LeoFinance Weekly Stats 03/22/2021 to 03/28/2021

Welcome to the weekly edition of the LeoFinance stats report.

This is a weekly report covering March 22, through March 28, 2021.

If you want to learn a bit more about the LeoFinance ecosystem and dig into the numbers, this is the place to be.

The following topics will be covered:

- Issued LEO Tokens

- Top LEO Earners

- Rewards to HP delegators trough the leo.bounties program

- Daily stats on tokens staking

- Share of tokens staked

- Top Users that staked

- Unique number of LeoFInance users

- Posts/comments activities on the platform

- Posting from LeoFinance.io interface

- Price Chart

Issued LEO Tokens

Let’s take a look into token issuance and how it is distributed over time.

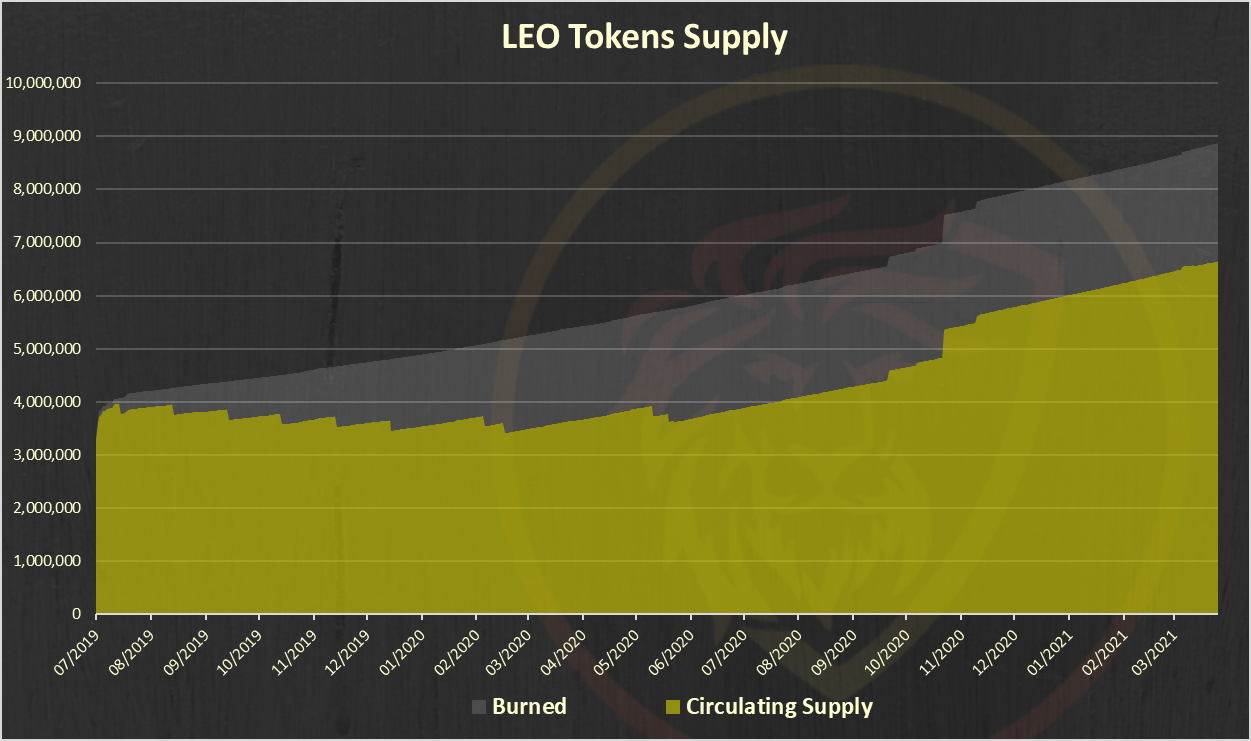

Below is a chart that represents the cumulative issued LEO tokens.

This chart is representing the total LEO supply, circulating supply and burned tokens.

A total of 8.87 issued LEO tokens, 2.22M burned, 6.6M circulating supply.

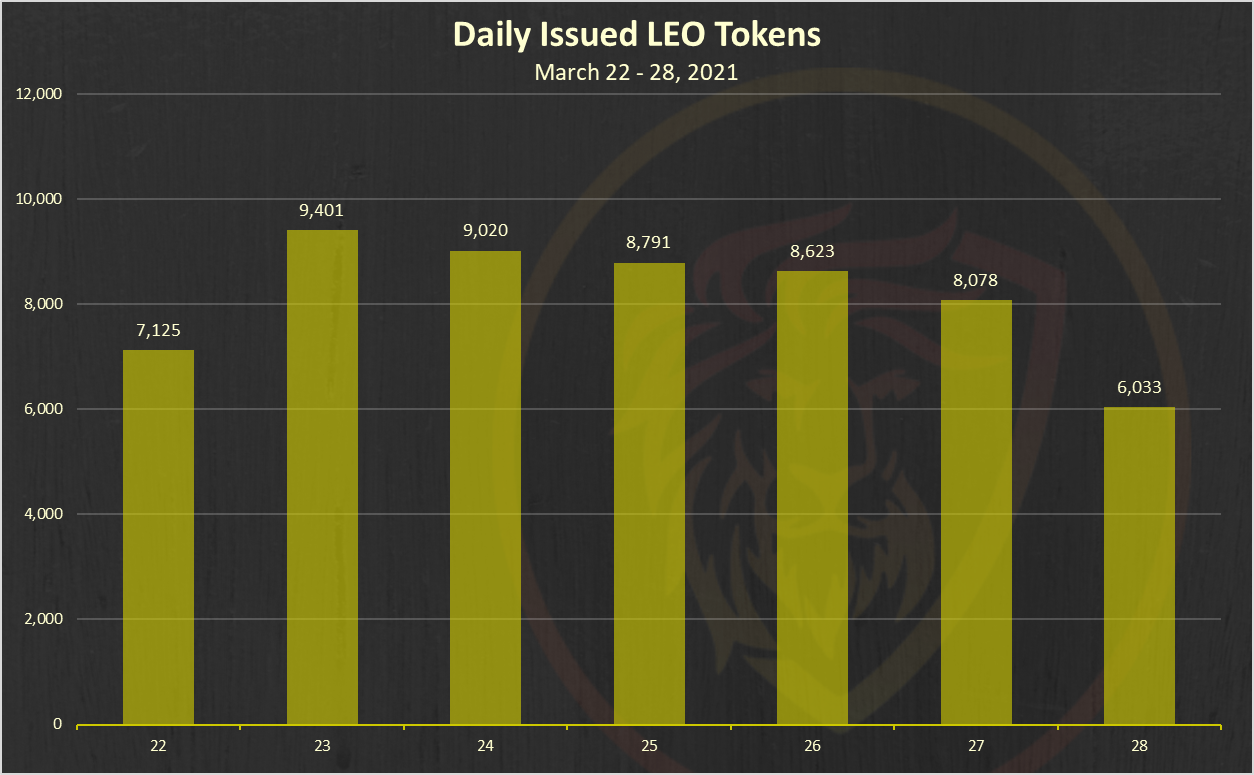

Next is the issued LEO tokens from last week. Here is the chart:

A total of 57k LEO were issued in the last week.

