Cleaning Up My Credit Report, One Mistake at a Time

A couple of months ago, I wrote about starting a credit repair journey. I was really serious about it. I bought myself a Udemy Course, and imagined myself having stellar credit while also helping everyone around me fix their credit as well.

It turns out that the Udemy Course was just what I needed. It gave me a lot of information I already knew, but it was good to hear it from someone who has been working on learning the credit system for years, instead of "I have heard that..."

It also helped me solidify a strategy, and recognize that a "Credit Repair Business" is not the thing for me.

My first step, was running my credit

Misinformation I had before, told me that running my credit myself would lower my score. I learned that it does not (or should not).

I also learned that: www.annualcreditreport.com is the place to run your own credit. It is the only site authorized by federal law.

Here in the US there is a whole business model aimed at "helping" people with their credit. There are commercials on TV with ukuleles and jingles, all in an attempt to earn your "credit safety" business.

It turns out that those programs are mostly unnecessary as you can do the same things you pay them to do for free.

I tried to run my credit on all three bureaus, but failed.

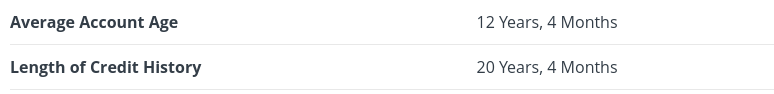

wow! look how long i've been a minion for!

Each individual bureau asks you personal questions to make sure that it is you running your credit and not some rando who is trying to steal your identity.

I was only able to pass the test for 2 of the 3 bureaus, TransUnion and Experian.

Apparently Equifax didn't believe that I am me...

In order to get the equifax report, I have to print a special form and send it in with a copy of my drivers license and social security card.

That is likely not going to happen anytime soon, so I will working with the other two reports.

I found that my reports have a whole lot of phone numbers and addresses for me

The bureaus have a "secret formula" for generating a credit score for you, and one of the things that might affect your credit is having too many addresses and phone numbers.

The rational behind this is that if you move around a lot and change your phone number a lot, then you must not be a very constant or reliable person.

I went ahead and disputed phone numbers and addresses off my report. Many of the phone numbers were vague memories, and some of them were for family members (I was somehow linked to my mom and my sister's phone number.

I also disputed any addresses where I didn't live for more the a few months, especially because some of those were over 15 years old. Since I always had a "permanent residence" with my parents, it was easy to dispute those.

I also disputed all of the incorrect addresses, and typos on my name.

My score went up by 8 points!

Now, it is nearly impossible to guarantee that my score went up because of removing addresses, but what other change happened in those other 48 hours? None that I can see.

The next thing I did was look at my collections

I found an embarrassing one from Kohl's Department Stores.

Some years back, I was working on my credit (hey, it is a journey not a destination) and someone suggested I get a credit card to use and show that I can make payments on time.

I got myself a Kohl's card and bought myself a nice maternity dress.

Then I went into labor, and forgot all about the dress, and the card.

Months later, the less than $50 dollar dress had late fees and interest rates attached to it. The minimum payment which was supposed to be $6 per month full of credit help, was now out of control.

The account has now ballooned up to $490 USD and has been charged off.

I was ready to pay for my past mistake, but it turns out I don't have to.

Next month it will have been SEVEN YEARS since I started that nonsense, and the collection, according to transunion will fall of my report on March of 2021.

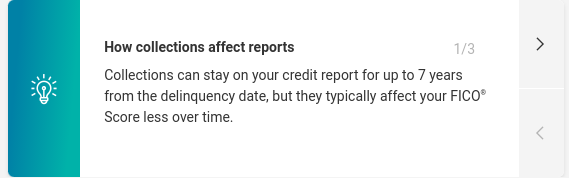

Collections are not so bad on your credit

Especially if they are old. That's what the website says anyway.

If the collections are small, no big deal.

The older they are, the better.

I have two other collections on my account, and I don't know where they came from...

I disputed them as well and am waiting for the results.

It seems like most of my "bad" credit comes from student loan debts

Seems like these should fall of soon enough anyway, but I am still actively trying to get them removed.

There are many, many times that I missed payments from 2012 - 2016. Some of those have fallen off, but some remain.

