Wall Street Vs Main Street - Trading Journal (1.28.21)

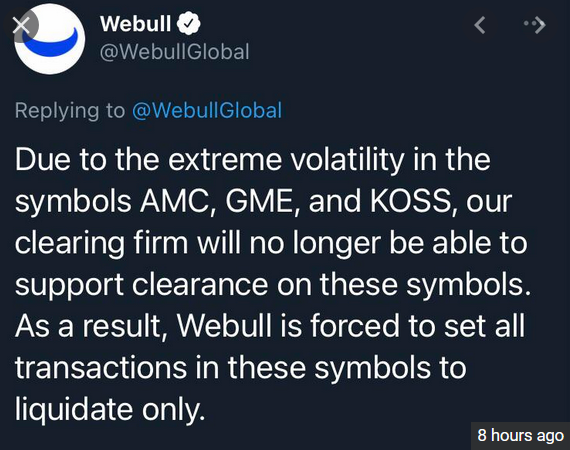

A war may have begun and the battles have already started on the establishment. Today multiple brokerages collaborated together to slow the bid of a few high flyers that have been short squeezing for the past couple of sessions.

When the rules started spreading in the morning prior to stock market opening people especially retail were angry that the brokerage would do such a thing. That is enforce rules that would not allow traders to invest in specific stocks basically because the retail were winning too much. The brokerages themselves were redirecting their reasoning behind the non-tradable stocks on the clearing house. All in all its was a coordinated effort by the government, brokerages, and clearing houses to stall what definitely was a full blown short squeeze on multiple stocks that were short heavy. The players shorting the stocks being squeeze were no other than Wall Street elites that hide behind the familiar name of Hedge Funds. Basically those who were short the stocks, Wall Steet, was being bailed out, while retail were to suffer heavy losses as stocks like Gamestop fell throughout the day due to limited buying allowed.

Now chaos among traders as retail is complaining rightfully so, "Wall Street messes up on a bet and gets bailed out by the government while hurting retail investors. While when retail investors losses on a bet has to suffer the losses." Clearly the rules are changing on Wall Street to stop losses from the elite while hurting retail.

Social platforms such as Discord, Twitter, and Reddit are now being scrutinized for initiating the trades that hurt the elite.

Wall Street is trying to do what they can to stop the retail investors from collaborating and making winning trades. While allow Hedge Funds to merge or come together to stifle retail buyers/sellers. Totally a double standard.

What will happen over the course of the next few days will likely be intense volatility in the markets due mainly on the establishments trying to get a control of what they want in the markets while the retail investors have their own buy list. A unity of retail traders can form a massive buy or sell that effectively changes the markets. If the establishment does not like the change they call it foul and remake the rules. If retail does not like a specific rule or standard change they are pushed aside just like what is happening now.

Multiple battles will wage and they lie in the stock tickers. GME after hours bounce back over $300 while hints of a Silver short squeeze maybe underway as it soared over 10% in one trading session. There is nothing that should stop retail from gaining equal footing when it comes to trading, but the establishment is having none of it. They are stepping up creating new rules to benefit themselves while harming others. As of today it is clear there is "no free market" to invest in.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HIveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

Posted Using LeoFinance Beta