Markets Were Red for the Week! - Trading Journal (2.26.21)

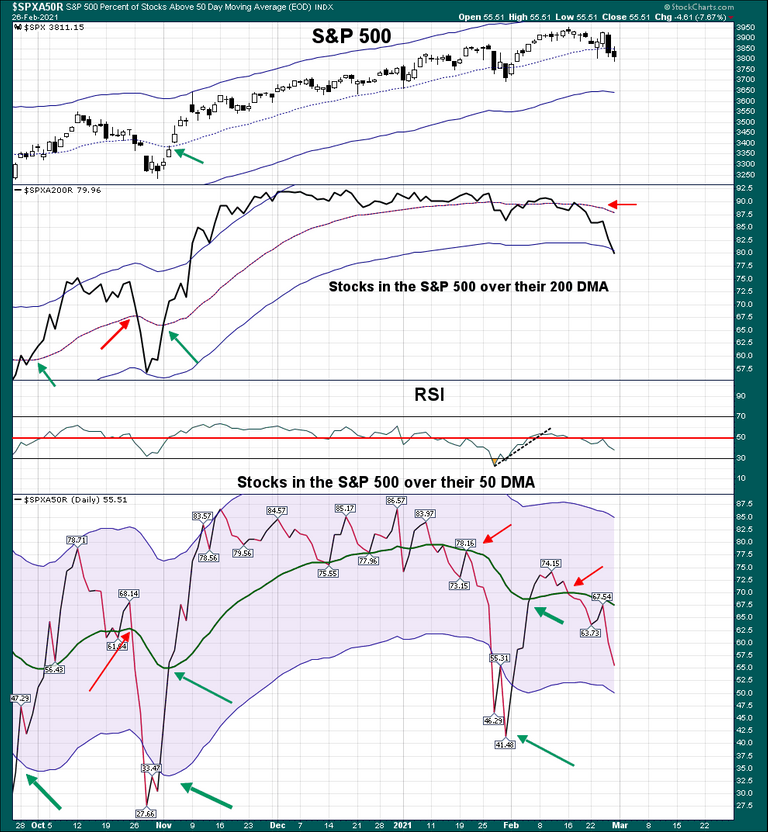

The signs of a crack in the current uptrend was seen this week.

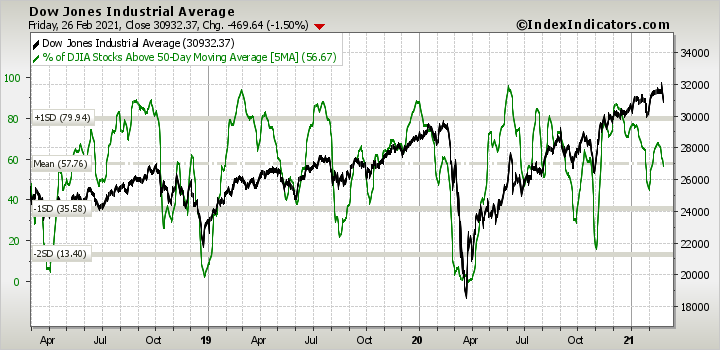

Stocks in general trended down this week as breath weaken.

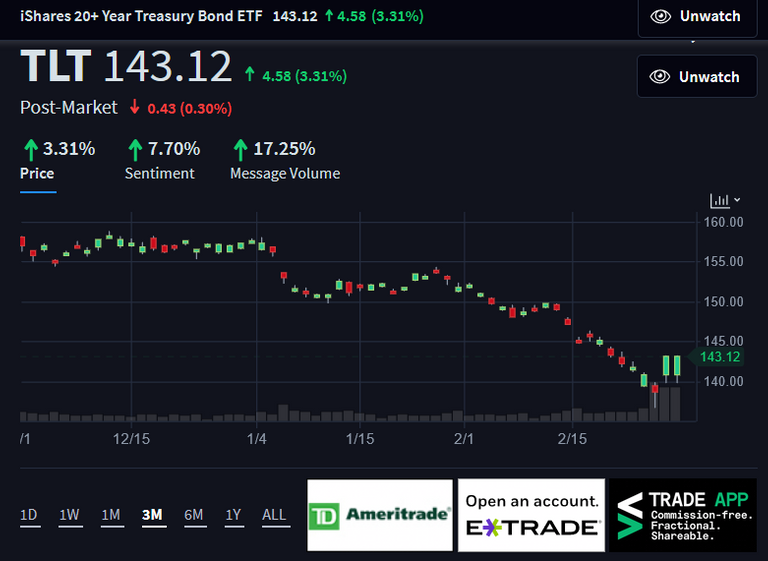

The culprit for the recent market draw down? Some are pointing to the bond rout. Long term bonds were sold off further during the week but end higher on Friday. Many are saying since the bonds are selling off and rates are rising there is now concern of inflation. The inflation in which will cause the FED to slow or stop stimulus and raise federal funds rate.

