SPinvest 100% HIVE power-down

Hello, SPIer's and welcome this today's post. The crypto bullrun is in full swing and anything is popping, green candles everywhere and many of us are watching our portfolio's dollar price increase massively. I look at SPinvest's HP balance and think to myself, why do we hold this balance? Sure it's the platform token and the token that SPI token is valued in but it's losing us money. I love HIVE, I love 3-second transactions, I love that usernames are address's and I love that it's decentralized. What do you do with your HIVE? do you power it up to earn 10% from curation, use it to buy into HIVE games, delegate it somewhere for a profit? do you buy HE tokens? cash it out? are convert it to LEO to earn 30% in curation? There are other things to do with HIVE but these are it's most used cases.

I have said it many times before and I'll say it again. HIVE is a bad investment. Dont get that twisted, im not saying it does not have any use case and will go to $0. Fiat cash is a bad investment, but it's essential for life to pay taxes, food, rent, etc. I personally think holding fiat long term is a bad investment, fiat's use case is to be used as a currency. From my view HIVE is the currency of the blockchain are a utility token if your like that terminology better. It's earned by most from creating content which is a lot like swapping your time for money which is what most of us do when we show up for work. I'll not go into HIVE's high inflation rate we all know it's high and it's always been like this.

Instead, we are going to explore the idea of powering down all of SPinvest's HIVE POWER and using that money to reinvest into other HIVE based projects. I have no plans are ambition to power down the SPinvest wallets, this is purely an exercise to show what we could do if.....we powered down the HP.

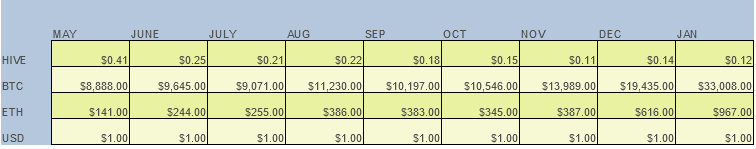

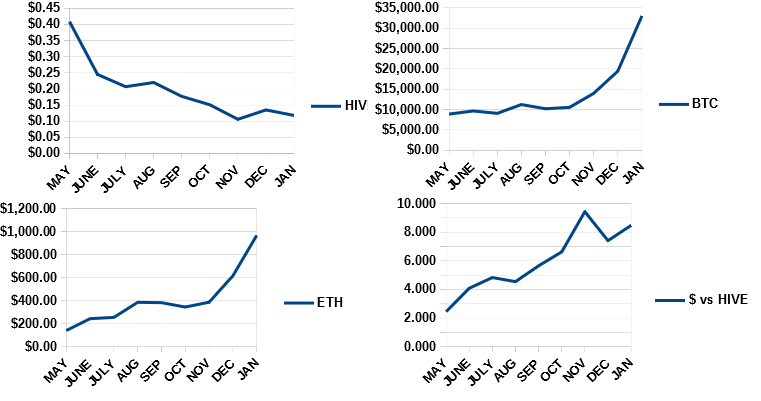

Before we start, let's look into how HIVE has performed as an investment from it was airdropped for free to STEEM holders. SPinvest was airdropped around 83k HIVE and we currently have around 95k. Im using charts from coingeko and im looking at the price on the 4th of each month starting in May. HIVE was launched in April with the initial pump and dump happening and seeing the price moon to around $1 for 1-2 days before tanking 50% in following 2-3 days. Let's compare it to other investments and i'll show you why the HIVE price will not follow the market. I look at charts and follow the lines, im not a trader are analysct but common sense tells me if everything is going up and HIVE is going down, it's not gonna follow the market. Why would anything change? The $ vs HIVE chart shows how many HIVE $1 bought that month.

The charts are not pretty for HIVE, we can see that fiat that loses spending power performed 3 times better than HIVE and it's very clear HIVE is not following the market. If you had $1000 worth of HIVE on the 4th of May and a glass jar with 1000 dollar bills inside, you could have burnt a dollar every day until today and still be $461 better off as your HIVE would be worth $292 today.

I used BTC and ETH as example's as they would have been most likely what we would have invested into, I showed USD to make my point clear as a bell. Jumping deeper into SPinvest's HP balance and how it's been performing in terms of dollars from launch. I have factored in earnings and taken HP balances from weekly reports to be as close to fact as I can.

