Are Stock/token buy backs a good thing? IBM spends $140B buying back stock and has a market cap of $105B

Hello and welcome to this SPinvest post

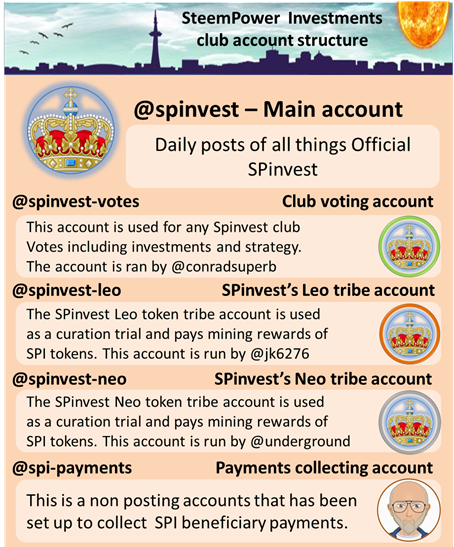

SPinvest is a tokenized investment fund/club for all users of social blockchains. Everyone is welcome! The concept of SPinvest is to get rich slowly by using time tested methods of earning, saving and compounding long term. This lets SPinvest offer an ROI of 20% per year on SPI tokens. We encourage long term investing on and off the blockchain. We hope someday everyone will HODL some SPI tokens that can be bought directly from @spinvest are through the steem-engine are dex.steemleo exchanges.

.

Are stock/token buybacks a good thing?

Over the past few decades, companies and corporations have been buying back their own stocks in recent amounts. We see that this practice happens a lot within cryptocurrency but why?

Share/stock buy back's have been getting a lot of criticism and rightly so based on the findings ever the past few months. Many of these companies have opted for short term gains instead of long term planning. As airlines and many other corporate giants fail due to their own recklessness, the hands are out and many are asking for government bailouts to get them through the Covid-19 pandemic.

The goal of the companies are a crypto token that is buying back it's own stock/tokens is to create scarcity within the circulating supply and increase demand with should, in turn, increase the price. Buying back stock/tokens and burning stock/tokens are different things but the results are 99% the same. Problem is, the shares/stock still exists so their is no value being added to circulating supply, there's just less of it which might cause very temporary scarcity but has no long term effect of the stock price.

IBM is one of the worst offenders for buying back its own stock over the past 20 years and it's a losing strategy that has not helped it's market cap at all. For the record, IBM has spent $140 billion over the past 20 years buying back its own stock but today, it carries a market cap of $105 billion. With the current pandemic in full swing and all markets getting crushed, savvy investors are starting to see through the smoke and questioning the strange practice of buying buy shares. Word on the street is that regulations could be put into place to prevent companies from buying back stocks.

As it stands

The US financial markets have rebounded back faster than soon predicted with stocks like Telsa jumping over 130% since the crash last month. This is evidence that financial markets do not represent the true state of the economy and runs more in line with the fed's balance sheet. With more company earnings reports expected over the coming weeks, this might change but i would not hold my breath.

Any sort of economic recovery will not truly become before 2021 but i think people will be very wary about how they spend their money for longer than this. In a deflationary crisis with no consumer demand, those companies that saved and made long term plans will be the winners of this pandemic. Those that spend all there buying back their own shares are now the ones asking for help. Given the current state of things and with more people waking to the shitshow that is planet earth, i hope governments can see bailouts do not help. These companies are busto because they are run poorly.

Just to add the crypto buybacks

Crypto's companies, in general, will buy back tokens to burn them and not hold them. This on paper does sound appealing, its always nice to see that Binance are even Leo making some posts to say they have burnt off 1-2% of total supply but is it worth it? Is there enough demand on crypto's that removing 1-2% from circulating supply makes a difference? I don't think so. When i see a some crypto company spending a few million dollars to burn off tokens, i always think what a waste of money. That money could be better used to increase the value of that company instead increasing the token price for a few days. There no real value to burning tokens as tokens are priced on a speculative market, lol. It's a complete drain on money, and the whole thing makes no sense but people think its good. It good for the CEO's of those companies that seem to cash out personal holding during these price pumps/buy back times. Weird that.

SPinvest will do buybacks from time to time but SPI tokens are 100% backed by real-world assets that have a real-world dollar value so put that in your pipe and smoke it Wallstreet. Get it round ya!!

Show support to SteemPower Investments through it's Patreon Page

Click here to join the SPinvest community over at beta.steemit.com (Steemit Communities)

.

Fully agree!