Since I have been paying on time for YEARS now, I will be contacting the companies and seeing if they will remove some of the older information.

If they don't it will just be a matter of time before my score starts going up on its own.

Overall, the process is pretty easy

Turns out that improving my credit simply means keeping paying my bills, and logging on to press the "dispute" button every once in a while.

Cheers to 720+ credit scores

Wish me luck.

How does your score look?

Posted Using LeoFinance Beta

Oh always so weird when people talk about credit score, we don't have a system like that over here, or atleast not a visible one. Banks and companies can take a credit check on me but then they will only see my yearly income and if I have any non-paid billed on my name

Posted Using LeoFinance Beta

I learned that the credit system can be a type of mafia a long time ago - so I gave up. And then tried again. And then gave up again.

It’s inevitable though, they run the game and I’m gonna play.

Posted Using LeoFinance Beta

Oh this was very intresting. I am a swedish contentwriter and write almost only about loan and investment. A lot about credit score of course. But is looks like in US you are miles and miles away from our credit system.

Sure we have a creditscore but it is not depend on so many things. And if you have paid back a loan the score "forget it" some years later. Never heard about business helping people to get better score...

intresting but also a little bit scary. Like - you need a company or course to tell you have to make better score. That sounds not so userfriendly way.

Thanks for sharing

Lol, I'm joining @anderssinho, we don't have a credit score as my county doesn't have that credit culture. People try to stay credit free as much as possible and only apply for a credit if it's a must, mostly to buy a property or a car. But we don't collect them.

Banks and financial institutions offering loans most likely have a credit score system, based on which you are evaluated but that's not publicly known, it's an internal system for them.

Posted Using LeoFinance Beta

@erikah yes excatly like here. Only thing people in general think it's acceptable to loan money for is house, renovation and maybe, just maybe for a car.

Posted Using LeoFinance Beta

For me this is a healthy thinking. Encouraging people to spend in advance is not always good. And I'm going to be contradicted on this by those living in a highly credited world :)

Posted Using LeoFinance Beta

@anderssinho @erikah

It's way more complex than that. It's like telling someone to eat healthy when that someone lives in a food desert.

Credit card debt today is not like the debt of the 80's. Today's debt comes from medical bills, malicious credit card companies who confuse their clients with "zero percent interest rates", companies that require a credit card on file to obtain service, and other traps.

I bought a $32 dollar dress in a credit card in 2012 - before that I hadn't used credit cards since 2003 - many people are just like me and somehow still in debt. How? It's the design.

Obviously something is not right if you don't use your credit and still paying.

Posted Using LeoFinance Beta

Yes, me :)

Credit can be real good for leveraging and growing. Depending on what it is used for. Opening a franchise chain, that is from day 1 profitable, can be done with a creditor buying a flat to rent and have a decent cashflow after interests and taxes is also a good credit.

Buying a TV on credit is definitely a bad thing to do.

Posted Using LeoFinance Beta

I agree but we were referring to buying personal items.

We specified buying a flat or a house is the exception :)

Posted Using LeoFinance Beta

I go on credit for every mean of production that gives a return, car is leased, but needs to overpay the monthly cost. Anything else, like clothes, electronics are paid in cash and can be sometimes refurbished or second hand.

Posted Using LeoFinance Beta

Congratulations @metzli! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 45000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

I'm having a decent score in Germany of 97 (95+ is very good), which is done by a private company and not the state.

The calculation behind can't be really seen, but the factors are known that influences it. If I move much, I lose points, if I live in a good neighbourhood I win points. A number of bank accounts can drag my score up or down. Open credits, for what the credits are, and the payments for them, all have an influence.

As I'm a foreigner, that lived only for 8 years in Germany and moved 7 times, I get minus points for that.

As I have invested and have good credits, I get plus points. No overdue payment and a good salary is also helping. I want to got to 99, but this will take some years and will need some other stuff in my life, which I can't afford now. :)

Posted Using LeoFinance Beta

I just found a big booger in my report.

I owe more than the original credit limit on a loan. When I get under the original credit limit, my score will jump.

I have a new mini-target.

Posted Using LeoFinance Beta

There you got! Hit that credit score up!

Posted Using LeoFinance Beta