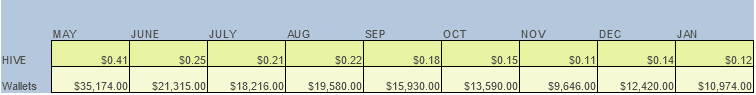

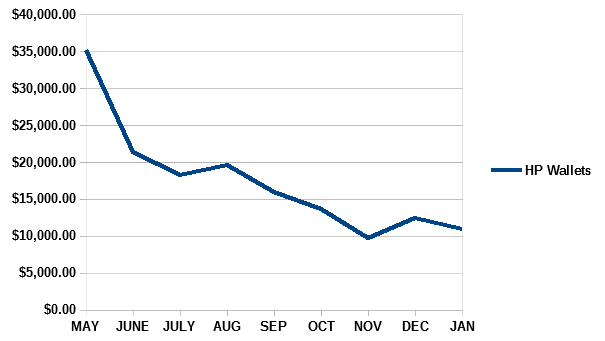

SPinvest has added 11k HIVE POWER into its wallet between May and Jan. If we sold on day 1, we would have had $35k. Now we have around 11k more HIVE than we started with and it's all worth $11k. We have all heard the quote from Warren Buffet saying that "compounding is the 8th wonder of the world", He does mention that you need to compound an investment that at least holds its value are in the case of many cryptos, faster than it loses value. If I had a dollar for every time someone has suggested SPinvest invest in a staking token because it has a 200% ROI. 90% of the time when asked what the blockchain did, nobody could answer, they knew was if you staked it, you would get a 200% ROI and that was all. Listen, even if HIVE paid a 200% ROI for leasing are curating, we'd still be losing dollar value.

I understand a lot of people are heavily invested into HIVE both with time and investment, I am 1 of them but dont be delusional and think that HIVE is going to go to $1+, I dont see a 1000% pump coming to HIVE, why would this happen? and where's the money coming from?. Hey, if it happens, I will be happy to eat my words. Think about how much your HIVE, hive-engine, STEEM and BLURT wallets are worth in dollars and then think about how much of your hard-earned fiat you actually invested directly into any of these wallets. I knew some people bought in heavy when STEEM was $4+ are even HIVE at 50 cents. Think how much profit they have made compared to someone that has never paid for 1 single HIVE with fiat. When brought down to its bones, HIVE is a reward token, it's given away for free and you should not buy something that is free even if you consider your time to not be free, you sorta got your time for free as well. I say earn as much as you can, buy it when you need more than you earn and spent it quickly, reinvest it back into HIVE project's whether that be an investment, gaming, tribe are anything else, dont cash it out on the exchange. Keep it within the ecosystem and keep it moving which will help with growing daily activity on HIVE dapps which is real exposure. Writing posts about how great HIVE is on the HIVE blockchain is preaching to the choir. Write your posts on Reddit, that would be more useful as exposure but than again, Reddit dont give rewards for posts so I guess, it's not worth it for your time, right? lol.

Use your HIVE, grow Dapp activity, keep it moving around. The more HIVE moves about, the more exposure it receives. We are what? 10k max active users? I know the reported number is higher but data bots cant tell the difference between a manual and an automatic transaction. Posts, comments, edits, transfers, powerup, receiving a dividend, upvote, downvote, following a curation trail etc, etc the list is endless but all transactions. If you thinking how can uploading a post be a transaction, can you upload a post if you have 0 RCs? If you are required to spend some RCs to interact on the blockchain, then it's a transaction. How many accounts have been created so far, 1.5 million? 2 million? in 5 years? Not a great retention rate.

I hope in the future that blogging is to HIVE as selling books is to amazon. Long gone and forgotten with many new fields explored and dapps added to the blockchain. I personally only post content for projects to share information. I dont post from my personal account ever because there are so many other things on HIVE im into. I would put my bottom dollar on im a lot more active in HIVE than someone who bangs out 2-3 shit posts per day of what they had for dinner. Writing posts is a hard work day in and day out and curating is hard also, if it was easy curation trials would not be so popular. Yes, powering up HIVE to curate is very noble but also one the worst rewarding ways to use HIVE plus one of the most work-intensive also. . I think games, tribes and investment (defi) tokens will be HIVE's future.

Once again, not saying HIVE is a shitcoin just saying it's maybe not a good HODL token if your expecting dollar gains. It's an excellent token, in my mind the best token for actually using for transactions. It's faster and easier to make transactions on HIVE than any other blockchain that I have used. I do hundreds of transactions manually every month and I've never one time lost HIVE. It's is excellent for using, not so good for HODLing. I'll finish by saying, we all know bull runs come and go, how good is an investment that takes 13 weeks to get back? If the price did jump to $1 someday, what percentage of you HIVE POWER balance could you sell at those prices before it tanks again.

