Can Bitcoin surpass the market cap of gold?

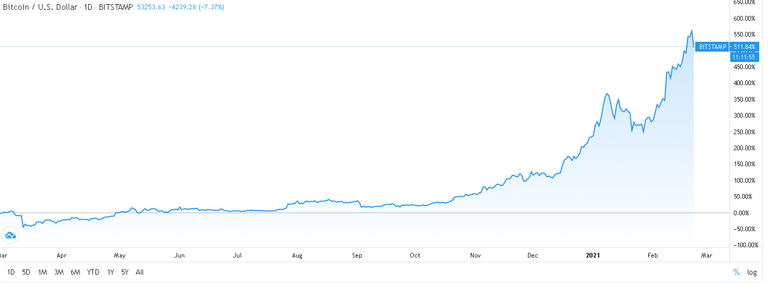

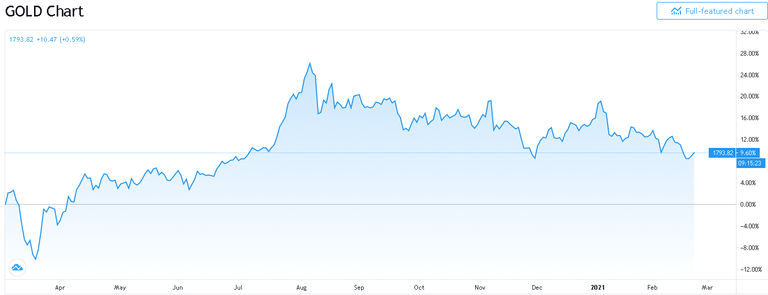

Btc's market cap has exceeded $ 1 trillion and Yesterday, it exceeded the price of 1 kg gold. It seems that this rapid rise of Bitcoin will force the $ 10 trillion market cap of gold, the oldest investment choice in history. Gold lost a lot of value within a year, but Btc gained incredible value.

Some institutional investors and banks made statements supporting cryptocurrencies and announced that they invested in crypto currencies, stimulated the cryptocurrency market upwards. This rise in crypto currencies has attracted the attention of many investors. The fact that Btc exceeded the value of 1 kg of gold and approached the market cap of gold attracted attention.

Gold is estimated to have a market value of $ 10 trillion. Can Bitcoin reach this market cap? It is not known, but it is not impossible for Bitcoin, which was likened to gold at its exit, to reach these values. The reason gold is so valuable is because the supply is predictable.

If we try to make a comparison between bitcoin and gold, we can offer many examples. But I will mention the most remarkable for me. Most importantly, there is a limit in Btc supply, but no limit in gold supply. Btc will be supplied only 21,000,000, I don't think this supply will be enough for everyone, maybe we will not find Btc to invest in a few years later. In addition, the increase in usage area of Btc and its easy purchase and sale is also an important factor. Gold is known all over the world and you can buy and sell it all over the world, it is one of the most reliable investments that has been used for thousands of years.

Btc is very volatile during the day compared to gold. On the one hand, Btc appeared 12 years ago, while Gold is thought to have a history of 4,000 years. Even comparing Btc to Gold in such a short time reveals the importance of cryptocurrencies in the next 10 years. In addition, Btc is not only used as an investment, it is also frequently used in product purchases and sponsorship agreements. Especially during the pandemic period, people switched to digital investments rather than physical investments. You can also transfer and use cryptocurrencies to cards, phones, computers and similar devices.

In short, when you compare cryptocurrencies and gold, there are pros and cons for the two. That's why I would love to have both. It would be great to diversify your investments and have both. But now I prefer cryptocurrencies more. I believe cryptocurrencies will be more valuable in the future.

I never give investment advice, I only guess by following the developments in the world. Sudden losses in value can happen anytime, things can turn around, I believe cryptocurrencies will gain more value in the long run.

Posted Using LeoFinance Beta

https://twitter.com/rtonlinetv/status/1363840091001679874