Let’s see how these tokens were distributed.

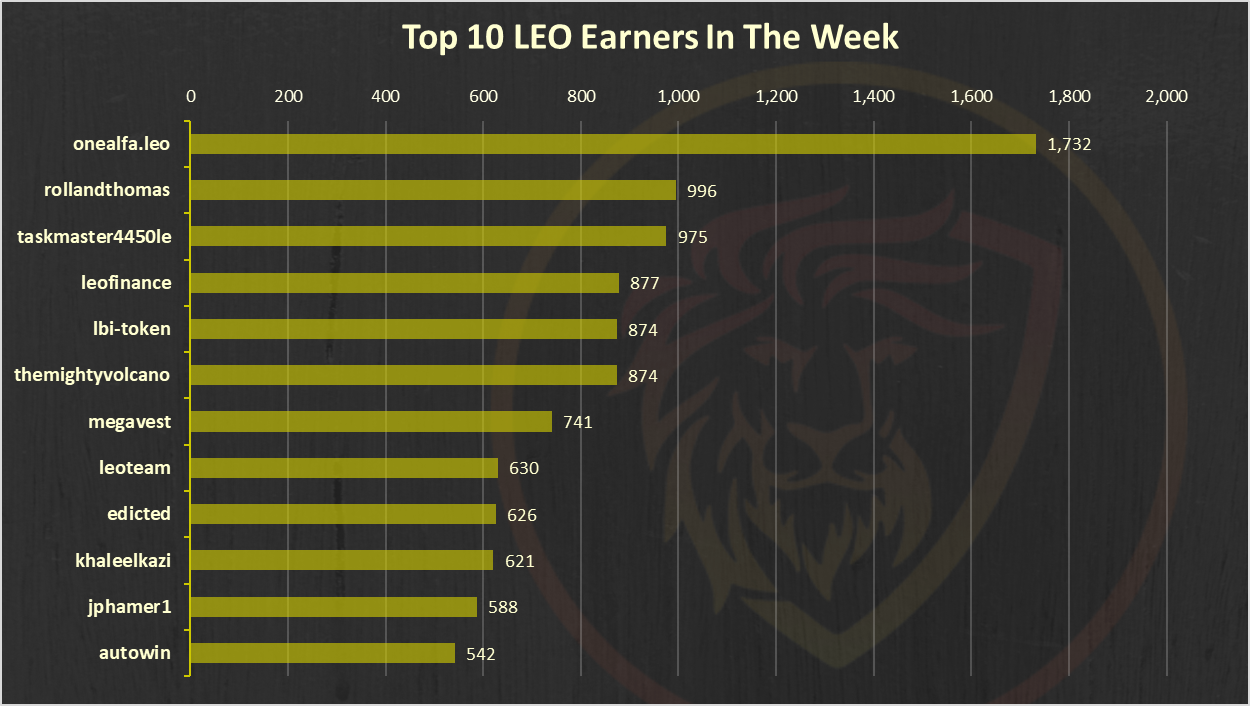

Below is the chart of the top 10 LEO earners this week.

@onealfa is on the top with 1.7k tokens, followed by @rollandthomas and @themightyvolcano.

The @wleo.pool account have 5.3k LEO issued in the week. These are liquidity providers incentives.

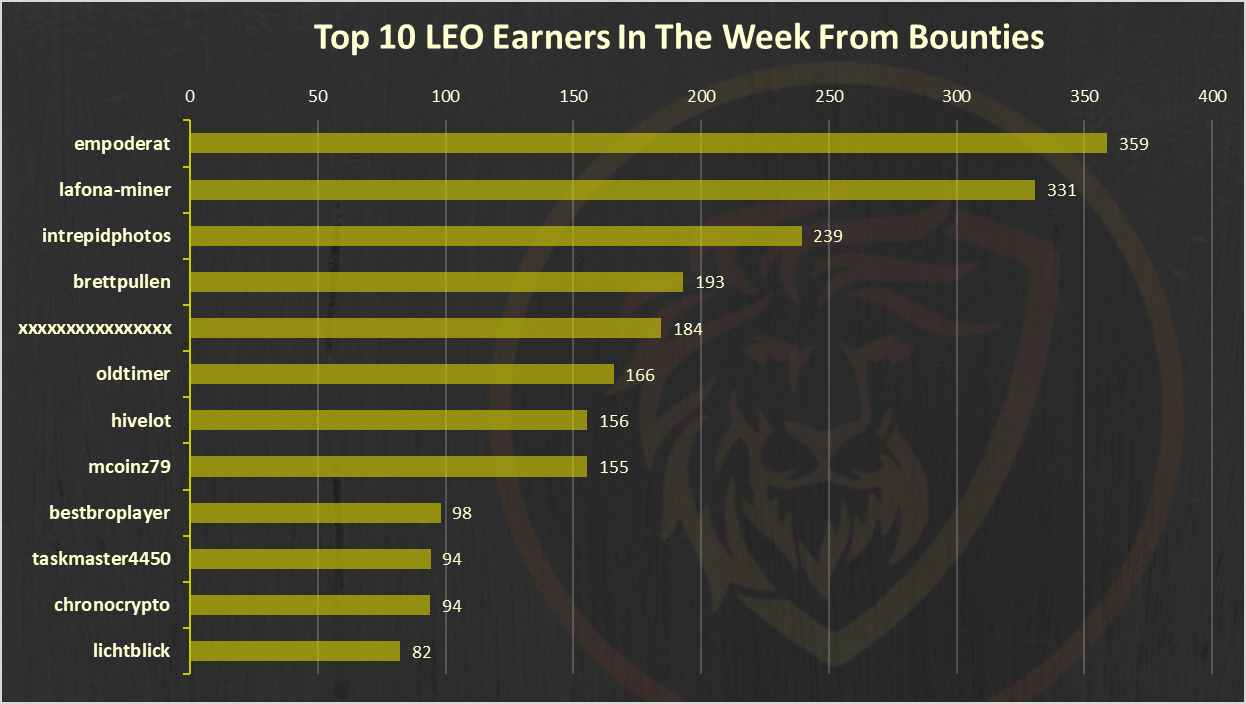

Rewards from Bounties

Users who delegate their HP to the @leo.voter receive daily payouts in the form of LEO tokens at a rate of ~16% APR. Also, at time some other bounties are in place.

