Can You Answer These DeFi Questions?

What is the difference between farms and dens

I have read plenty of places that DENS are safer, but why?

Next Question

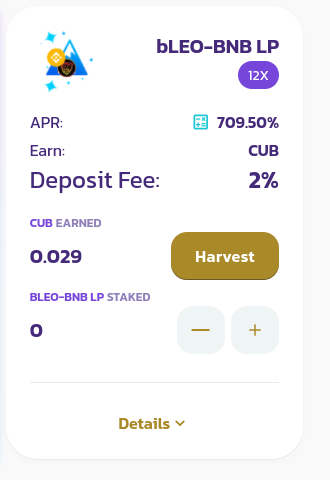

What the heck is going on here?

While I was figuring out how to use my CUB, I ended up making a bunch of transactions I did not need to make.

I opened a Binance Chain Account

I opened a Binance US Account

I transferred HBD out to try to buy BNB (Now I have $18 worth of bitcoin in ionomy and no way to take it out because it costs more to transfer than what I have)

I transferred litcoin into Binance US

I traded litecoin for bitcoin

I finally bought BNB

I somehow wrapped leo into bLEO

Then I finally got my CUB staked and was happy.

But what to do about that bLEO?

I tried to turn it into BLEO-BNB LP STAKED, and did so in two transactions even though I used the "max amount" twice.

Then I staked it.

Then I lost it

And now I can see that I have ZERO BLEO-BNB LP staked, yet it is earning CUB

How I am earning on ZERO BLEO BNB LP?

Is it because I transferred so little in that it shows up as zero?

From the number that is missing from my wallets it seems that I have at least $40 in there.

So please...

- difference between farms and dens

- can you explain my screen shot?

When I started earning crypto it was the most difficult thing to learn for me... ever. Now I can explain it easier than I can explain why the "a" makes so many different sounds in the english language.

I look forward to your answers.

Posted Using LeoFinance Beta

Do you press on + and add the amount?

Posted Using LeoFinance Beta

The other comments here explained it really well. The amount of bleo bnb I HODL is just too small for it to show. It is paying dividends though.

From what I understand, in dens you stake a single token instead of a liquidity pair and still earn CUB as interest, so you won't suffer impermanent loss as you would when providing liquidity.

Re #2: it's not zero. Your provided liquidity is there. You can check it using this tool https://howmuchismylp.com/

Use MasterChef Address: "0x227e79C83065edB8B954848c46ca50b96CB33E16"

Hope it helps. I'd let the experts explain deeper. 😊

-@arrliinn

Posted Using LeoFinance Beta

!ENGAGE 20

Posted Using LeoFinance Beta

ENGAGEtokens.Thank you. This was a very helpful comment.

You haven't lost your BLEO-BNB LP.

https://leofinance.io/@swelker101/optimize-your-cub-farming-staking

Please read this post and see how you can check your staking details.

Posted Using LeoFinance Beta

Thank you for the tip. I'll be sure to check that out.

Posted Using LeoFinance Beta

I also suggest you to read edicted's posts as he has some good descriptions of things.

Posted Using LeoFinance Beta

I have read a lot of his posts, but its a whole lot of information coming at the same time from a lot of different places.

Hi definitely are my favorite. Though one of the recent posts today that "explained math" just kind of bounced off my head.

Posted Using LeoFinance Beta

Oh dear. That description sounds like the inside of my head. 😂

You get an A+ for perseverance!

I stuck with just putting my cub in a Den, with help. The whole pooling thing was too much for me since it involves tokens I don't already have. Whereas putting Cub in the Den just involves earning "interest" on the Cub. As far as I understand it anyway.

Posted Using LeoFinance Beta

Yes. That much I understand too.

I give myself an A+ for perseverance too.

It took me five years to figure out how to buy bitcoin and when I finally did I could not believe it had been so easy all along.

Posted Using LeoFinance Beta

It probably wasn't as easy when you first started looking though. I remember trying to buy BTC in order to be able to buy Steem, back in 2018. It was really complicated starting with GB pounds.

Things are a lot easier nowadays thank goodness. At least as far as buying BTC is concerned. 😊

Posted Using LeoFinance Beta

I am having so much fun learning more about crypto and applying the concepts.

Posted Using LeoFinance Beta

Farms are for liquidity providers so you provide a pair and and in return you get LP tokens which you stake to reward you for providing the pair that will suffer from impermanent loss as people trade between pairs

Dens are just straight up staking so you drop in tokens so the app has liquidity for trades same same but different

You just spoke a different kind of english and I don't understand what that means ... yet.

Posted Using LeoFinance Beta

@urun wrote this good explanation on "impermanent loss" that covers why staking in a Den is lower-risk than Farming: https://leofinance.io/@urun/impermanent-loss-on-defi

To the second question: Yes, you've just got "too small" a fraction of a token staked. If you click the

-sign, like you were going to withdraw, you'll see your fractional token represented there!Hope this helps, and that you've been enjoying the approaching spring!

!BEER

!WINE

!LUV 1

Congratulations, @emsenn0 You Successfully Shared 0.100 WINE With @metzli.

You Earned 0.100 WINE As Curation Reward.

You Utilized 1/1 Successful Calls.

Total Purchase : 24376.125 WINE & Last Price : 0.290 HIVE

HURRY UP & GET YOUR SPOT IN WINE INITIAL TOKEN OFFERING -ITO-

WINE Current Market Price : 0.290 HIVE

Thank you! I will be following that link.

Posted Using LeoFinance Beta

Sorry, out of BEER, please retry later...