but then Pancake cathing up in the spring of 2021. A drop in the summer of 2021, and a similar up and downs since then.

In the last months, Pancake has been around 500M in daily trading volume, or under that, while Uniswap has seen a lot of volatility with the trading volume reaching as high as 4B at one point.

The average trading volume per day in June is 1.5B for Uniswap and 0.25B for Pancake.

A note on the trading volume. Unlike the TVL where capital is locked in smart contracts, the trading volume can be played a bit with wash trading. Since the fees are smaller on BSC its cheaper to wash trade there. It also can be happening on Uniswap as well. The main point here is that the trading volume should be taking with some reserves due to possible wash trading. Still more legit than most of the CEXs where the trading is on a central servers and possible zero fees for wash trading😊.

DEX VS CEX Volume

If we take a look at the data for the trading volume on the other exchanges provided by some of the aggregators like coingecko the numbers looks like this.

An example for the last 24 hours:

- Binance 10B

- FTX 2B

- Coinbase 1.7B

- Huobi 1.3B

- Kucoin 1.3B

- OKEx 1B

- Gate.io 1B

If we plot Uniswap here with the 1.2B in the last 24H it will be positioned as a no.6 exchange. Pancake will be somewhere around the 10th spot. Not bad for the DEXs.

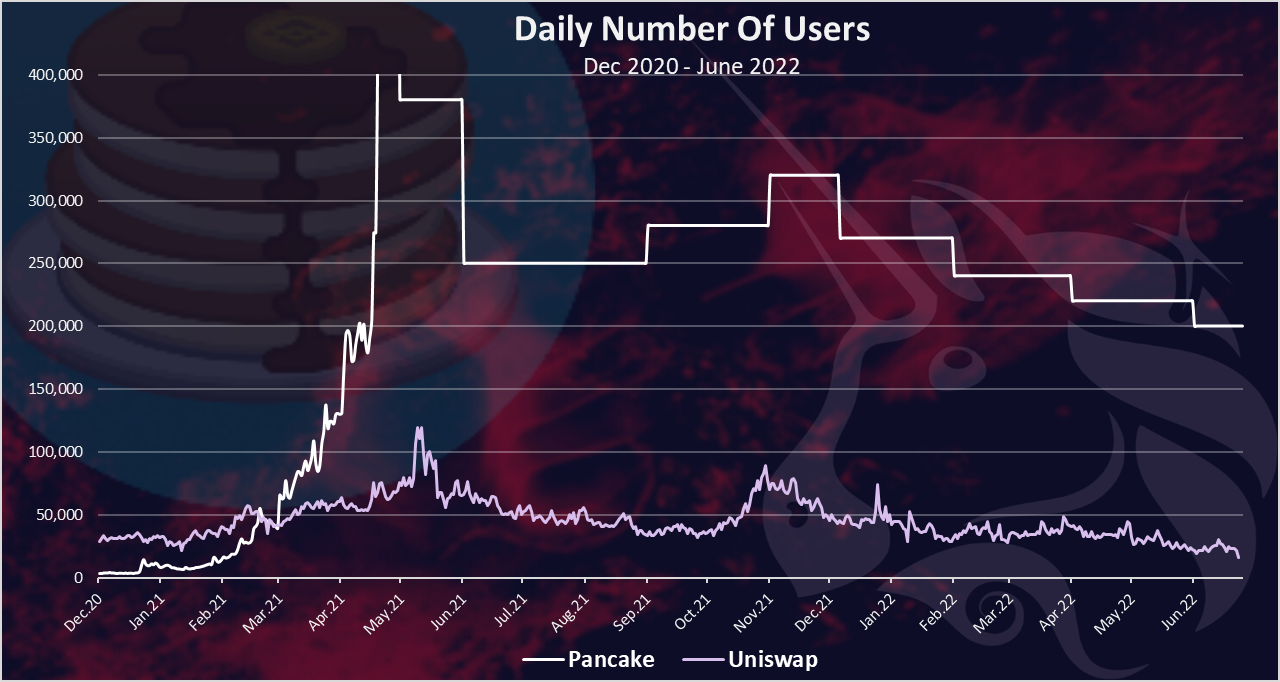

Numbers Of Users/Wallets

This one was a little bit tricky to do since there is no data for Pancake. Because of this I have simplified and extrapolated the data for Pancake users. It is not accurate daily data.

On the number of users side, Pancake leads by a lot. It has surpassed Uniswap in February 2021 and is leading since then. The ATH for DAUs on Pancake is more than half a million while on Uniswap is 120k DAUs.

In the last period Pancake has around 200k DAUs, while Uniswap is around 20k DAUs. A 10x more for Pancake.

