Spinvest's weekly earnings and holdings reports #10

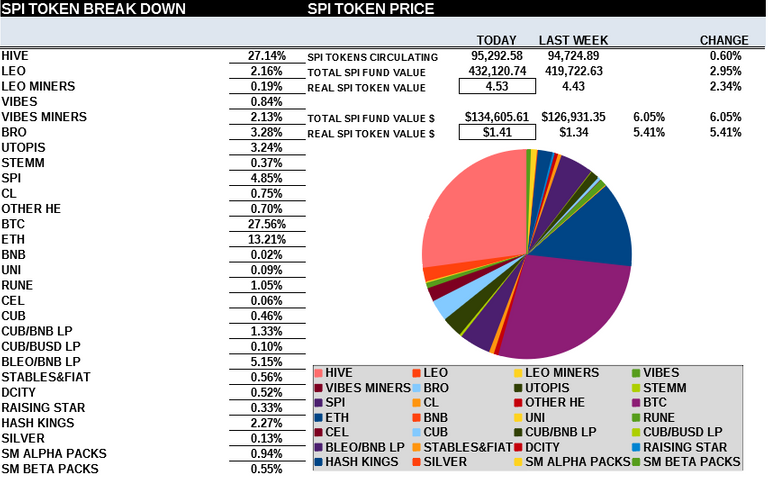

Hello SPIer's. We have a few things to cover this week as an investor with the decent holding of SPI's has requested a cash-out and we're going to lose some funds. This amount is equal to $7,200 or 5.3% of the total fund so liquidating whatever assets are required will be tricky. We have the liquidity no problems, it's just picking what to let go of. I put it to the SPI team of operators and we think the best thing to do is burn these SPI tokens bringing the hardcap down from 100,000 to around 94,700 SPI.

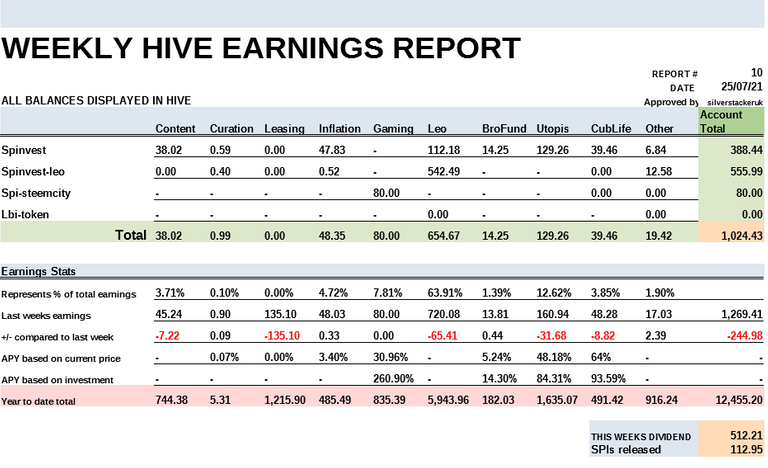

Yarning this week or so so, content earnings are down from posting less which has a knock-on effect on LEO earnings. You can also see our leasing earnings this week are zero. Our long-standing lease with ssg-community has ended as they juggle their delegations to save a few HIVE. This was earning us 15.6% and will be replaced by Leo.voter which pays out equal to 16%, so now SPinvest has 63k HP delegated to leo.voter.

@lbi-token will start to issue dividends from next week mainly SPI will start to collect a weekly operators fee equal to 10% of LBI weekly LEO earnings which are currently around 1500-1700 LEO per week. JK is working on a plan to increase our LEO div's further and it would be nice to see a 2000 HIVE week in the next so far off future.

I have had to unlock our HIVE saving to deal with this buyback. I'll most likely use a lot of HIVE and some stables, ETH and BTC to fund this buyback. I'd take a stab in the dark and say SPI will be bullish toward HIVE the next few months as we'll need to replace some of the HIVE that's going to be used for this buyback.

