How to Invest Your FARM Tokens

Harvest Finance is an automatic yield farming protocol. This protocol intent to farm the latest DeFi platforms to return the highest APY. The main advantage is to save on gas fee costs.

Now is possible to earn $FARM in Publish0x when tipping authors. This is huge because is a DeFi token with great potential and APY. Also, it makes a great synergy with ETH, as we will see below.

Stake

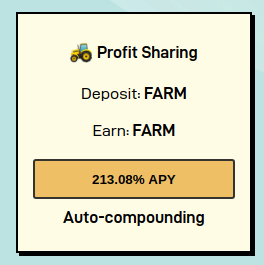

Probably this is the best and easiest option, you just need to stake your FARM token in Harvest Finance's profit-sharing pool. This option has a high APY and the best feature, in my opinion, auto-compounding. This means once you deposit your FARM, all generated FARM profits will be deposited again without any additional gas fee cost.

But how it works?

The Harvest Cooperative is comprised of humble farmers pooling resources together in order to earn profits and become the largest industrialized farming co-op in the world. When farmers deposit, Harvest automatically farms the highest yield with these deposits. 70% of these profits are distributed back to the depositors. The other 30% of profits are used to market buy FARM tokens en masse. These FARM tokens are then distributed proportionally to the Harvest Cooperative who stakes FARM tokens in the profit share pool. This aligns long term incentives with our FARM holders.

In resume, your deposited FARM in the Profit Sharing pool will be used automatically to earn profits which returns to you in two forms, distributed profits and token buybacks from the market. Not only you are earning some nice profits but also this adds a potential value to the $FARM token.

Add Liquidity

Because you can earn ETH in Publish0x too this generates a great synergy. We can take advantage of this by providing liquidity on the pair FARM-ETH in Uniswap. There's another pair, FARM-USDC, but you will need to swap your ETH for USDC. Also, it has a lower activity than FARM-ETH so is probably less profitable.

🚜 165.88 (1.39% of week 20) $FARM to $FARM liquidity providers in the Uniswap WETH/FARM pool

Also, as you see, adding liquidity to the pair enables you to receive more $FARM from the weekly emissions, so now you got an incentive here.

In conclusion, FARM isn't just another governance token. We have seen that is possible to invest and make profits and is quite simple and easy. The TLV is at 76.6% and the constant buybacks add value to the token in the long term.

How are you going to invest your Farm tokens?

Follow me

Posted Using LeoFinance Beta

interesting way to generate tokens, do you have any idea how to add liquidity in unisawp of this token? Do you only win for having these tokens there in unisawp? Cheers

Posted Using LeoFinance Beta

Good question.

You need to have a position in the FARM-ETH Liquidity Pool. You do that by adding FARM and ETH here. Then, you will receive pool tokens. With these tokens, you will collect farm and eth fees when another user swaps both ETH and FARM, and weekly, you should receive additional FARM from Harvest Finance.

Posted Using LeoFinance Beta

I just saw they booted BAT. Sad, but I also like the addition of a DEFI token. I just don't earn enough over there to make it worth my time.

Yes, you need to write articles almost every day if you want to get something.

Posted Using LeoFinance Beta

Sweet. I will have to earn some FARM and then reinvest it. Love automatic/passive growth.

Posted Using LeoFinance Beta

I love it too! The first option is the best for that.

Posted Using LeoFinance Beta

Congratulations @jmsansan.leo! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP