Ways to Profit from a Crypto Crash?

As many have heard last night there was a whale selling a large sum of BTC in the tunes of billions which came somewhat of a blindside to the overall markets hence a major selloff came through out the crypto space. According to Yahoo's news a liquidation of $10 billion in BTC overnight due to fear of government regulation coming soon for crypto was the cause of the crypto draw down.

Whether that is true or not is not the point of this post, this post is to point out the actionable options we have in capitalizing on the current draw down. Look BTC had massive draw downs since inception in 2009.

Straight out of coinmarketcap is a log chart of BTC over the past decade and we can visually see there have been several draw downs from a peak. If history serves as a guide BTC will likely sooner or later make another all time high. Rather than timing the market observe the current draw down as a discount to getting into crypto so here are some ways to profit from the current draw down.

1. Outright Buying

Stating the obvious option here. If you have stable coins or fiat it is not a bad time to invest as BTC has come close to 10% off its all time highs. In stock markets when an asset is trading 20% below its high that is considered a bear market. BTC is literally half way there. Whether it has more room to drop won't matter if you are here for the long haul.

2. Trading between Crypto as Aribtrage

With big movements in prices there will be a point where not all cryptos are align, this is apart of volatility of the markets. If one can time it right they can actually profit from trading in and out of certain cryptos to squeak out some gains.

For example last night about 30 minutes into the BTC draw down I notice news on LeoFinance Discord channel. I immediately went on Hive Engine to see what stable coins I could trade into in hopes of holding up my Hive value as it was also falling as did many other altcoins based on the BTC draw down.

I went and sold my Hive, around ~82 Hives in all for DEC. For those unaware DEC is used in Splinterlands and has a fix value of $0.001 USD per DEC in game. Currently DEC is price lower than that on Hive Engine but since last night when Hive drop it would have been ideal to trade Hive into DEC. Why? The Hive actually value was dropping with the overall market. Hive went from $0.60 to $0.50 within minutes of when BTC started its sell off.

As Hive price was diving I wanted to capture is current value as best I could and bought in DEC at around 0.00167 Hive / DEC. I knew the ratio would have to go up because Hive was losing value. Since DEC is a stable coin it would not drop as quickly as Hive. The end result I sold my DEC at 0.00179 Hive / DEC giving me a difference of 0.00012 Hive / DEC in profits.

The way I had profit from this is trade Hive into DEC and then later back to Hive. This trading lead me to earning more Hive. The idea is to accumulate more crypto while the market prices are moving. This is a great way to invest for those who do not have fiat or do not want to trade outside of the Hive ecosystem. There are other stable coins similar to DEC such as SIM for dCity but since at the time DEC looked the better choice in price I went with DEC. Note there is also USD Tether swap in Hive engine but liquidity still lacks a bit so orders may not go through as well.

3. Post and Curate more on Hive Blockchain

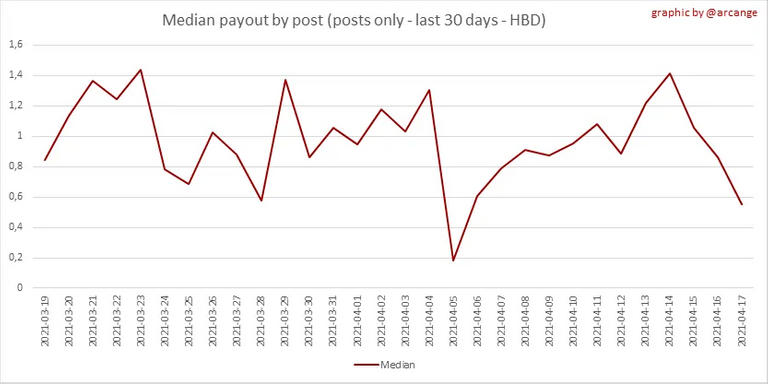

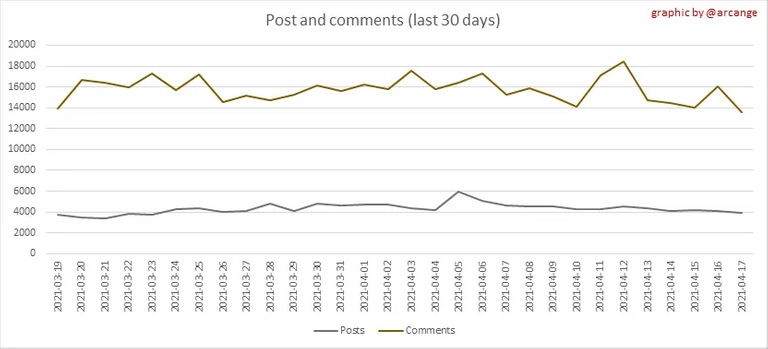

This one may appear to not have much impact on earnings but what I have experience through the years of blogging is that when something is hyped there are more users wanting the pie. As Hive rose over the past few months from less than $0.15USD a Hive up to $0.70USD it became a hot item for bloggers to blog more in hopes of earning more money. Yet with more blog posts there is more competition. The reverse is true too.

With a lower price Hive there tends to be some attention lost from users and the hype for Hive. The less participation will lead to greater share of the upvote pie for those remaining and dedicated to posting daily.

Notice also the higher Hive price is the less rewards on average is paid out therefore less Hives gets into the hands per user. This is likely due to more participants on the blockchain hence more payouts at smaller amounts. The thought here is if Hive prices falls then less demand and participation on the blockchain and in turn higher payouts to those still participating.

Although not exact the trend is clear, lower participation in posts and comments is creating more post payout for users who are still active.

You can get more data info from @arcange posts about daily Hive activities.

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

Posted Using LeoFinance Beta

Do you know how this is done? Are there technical measurers in place to achieve this, or is it 'just' that the same in-game items can be purchased for a fixed fiat amount so it regulates itself?

Its the latter. Just in-game when you spend DEC its equated to $0.001 each.

thanks!

!wine and !LUV

Right back at you !wine and !LUV

Hi @logicforce, you were just shared some LUV thanks to @mawit07. Having at least 5 LUV in your wallet enables you to give up to 3 LUV per day, for free. See the LUV tokens in your wallet at https://hive-engine.com or learn about LUV at https://peakd.com/@luvshares

Hi @mawit07, you were just shared some LUV thanks to @logicforce. Having at least 5 LUV in your wallet enables you to give up to 3 LUV per day, for free. See the LUV tokens in your wallet at https://hive-engine.com or learn about LUV at https://peakd.com/@luvshares