@empoderat is on the top here as a new entry, followed by @lafona-miner and @intrepidphotos. The last one is a new entry in the top 3.

Staking LEO

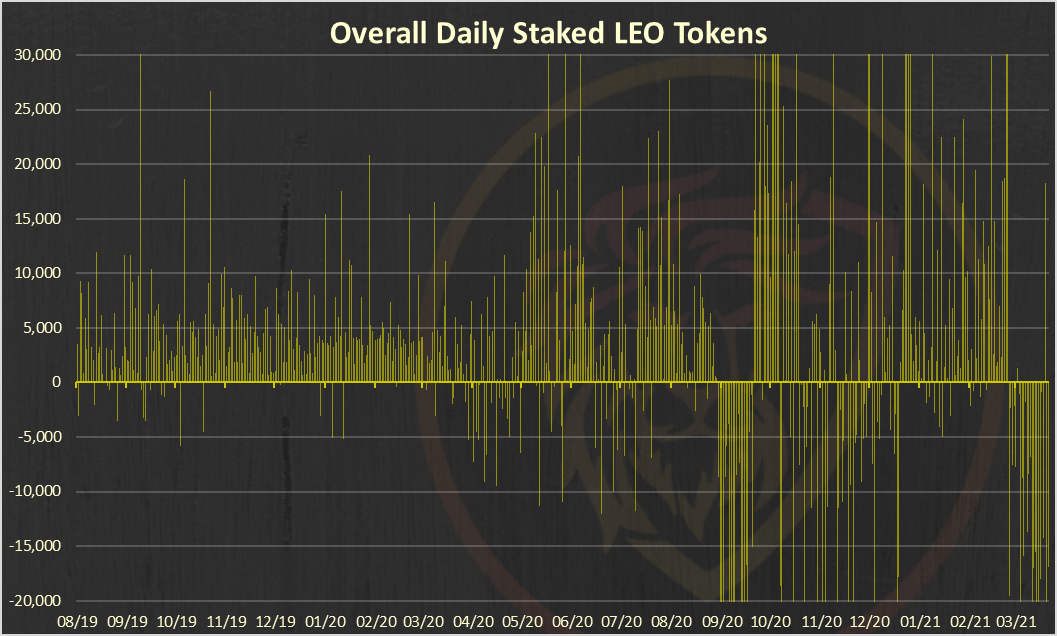

Below is a chart that represents the daily flow of staked and unstaked LEO tokens. A positive bar going up shows a day where more LEO was staked than unstaked.

July 2019 is excluded from the chart for better visibility. Those are the first days and there are a lot of tokens staked.

There is some unstaking happening in the last week after a lot of staking before the CUB airdrop. This is mainly because of the bLEO pool on CUB, and people want to stake bLEO there.

A lot of possibilities to earn with LEO now, that will most likely result with an increased APR for all the options, when it balances itself.

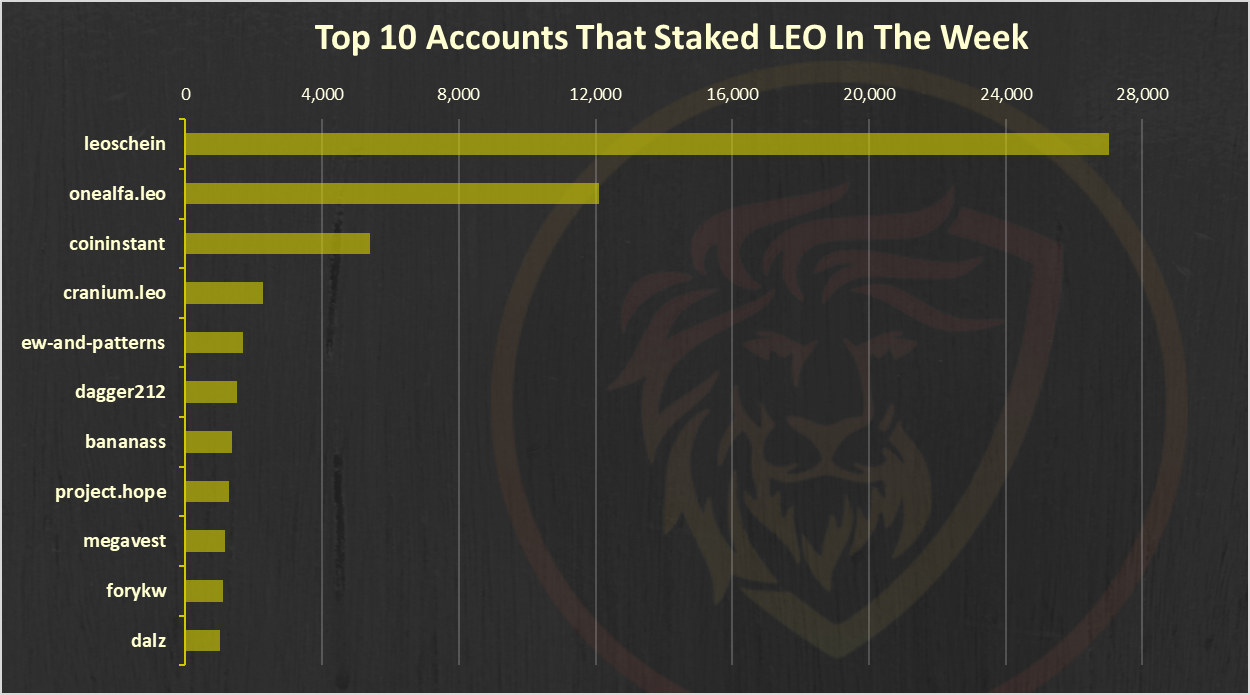

Below is the chart of the top 10 users that staked LEO last week:

The @leoschein account is on the top wit a massive 27k LEO staked, followed by @onealfa.leo and @coininstant.