What if we powered down all SPinvest HIVE POWER?

First off, our earnings would drop by around 230 HIVE a week as we would no longer be receiving leasing payments but we would have 95k HIVE tokens to play with. I understand powering down takes time but this is a thought exercise and we'll speed things up.

I would start off by going to hive-engine and seeing what tokens we could invest in, something that will bring us in some income. As we are playing hypothetical here, let say we invest all 95k HIVE into BRO tokens. At today's price of 8 HIVE each, we could buy almost 12,000 tokens and that would earn us around 402 HIVE per week in dividends, almost twice as well as leasing and a little work required to convert div's into HIVE, 10 minutes per week.

We could buy around 31k LEO and based on earning 30% curation we would earn 530 HIVE's worth of LEO every week. Again, would need to sell some LEO every week to pay dividends. Im aware dividends are paid in SPI but the SPI sent out are paid for with HIVE. Moving on, we can see this is a little more than double what we are earning from leasing.

If have no idea on the ROI on dcity but im pretty sure that spending 95k HIVE would bring in SIM rewards of much more than 230 HIVE per week, maybe more than that each day. Our current city is worth around 5k HIVE and brings in around 23-25 per day so times that by 20. Nah, that's too much. @shit-signals?

There are other tribes, investment tokens but nothing that looks like a solid investment. We are not here to take a gamble, time tested and proven is best. BRO, LEO and DCITY all qualify. Theses 3 investments can also be viewed in order of ROI vs liquidity. Leo is the most liquid of the 3 being able to cash out a few thousand dollars in a day easy, BRO token offers a higher ROI but would be hard to cash out 12k BRO tokens without crashing to price and DICTY offers the highest ROI but is also the hardest to sell for what it's worth and within any reasonable timeframe. A perfect example of reward to liquidy. The risk to reward with the risk being not being able to cash it out for the value you think its worth. Hive is comparison earns around 10% in curation and takes 13 weeks to power down. I think hive-engine tokens are better than HIVE POWER.

Point is, we are sorta using our HIVE balance in a very inefficient way and as an investment fund, we should really reallocate these funds to earn more. Our hive engine wallet is already worth more than our HIVE wallets and I only see the spread between the 2 increasing as tribe token earnings are worth much more than direct HIVE earning. For SPI, when we earn 2 HIVE, we earn 3 HIVE worths of HE tokens.

What do you think?

So what do you think? Is it a good idea to power up HIVE? and if yes, why? Would you be ok if SPI powered down its HIVE POWER? All hypothetical of course.

Posted Using LeoFinance Beta

https://twitter.com/Bhattg18/status/1346767222450995206

It's a rational move. You laid out the common reasons why staking Hive generates less income that what you would have earned if you put it into HE based projects. I've been doing the same thing for weeks now and the returns I'm receiving are way better than what I could have gained if I kept my stake powered up.

I'm happy you got this covered. Bought some SPI on different accounts and hodling it for the long term.

Posted Using LeoFinance Beta

It's something that i have been wanting to write about for a while but never got round to it. It's interesting to look into things and i like to gather feedback from token holders so i can better plan my future actions. No plans to power down but we could be earning much more.

Yea, the price of SPI has really mooned the past few months, better late than never cause never is too late, haha

Posted Using LeoFinance Beta

Will the Hive-Engine based tokens such as SPinvest, LEO and the rest survive without HIVE and its community?

Posted Using LeoFinance Beta

Would HIVE survive without hive-engine? where a lot of dapp tokens are based? STEEM seems to be doing ok without the HIVE community.

SPI would still retain must of its value as most of it's investment is now off-platform but LBI would be game over until someone came up with another sidechain (that is being worked on) and assuming Khal drops new side chain LEO tokens based on his last snapshot.

Posted Using LeoFinance Beta

Good explanation. A good game play too. Sure many will use this strategy, thanks.

Just interesting to look at, been meaning to write about this for a while now, finally got round to it. Glad you enjoyed and thanks for the feedback.

Posted Using LeoFinance Beta

Investing in Dcity , LEO , BRO , INDEX - a big thumbs up from me.

Not so keen on INDEX. I love the distribution plan, i love the website and how its very simple and easy to understand how the token works. I know SPI is in there but im not so keen on other tokens in the index.

Will need to talk tot he SPI Dcity guy

Posted Using LeoFinance Beta

It's a little bit like keeping all your savings in your Post Office book or Preium Bonds 🙂. These days, even long-term fiat savings accounts are not earning very much.

