Capitulation, Great R/R Trades- Trading Journal (2.27.21)

When an equity is at an extreme it will likely reverse in direction in the short term. This is because the equity is either extremely oversold or extremely overbought. The end result is likely termed as a form of bottoming or topping.

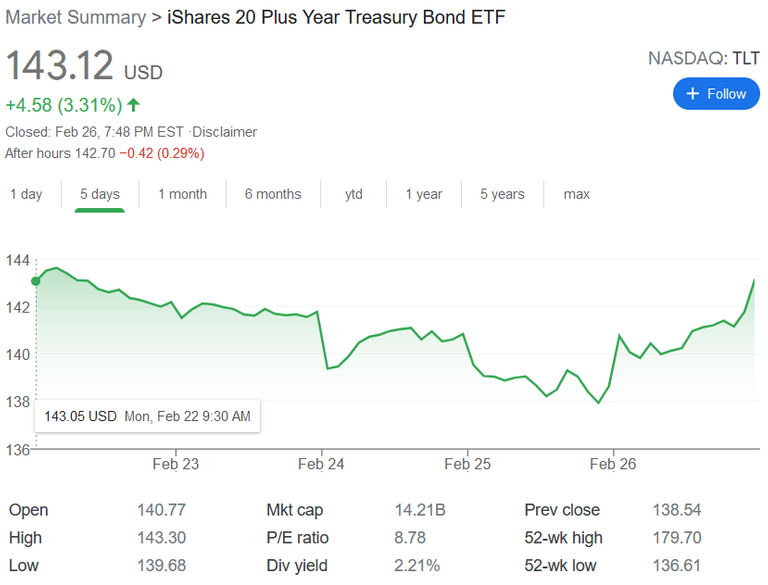

This past week the TLT had a capitulation event that would have been a decent risk versus reward trade to go opposite of the primary trend to play for a bounce. There were a few indicators that lead to this decision to go long TLT while the trend remains bearish.

The volume traded in TLT on Thursday was second most amount of volume traded in the stock. Only last March was the volume ever higher.

The RSI on a daily was at an oversold area, being under 20 is an extreme.

Mean revert where price of TLT was moving in the opposite direction of the primary trend.

The risk versus rewards is extremely high to play counter trend when a capitulation event occurs. This is likely because the most amount of traders who are position incorrectly will likely be left with a scare that makes them avoid the ticker for periods to come.

Knowing that the potential for a bounce play in a stock is easier when extremes occur. Although it may sometimes be too obvious to be playing a counter trend trade, but when extremes do occur one has to act quickly as price action will move much quicker.

It is clear that what TLT lost from Monday to Thursday had effectively created a bound that occurred Friday and basically almost round trip the TLT price for the week. TLT moving +3% on Friday as such a move is not often seen. Talk about capitulation leading to a mean reversal!

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

Posted Using LeoFinance Beta

$wine

Congratulations, @logicforce You Successfully Shared 0.300 WINE With @mawit07.

You Earned 0.300 WINE As Curation Reward.

You Utilized 3/3 Successful Calls.

Total Purchase : 20612.923 WINE & Last Price : 0.290 HIVE

HURRY UP & GET YOUR SPOT IN WINE INITIAL TOKEN OFFERING -ITO-

WINE Current Market Price : 0.290 HIVE

I personally think TLT is bound for an actual move back up. The primary buyers of bonds up until the worst 7 year bond auction was US banks and foreign banks. This means there are so many bonds bought at a premium compared to what it is now. I fully expect a rally in TLT so they can offload the bags to the retail mob.

Posted Using LeoFinance Beta

Congratulations @mawit07! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz: