Market interpretation

Recently, the Bank of England will hold a bank’s negative interest rate discussion meeting. According to the results of the meeting, the Bank of England will enter into discussions with banking regulators on negative interest rates. This actually means that bank savings will be similar to lending institutions, and savings users must pay for their savings. The reason is the economic impact of the new crown virus lockdown policy and the imminent prospect of Brexit. "Because of these increased uncertainties, banks are putting all options on the surface," an analyst revealed in light of the news.

As reported, the Bank of England is particularly notorious in Bitcoin circles. On the eve of the birth of Bitcoin in 2009 , the British government collectively rescued the banking industry. An article in the national newspaper "The Times" was even included in the genesis block of Bitcoin.

Recently, central banks' response to the coronavirus has made people feel that Bitcoin will increasingly play its role as a hedge against fiat currencies.

In fact, Japan has entered the era of negative bank deposit interest rates before, that is, when you deposit money in the bank, you have to pay the bank a custody fee. This in itself makes the situation of rising inflation in the market economy worse. Although the annual interest on the money originally stored in the bank is not much, and it can't escape inflation, at least there is no need to pay extra for storage fees. Now it's a double blow. The role of safe-haven assets is to resist inflation and other irresistible factors caused by the devaluation of legal currency, so they are welcomed by people.

BTC

BTC pulled back slightly yesterday. After falling below the 4-hour 30-period average buying line, it rebounded and the overall trading volume was not much. At the end of this week, the market rushed to the height of 11180. After breaking through the 200 line, it fell back. This is a false breakthrough. The current 30 line continues to rise, and the 90 line has also started to turn up. This is good news. , We believe that the big trend has formally formed and started to rise continuously. The absolute value of the current premium has reached 229, basically unchanged. The premium ratio is 2% (the premium refers to the value of the OK contract price minus the current price, and the premium ratio refers to the value of the contract minus the current price divided by the current price), The overall development tends to be stable, and there are still more people who are bullish than bearish. The 200 line continues to be suppressed downwards, because there has been a failure to rush the 200 line in the past few days, so the first task is to break the 200 line upwards, and the next trend will be preferred. The extraordinary point of view remains unchanged. There has not yet been a substantial breakthrough of the 200 line, and it is still a risk point, so the plan is still to wait for the market to break through the 200 line and then pull back and buy low. The upper resistance level is 11024.2 and the lower support level is 10561.3.

ETH

Ether pulled back a lot yesterday, temporarily supported by the lower 4-hour 90-period average buying line, and performed well on the 90-line K line, with more lower shadows, indicating that there are more people taking orders here. As the 90 line continues to rise, it will gradually converge with the upper 200 line, forcing the market to oscillate up and down within the "convergent triangle" pattern, so that the market needs to make choices in the short term. Extraordinary advice is still based on waiting, because this is the risk point that we have repeatedly emphasized. After the previous market has repeatedly hit the upper 200 line and failed, it is very likely that it will not break through the 200 line. You need to be careful. In order to buy here, then even if the market rises and breaks the 200 line, the actual profit brought by it is not high. Therefore, it is safer to wait and see as the mainstay. After the real market hits the 200 line, there is a callback before entering the market. The upper resistance is 386.93 and the lower support is 367.4.

BCH

The prince’s correction last weekend was relatively large. In fact, it has fallen below the 4-hour 90-period average buying line. The trading volume is not too large, but it caused some interference to the 90 line that was already on the right track. You can see When the market fell below the 90 line and rebounded again, it was suppressed by the 90 line, which is a disadvantage in the short term. The suggestion at this time is that small partners who are in the short-term band can give priority to staying on the sidelines here, and the small partner plan that has been scheduled for short-term investment until November remains unchanged, and it is enough to implement the plan that has been formulated. The upper resistance level is 228.4, and the lower support level is 199.61.

