LBI Value Up 60.21% Annualized

LBI is nearing the completely of its 5th month of operation. The start to this fund is absolutely incredible. It was modeled after @spinvest but compared to the start of that, this project is in the express lane.

Obviously, we saw a tremendous amount of activity to start the project. It was long anticipated resulting in a large number of tokens being bought the first few weeks. This helped to really put LBI in a strong position as a curator, generating a significant amount of revenue each week that carries through to this day.

During the last earnings report, we see that the projects has generated over 21,000 worth of LEO since inception in early December. Even with the pullback in the price of LEO, this is a fair bit of revenue.

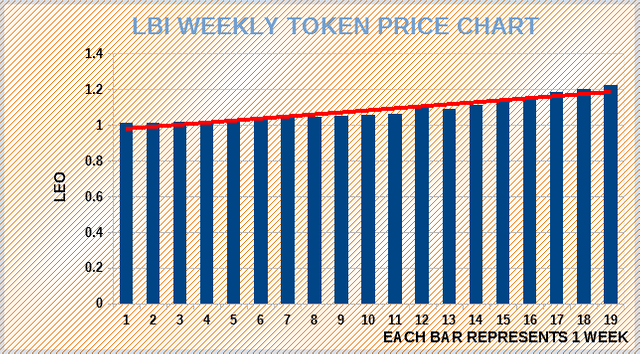

Of course, that is only the tip of the iceberg. We also saw a number of other aspects that fed into the value of the LBI token. The chart above shows how the pace has moved since we started.

It does appear, which makes sense, that the acceleration is increasing over the last month or so. This is in alignment with what is taking place considering the introduction of CubFinance and LBI's involvement in there.

Since that kicked off, we find this to be a terrific stream for the project. Each week, we see the value of LBI moving higher. This is allowing for the prospect of even more projects, furthering the flow into the fund.

This is the simple premise that LBI was built upon. Over time, as more projects are engaged, we can see the streams of revenue expanding. This will help to advance the value of the token by increasing the holdings that back the token.

Here is a good place to mention that we are closing in on the end of the direct token sales. In the next couple days, that ends. What that means is the only place to purchase the token is the open market. Thus, the pricing will be completely determined by those participants.

The charts we show are based solely upon value. This is determined by adding up all the assets and dividing by the tokens outstanding. Pricing is free floating now since the token is traded on Hive-Engine yet it could be hindered by the direct sale.

That will no longer be the case. Does that mean the price will go up?

This is impossible to forecast until it happens. However, if we look at the banking industry, perhaps we can get some idea.

When we look at book value, which is common in the banking industry, we see that it is simply a totally of the asset base. That tells us exactly what the bank is worth. Then it is compared to what the stock is trading at.

Banks rarely trade at book value. If they do, that means the shareholders are paying exactly zero for growth. We know that there is some type of premium usually paid for that since no seller is willing to give future growth away for free.

It is why banks typically trade at a multiple of book value. Traditionally, if you can pick up a bank for a price under 2x book value, that is a good buy.

What does this have to do with LBI? We can look at the value of the assets as "book value". It is the total we could get if everything was sold off. Of course, this is based upon the pricing at the time of the accounting. Markets are continually changing. That is why accounting is just a snapshot of where things are at a certain point in time.

With LBI, we have our "book value". Now it is just a question of what the token will trade at based upon that. Will it be 1.5x? 2x? .75x? Nobody knows.

Since we know the value of the holding, we can also compare that to the growth rate. Thus, far, the value of LBI has increase 22% in just under 5 months. On an annualized rate, that is growth rate of 60.21%. In the traditional markets, that is considered an enormous rate of growth. That said, we have to keep in mind that we are dealing with much larger entities there.

So basically we are looking at a fund with a "book value" of 1.22 LEO per token that is experiencing a 60.21% growth rate on an annual basis.

What is that going to sell for on the open market?

That is the question that is clouding the ole crystal ball. Will buyers and sellers on the market look at things from this perspective? Also, will there be a premium or a discount because it is trading in a low liquidity environment? Certainly this is going to factor in somehow.

Markets will do their thing. In the meantime, we can only focus upon growing the value of the assets back LBI and making sure the growth rate exceeds the targeted 20% annually. So far, we are proceeding nicely in that area.

Growth rate is 52/19 x 22%

Post by @taskmaster4450le

Posted Using LeoFinance Beta

Not that I am looking to sell or anything, at least for a few years, but is there still a 95% buy back from LBI if I did sell?

Posted Using LeoFinance Beta

@silverstackeruk will have to answer that one. I am not sure.

Posted Using LeoFinance Beta

Empty promise as far as I know.

And even 1.22 is a joke. No liquidity.

Posted Using LeoFinance Beta

There will be liquidity once the cap is in place, in my opinion. Also, once the dividends are actually being paid out, I think more people will become interested. I know you're salty about the delay and, for what it's worth, I think you have a right to be but....at this point, it is what it is. The project is performing extremely well and the dividends will be bigger, earlier because of it. It won't take too many payments for the returns to eclipse the totals had they started paying dividends at the time of the last vote. If the price dips in the open market, I plan on adding more and I doubt I'd be alone.