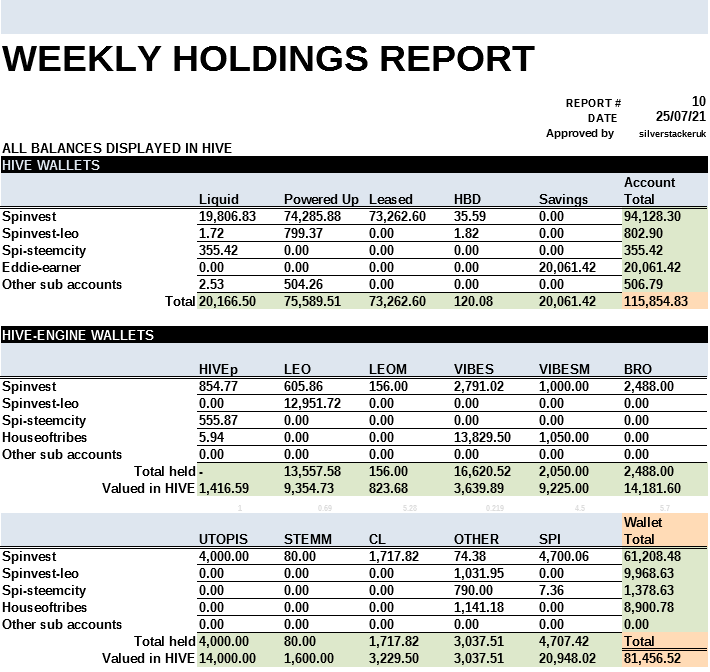

Hive-engine wallets are holding up just fine. Im going to holding off from buying back SPI tokens from the market for a few months to drain the wallet a few thousand. There is plenty in the wallet for weekly dividends for a few months and we might switch the dividend token once more for the last time. News about that in a few weeks from now. Nothing to get too excited about to be honest, just another token project from us. We're int eh process of moving our staked LEO to CUBfinance and adding it to the bLEO/BNB LP to earn a better return and things are looking up.

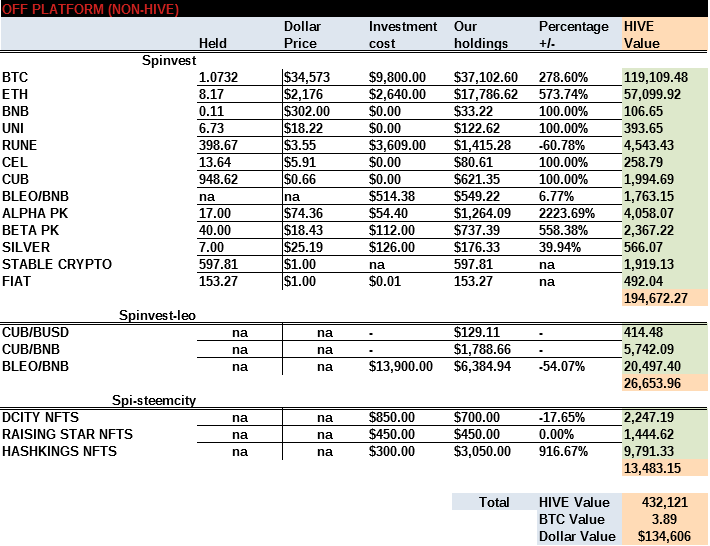

First off, RUNE is turning into a pan with a hole and has done nothing but nose dive from we get into it. Everything is up on last week by 5-10% so can't complain really. Take a look at our ALPHA splinterland pack cards and you'll see that 1 pack now is worth more than we paid for the 17 packs we have. 2200% ROI and still growing. The BETA packs are doing ok as well at 560%. These were one of our very first investments, damn we picked good.

We're up 5% on last week which is great to see, this is thanks mainly to the prices of crypto increasing a little. Currently, our ETH and stables are in limbo as I look for a place to park them. I am aware of the ETHbelt on CUBfinance but when converting 5 ETH, you receive something like 4.9 beltETH and I dont like that because what if the peg stabilizes and then you lose 2% of your ETH. That would take 3 weeks to earn back of the kingdom pays out 30%. Plus belts fees are ridiculously high. It cost $8 to wrapped some USDT yesterday for LBI. I mean $8 is not ETH fees but for BSC, it's pretty high.

HAPPENING SOON

X 5300 ($7,200)

Who says SPI tokens are not backed and the buy back offer is bullshit? They say the proof is in the pudding and pudding will be displayed in next weeks earnings and holdings report as the total fund size shrinks by 5.3% as will the circulating supply. It's one thing running an investment project on HIVE and a completely different thing when you can offer liquidity to your investors with no risk to them having to worry about holding "paper" profits forever. SPI offers something very unique that is overlooked by many investors. If you cant sell your investment tokens due to no liquidity are having to sell at a reduced price, that's a problem because you lose profit when you sell/unload if you can at all. How many other HIVE projects will pay out $7200 directly to buy back their own tokens?

Have a think about that. What good are your hive-engine holdings if you cant cash them out in a timely manner. What if you need that money and your wallet says to get $1000 but when you spend days/weeks adding sell orders and changing the price and waiting to sell, you only get $700 cause you've had to sell cheap to sell fast are you have to many of token with almost zero market volume and simply can't sell them.

Anyways, it's been a decent week. The holding will change a little bit by next week as we lose 5.3% of our holding but we continue and every one % of SPI ownership increase's a little. The token price will not be affected. That's all I think of right now. Thanks for taking the time to read through this weeks report. I hope your bags pump and you have a great week.

Posted Using LeoFinance Beta

It will be interesting to see the effect of this and, as you say, this is a fantastic perk of being invested in SPI. 5.3% of stake returned is a great recommendation for the product. 😁

Glad it's you working out all those figures though. My brain just switches off. 😂

Have a fun week and thanks, as always for all you do.

Posted Using LeoFinance Beta

yeah sure i like to see

Posted Using LeoFinance Beta

Thanks for letting us know. I trust your decisions and yea the liquidity problem is definitely an issue. Hive Engine itself doesn't have a huge pool so you can't load off a ton of tokens without affecting price.

Posted Using LeoFinance Beta

One of the things I really like about the SPI team and family of investments, the INTEGRITY behind them all.

I will buy some and see for myself

Posted Using LeoFinance Beta