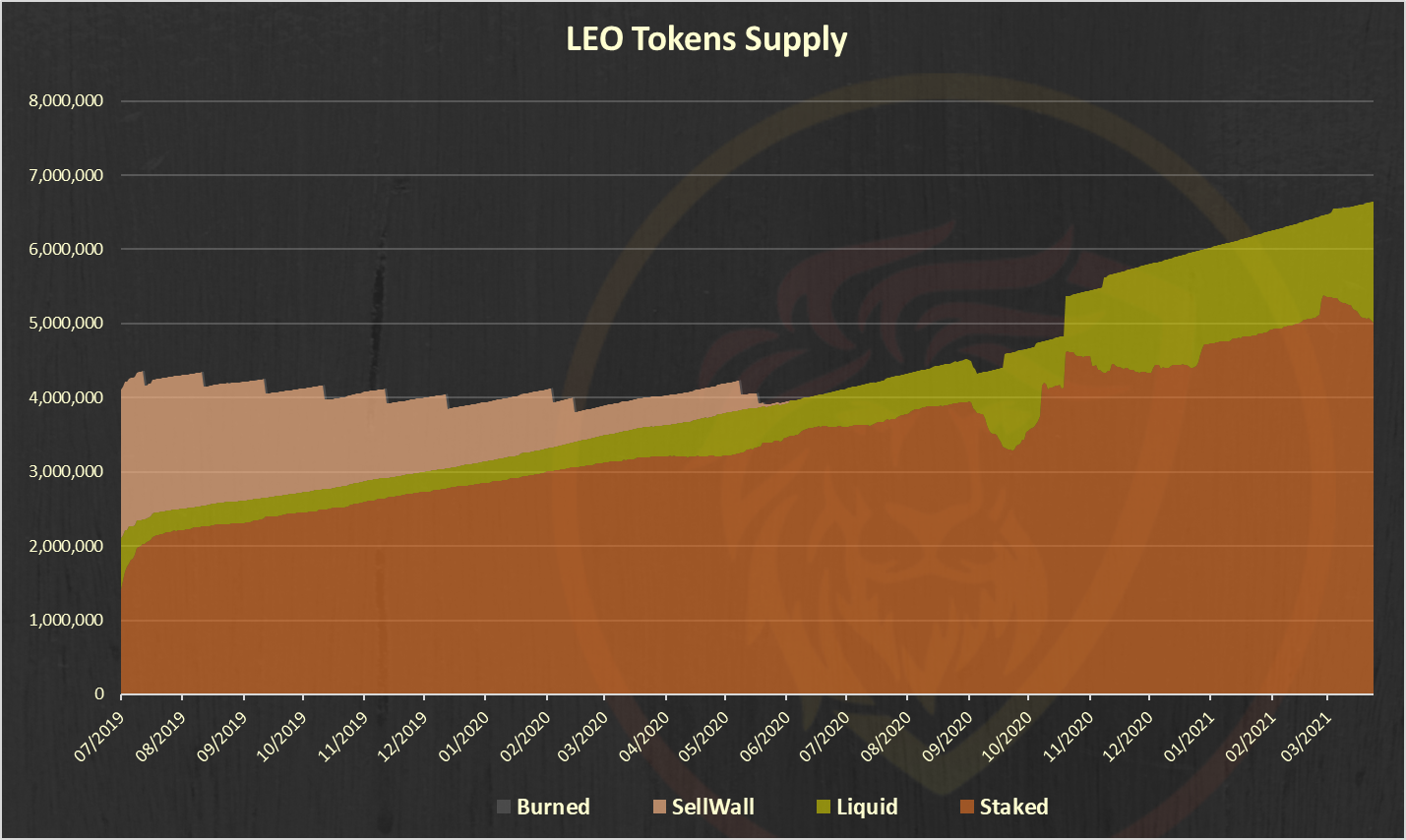

The Overall Flow of the LEO Token Supply:

The yellow (liquid LEO) is an interesting category. A lot of movements here due to the WLEO launch.

Note on the yellow, liquid category above. It includes the LEO in the liquidity pools on ETH and BSC as well. If we remove that, the liquidity will be much lower.

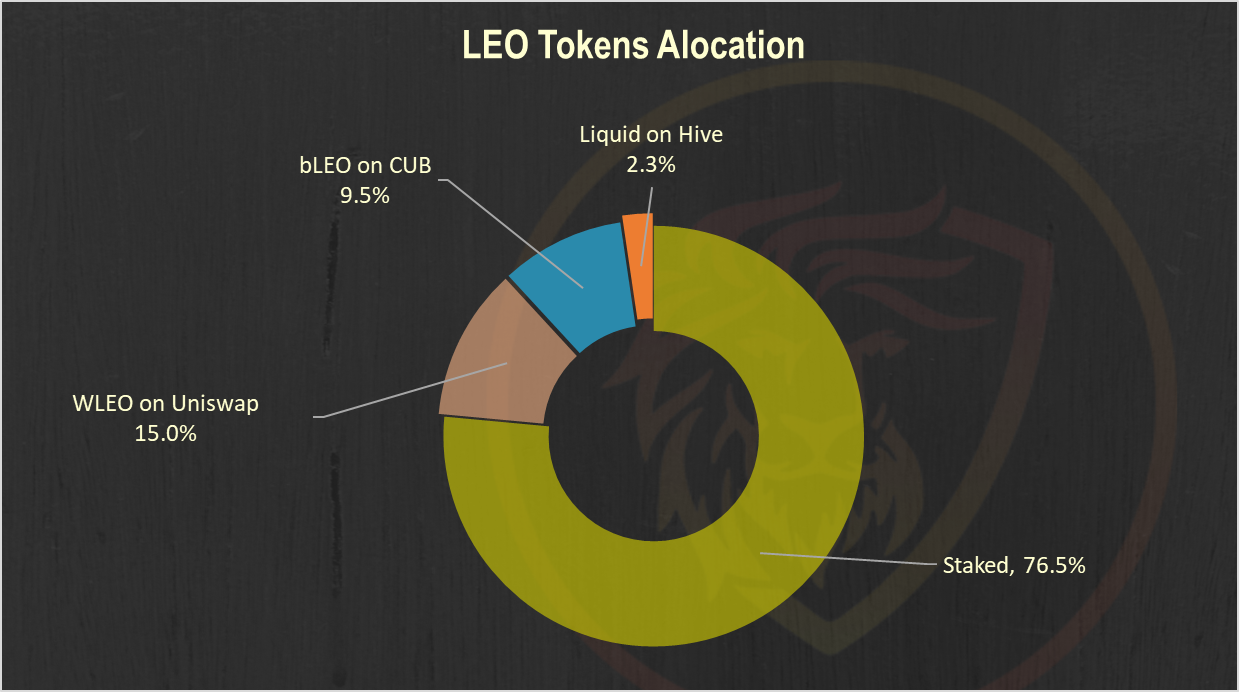

Below is a chart of the LEO tokens alocation.

