Tax Season 2021

It's that time of the year again. Taxes! At least, if you live in the USA, it's tax season. It's one of the (almost) unavoidable things in life.

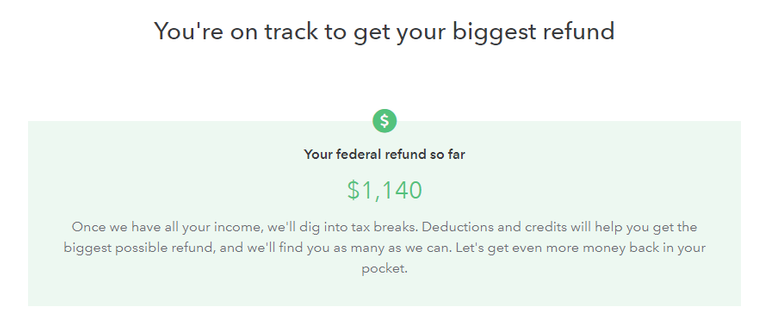

Each year, they seem to become more and more complex as I dive into different parts of finance. On one hand, it's a learning experience. On another, they can be pain in the neck complicated. As with previous years, I use TurboTax. So far, things are going okay.

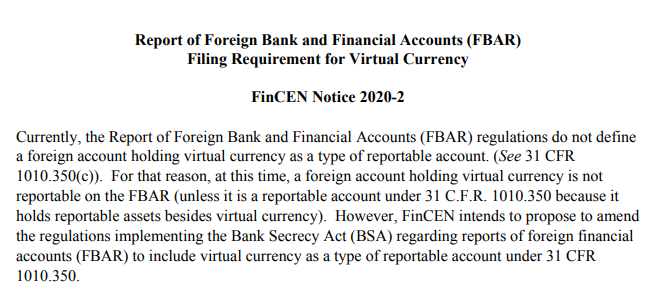

Like I mentioned before, things seem to be more complicated each year. I looked into Foreign Banks and Financial Accounts (FBAR). This had to do with some activities on non-US based exchanges. Lucky for me, there are tax experts like @nealmcspadden on Hive. He corrected a major misconception I had in regards to FBAR with supporting document.

For reference, here's a screenshot of the said document:

I guess I won't have to worry about that this year and see if that changes in the future.

The downside of getting into more taxable events is that it takes a while to receive all the tax documents. I remember when I was in college, it was very simple. I could finish filing within a week after getting all the W-2s by the end of January. Now, I'm lucky if they all arrive by the end of February.

The worst type of forms I had to deal with were the K-1 forms. One year, I didn't receive them until mid-March. The hassle of filing them was a pain as well. I liquidated the partnerships later so I'd only have to deal with them for one more tax season.

The world of taxes is so complicated that it's hard to navigate even with the access of information today. Sometimes, I wish there were only a flat tax that everyone has to pay. But, I doubt many people, especially at the top, would like that idea.

Anyways, enjoy the bull market for now. Many of us will have to deal with the aftermath next tax season.

Posted Using LeoFinance Beta

Seeing how you brought up the topic, how the heck did you do the taxes on your Hive-Leo and other tokens that you earned and swaped all year?

Posted Using LeoFinance Beta

I’m too lazy and whatever I make in them isn’t that much. So, when I do cash out, I just pay the 40% and call it a day.

So if you pay the 40 percent they don't make you show every transaction you have ever done to get it?

Posted Using LeoFinance Beta

40% is what they expect from you if you can't prove you've held for longer than a year in the US.

I'm sure they could make you show them more if you get audited.

Ok, thanks for the answer, I hate worrying about this crap, it takes all the fun away!

Posted Using LeoFinance Beta

What is this tax you speak of?

It's the fees for being part of the cabal.

where I live the state just gets 40% of you salary and everything that you buy has VAT. Other incomes have a 15% tax if I'm not mistaken but I'm not cashing out my crypto so the state can go suck a lemon :P

Posted Using LeoFinance Beta

Can't tax you if you never cash out, right? lol

1000 IQ :)))

Congratulations @enforcer48! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 12000 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

This year I'm going to try TaxBit. I've heard good things, not sure how much they ask you though to generate the forms after linking all your exchanges and wallets.

The basic plan is $50. If you want more stuff to help with DeFi, etc., it’s like $175.

I think the pro version which includes CPA costs like $500.

mm.. it looks like CoinTracker costs only 10 bucks more and integrates with many more platforms. Have you ever used it @enforcer48?

Nope. I use Bitcoin.tax.