I aim for a balanced get-rich-slowly portfolio, based across five investments and building/selling until each represents 20% of the portfolio. So I wouldn't go all out with 100% power-down, and I would do it over time (with Hive, that's what happens anyway). Some things I wouldn't sell, of course 😍.

Separate to that is the thought that there is a very low user base here at the moment - about 20,000 active posters globally. It seems like there's a lot of Hive out there but it would only take 800 institutional investors globally spending £60k each and that Hive would be cleaned up.

I remember having some bonds for a few years, won a few times, never more than £50. Not planning to power down anyway, I'd hate to miss out on a big future HIVE airdrop if it ever happens. This time last year, we would have never thought STEEM would have been forked 2-3 times by 2021.

HIVE is a niche platform/blockchain. It is what it is. I here, i love it but im not in love with it. baaa-hahaha

Posted Using LeoFinance Beta

Very good post and indeed a discussion about that topic may be enlightening for all of us. From a 100% investor perspective, it really looks like HIVE is not a winning asset and the opportunities may be elsewhere. But as @eirik already asked:

This is really a good question. And turning it around is also a good one: If tokens like SPI, LEO, STEM or any other project here really moons, would this result in a considerable increase of the value of HIVE. In addition to the value of HIVE the governance-aspect of HP may be an asset in itself on a blockchain hosting one or more really successful projects. Voting for witnesses and DAO proposals may be much more in the focus in the future than it is today. As long as HIVE-Engine is running on HIVE, this club is 100% tied to HIVE and a full power down is the confession of having lost trust in the future of this platform, kind of biting the hand that you feed imho. There is no question to search for the best investments for the revenues SPI has, that may at the moment lay outside of HIVE or on the second layer. But SPI should hold its HIVE and rent it out on DLease also if this is we may get bigger revenues elsewhere. That is my opinion, but I am open to discussion.

Posted Using LeoFinance Beta

The reason you state for lost trust as a result of powering down is exactly why i would never consider are propose the idea for token holder vote. SPinvest from day 1 has said it'll never power down, but it's interesting to look all the same.

Dlease is piss, we can get more from private leasing 😉

Posted Using LeoFinance Beta

Goot to know that we are on the same page here. By the way - to turn that discussion completely on the head. Shall we buy more HIVE, run a node and try to get a whiteness ;-)

A balance is needed as I would not keep all my eggs in one basket. I would keep half of the Hive, as we never known when it bounces back. The thing on Hive is that there is a massive sell pressure coming from the top to the bottom. Top witnesses sell Hive like crazy which brings this price.

Leo would be a good investment as it brings a very good return.

I would as high risk investment 10% into DCity. This would need a good strategy control on it, as it can bring 300%/year.

Posted Using LeoFinance Beta

Not even considering powering down any. HIVE used to represent 85% of SPI's token value when we switched from STEEM to HIVE but it's gone down and our off platform investments have gone up so right now, HIVE only represents about 15% of an SPI. Im just thankful the SPI dollar value has increased and been able to cancel out any loses coming from HIVE and still have bacon to bring home :)

Posted Using LeoFinance Beta

Airdrop coming from the 3Speak project is a good reason to hold on to HIVE. 16% ROI from delegating isn't bad either. I know this is just a thought process, but I won't be surprised if 2021 sees multiple airdrops to HIVE holders (and LEO) and HIVE's fortunes turn around a bit.

I'm ok with holding 10 - 20% of the fund as HP. Hive is the only reason any of even know each other to work together on this thing.

Posted Using LeoFinance Beta

Agreed, i replied back to another comment saying about HIVE airdrops that could take place.

Heard about the 3speak airdrop but dont know anything about it. I upload the SPinvest updates to 3speak, switched over from youtube a few months back

Posted Using LeoFinance Beta

Perfect timing for me to read this as I'm trying to get to grips on my tokens/earnings and come up with more of a strategy rather than just being so random.

I was all set to turn my liquid LEO into LBI-tokens but now waiting to hear the details of the airdrop before deciding if I buy later rather than sooner.

I sold pretty much all my airdrop Hive (or rather Asher sold it for me 😂) and turned it into BTC. 😂 😂 😂

Now every time I cringe when I come across an exchange of BTC or LTC for Steem (I'm trying to get some records sorted so I can do my taxes) I can remind myself, without that steem I wouldn't have the Hive so I wouldn't have had the BTC. I would never have bought BTC for it's own sake back in the day.

