85,000 STEEM Spending Spree worth over $14,000 - Let's GO!!

Hello and welcome to this SPinvest post

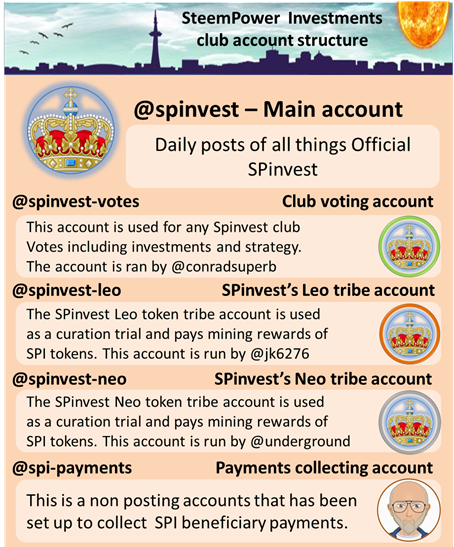

SPinvest is a tokenized investment fund/club for all users of social blockchains. Everyone is welcome! The concept of SPinvest is to get rich slowly by using time tested methods of earning, saving and compounding long term. This lets SPinvest offer an ROI of 20% per year on SPI tokens. We encourage long term investing on and off the blockchain. We hope someday everyone will HODL some SPI tokens that can be bought directly from @spinvest are through the steem-engine are dex.steemleo exchanges.

.

The past few weeks have been hard, they have been hard for everyone from the average user to project admins. So much change happening and keeping up is hard as things on HIVE look to be moving fast. Even on lockdown, i can't keep up with everything being released. It's certainly a very stressful time but their is a silver lining in all this. We have 84,000 STEEM to spend.

Let's prepare a spending spree

I think its time we started to plan what we are going to do with all this fabulous STEEM that'll soon be worthless are at least valued in the single cents. The same STEEM many of us have been blog grinding for years to get. Funny how things turn out? Anyways, we're needing rid of the rubbish and we need a plan. Below is 2 examples of stuff we could do. Please remember that my examples are based on thinking about STEEM as an off-platform investment. As we only invest in the time tested investments that will give us small consistent returns, STEEM is not our cup of tea. And neither is HIVE as it's only 10 days old. But at the end of the day, it's not up to me.

Now, let's have a look at how can spend $13,300 of STEEM (at today's prices). The examples below are all simple and require no work after the set up is done. Here are a few key points you should know.

- First power down payment expected on 6th of April

- Each power down will pay us roughly 6,538 for 13 weeks

- 25 SP will remain on each SPinvest account so it's always useable

Example one - Compound Tether

Saving Power downs to a lump sum

This is nice and simple, each week when the power down is paid out, we sent it to binance, convert it to tether and send it to celsius to earn 8-12% interest. Do this for 13 weeks until all STEEM is powered down and then either leave it there to earn a simple passive income are split it into different investments. I like this option because we can collect our power down while earning a little interest with minimal risk to our funds. After the power down is complete, we will know exactly how much we got and it would be easier to split into more equal parts. Maybe 20% gold, 20% bitcoin, 20% stocks, 20% tether and 20% wild card off the top of my head.

We could also do this with Bitcoin but it's not very stable and the SPI token price would basically become 50% backed by bitcoin which means the SPI tokens value runs a very high risk of dropping under a 1 HIVE value and the token price certainly would not grow slowly and consistently.

Example 2 - Spend it as we get it

This one requires a little work, a weekly voting post. So each power down is 6500 STEEM, we have a weekly vote to pick investment for our 6500 that week. Im not sure how this would play out, we might end up with a bunch of crap investments and overpay on fees. But then again if the markets have another tumble we can get in on some investments on a good spot.

Get the juices flowing

I like the tether idea but i want to get the ball rolling and making members aware that we are gonna have to have some sort of plan in place before the 6th of April. Get on your thinking cap

Have you any ideas?

If you are a club member and have an idea, please share it below. A few things to be considered when thinking up ideas. We want to go with time tested investments, safe, small yeilding consistent payments. Get rich slow, not from an ICO. Please think about investments that will increase over time based on interest payments and not market-driven are provides a good hedge against fiat cash. Investments should be easy to set up, maintain and cash out. It's fun picking 13 differents investments but tracking them might be a pain for me and cashing them all out might take some time and cost lots of fees.

Remember that STEEM represents over 40% of SPinvest's total fund so when thinking about an investment(s), we need to think stable because this will help to maintain a slow SPI token price increase over time. We only need to finish the race, not come 1st. 1, Bitcoin can go up 500% in a few months and drop 85% the next few. 2, We can plod along and compound 20% down every year. I like option 2.

Show support to SteemPower Investments through it's Patreon Page

Click here to join the SPinvest community over at beta.steemit.com (Steemit Communities)

.

The interest rate on Celsius, isn´t this kind of risky too? How reliable is this company? Are the funds safe there? Bitcoin is volatile but eventually it is doomed to go up again, isn´t it? Since we are long term investors I would use at least a part of the weekly Steem for a BTC weekly buy plan, using any dips as a welcome opportunity.

I think tether would be safe for 13 weeks and the way I see it if tether falls so does Bitcoin as the 2 are closely linked in movements as when tether prints another billion's worth of tokens, Bitcoin goes on a bull run and vice versa.

Really just trying to figure out if club members wonna spend it as we get it on different investments are do we wonna save it all in on place until the power down is finished and then decide what to do with the total amount we have.

Thanks for your feedback man.

Thanks, my concern is rather for that celsius wallet. Offering 8%+ for nothing is bit fishy. From where do they gain their income?

Oh, they are a lender and it's interest from loans. They give out loans to people for around 70% of your their deposited collateral.

What about buying Dai instead of Tether? For exp using good DeFi apps like using Compound the interest rate is 2.56%.

They are more decentralized and more noncustodial(not 100% b/c of the DAO but it pretty close) and they have pretty high interest rates paying.

We could earn more than 2.5% from a high street bank.

I think Celsius is a central company. We can use another but the interest rate would have to be at least 6%, at the very least 6%.

True we could also use BlockFi but just wanted to point out that using them are pretty risky. Tether itself can collapse anytime as well as Celsius/BlockFi can be hacked or lose all of its money.

Probably why it has such a high interest rate...