Zombie Companies Will Ruin the Markets? - Trading Journal (02.28.21)

With February over the market indexes have mostly stayed flat for the month. This is after a booming February before the last week massive drop to make it essentially a weak end to the month. A lot of focus has been on bonds that is to blame for the end of the month massive drop. What few are mentioning is what could potentially be the side effects of higher interest rates in bonds.

With higher interest rates it leads to higher interest cost on debt. The global debt recently hit $277 trillion and US has $80 trillion of it. Most people who track government debt is aware there is close to $28 trillion debt from the US government.

The remaining debt is retail and corporate. The focus on this post is the corporate debt as it has a potential shoe to drop on the stock markets. If interest rates rise too quick it will lead to many companies having difficulty to pay off their debt which will hurt their bottom line.

So how concerning is it for worrying about companies that can potentially face default which will likely lead to stock shares going to zero. A term many economists uses for companies that are in-debt and potentially can not pay off their debt are called zombie companies.

Zombie Company

A clear cut definition of a zombie company is a company that can not earn enough to payoff it's debts interest for 3 years or more. Some consider short time period but 3 years is an average. This happens because companies that issue corporate bonds are promising their investors interest on the principle they are borrowing. When the company can not even meet to pay off the interest there is very little chance they can pay back the principle. In addition if they can not pay their debt for several quarters up to years then the companies will have harder time to pay off all their borrowed cost.

This leads to the fact that companies the keep borrowing will only get further in-debt leading to its existing only on the basis that it can still borrow. However if rates are too high and or the dollar becomes scarce then companies that are not making a profit will likely get less to borrow and in turn less money to operate. This potentially will lead to downsizing companies to the point of business closure.

The crucial thing to catch here is if financial assets are unable to sustain on its own then they will likely have to close. One of the major reason many companies that are categorized as zombie companies are a concern is because currently many companies today are unable to pay off their debt.

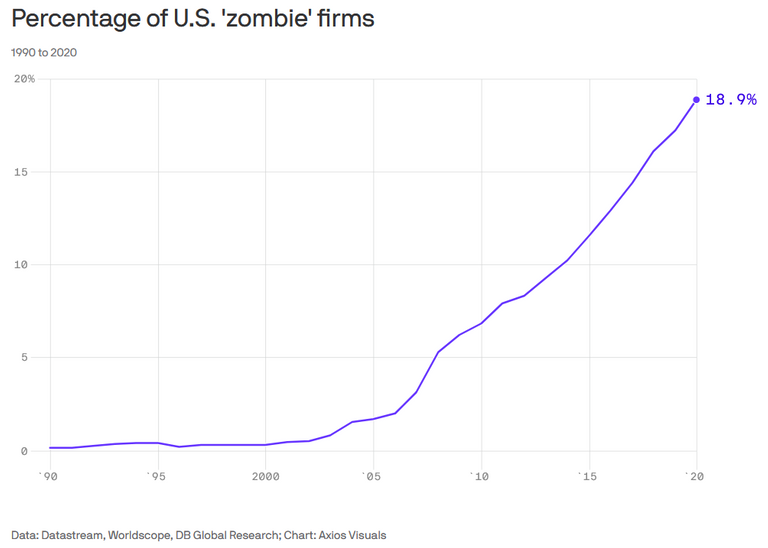

2020 and beyond has increased in zombie companies and there should be concerns moving forward as to how these companies can payoff their debt. The next big shoe to drop can potentially be the fact that many companies will cease to exist if they are unable to pay off their debt and borrow more.

And for those conservative investors of indexes funds such as S&P 500, a far warning, out of top 3000 stocks that are publicly traded, about 600 of those companies are considered zombie companies, that is 20%. Very similar to the chart given earlier of ~18.9% of US companies in trouble. Just imagine if 20% of the S&P companies are repriced to zero how much that would effect the whole market as a whole? Not so conservative of a investment is it anymore?

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

Posted Using LeoFinance Beta

!wine

Congratulations, @logicforce You Successfully Shared 0.300 WINE With @mawit07.

You Earned 0.300 WINE As Curation Reward.

You Utilized 3/3 Successful Calls.

Total Purchase : 21738.785 WINE & Last Price : 0.290 HIVE

HURRY UP & GET YOUR SPOT IN WINE INITIAL TOKEN OFFERING -ITO-

WINE Current Market Price : 0.295 HIVE

I've wondered if the huge debt burden is the result of hard times or if it is the result of some bizarre accounting theory that favors interest bearing investments to debt investments.

Economists used to talk about a problem called "rent-seeking." Big investors seek to structure the market so that they have a guaranteed profit without having to create wealth.

Regardless of the motivation for taking on debt. Debt seems to turn companies into zombies.

it is miss allocation of money. The FED and world central banks have printed massive amount of cash and lower borrowing rates so that bad businesses can still borrow cheaply. This can not last forever since productivity is falling when too many companies have negative earnings. It comes down to the punch bowl of easy money no longer being effective to prop the economy. Central banks may never dare to remove the punch bowl since stock market and asset prices are held up by its use, but its getting less and less effective as more companies turn into zombie companies.

Yay! 🤗

Your post has been boosted with Ecency Points.

Continue earning Points just by using https://ecency.com, every action is rewarded (being online, posting, commenting, reblog, vote and more).

Support Ecency, check our proposal:

Ecency: https://ecency.com/proposals/141

Hivesigner: Vote for Proposal