ALL TIME HIGHS!!! - Trading Journal (12.04.20)

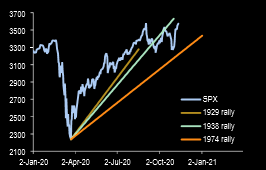

The current uptrend in market indexes is one to remember. How fast and strong it has risen since March is all but remarkable. Yet some may still believe that trouble in the future is brewing and it is very understandable.

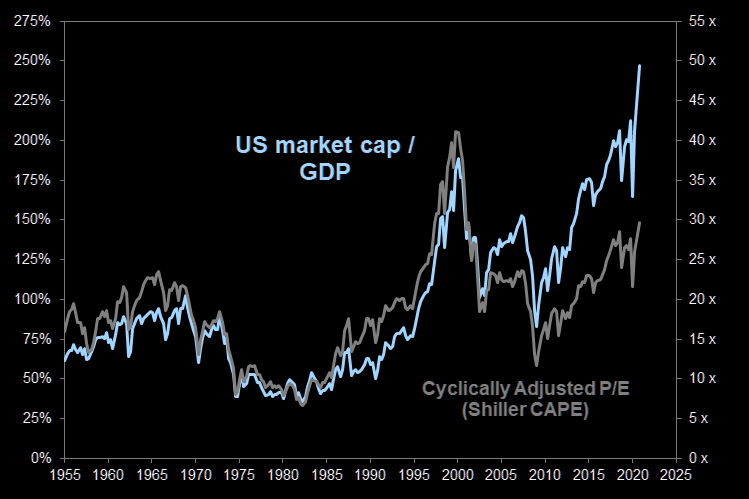

Market cap and P/E ratios are near their highest levels ever, while the country and globe is still fighting a pandemic on top of economic troubles. The bigger issue is once the pandemic is over the wealth gap will have significantly widen. This will lead to further tension among the population. I bring this up because the reality of most American are facing financially challenging times. Today's employment numbers for November were 250k jobs, half of what was expected. For the past three months the growth of new jobs have slowed leading many to believe that the economy is slowing.

Yet here we are with markets continuing to rise and hit all time highs. Some hidden reasons as to why?

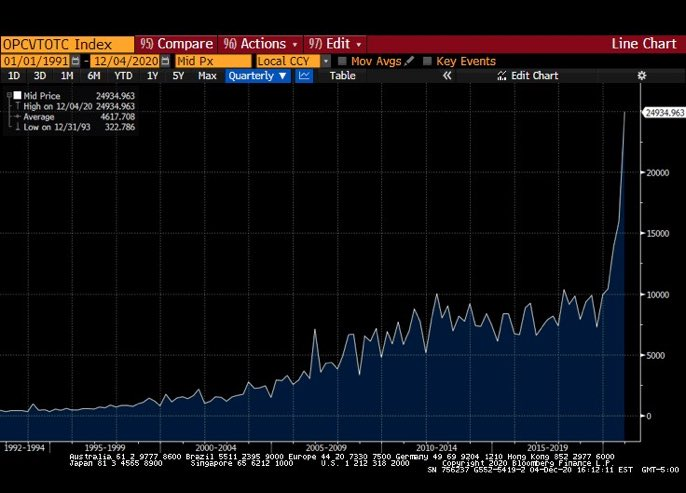

The derivative market is this year's hot ticket and many bulls who bought shares near March or any time after basically scored big. The derivatives I am mentioning is the options market. Multiple stocks are lifted due to the demand in call buying from mostly retail investors. The demand for calls have never been this high and is shown in the chart above. Just imagine all those calls expiring and having to roll out to a further date. Goodbye Bulls?

The magnitude of an option moving the market by the people who created them is saying should be zero. Yet here we are with a strong bull trust. My full belief is that the call option buying spree is the cause of showing stock price action being so positive in the mist of all the negative head winds. The Bulls that keep bringing up the fact that current uptrend is so strong that it is historically considered the start of a new bull market may not be wrong, but who is to say history will not repeat itself? That is when everyone has bought, who else is left to sell?

NYSE is the oldest stock market in the US. This is showing exactly what I am trying to describe. If in fact that most have already bought, where volume advancing is nearly all the volume then who else will be able to buy when there is nothing to sell? The ratio of volume advancing to total volume is not at its all time highs such as that seen in June but it is making a double top look. Will there still be more buying ahead, it potentially still has some room left, but will it get there before it falls?

Posted Using LeoFinance Beta

Honestly, this is absolutely crazy, especially considering the Corona situation throughout the year. German companies, which would have looked bankruptcy in the eye without government support, are seeing rises in stocks that could point to best company times.

Posted Using LeoFinance Beta

Precisely. There are still zombie companies even with these higher evaluations. Nothing really got fixed other than adding a few zeros behind a number. The facade will come to fruition when we least expect it. I fear it is sooner than later because what I originally mentioned a bigger wealth gap will be its undoing. Not just within the country but also on a global scale. Asian countries are not hit hard by the pandemic as much as Europe and US. But my focus is not about conspiracy theories but observing real economic data. As Asian countries get back to normal the West is still printing money to fill in on its production deficits. This will only make Asia economically stronger since they are producing more while Western nations are stalling and falling behind. Stocks do not need to crash for wealth to be evaporated. Hyperinflation can pretty much destroy a nations' wealth. So imagine if stock markets basically continue 100% up from here, its not like a really good thing when its on the back of a weaker dollar. If markets do pullback it will be a healthy sign of the economy as things need to re-balance. I am a long term bull, but markets going parabolic usually do not end well.

Posted Using LeoFinance Beta

I completely agree with you there. One of the reasons why I'm still Bullish on Kryptos. Whoever uses these profits from the shares to go into Bitcoin and Co., however, I think is doing everything right.

Posted Using LeoFinance Beta

One more: In the long run I think that in this world it is less and less possible to make out the fixed separation you describe. I think in the long run you can only win or lose together, because the dependencies on each other (with different degrees of intensity) are still present and rather increase than decrease.

Posted Using LeoFinance Beta