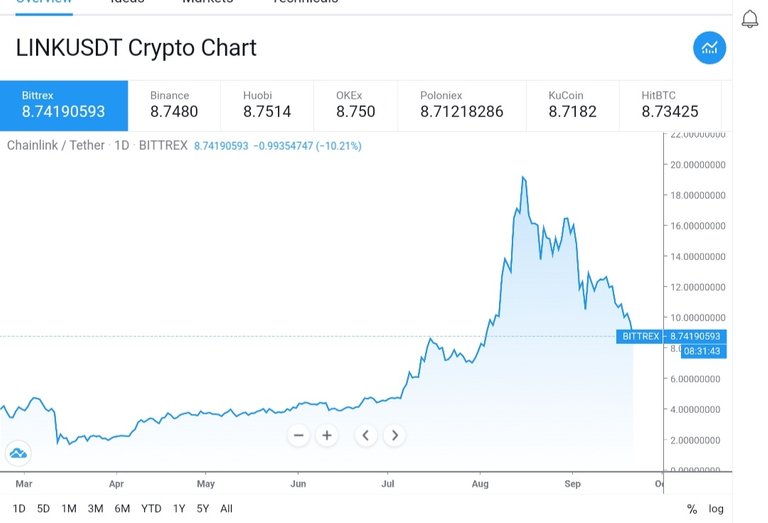

LINK

LINK continues to fall. It can be seen that the market has continued to fall in the recent period. The downward trend is obvious, and it is about to approach the previous low in the short term. Among the few rebounds, they were all suppressed by the 4-hour 30-period average buying line. A long time ago, Bufan suggested that everyone should not buy, because the overall trend is downward and the buying conditions are not met. In the short term, it is recommended to continue to stay on the sidelines. There is no sign of bottoming out for the time being. We can also try to enter the market as soon as there is a bottoming out.

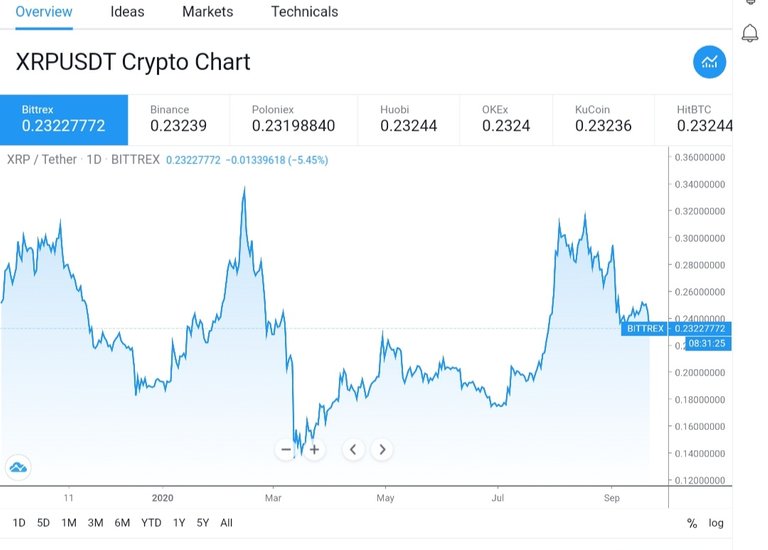

XRP

Ripple is also correcting without exception. The current market is supported by the lower 4-hour 90-period average buying line. The trading volume is still relatively large. The short-term upward trend has not been destroyed for the time being. The market still hopes to break through the short-term. High Point. Similar to other mainstream coins, the lower 90 line will continue to catch up with the market, and the upper 200 line will continue to fall, thus forming a "convergent triangle" pattern. It is still recommended to buy low in the short term, especially for those who have not entered the market , The current market is above the 90 line, close to the 90 line, we also use the 90 line as the support level, so now the stop loss after buying is relatively small, as long as the real hammer falls below the 90 line, the stop loss will exit the market, and if the market follows Rising, then the income is still considerable. The upper resistance level is 0.262 and the lower support level is 0.244.

