How many BTC's move around each day

Hello SPIer's, today I have been thinking mostly about BTC Bull and Bears and what amount of BTC is being used to drive the price up or down. How can a small group of people have such an impact on the price of an investment? I will be using Bitcoin as an example but every market class has its bull markets and bear markets whether that be crypto, stocks, bonds, interest rates, world currencies, PM's etc, etc.

Why Bulls and Bears?

Both very strong animals that attack their opponents in different ways. Bulls will charge and thrust their horns into the air while a bear will move slowly and down low.

Bears are called so because of an old story from back when people traded bearskins. They would sell something at one price before they bought it themselves hoping to buy it at a later date for less. This is basically shorting the market, in today's world these bear(skinners) borrow BTC and sell it to the open market in the hope the price will drop in the future allowing them to buy the BTC required to fulfil the original transaction while profiting from the spread. Bears profit when the price goes down.

Bulls are much easier to explain. Bulls invest with the hopes the price will increase. Bulls profit when the price goes up.

Hence bulls for up and bears for down

How many Bitcoin really circulating?

We all know that there can only ever be 21 million BTC ever minted. Miners have mined roughly 18.4 million so far with 2.6 million more to issued into circulation. Let's look and see if we can get a rough number of how many BTC is being used to either drive the price either up or down.

Total in Circulation of 18.6 million

- minus Satoshi's wallet of 1.1 million BTC

- Dead wallets due to forgotten passwords, broken hardware, sending to the wrong address, BTC burn address's or dying. Glassnode predicts 3.7 million BTC lost forever

- Roughly 9.13 million have not moved in over 1 year. After we take away the 3.7 million from above, we can guess that 5.43 million belong to HOLDer's that are not active in the market.

- Exchanges hot/cold wallets contain about 2.3 million BTC

When we take these numbers away from the circulating supply, we are left with 6.07 million bitcoin. This 6.07 million BTC are inside active wallets such as your exchange wallets, offline wallets, any defi you are involved with, etc.

Just over 6 million BTC circulating in the past year excluding exchange hot/cold wallets.

How many BTC moves around every day?

Many how of these 6 million BTC or used for trading? Im no scientist but I can see BTC daily volume for the past 24 hours is $61 billion and each BTC costs $58k, so daily volume is just over 1 million BTC. This does not mean that 1 million BTC were traded, it could have been 100,000 BTC traded 10 times over or 500,00 BTC traded twice. If you sell 1 BTC for $58,000 and buy it back 2 minutes later at $57.999, you'll have made $1 and created $155,999 in volume, actually $77,999.50 because each transaction has 2 parties, 1 seller, 1 buyer but $155,999 in total. Anyway, I could have skipped all the other numbers and gone straight to the 24 hours volume number but there's no fun in that and im needing 1000 words here FFS.

We can see that under 1 million BTC are used for trading every day an average. When it comes to changing the price of BTC up are down, it's all about the volume and depth of selling and buying walls on exchanges. Think of deep selling are buying walls like brick walls you have to smash into 3-4 times before you get through them. Each time, you have to take a few steps back to build speed for your next impact.

Example of Bulls vs Bears

We have recently seen over the past few days Bitcoin's price hitting $62,000 before falling back down to $55,000. This is because there's are huge selling wall at $62,000 that bulls could not breakthrough on the first attempt. It might take 2 or 3 more runs at $62,000 until the wall is gone and all the people looking to sell BTC at $62,000 have their orders filled. Bears watch the market walls depths and when they see these huge selling walls being built, they'll short BTC when the price is close to the selling wall's price hoping the price goes down when BTC can't break the wall on its first try.

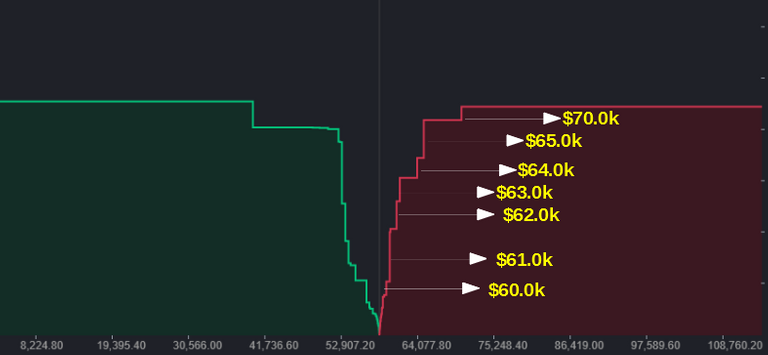

Below is a sample of what selling vs buying walls look like for BTC on Binance. As BTC is a 24/7 market, these charts change all the time and by the time I snapped the picture and uploaded it for editing, the live charts have changed so I eyeballed it and put in ballpark figures.

We can see there is a big selling wall at $61,000 and also $65,000. These will the next big tests for BTC bulls. I would be sure as the price comes closer to $70,000, the $70,000 wall will grow massively. Top tip, if you wanna sell at $80k, sell it for $79,500 as people sell in round numbers. Nobody plans to sell BTC for $98,382, they plan to sell it for $100,000 because it's a nice number and bears know this and will take advantage of it. Even by looking at this chart for a few minute's we can see if you are looking to sell BTC now, you should sell it at $60.50k as there are not many selling walls between today's price and $61k and it's likely to get filled quicker. Remember this is always worth checking out.

I think I should also point out that if BTC's price starts to reverse, there's not much there stopping it from falling back to about $52,000 and that could happen very quickly if large amounts are liquidated into buying orders.

Wrap Up

I've sorta gone off point I feel, I've definitely written something but im not sure if it explains Bulls and Bears very well and im sure it's riddled with bad information as i've heavily used google for collecting the numbers. I hope there are a few nuggets of information in there for you. I've been blogging for 4 years and still never learned to properly articulate my thoughts into words, maybe that's why I use a lot of numbers and stats.

Anyways, we are all BULLS in SPinvest. Even in the Bear market, we are bulls and only move forward. We plan for the bear market the same as we plan for the bull market. That's not a cheesy line, SPinvest has been planning this 2021 bullrun for almost 2 years and we've been planning to the next bear market for just as long. Planning how to react to half a market cycle is wasted time and resources if you cant preserve your bullrun gains through the bear market.

Thank you for reading today's post, I hope you found it, (cough) entertaining and educational (cough, cough). Slap the upvote and drop a comment.

Posted Using LeoFinance Beta

Well, I get "resistance walls" now.

Thanks.

Posted Using LeoFinance Beta

Me too . . . I think! 😂

Posted Using LeoFinance Beta

where can we see these resistance walls for BTC? I couldn't find them on Coingecko. Are they on CoinbasePro? I only remember seeing candles and lines?

Wait . . . On HE they are in the depth chart, so maybe there is a depth chart on CoinbasePro . . . goes away to check, muttering to self . . .

Posted Using LeoFinance Beta