My Most Shitty Investments Challenge

Thank you @opidia for inviting me to this challenge and thank you @trumpman for starting this interesting challenge. It is not as easy to share the losers compared to the winners when it comes to our financial investments and trading experiences. Yet, losers are the ones that teach us the invaluable lessons. I have written in the past about my story trading $CIE, a story of amateur trading mistakes that ended up in loss of significant portion of my entire portfolio. You can read more detailed story here. Since the lessons learned from that trade/investment in $CIE shaped the way I look at trades and investments today, I feel like they are worth repeating again and appropriate to this challenge.

My investment in $CIE - Cobalt international Energy started with a tip from a friend. I normally do not invest long term, I prefer swing trading. Upon closer look at this stock, it did look like a profitable trading opportunity. In fact, I was able to make profitable trade when its price was oscillating between $1.10 and $1.20. The friend who gave the tip kept insisting this stock has great potential for bigger gains. This was my first mistake/lesson - blindly following a tip and someone else's research. This wasn't a big mistake though. Acting on tips is a normal phenomenon among amateur traders. It turns into a problem when a traders/investors doesn't do their own research and blindly rely on others.

The second mistake/lesson was a classic example of amateur traders' behavior when market goes agains them. The CIE stock price started dropping below its usually trading range. More experienced trader would get the signal the market is sending and cut losses at the first big move against them. I did the opposite. I kept telling myself I was right and knew better than market, based on the confidence built up in lucky winners prior to the experience with $CIE. As $CIE kept dropping in price, I kept adding more to my long positions. It never recovered. It just kept going down, dropping 10% every a week or so. I kept buying more until I ran out of money. This how amateur traders like myself become long term investors in a stock that was originally meant to be a trade that shouldn't have lasted longer than a week.

Third lesson became clear when unknown variable that affect the financial health of the company and the price of the stock became known to the public. While traders/investors trying to find logical reason for the way prices are behaving, there are many unknowns. Yet these unknowns are known to a few who make take advantage of the situations. Furthermore, experienced traders/investors even without knowing the full context and not having inside information may detect red flags based on known information.

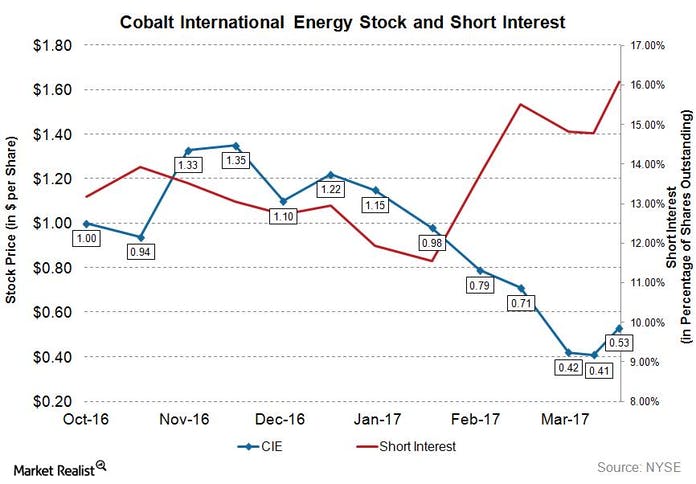

If you look at the chart above, you can see how short interest on the stock kept increasing as soon as the $CIE stock price dropped below $1. While for amateur traders/investors the fundamentals of the company looked good, bears knew there was something wrong. The wrong in this situation was that, assets of Cobalt International Energy worth billions of dollars were at the mercy of Angolan government. The rights for those assets had to be licensed by the Angolan Energy department, who was known to be corrupt. In fact, CIE itself was previously under corruption investigations. So, Angolan government decides not to renew CIE's license which caused their assets being nationalized and loss of billions from their balance sheet. This has become public when the price of the stock already dropped more than 50%. That was when I finally made peace with the losses, acknowledged the defeat, sold all and never looked back at it again.

In conclusion, $CIE is was the worst trade/investment I have ever made and paid the tuition fee to the market. At the same time it has taught me valuable lessons I hope will be useful in my present and future trading and investment endeavors.

I would like to invite @azircon, @edicted, and @enjar to participate in this challenge. Please see the details in the original challenge post by @trumpman here.

Posted Using LeoFinance

I have several friends used to work for them before the bankruptcy. They used to be quite aggressive and nimble in deepwater GOM lease sale. I probably know a lot about CIE :)

Regarding mistakes, there are too many to talk about. Most of mine are in futures. Mostly ES futures as that is what I mostly trade. Nothing recently though. I remember trading a lot of gold stock into the 2002-2007 bull market, which is probably my biggest mistake, as I could never believe in that rally. It ended up working well, but I was a moron trading gold stocks.

I keep hearing more and more that experienced traders like trading futures. Futures and trading futures to me seem to be the most difficult thing to understand. Your gold stocks story sounds interesting. You should share it and participate in the challenge. Always great to learn from experienced traders/investors and their experiences.

Posted Using LeoFinance

Your experience sounds like a lot of my earlier investments, unfortunately. I'm not smart enough to trade stocks. Now I will only swing trade with atocks that I would buy as a long term investment anyway. That way if I get stuck with them (which is likely to happen with me) I don't feel bad about it.

If it is a long term investment it should work out, but when swing trades turn into long term investment due to the price drops that is not a good sign. (in my opinion) :)

Mainly because the trading capital can’t be used anymore for other potential trades.

I read your post and couldnt believe how we really all made the same mistake .

Oh well , we live we learn 😘