It appear on Thursday bonds had capitulated when it sold off on high volume but bounced off its lows. TLT which corresponds to 20yr bonds bounced off on Friday with a sizable daily gain of over 3%.

Whether the markets have more to fall remains to be seen but there were multiple signs that a draw down was close.

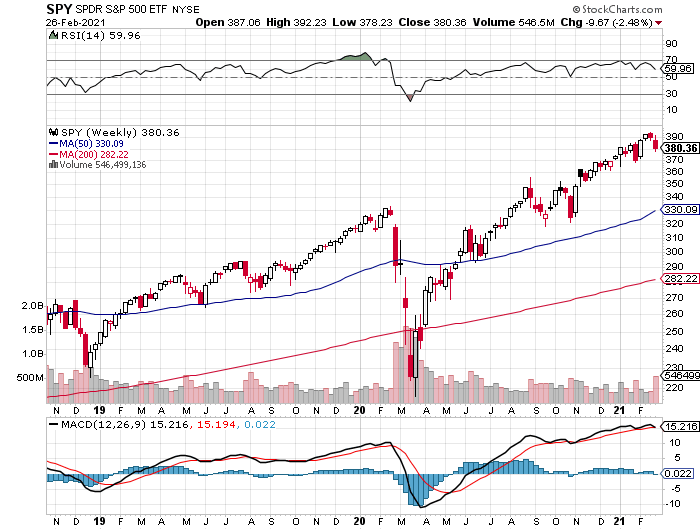

Just from a daily SPY chart one could see the long candle wicks over the past few trading sessions.

The weekly show an even clearer turn from the uptrend.

Now to confirm if further drop will occur look no further than market breath. Market breath is deteriorating as less and less stocks are above their 50MA and 200MA while SPY price continue to rise.

Another noticeable data was Wednesday rally was swift but no strong breath showing across the board buying. This meant more likelihood or a short covering and only be a relief rally. It played out just as such as both Thursday and Friday the SPY and other major indexes struggle to stay green.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

Posted Using LeoFinance Beta

!wine

Congratulations, @logicforce You Successfully Shared 0.300 WINE With @mawit07.

You Earned 0.300 WINE As Curation Reward.

You Utilized 3/3 Successful Calls.

Total Purchase : 20548.377 WINE & Last Price : 0.290 HIVE

HURRY UP & GET YOUR SPOT IN WINE INITIAL TOKEN OFFERING -ITO-

WINE Current Market Price : 1.200 HIVE

prediction and analysis is quite good, thank you for informing it here

Yay! 🤗

Your post has been boosted with Ecency Points.

Continue earning Points just by using https://ecency.com, every action is rewarded (being online, posting, commenting, reblog, vote and more).

Support Ecency, check our proposal:

Ecency: https://ecency.com/proposals/141

Hivesigner: Vote for Proposal

I hear in March, there will be huge changes due to people receiving some sort of compensation/money from government, do you know anything about that? Or if it will affect markets?

Yes every tax payer gets $1400 to spend on what ever they choose and that money is not taxed. Last year about the same time they gave $500 per tax payer and we all saw how stock markets went in 2020. Now almost three times more and if we include the $600 that was initially given its $2000 total this year compare to $500 last year. The end goal is to create inflation and when there is inflation markets will go up. All a numbers game. Trouble though is all bubbles will sooner or later pop. Looking ahead there is less chance that 2022 and years ahead we will get more stimulus and stock markets are forward looking. So my gut feeling is markets continue to ramp up but before the end of 2021 it will have a pullback because it will have to adjust for lack of or less of stimulus in the years ahead.

What it means for crypto? I hope some of these money will go to crypto market 😊

I feel they go hand and hand, and since crypto has not had a massive draw down like -40% or more it should be a safe bet that some of that money will go into crypto. I am bullish in crypto as well and do not bother me if we get a big draw down. I would be buying more if that was the case. Long term believer in bitcoin and several altcoins such as Hive.