Crazy Things Happen - Tackle your spending spree problem

In this part of the world, weekends often signals the beginning of a spending spree and a lot of people act recklessly all in the name of cruising over the weekend.

They spend as if money grows on trees and they don't mind spending down to the last cent in their account.

That's ridiculous, isn't it? l know how insane it is to even imagine that someone lives that way but I've seen many teens, singles and married people making such unwise financial decision so, l know what I'm saying and l don't intend to mince my words for any reason.

Just to be sure, are you one of those that empties your account due to weekend expenses?

Weekends are for resting so almost everyone feels the need to blow off some steam and relax in ways that suits them. Some go for shopping, travels, parties, movies, etc. Of course, all these make each weekend enjoyable but there is always a price to be paid for it.

Everything boils down to debiting your account. This on it's own does not count as a bad thing as far as you are spending 5% of your earning or 10% at most. I mean, you've got to save for rainy days and you've got to invest. But then, is that how you plan out your weekend expenses?

How much are you planning to spend this weekend?

You don't need to tell me. Just look yourself in a mirror and tell yourself the truth. I won't be surprised to hear that some of us are already cashing out 50% of all they earned within this week. Not that I have any problem with cashout, it just wouldn't make sense for anyone to blow off everything they earned just because of some cheap thrills.

Some wouldn't mind cashing out 100% of their earnings, but the reward system is recurrently saving their ass.

Tips to take in order to readjust your spending habits

Well well well, you might be among those that have been making a mistake of reckless spending in the name of enjoying the weekend but it's not yet late to readjust your spending pattern for the sake of your financial status. Take note of these;

1. Draw a budget: Spending money without having a budget only increases our chances of being broke despite the amount on your paycheck. You've got to draw up a budget

to make sure that you will never spend more than you earn

Scary, eh? Well, you don't have to make it to be as perfect as that of someone that is running a degree in Harvard Business School. Just keep it simple and stick to the plan.

2. Don't pay except if it's something you need: Before you jump to a conclusion, I'm not asking you to grab items in a mall and bounce out without footing the bills.

The plan is for you to overlook that pizza if you've already had lunch. Don't bother getting a sports car if it will take up your 10 years salary.

Do you get the gist? There is no better time to start being conscious of your spending habits than now.

To all those that are economically active, you've got to remember everything written here and forget nothing.

Thanks For Not Missing Any Full-stop Or Comma

Image Source 1

Image Source 2

Image Source 3

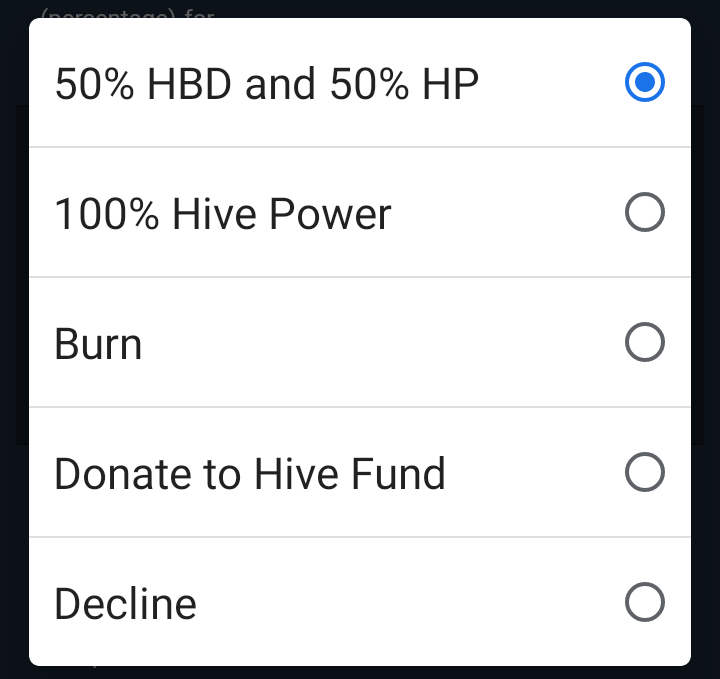

Screenshot taken from my account

Posted Using LeoFinance Beta

Congratulations @kenechukwu97! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next payout target is 2000 HP.

The unit is Hive Power equivalent because your rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPMy friend, in a country with an inflation that eats away at us, in my case I manage my money very well, only for necessary things, the situation in Venezuela right now is very very difficult.

Many countries are making their citizens to live in regret but my prayer is for everyone of us to succeed and Excel so that we can soon move into a better and more suitable place

It's interesting that when you have a budget for spending your money you come to realize that you don't have that much money to waste.

That's why I always plan how to spend my earnings ahead. I don't like to be in debt and that's what will happen if I spend recklessly

Exactly... I have unavoidable been a debtor before and I was lucky enough because the person never disturbing me about paying back but I still didn't have rest of mind until I paid down to the last cent.

Since that moment till date, even borrowing from MTN gives me a huge scare 😂

Exactly that rest of mind is the most important thing.

hahahahaha oh my!!! this was me years ago

as soon as the weekend hit it was time to spend! i felt like i had earned it

now??? i have MUCH more joy in earning more in my savings account hehehe so that i can plan a nice goal to achieve :)