More LEO is being moved to BSC and bLEO. Almost 10% now on BSC. Soon it might flip the WLEO pool.

The staking has dropped in the period as well, from 82% two weeks ago to 76%. Again, LEO is moving to bLEO. Will be interesting to see where the balance will be after this initial token reallocation.

LeoFinance Users

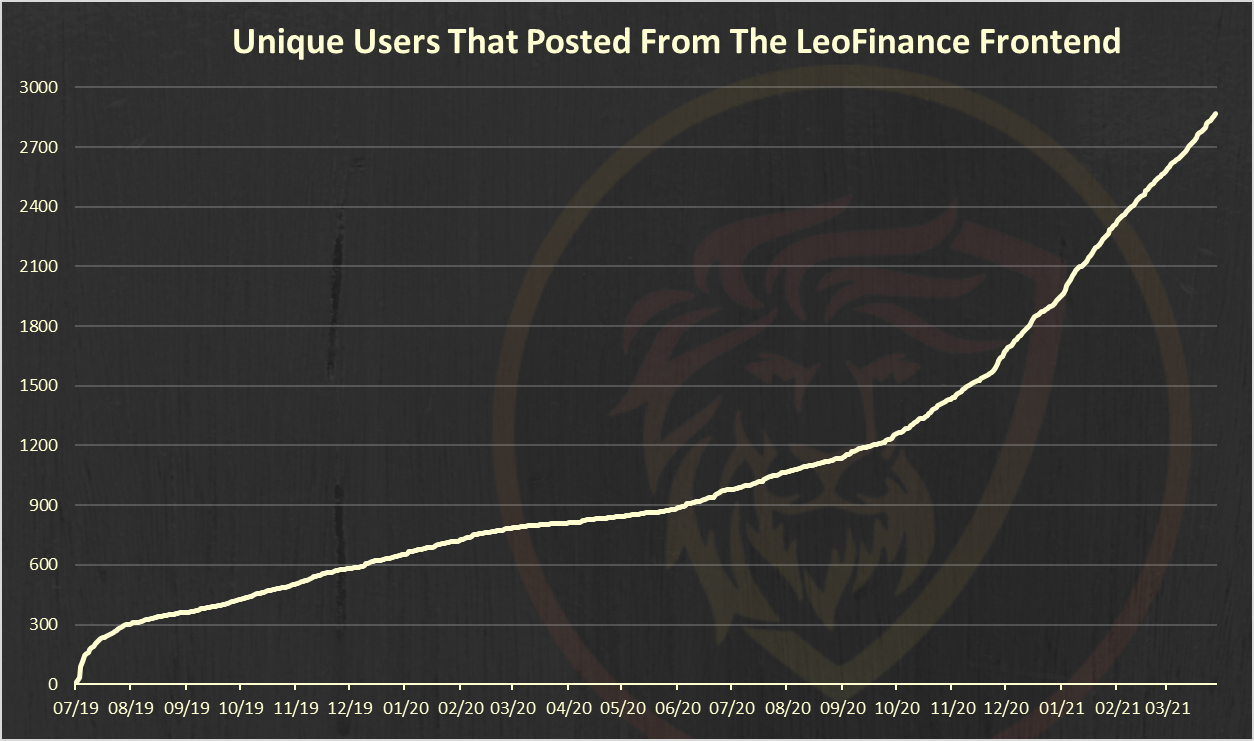

Below is a chart with the number of unique users that posted from the LeoFinance frontend.

A total of 2871 unique users have posted from the LeoFinance frontend.

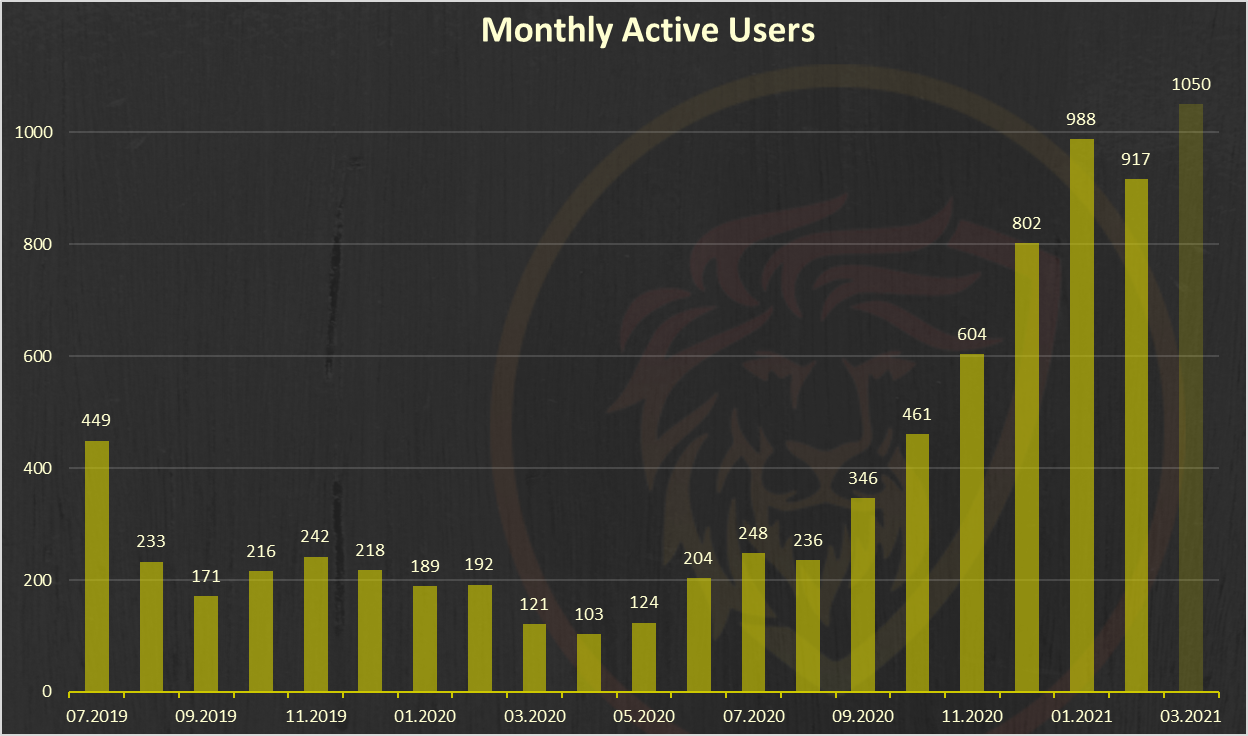

Monthly Active Users Posting from LeoFInance [MAU]

Here is the chart for the monthly active users that posted from the leofinance.io interface.

