How do you know you are prepared to purchase a property?

Purchasing a house is a huge commitment. There is more to house ownership than getting accountable adequate to meet billing deadlines and saving on utilities. Getting a home, in reality, indicates a component of your finances will go into paying a mortgage.

How do you know you are prepared to purchase a property? Is there a certain age, a salary variety, or possibly level of management? The selection of no matter whether or not you are prepared for this crucial buy is up to you, but a handful of suggestions can assist point you towards the correct path.

You Have A Steady Earnings And Workable Spending budget

Households and folks, nonetheless living from paycheck to paycheck, may well not be in the most fantastic position to shop for properties. You may well be prepared for the duty of affording a month-to-month mortgage and bills regardless of how considerably you earn if you have a steady supply of Earnings and you know how to manage it.

You Have An Emergency Fund

You might need to place up a security net bank account before developing wealth to afford a down payment. A complete emergency fund implies you can afford to pay your bills and afford your lifestyle for at least six months in case of sudden unemployment or loss of supply of revenue. This fund will preserve you afloat and save you from bankruptcy or foreclosures in case of an economic tragedy.

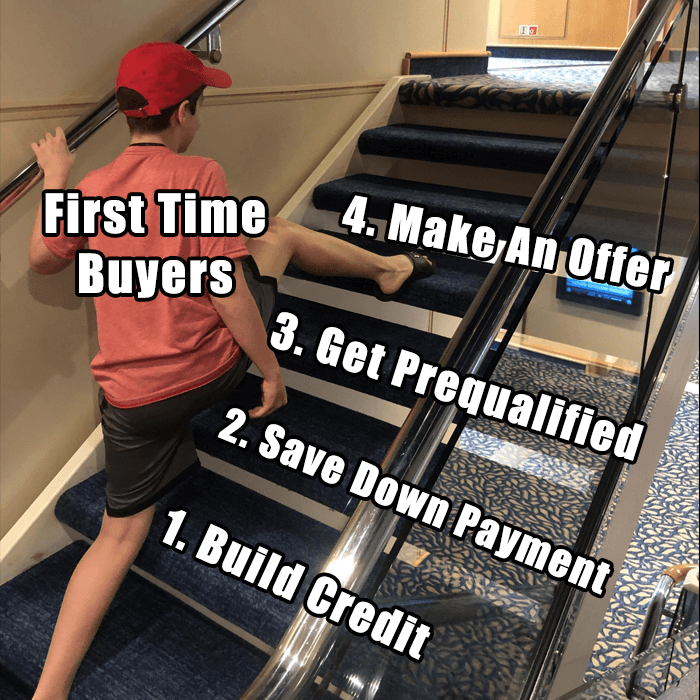

You Have An Excellent Credit Score

You will have to take out a loan to afford a new residence unless you have a far more than sizable debit account. There are numerous home loan businesses ready to give you a loan regardless of your credit score. What you have to aim for is a low-interest price. A mortgage of more than 10% may have you paying significantly a lot more than you are supposed to for your property.

You Have A Down Payment Prepared

This indicates you have the income to pay for 20% or a lot more of the total price upfront. This will be the most significant quantity you will give out in a single buy. The capability to afford a lot more than 20% signifies a lesser mortgage balance to pay. Save up for more than 20% as a down payment when you consider getting a residence if you require to ease your monetary burdens for the subsequent handful of decades. Preserve in thoughts acquiring a house also implies paying for realtor and conveyancing costs.

You Have A Manage On Your Debts

This might be outstanding student loans, car loans, or a basic credit card debt, but you need to manage the payments just before you add mortgages and utilities to the list. Lenders check if your month-to-month house fees will only take a third of your month-to-month gross earnings to pay for. In this way, they can be sure you have much more than sufficient left more than to pay debts and afford other amenities.

The approach of obtaining, deciding on, and getting a house is lengthy and occasionally confusing. Bringing experts to aid you every step of the way can undoubtedly ease your burdens. You can check out internet sites for specialists you can rely on if you uncover oneself in need of a conveyancing expert to transfer title names.

Thank you for reading and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Steem || Read.Cash || Noise.Cash || Uptrennd || Instagram || Twitter || Pinterest

Posted Using LeoFinance Beta

We have a different system over here and don't have credit scores but a deposit, history of regular savings and a permanent job are the main things to have.

Posted Using LeoFinance Beta