About DeFi Flash Loans

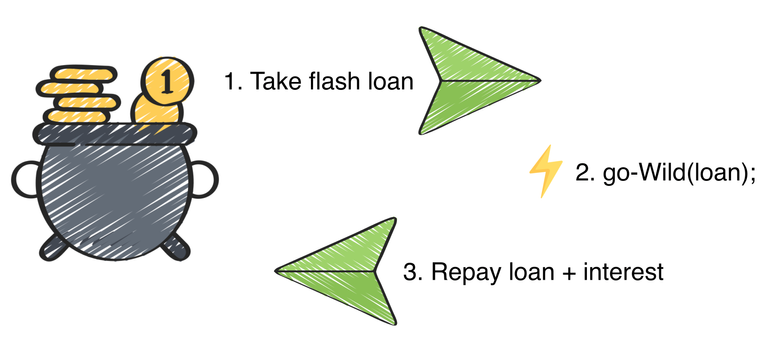

A flash loan is an element that permits you to acquire any measure of resources from a predetermined brilliant contract pool without setting up any insurance. Flash loans are valuable Decentralized Finance building blocks since they can be utilized for exchange, obligation exchanging, and self-liquidation. While the marble convention was the first to carry out them, AAVE and dYdX made them mainstream.

The idea of an exchange in software engineering is equivalent to the definition of an exchange on a blockchain, like Ethereum. An exchange is a progression of activities that should be acted in a nuclear way; both of these kinds should be finished, or the exchange will be moved back and none of the means will be finished. With regards to Ethereum, any commonplace activity is performed inside the exchange range, including sending Ethereum, ERC20 tokens, and speaking with keen contracts. Ethereum blocks are comprised of exchanges that are bunched together.

Numerous stages might be utilized in a solitary Ethereum contract. On COMPOUND, for instance, you may supply Ethereum and get DAI. On CURVE, trade half of your acquired DAI for USDC to give liquidity to DAI. On the off chance that these systems come up short, the whole exchange will be moved back and none of the resulting steps will be performed. What's more, if an arrangement isn't done, you'll likewise need to pay petroleum charges.

Tracking down a flash loan supplier is the most basic part of the cycle. DeFi clients can get different coins from a predetermined pool utilizing keen contracts made by AAVE and dYdX, as long as they are reimbursed inside a similar Ethereum exchange.

With regards to flash loans, there is generally a set rate. For e.g., AAVE contracts power the loan boss to reimburse the first installment in addition to an extra 0.09 percent of the acquired sum. Investors who supply the loaned reserves share the expense with integrators who make the AAVE flash loan API simpler to utilize. On the off chance that the cash has been loaned from the loan pool, it very well may be utilized on anything you need.

Exchange flash loans will support the profit by a beneficial exchange. Exchange bargains including numerous stages can be expensive. Regularly figure in preparing costs while assessing income, just as the measure of value slippage you'll confront while submitting your request. There's a decent danger that another person will have a similar potential and will actually want to finalize the negotiation before you. Moreover, bots that track the mempool may get on your beneficial exchange opportunity.

Security flash loans are traded. For instance, assume you acquired DAI from COMPOUND and put Ethereum up as guarantee. You will trade the ETHER guarantee for DAI insurance by taking a DAI flash loan to counterbalance the DAI acquired.

Self-liquidation flash loans. Think about the accompanying situation: you have a DAI loan with Ethereum as insurance on COMPOUND. The cost of Ethereum begins to plunge, and you're arriving at the mark of liquidation. You either don't need to, or don't have any desire to, add more Ethereum to the liquidation stage. Besides, you come up short on the DAI expected to reimburse the loan. You will presently take a flash loan for the measure of DAI you owe, discount your DAI loan, and pull out your Ethereum rather than your contract being sold.

you can read more about flash loans...

https://www.coindesk.com/what-is-a-flash-loan

Posted Using LeoFinance Beta