Trouble ahead for the Markets? - Trading Journal (11.12.20)

In January when news started spreading about the virus spreading in China the vast majority of the world was still running as usual. That included the stock markets. Within weeks by February US stock markets turned downward and had one of the fastest bear markets in history. It only mean reverted and became the fastest bull market in history.

As where the SPY stands today, closing above 352 it has come of its recent highs of 370 just this past Monday. The speed that it got to this is somewhat remarkable from its up move on Monday and current drift down since. What will be important to note is where the markets be heading tomorrow and next week.

Fill those Gaps?

SPY had multiple gap ups last week and even on Monday's meteoric rise. The current drop from Monday's highs have filled last Friday's gap up. Trouble is the bounce that occurred yesterday was sold off today so SPY is back inside the gap range.

From where it is to 350 it is still within a range and consolidating. Either time has to catch up with the MAs or price will fall further. My opinion is the later due in part that markets have been moving up significantly since the start of November.

There are multiple gaps that will need to be filled in as volume is minimal and all gaps eventually get tested. On the flip side there is little to no volume from 357 and above since Monday's gap up was quickly sold off. Any movement back up will be easily for price to continue moving up with little to no resistance.

Caution is warranted though for bulls as VIX has finally started to turn up since its swift decline after the elections. Furthermore bonds have recently bounced of a support level and seemingly strong enough to continue moving upward. The dollar is also firming from a support level.

All signs of risk off in the past couple of sessions is difficult to ignore.

Indexes diverging may be a good thing?

Compare SPY, NDX, and RTY they moves are currently in somewhat different directions. SPY has been holding steady the best, while NDX sold off hard on Monday and is trying to make a support level. Then there is RTY that was strong the first few days of the week and ended today as the worse performer of all three to the down side.

I mention this due in part that the market participation is still active as traders are moving $$$ from one sector to another. However what will be concerning moving forward is if all three sectors sell off together it will likely be a swift and painful fall. Without or very little buyer support the gaps that exists in SPY also in NDX and RTY will likely get tested.

Walls of Worries

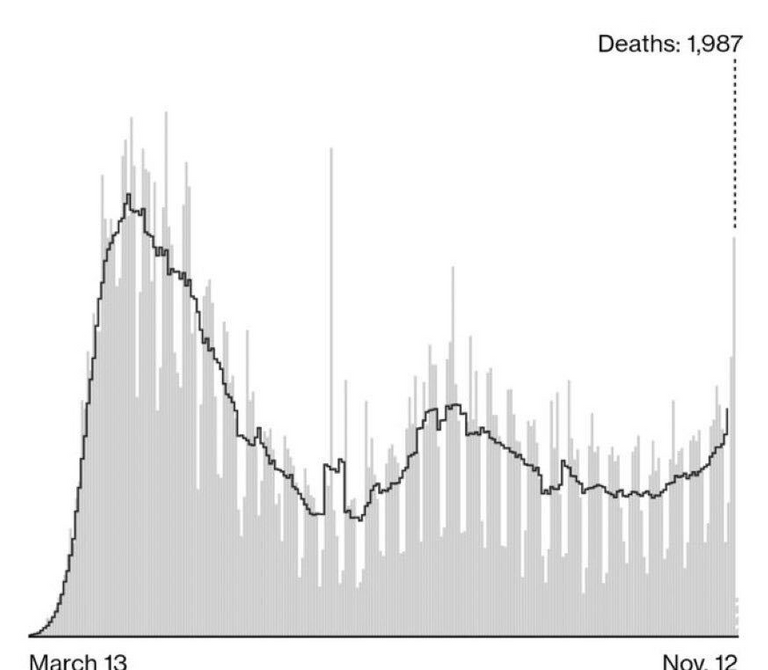

Then there is still the President dispute over the election and unwilling to concede. There is also the current increase in cases of Covid19 that could potentially lead to a second US shutdown. Europe is already facing this scenario and that will definitely not help the economy or the stock market.

Posted Using LeoFinance Beta