Implementing Value Added Tax in Suriname || Yay Or Nay?

During the holidays when the drinks were pouring; in a sober and smaller setting of course; the conversations went from work to politics and to the economic status of the country. A lot of topics were discussed. I couldn't partake in al, but the one that got my attention was the one about taxes.

I'm no expert whatsoever; not in taxes nor in economics; but I am a tax paying citizen, who is interested in how the system works and especially interested in how it all will affect my spending and living situation. So I decided to do some online research about it today, to better understand the reasonings behind the choices being made by my government.

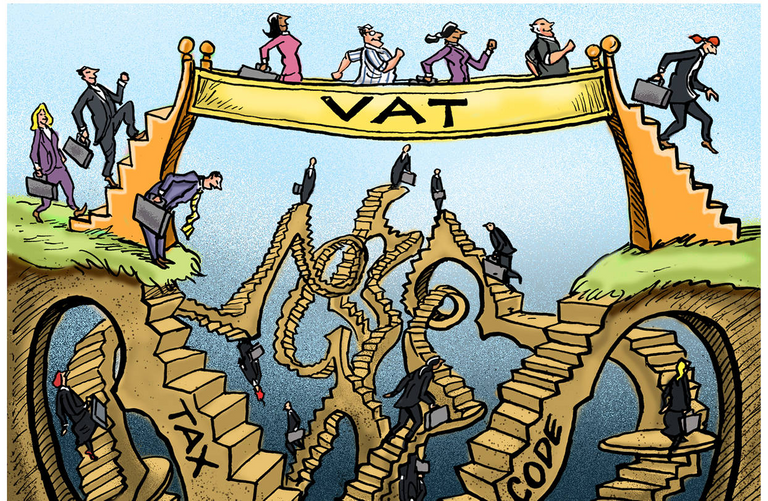

A few years now the government announces the implementation of the Value Added Tax (VAT), which should benefit the income of the State. The word implementing was used, because at the moment Suriname has a tax called Omzetbelasting. From what I've read it's a variant of Goods and Services tax (GST). It was a strenuous task to find the English name for Omzetbelasting, because in Suriname most laws, articles and information (websites) are written in Dutch. That's the formal language spoken here and I'm not a trained translator 😅.

The reason for implementing VAT in Suriname is, because some sectors are being exempt from paying the GST and Suriname was in a economic crisis long before the pandemic and still is and needs income to pay its debts, pay government workers and needs to invest so that the country will become more financially independent. We need to produce more ourselves and export more, instead of the other way around.

When the announcements were being made, I didn't know what all the fuss was about, but now that I've done my own research I could understand the concerns of the citizens. The introduction of VAT in Suriname was planned for 2018, but even now we're not ready to implement it, because the tax infrastructure is not in place. Those other laws and regulations that cross section the VAT also need to be updated, businesses which were exempt from the GST will have to change their whole administration and the tax office needs to undergo a whole transformation. The service also needs to be digitalized, which will make the whole process of registering and paying taxes efficient and streamlined. A guiding and informative phase should also be incorporated into the implementation process. And the political and social economic implications should also be taken into account.

Those are just some of the requirements, before introducing VAT into Suriname. Which taxing form is being used in your country and what are your thoughts on the pros and cons of the taxing systems? Feedback is welcome in the comment section below.

Chasse into the backstage! 💃

Posted Using LeoFinance Beta

Congratulations @tanjakolader! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

https://twitter.com/Bhattg18/status/1343616873271726081

We've had VAT here since I can remember and it was 14% until recently its been moved to 15% to pay for government shortfalls and mismanagement of capital, it's surely going to impact economic activity in your country and drive higher inflation and destroy some low paying jobs making it uneconomical as margins dry up

It's also become a must here, because of mismanagement of corrupt governments and not investing in long term goals for the country. The government of the past ten to fifteen years didn't even save up. There were loans upon loans and the coming generations are inheriting debt instead of wealth, which is really sad. The inflation is now already going crazy. I do hope that this years elected government is now making smarter choices and also taking the ones below the poverty line into account.