Posted Using LeoFinance Beta

no way to trade it.

Posted Using LeoFinance Beta

What liquidity does any other hive-engine token offer? Does, BRO, UTOPIS, EDS, INDEX, DHEDGE, etc buy back their tokens?

No they don't

Once again, this comment comes from someone that still has not looked at the terms post for LBI. The buyback is on the roadmap. As far empty promises go, SPI bought back $5000 worth of SPI tokens a while back, so what are you talking about? Again, chatting shit with 0% knowledge.

If you are so unhappy, please sell your tokens and invest in something that better suits your needs instead of moaning like a baby.

SSUK

Posted Using LeoFinance Beta

You just don't get it, or what?

My whole point was that the buyback is an empty promise. That's why I can't sell my coins even at 95% price which was promised in the terms. And you talking about great growth with the price of lbi token at 1.22 is misleading. Well, luckily you have a lot of naive and blind followers.

Wake me up when you'll start buyback, please. Or when the coin liquidity grows and I can sell my 1.4K bag.

Posted Using LeoFinance Beta

Yes, i do not get what your problem is. I don't understand why you cant read the terms post and understand what is wrote.

Why can you not read the terms post?

False promises? You think im ripping people off? Here's a snap from someone that sold back SPI tokens, this was 10% of all SPI tokens at the time. False want??

JK sold 10,000 tokens on the HE exchange in under 2 days. Im sure your small pile of 1400 will sell ok.

I'll wake you up bubby, don't worry, go back to sleep and quit slandering me without evidence. 😉

Posted Using LeoFinance Beta

Thanks for the answer. :)

Posted Using LeoFinance Beta

I don't think it is an empty promise , SPI bought back from a person within less time thousands of dollars worth SPI .

Right now , yeah but once hard cap is in and dividends start to roll out , it will change .

Posted Using LeoFinance Beta

I think the asset values will continue to go up because we still have the Cub Life project and airdrops from 3Speak/Project Blank. Also since everything is in LEO, we may see a drop in the growth if LEO pumps up (base numbers drop) because the asset value relative to original LEO holdings will dip.

But either way, it should still be fairly high but I don't know if 60% throughout the year would be true given the fluctuations in LEO price. I also think there will be people who are looking at the dividends for APR and they won't really care about the assets since its only on the balance sheet.

Posted Using LeoFinance Beta

That is always the tricky part. Depends upon what currency the valuation is being done. We price it all in LEO but there is also the USD (or Euro) conversion. Hell we could look at it in Bitcoin too.

As long as the revenues keep flowing in, the rest will take care of itself. Cant control that other stuff but can focus upon building.

Posted Using LeoFinance Beta

I transferred 42.573 LEO tokens to @lbi-token account to but LBI token, Is there anything else as well that i need to do ?

Thanks in advance.

!LUV 1

No you do not.

When @silverstackeruk gets online, the tokens will be send to your Hive Engine wallet.

Posted Using LeoFinance Beta

I checked this morning and received token.

Thanks a lot for the confirmation.

Excited about this project.

Best wishes

!luv 1

It is manually transferred to you by @silverstackeruk . He will do it once he is online :) don't worry .

Posted Using LeoFinance Beta

Thanks buddy

Yeah I got the tokens this morning. Thanks a lot for replying 👍

Sorry, you're out of LUV tokens to be sent today. Try tomorrow. (Having at least 10 LUV in your wallet allows you to freely give 3 per day.)

This is extremely valuable insight

I would expect it would trade at "book value" because the assets held are tradeable securities. In the Banks case, it's assets aren't tradeable so are worth more than the book value, e.g. value of the brand, distribution network etc. But I would love to be proven wrong

Posted Using LeoFinance Beta

You might be right. Hard to tell.

But if the price is trading at the book value then it is a steal since the growth rate has to be accounted for in some way.

Posted Using LeoFinance Beta

This is truly amazing and believe we will see bigger gains still over time. Anyone being told you could make over 60% gains would ask where they could sign up and one reason I believe this project is heading to the stars. A good team makes a difference to any project and you guys are truly performing.

Posted Using LeoFinance Beta

Very true. They would look at you crazy. Obviously, this is small potatoes in crypto especially with DeFi farming. However, this is a much different, more reliable approach.

We are going to see more projects I believe that LBI is somehow tied into that will help to increase the money coming in. We are not even to the 6 month point yet.

Posted Using LeoFinance Beta

Yes but this far less risky and a great investment in my opinion .

That's one of the reasons why I buy SPI and LBI more and more .

Posted Using LeoFinance Beta

I think the price will rise but I'm not even too much focused on that. I'm impressed by the growth rate. Even 20% is a great target and right now we are looking at three times that.

Keep up the great work folks. This is one of my favorite projects in this community.

Posted Using LeoFinance Beta

When is it being listed in the open market again? I vaguely recall the cublife being a trigger for that

Posted Using LeoFinance Beta

This is probably a poorly phrased question LOL I know it is in LeoDex already, but where do you think we will see it being traded?