At the moment things stands like this:

- In TVL the winner is Uniswap

- In terms of trading volume Uniswap

- In numbers of wallets the winner is Pancake

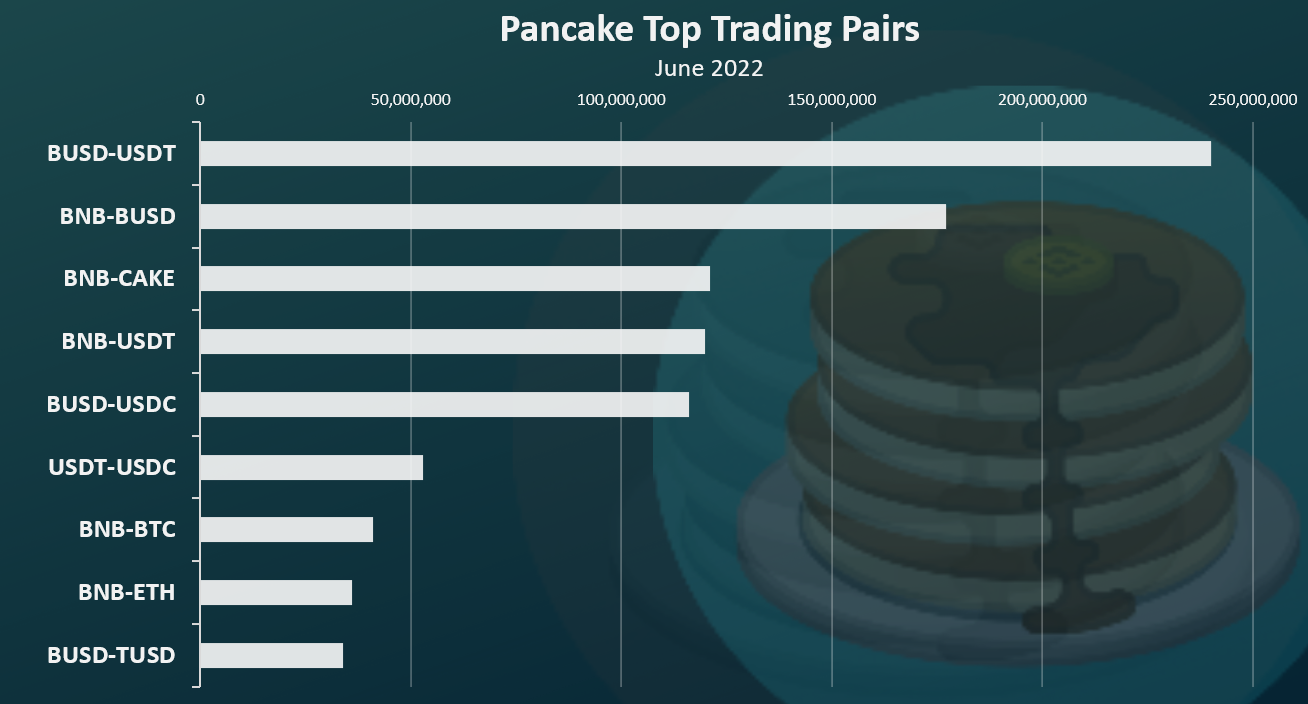

Top Pairs

Here is the chart for top pairs on Uniswap and Pancake.

For Uniswap I have compiled the data from V2 and V3.

The stable to stable pools are dominating the Uniswap pairs. The USDC-DAI pool in some form is taking three out of the top four pairs. Combined all of these pairs have 1.5B in liquidity. Next is the USDC/ETH pair, then the BTC/ETH pair, and some other stable coins pairs.

Most of the top 10 trading pairs on Uniswap are paired either with DAI or ETH.

The Pancake pairs looks like this.

BUSD/USDT comes on top here with almost 250M in liquidity. Next is the BNB/BUSD pair with 180M and the BNB/CAKE pool is on the third place. More stable to stable pools follows.

Overall the pairs on Pancake has a smaller liquidity compared to Uniswap and the majority of the pairs are in BNB or BUSD.

Price

Here is the chart for the price of UNI and CAKE.

The similarity in the price is amazing 😊.

CAKE has come a bit late to the party and started its price growth in 2021, reaching more than 40$ token at the same time as UNI in May 2021. Since then, both of the tokens have been in a downtrend with a jump in the price in November 2021, but were not able to reach their previous highs.

At the moment UNI is trading at $5 and CAKE at $3. In terms of market cap UNI is at 2.5B and CAKE at 0.5B.

All the best

@dalz

Posted Using LeoFinance Beta

Pancake has lost its value sharply, because its farms and pools are not performing well. On the other hand Uni is maintaining its quality of service and provide desired yields to its investors. Thanks bro

From the above it seems that Uniswap and Ethereum in general have acculated a lot more stable coins in their ecosystem, USDC and DAI primarily, while on Pancake it is mostly BUSD and some Tether.

Exactly, since BSC chain mostly focus on BUSD, which I see never peg to the fullest and remains at 0.99$.

Thanks for enlightening on the subject.

Interesting how similar some charts are, but overall pancake is the winner in my opinion.

Uniswap wins in more data points then Pancake. Why do you think Pancake is better? Becouse of the bigger user base?

yeah, user base and lower fees ;)

Uni and Cake fluctuates almost equally :P

!1UP

Yea a lot of similarities in the charts :)

You have received a 1UP from @luizeba!

@leo-curator, @ctp-curator, @vyb-curator, @pob-curator

And they will bring !PIZZA 🍕, !PGM 🎮 and !LOLZ 🤣

Learn more about our delegation service to earn daily rewards. Join the Cartel on Discord.

PIZZA Holders sent $PIZZA tips in this post's comments:

@curation-cartel(20/20) tipped @dalz (x1)

Join us in Discord!

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

The real winners are ETH and BNB due to all of the liquidity being provided.

Posted Using LeoFinance Beta