But I digress . . . from what you've explained it sounds like powering down Hive and reinvesting would be a smart move.

Posted Using LeoFinance Beta

I bet your BTC is looking pretty good now :)

To make the best ROI on HIVE, reinvesting it into something would make sense but that of course, carries more risk.

I'd say spread it out, test a few different things small scale for a month are so and then make your big moves based on the results.

Posted Using LeoFinance Beta

A truly awful post.

Is SPInvest going to be a leader or not.

Well maybe if people like you wouldnt keep saying it, things would be better. After all, who is going to buy when perceived leaders of the community keep knocking it.

By the way, didnt you think LEO was a shitcoin and sell that for at like .2 or .3 HIVE? Not like missing a 10x run.

Screw the words, where is the money. I guess you are eating your words on LEO but that doesnt make up for the loss in gains.

Powering down? No it is time that buying and powering up should be done.

There is also another factor you miss: HIVE is a governance token. Many complain about some of the things taking place, and rightly so. Yet those do little to change the governance buy holding HIVE. Instead, lets dump it and make the same cancers even more powerful.

Oh boy. Damn man, do you know what is going on. Hived, the software that this is run on, is just coming out of Beta. After close to 5 years, work was finally done on it to get it optimized and not faulty. It took Blocktrades under 9 months, after 4 years of Steemit Inc sitting on it. To think that the past 5 years reflect upon Hive is foolish. This think really is only 9 months old and came with a host of defects that needed straightening out.

It is only now that the development is getting to the point where they can focus upon what is needed instead of putting out fires that were burning for years.

Yet lets sell because this token will never go up.

Gimme a break.

A lot to consider now that SPInvest is showing what it stands for.

Posted Using LeoFinance Beta

I understand your hardcore HIVE and very committed to it. Im not saying to sell HIVE, im saying use it for other things. If I dont stake my TRX token with TRON for governance and to earn a little ROI and choose to stake it somewhere that pays me a better return, im I wrong? Im I wrong to point this out and show that better returns can be made elsewhere within the ecosystem? Am I wrong because im talking about HIVE? If this post was about STEEM and was saying that holding SP is a shit investment and you should use your STEEM for SE tokens instead, would your reply be different?

I made it very clear SPinvest will not power down any of its HIVE balance. I hope it jumps to $1+ someday, why not?

And FYI, the LEO we cashed out was earned when LEO was trading for 0.1-0.2 HIVE, I have to take profits when they are available and seeing a token x4 in 3-4 weeks is a no brainer 90% of the time, remember im expected to provide an ROI. I've only ever sold @spinvest's LEO balance which was earned from post rewards and is needed to pay toward dividends and off-platform investments. Its part of the model, and not so much emotionally based. We've never touched the @spinvest-leo balance and still hold more than we've sold. When we sold a bunch of LEO at around 1 HIVE when HIVE was 18 cents, that money was to put toward buying ETH to provide liquidity for the 1st wLEO LP. LEO has 2.55x in terms of dollars since then and ETH has gone 3.6x from when we bought them for $330. I dont see the loss but your probably not looking at all the numbers in a nicely compiled spreadsheet while you write your comment.

Ok, maybe this post was written in bad taste but if I was talking about any other blockchain other than HIVE...

Posted Using LeoFinance Beta

We could easily get 600-700 hive per day with 95k hive in dcity.

But i would suggest not to power down hive for bro or dcity.

Remember if hive price goes down dcity value in terms of $ will also go down.

I wouldn't want to power down for BRO or DCity either.

Posted Using LeoFinance Beta

I am one of those non-investors that have some HIVE. I enjoy the social aspects of Hive Block Chain, and the content available shit post and all.

I do understand though, as the saying goes, It takes Money to make Money. SPinvest account is about making money. It is not a social account. My personal account I have set at 50/50 reward, I am using the liquid reward part for fun and for Hive investing. All my LBI, SPI Dhedge, and Index tokens have been purchased with the liquid part.

In about 8 weeks Hive Block Chain will be one year old. We will be well on our way toward the next hard fork. If the liquid funds can help grow the account dollar value and Hive Value wise then I see no reason you should not.

Based on your response to @alexvan about Hive holdings in SPI, I would have no problem with the power down there either. But I may be an outlier, I like SPI because I can not afford to invest with other than Hive reward earnings, so it allows me to be invested outside of the HIVE block chain in other investments. The same reason I have been looking at and trying to learn about other Hive or HE indexing type funds.