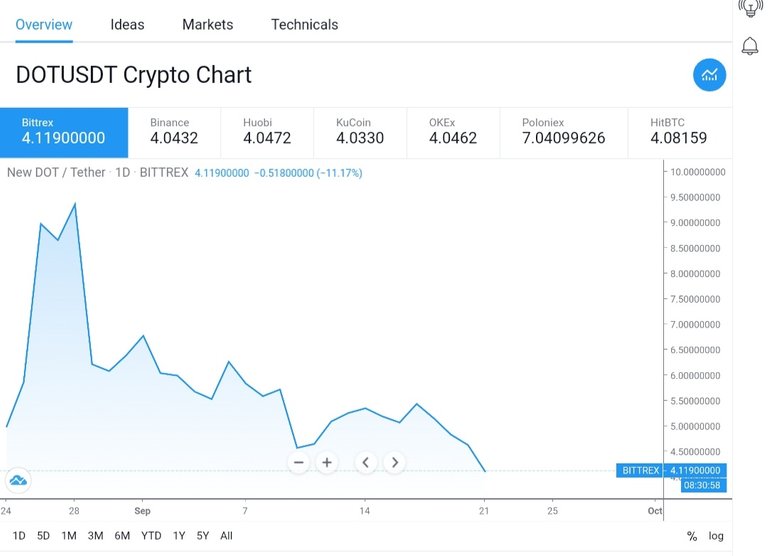

DOT

Polkadot made a lot of corrections last weekend, and the market has fallen out of our previously set fluctuation range. The previously set range is 5.577 above and 4.98 below. It has fallen below the short term. The advice that needs to be given in the short term is that after the market fell below 4.98, people who had bought a lot of bottoms at 4.98 had already experienced floating losses on their books. Although they don’t know what their psychological range is, but from an objective point of view From a perspective, this is still a risk point, so it is recommended that small partners who do short-term swings can temporarily leave the market and wait and see. Wait for the follow-up market to break through 5.577 before entering the market. For long-term partners, the current decline is relatively large. It has fallen 21% from 5.57 to 4.4, which is more worrying. If you are long-term, that is, at least 1-2 years optimistic about Polkadot , Then it is not recommended to try the fixed investment plan, so that after the market has fallen, you can buy at a low level. The upper resistance level is 5, and the lower support level is 4.4.

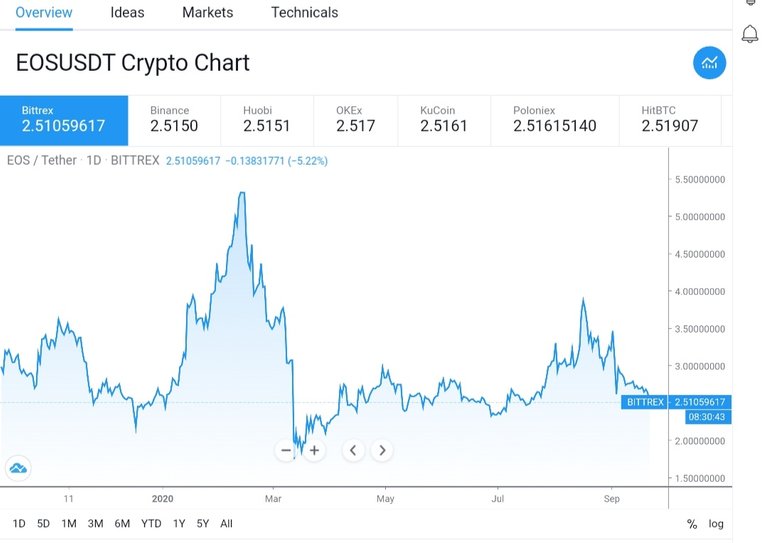

EOS

Grapefruit is still declining, the trading volume is not large, and there is no popularity. EOS was followed by Bitcoin before. Now it seems that it has no longer followed the current market of other currencies and is moving at its own pace. It is not recommended to enter the market, keep a lot of attention, when the bottoming occurs, you can give priority to buy a position to try. The upper resistance level is 2.74 and the lower support level is 2.5.

Subject currency

UNI has a callback today. It can be seen that from the previous day's highest of 8.6 to the current 5.1, it has fallen by nearly 40%, and the top is covered by 40%, which really upsets those who have already bought. Someone previously predicted that when UNI exceeds 4 yuan, the market value of all tokens unlocked will have exceeded Binance. If the market continues to rise, then everyone believes that Uniswap will surpass Binance in the future, or that Binance’s market value will be Decrease, so the market value of Uniswap has become relatively high. The latter may be unrealistic. Exchanges require a large amount of accumulation, and industry barriers are relatively high. Moreover, decentralized exchanges and centralized exchanges have different operating models. There is no active income, and centralized trading has many initiatives. Everyone knows about earnings, so Bufan believes that the probability of Uniswap's future market value exceeding Binance is small. It is also remarkable that the market value of the currency circle is brought about by liquidity. Everyone agrees that a certain currency will be valuable in the future. Then it is very valuable now and will rise very quickly because many people go back to follow suit. It’s not that UNI is bad, but that you need to be cautious about entering the market. UNI has a lot of room for development in the future, and the barriers of its decentralized exchange have been formed. If there are small partners on the top, and optimistic about the future of UNI , Then it is a good idea to recommend fixed investment. As time goes by, fixed investment will gradually flatten your buying costs, and you have more opportunities to buy at low points.

image source: tradingview