I have added March in the chart as well, although it is not over yet. As of today the number of unique users that have posted from the web in March has reached more than 1000. For the first time LEO has more then 1k MAUs.

Activities on LeoFInance

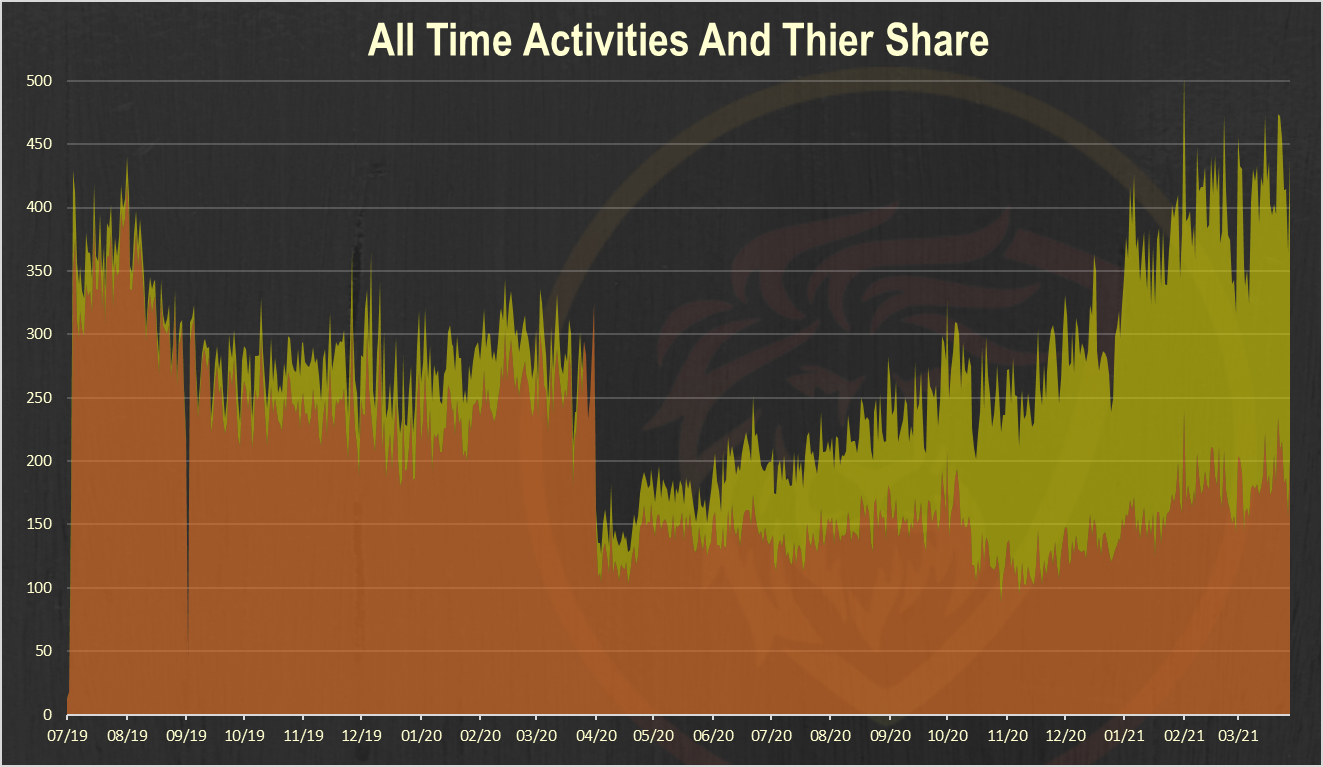

Below is a chart of the LeoFinance activities with the numbers of posts from the LeoFinance interface and posts with the #leofinance tag.

The yellow are posts from the leofinance interface and the orange posts from other hive frontends with the leofinance tag.

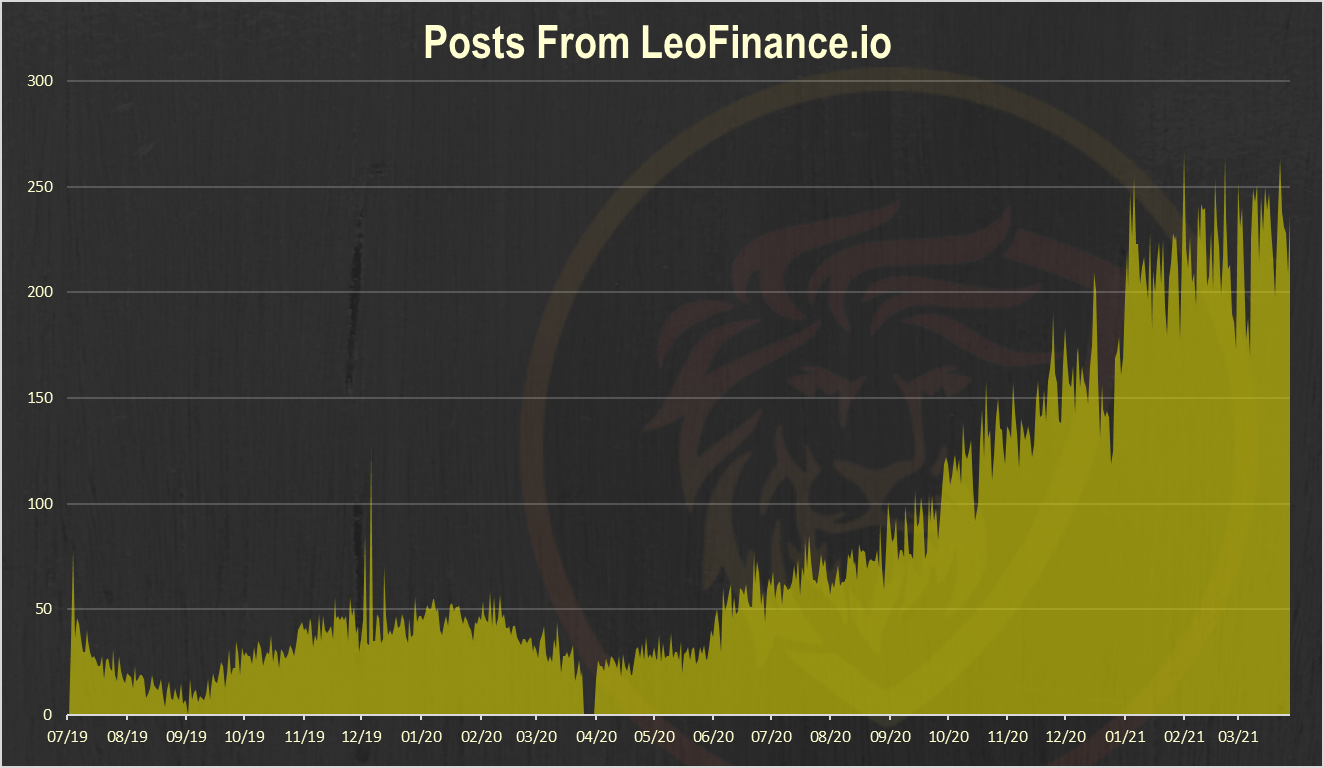

Here is the chart showing only posts made from the LeoFinance.io interface.

