Interesting Stats - Trading Journal (11.19.20)

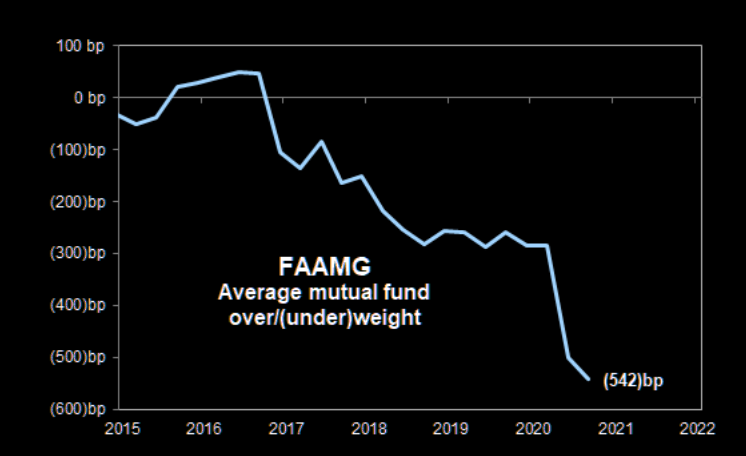

Since the elections FANGM has not really exploded in value when compared to small caps. As a matter of fact small caps IWM officially gained more than Nasdaq this year in the middle of this week. One of the major causes of this rotation is the lack of large institution buying more of FANGM. Mutual funds have been under weight on FANGM significantly over the years but much more in 2020.

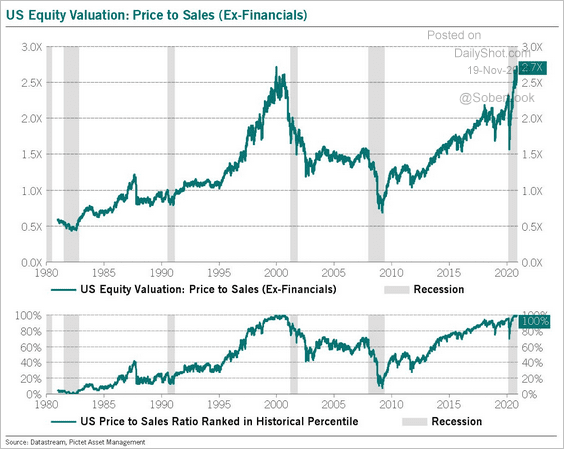

High evaluations may justify stock prices but what about price to sales valuation? Clearly that is at an all time high and last time it reached this level in 2000 the markets later retreated for a better part of 2001-2003.

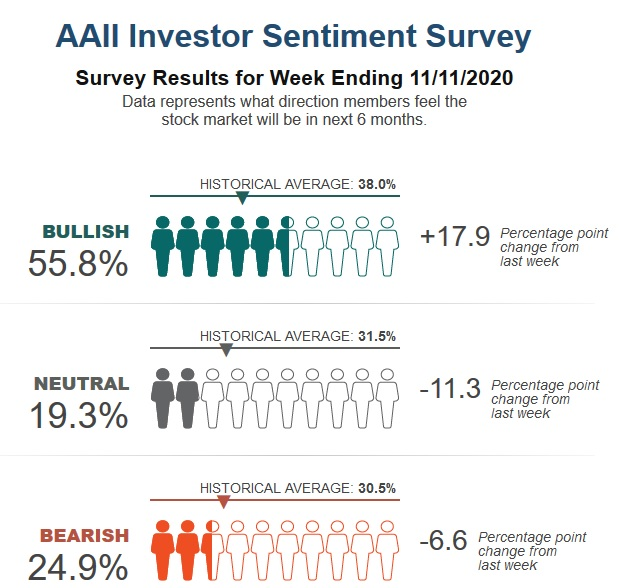

Sentiment in markets are more bullish but one has to wonder how much longer can this remain bullish. Markets at all time highs yet globally countries are still facing a pandemic and shut down. This creating real world job losses.

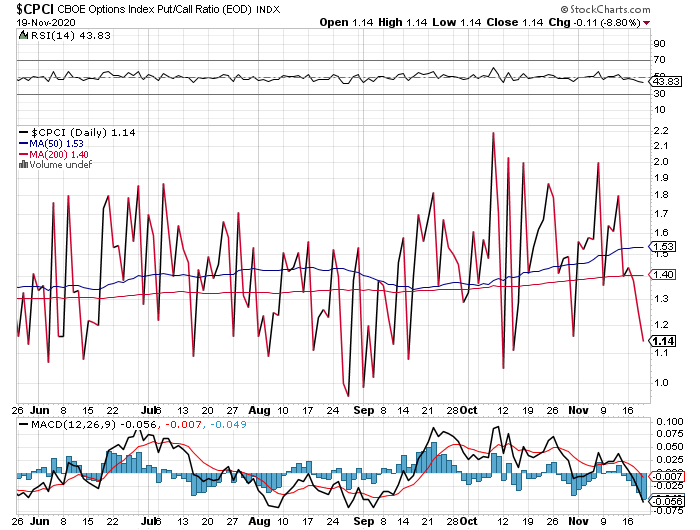

As of today the $CPCI put to call ratio on indexes is near a low of 1.14. This is another sign that market participants are overall bullish in the markets. Contrarian thinking is once all the buying drys up there is a swift drop due to lack of demand. With holidays coming up and end of the year re-balancing it is still in bulls court in control of prices.

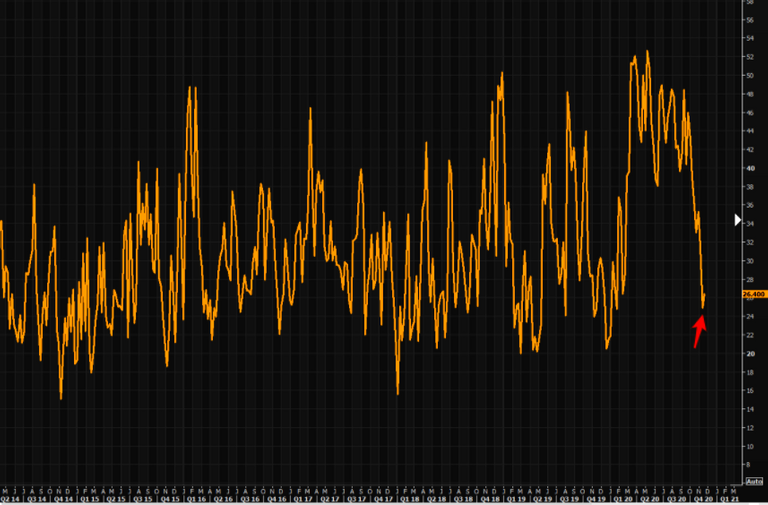

What better reason as to markets at all time highs than the FED balance sheet at all time highs.

Since the Feb/March crash markets have pretty much reap apart bears to the point there are almost none active. Brutal.

Posted Using LeoFinance Beta

https://twitter.com/Bhattg18/status/1329685892261322753