Is Bitcoin about to Moon? - Trading Journal (1.16.21)

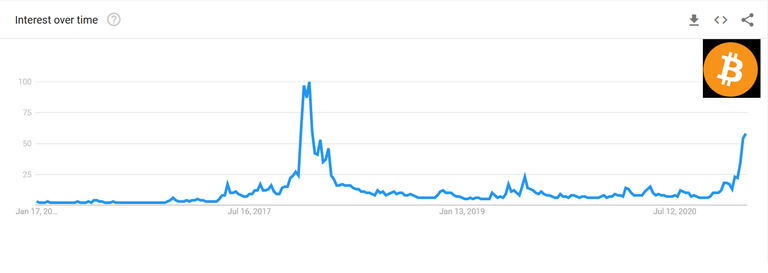

In 2017/18 bitcoin and cryptocurrency interest peaked and chart in front of blog post shows the Google search related to bitcoin. The chart shows exactly when interest peaked and since then no real pickup in interest until 2020. Now as 2021 starts and bitcoin recently reached all time highs before retreating I wonder how much higher or lower bitcoin prices can go?

Interest has not Peak therefore Demand has not Peak

The searches in google for bitcoin is still on the rise and fundamentals still favor bitcoin price appreciation. Bitcoin bull appetite is for real and let me show you a few examples.

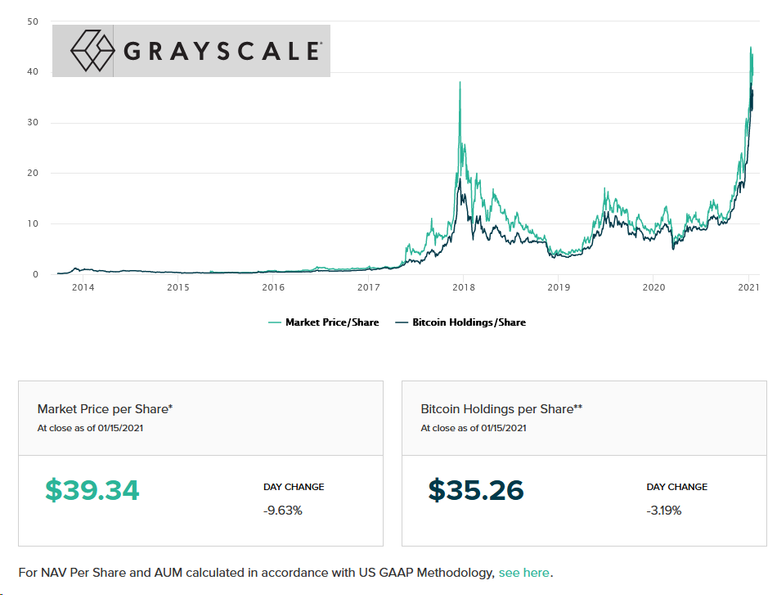

Grayscale for many stock investors interested in bitcoin is one of the current most popular tickers to trade. Grayscale is a exchange trade fund that holds bitcoin as a direct asset. The current market price per a share is $35.26 as of close on Friday, but the amount of bitcoin per share is currently 0.00094934.

What this shows is people are willing to pay a premium to own bitcoin. Demand for bitcoin from investors is there.

Another example is MicroStrategy's CEO Michael Saylor who has been publicly bullish on bitcoin. The ticker symbol MSTR for Microstrategy has also been going parabolic and demand in it has even reached institutions.

Morgan Stanley buying MicroStrategy shares

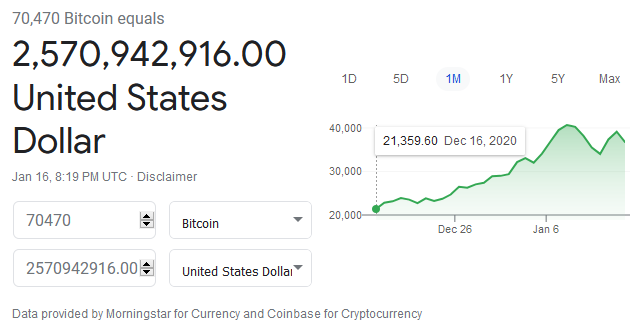

Latest public record indicates MSTR hold 70,470 bitcoins. That equates a little over $2.57 billion

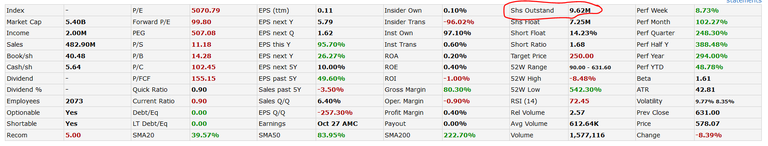

The stock ticker has a little more than 9.62 million outstanding shares. Base bitcoins per shares alone it equates 0.00731776 bitcoin per share.

That comes out to be $269/share for MSTR if just including bitcoin. Yet the public traded price is $578. That is more than twice the value of the what bitcoin is worth for a share.

Other tickers are in even bigger margins such as RIOT and MARA. If real public demand in ticker symbols have yet to peak and people are willing to pay more to own bitcoin right now.

This does not even take into consideration traders in cryptocurrency exchanges alone. Talk about the hot demand out there right now.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HIveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto related and how to make financial gains in crypto!

Posted Using LeoFinance Beta

Your current Rank (49) in the battle Arena of Holybread has granted you an Upvote of 18%

Nice post, yeah using myself as an example...one willing to overpay, I own MSTR, GBTC and MARA...just enough to know what's going on with these companies.

Posted Using LeoFinance Beta