The up trend in the numbers of post from leofinance continues in the last week as well with a total of 1654 post in the week.

LeoFinance has introduced a 10% incentive for posting trough the native frontend. When users post from other frontends and just with the leofinance tag they have 10% less rewards.

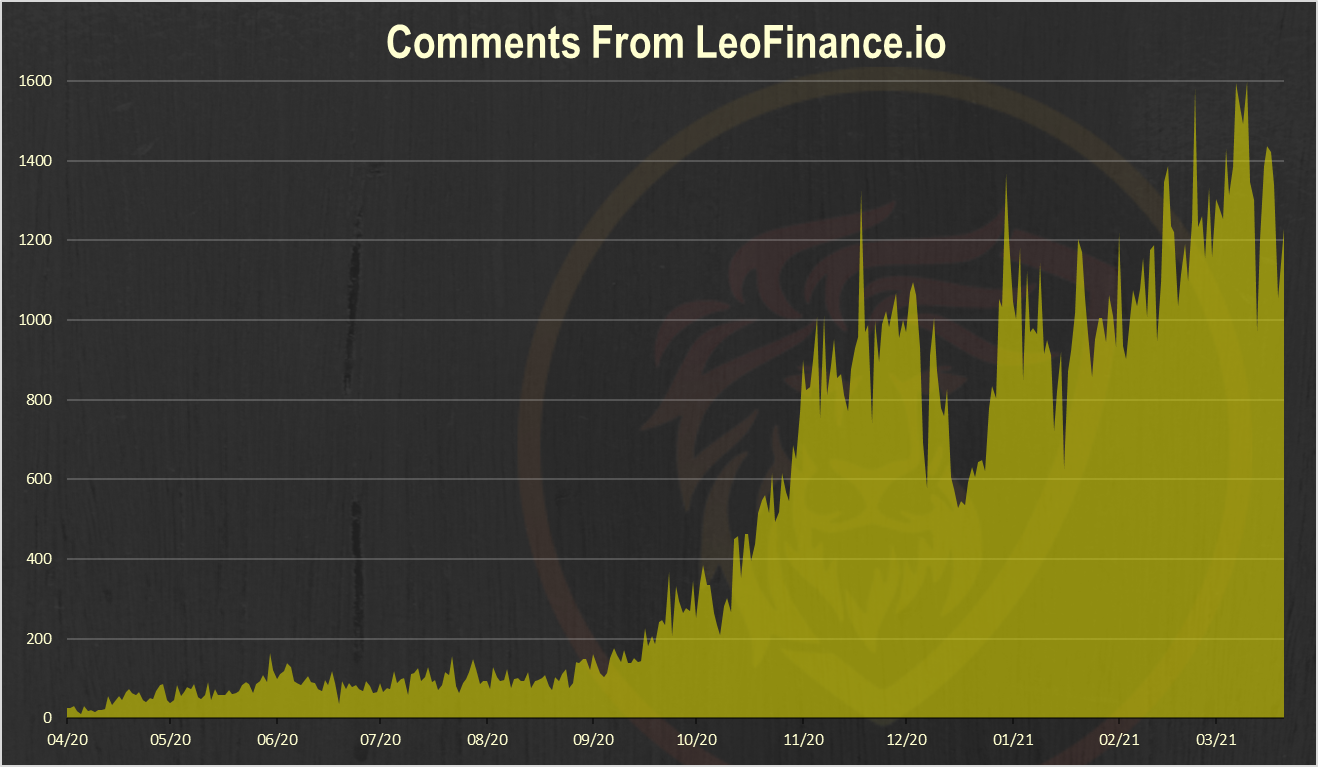

Number of comments from LeoFinance.io

There is an initiative in the last period for engagement on the platform and some of the large stakeholders have been voting comments a lot.

Here is the chart for the numbers of comments starting from April 2020.

The comments are increasing even more than the posts!

Almost 9k comments in the last week, around 1.2k comments per day.