Posted Using LeoFinance Beta

Hehe what do you mean by that :p

I mean LBI is already in open market , users can buy and sell on LeoDex and HE .

Posted Using LeoFinance Beta

I suppose I was reading it wrong, my bad LOL

Posted Using LeoFinance Beta

Lol it's all right :p it happens .

Posted Using LeoFinance Beta

As the assets grow overtime, we will tend to see more buying pressure of the token.

Not sure how many people are getting more LBI to get the Cublife Airdrop but it will surely help to push the price up.

This is the rate we might see if the growth is linear? But there is a possibility of this turning into an exponential curve once we start expanding the backing assets like Cublife. Also, once LBI starts paying out dividends, it could attract more people to it. Let's see how all of this will reflect in the price.

Posted Using LeoFinance Beta

60% in a year is absolutely massive for any project. Meaning the value of LBi can even get higher with more development here and there. Great one guys

Posted Using LeoFinance Beta

I think this thing is awesome. We are still in its infancy and it is showing tremendous potential. The base position of Leo will continue to attract airdrops and new opportunities for revenue streams. And that position will only continue to grow, even as the tokens are now capped. Being priced in Leo, the Leo growth should continue, albeit at a slower pace once dividends start paying, but where it will really shine is if and when the Leo price starts performing. If LEO goes to $5 and the "book value" doubles over that time to 2 Leo per LBI, we'll be looking at each LBI being worth $10 PLUS all the dividends paid along the way. That's a 30-50x for those who got in when Leo was 30 cents! I'll be adding a few more tokens tomorrow before the cap is official.

Is there an actual UTC deadline? Would be helpful to know....thanks!

Posted Using LeoFinance Beta

In fact, in regards to the deadline, I think it would be helpful to post a 24 hour warning. You probably already thought of that but, just in case....

Posted Using LeoFinance Beta

Rate is really good.

Posted Using LeoFinance Beta

Congratulations @lbi-token! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 10000 upvotes.

Your next target is to reach 4000 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

I am in for the long term but the book value is something to be confident in. I do see that the open market is quite active at the moment and I am sure it will become more so after the hard cap is In place.

Posted Using LeoFinance Beta

So you lied to us all ? How can you do this to us ?

You lied to us by saying this is a "get rich slower" project but seems like you are providing returns like no other projects . -_-

Posted Using LeoFinance Beta

LMAO. This is what I was thinking.

It is the opposite of 'GET Rich SLOWLY"

I am worried, we are going too fast. 😂

Posted Using LeoFinance Beta

Right ? lol

Have you invested in SPI ?

Posted Using LeoFinance Beta

I haven't. Do you think I need to?

Posted Using LeoFinance Beta

Well not a financial advice but you should definitely check it out .

Posted Using LeoFinance Beta

Slower than @spinvest so not "like no other projects".

Posted Using LeoFinance Beta

Oh lol , good comparison :p

Yeah I have to invest more on SPI I guess .

Posted Using LeoFinance Beta

Your post was promoted by @amr008

This is a life changing opportunity for those who understand how the project works. It's the best investment opportunity on here so far and I'm glad I could join at the beginning and add to my initial investment slowly, on the go. I see some are still salty and continue on the negative path.

Today is the last day to buy more, so I'm buying.

Posted Using LeoFinance Beta

Me, too. I really feel like the 60% is incredible but that the long term potential of this thing is off the charts. I mean, think of the compounding of 60% returns. Even 25% returns compounded are massive.

So, just for the hell of it, I ran some numbers. I plan on being in this for the next 10 years, maybe longer. Anyway, if we get 50% this year (conservative), and then grow at 25% per year after that (aggressive but not crazy by any means), in 10 years the "book value" of 1 LBI would be 14 LEO. So that's a 14x on your money, PLUS 9.5 years of very fat dividends along the way. So, I would say you could reasonably look at a 20x on your investment over that time. Where things really get crazy is if the LEO price goes up. If you have 100 LBI worth 14 LEO each, that's 1400 LEO at say $10 just to make easy numbers. So a book value on your 100 LBI of $14,000 plus all those dividends. Just so you know, you could buy 100 LBI tomorrow for about $75. Hmmmm....

Posted Using LeoFinance Beta

Lol, thanks for doing the numbers. I'm not sure for how long it can go on, but there's no limit, so it may as well work for 10 years, as you mentioned. It is a lot of money!

Posted Using LeoFinance Beta

I didn't know about the 20% annual growth target, that's really nice. Will that impact the dividends or will they stay more or less the same each year?

Posted Using LeoFinance Beta

Dividends are based upon revenue producing assets, not value of assets. So the amount of LEO coming in each week is what will pay dividends. If the value of LEO goes up 2x or 4x, that has no bearing on the amount of dividends paid out.

Posted Using LeoFinance Beta

I see, I guess that applies to stocks as well ? thank you for the financial lesson :)

Posted Using LeoFinance Beta