Institutions predict $75k - $100k BTC by May! - Trading Journal (03.02.21)

Readers of my blog am aware that not only do I play Hive games but I also am a trader in equities markets. Recently I read some business articles about institutions investing in future contracts that bitcoin could hit as high as $100k in the next 3 to 6 months. Now this may sound crazy to believe since that basically doubles from where we are currently in less than half a year, but institutions are putting their money where their mouths are.

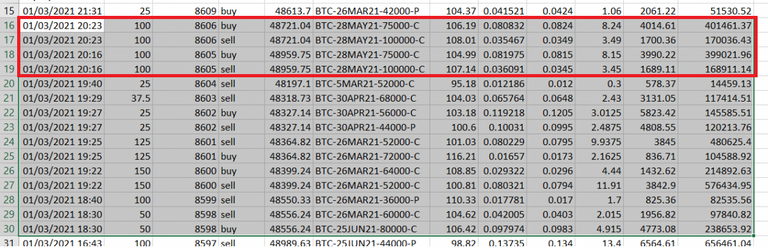

(Courtesy of Coindesk)

For 200 vertical spread contracts at a premium of close to $460,000 the bet is that bitcoin will hit over $100k by May 28th. If it was not to exceed $75 by May 28th the vertical spread contracts will expire worthless.

For those that do not know how options are price I will try to explain in layman terms. An investor wishes to leverage their principle on a bullish bet that bitcoin can rise up to a specific value within a given period can buy options. Options are derivatives that allows the trader to speculate their bets with leverage. In the money option is a option that is contractual for buyer to exchange for underlying asset at the contract's strike price. One contract equates to one bitcoin.

Now the investor may want to reduce their leverage exposure on their bullish bet so they would buy one option contract at a close to underlying asset price and sell one at higher price. This is a vertical call spread. The crucial part with options is there is a expiration date to them and if they expire in the money it gives investor gains while expiring out of the money will mean all the investor's investment goes to zero. This is a very risking investment and hence considered leveraged.

Now going back to the trade in focus it is 200 vertical call spreads for bitcoin to be at least $75k by May 28th but if it can hit $100k then the user will have a return profit of close to $4 million. That is right for almost a $5ook bet if the trader is correct they can net close to $4 million in profits. Will be coming back to this post with an update come May 28th to see how the trade played out.

For now it is definitely bullish for bitcoin as more call options are pulling its weight to bring bitcoin prices higher. The more call options invested in bitcoin price may lead to something of a gamma squeeze where many traders have seen from the recent pumps of Gamestop- GME and other stock tickers that had a meteoric rise. Exciting times ahead for bitcoin and the crypto market.

Leaving one final article, is Fidelity one of the largest institutions in America is already predicting bitcoin will take share of gold in the near future. The anticipation of bitcoin becoming an asset that is worth investing should bring great faith to all crypto investors.

Fidelity Predicts Bitcoin Taking Away Gold Shares

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

Posted Using LeoFinance Beta

!wine

Congratulations, @logicforce You Successfully Shared 0.100 WINE With @mawit07.

You Earned 0.100 WINE As Curation Reward.

You Utilized 1/3 Successful Calls.

Total Purchase : 23198.834 WINE & Last Price : 0.290 HIVE

HURRY UP & GET YOUR SPOT IN WINE INITIAL TOKEN OFFERING -ITO-

WINE Current Market Price : 0.959 HIVE

Thanks.

!wine

Congratulations, @mawit07 You Successfully Shared 0.200 WINE With @logicforce.

You Earned 0.200 WINE As Curation Reward.

You Utilized 2/3 Successful Calls.

Total Purchase : 23198.834 WINE & Last Price : 0.290 HIVE

HURRY UP & GET YOUR SPOT IN WINE INITIAL TOKEN OFFERING -ITO-

WINE Current Market Price : 0.959 HIVE