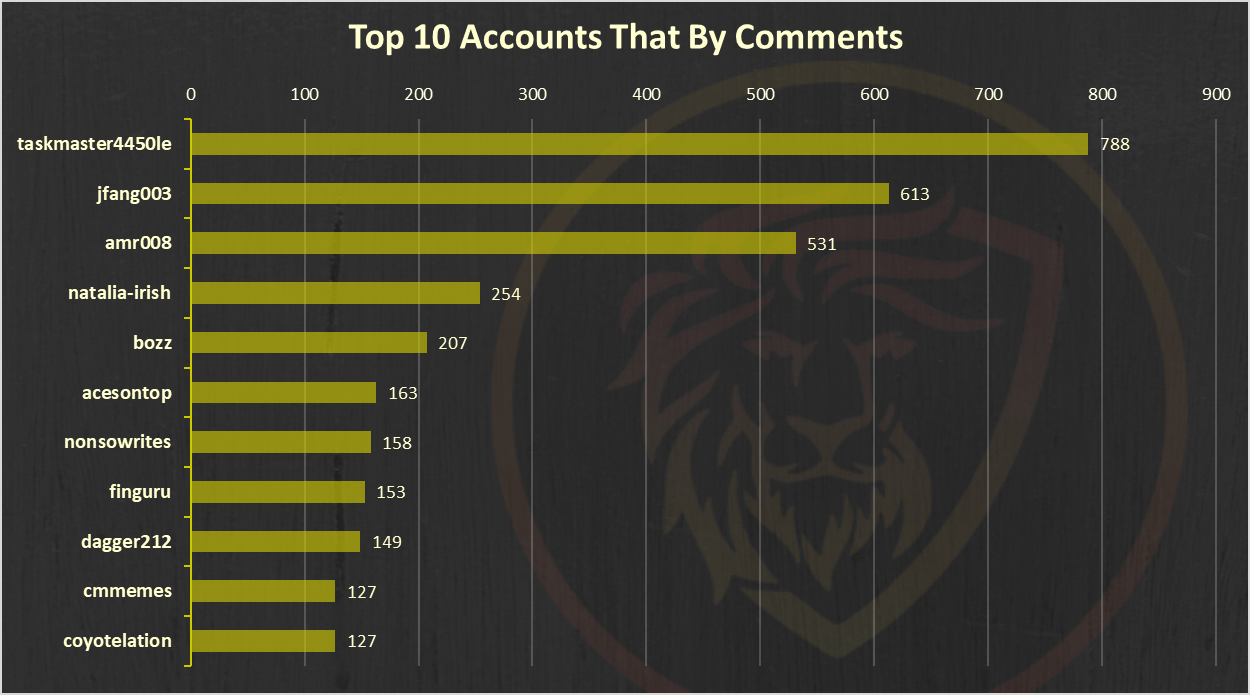

Authors that commented the most

There is an initiative in the last period for engagement on the platform and some of the large stakeholders have been voting comments a lot.

Here are the top authors that commented the most.

@taskmaster4450le has made yet another record in comments with a total of 788 comments!!!

@jfang003 is second followed by @amr008.

Price

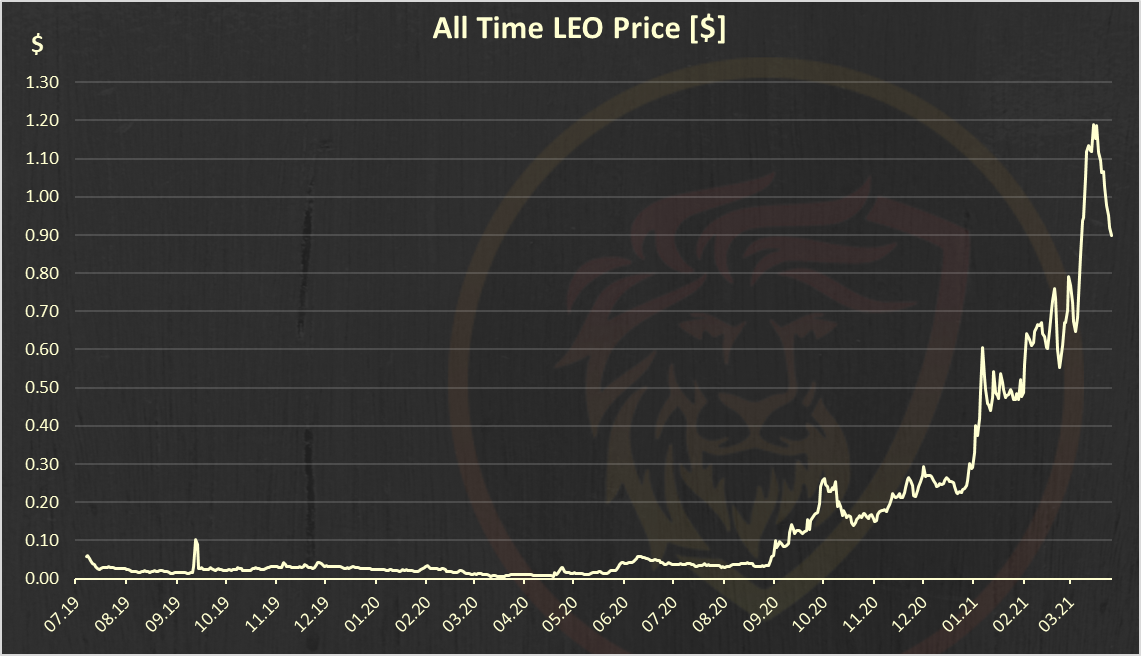

All time LEO price

It is interesting to look at the LEO token price, keeping in mind the crazy ride that HIVE had in the previous month.

Here is the price chart in dollar value with average price for better visibility.

Have in mind the above is an average daily price.

LEO price in the Last 30 days

Here is the price of LEO in the last 30 days also in dollar value:

The chart above is from Hive Engine and there was a lot of volatility in the last days because of the HIVE price pump. Overall LEO is holding around 0.8$ in the last days.

| Track Hive Data | New Interface! | About Us |

|---|---|---|

| Hivestats | LeoFinance Beta | Learn More |

|  |  |

| Trade Hive Tokens | Wrapped LEO | Hive Witness |

|---|---|---|

| LeoDex | Trade on Uniswap | Vote |

|  |  |

Report by @dalz

Posted Using LeoFinance Beta

Another stunning report.

I will have to look, did the token supply decrease from last week with all the burns due to the Cubfinance pool money?

Great job to @jfang003 passing @amr008.

Posted Using LeoFinance Beta

Last week there was 57k tokens minted, just above 10k burned ... the week before there was 31k burned ... that one was more close :)

Posted Using LeoFinance Beta

Okay thanks for the update. We will see how the pace of burn is when LeoBridge and the Vaults are introduced.

Posted Using LeoFinance Beta

Maybe I exaggerate a bit, but I see a parallelism between the behavior of BTC and LEO, at least for me that's the reason why I trust this token so much. As for CUB, I know it's a new initiative and it's going amazing, but I maintain my stance of not trusting centralized platforms, so I will only join CUB when I see a form of decentralized DeFi within the Hive scheme (I feel that in the future this I think will become a reality, I have no doubt about it and I'm in no hurry to see it materialized).

On the other hand, I love that comments are somehow rewarded, this is an initiative that distinguishes Leofinance from the rest in the Hive ecosystem. I think that if others take the trouble to make a quality publication, the most sensible thing to do is to recognize their effort beyond the upvote and write a comment that encourages the author to continue sharing their views with the community. In my case, I promise to make April my most important month in this regard.

Posted Using LeoFinance Beta

It's nice that this week I hit one off the diagram. It is necessary to make a tradition, to be in at least one diagram every week.

Posted Using LeoFinance Beta

Congrats for that milestone! Agree with you, for personal growth at least one diagram is important!

Posted Using LeoFinance Beta

I love this recap so much ♡

Posted using Dapplr

Another amazing week, despite the price drop. The activity is blooming and this is all that matters as this is the main driver and not the price of the token.

Thanks @dalz for the report!

Posted Using LeoFinance Beta

Large amount of unstake happening and selling off at the moment? Or are those reductions from wrapped Leo? Any way to be able to tell?

Posted Using LeoFinance Beta