Hive Backed Dollar: Showing Need For Decentralization And Distribution

The word "**decentralization"" is often tossed around the world of cryptocurrency. Not that it is wrong, but it is something that became a buzzword. It also only captures a part of what needs to take place.

Perhaps we are stumbling over semantics but utilizing both words provides a much broader focus. It appears one is commonly applied to architecture while the other to tokens. This is the conclusion looking at the average user at least.

Ultimately, it is both that are required. As we will see, those that fail to do so will be at risk of being attacked.

Source

Decentralization

This is a concept most of us are familiar with. When we say something is decentralized, especially within the context of the cryptocurrency world, we are usually referring to a blockchain or an application.

What is the first thing that comes to mind when talking about a "decentralized blockchain"? Obviously, we look at the architecture to determine who is or is not controlling the system.

For example, we all know Bitcoin is decentralized. How do we know that? There are hundreds of thousands of miners, spread all over the world. They are putting up an increasing amount of hashrate while having the percentage of any single entity, as part of the whole, is declining.

We also know that the recent ban in China further helped to decentralize Bitcoin since it took a large portion of the mining that was concentrated geographically and spread it to other areas of the world.

At the same time, we can look at something like Hive. This is decentralized by having block validators also spread around the world. It is a system where there are 20 consensus "Witnesses" along with near 80 others who rotate through. Here again, we see the block validation spread over a large number, with no single entity controlling the bulk of the activity.

Therefore, anything that is built upon it has the chance to be decentralized. At least the core layer is not turning something into a controlled application.

The flip side is we know chains that are not decentralized. For example, people question chains such as BSV, which was hit by 51% attacks. In this instance, the validation process is switched into the hands of a few (one) who then is in control. This is often done for nefarious purposes.

Distribution

Here we are dealing with what appears to be the perception of the masses. There is no doubt that for technical people, the term distribution can apply to architecture. For example, we see the idea of "distributed computing" operating in that realm.

However, for the masses, when we see the term distribution, most associate it with the tokens. How widely distributed is the token?

There is also the consideration of how important is it. With Bitcoin, the token distribution means nothing for the state of the system. The mining process is what determines who is validating. Hence, processing power is more important than token distribution. If all the Bitcoin was in 5 wallets, the blockchain would still be decentralized.

This is not the case for many blockchains, especially those under the Proof-of-Stake model. Here the token holdings have the ability to impact who is in control of the chain. Token distribution can severely impact the operation of the chain.

Ethereum is one that would be described as decentralized. Their mining system is spread out. While not as wide and deep as Bitcoin, Ethereum miners appear to be at a point where the hashrate is well shared.

We do see the prospect of changes in the system eventually putting Ethereum in the state where it is centralized. By switching to a Proof-of-Stake system while adopting a deflationary model, it opens itself up to influence of larger players. This is happening at a time when the biggest player in the world, Wall Street, is getting very friendly with the Ethereum token.

From this, it is easy to see how those who have the largest amount of collateral are given a major advantage. Hence we can see how token distribution can vastly impact the operation of the network.

Follow the link read more about Proof-of-Stake versus Delegated-Proof-of-Stake.

Hive Backed Dollar

In the article, Some Thoughts on Hive Backed Dollar (HBD), an issue was brought up that really drives home the point of what needs to be focused upon.

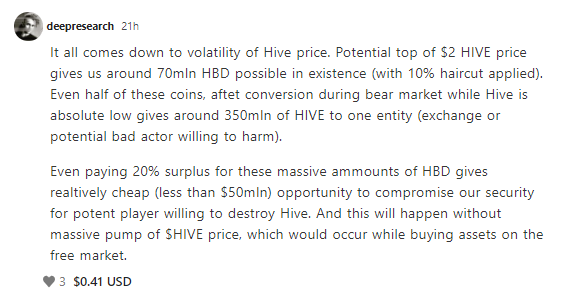

We see this comment which brings the discussion to the forefront.

Some very interesting points are made by this, most of which are outside the scope of this article. For those who are new, check out Hive Backed Dollar Becoming A Stablecoin to get a general sense of what is taking place.

The crux of the discussion is network vulnerability. How much is the possibility of something becoming centralized through the use of Hive Backed Dollar?

Nobody can argue that, at the base layer, Hive is fairly well decentralized. We also see the token distribution spread out. There is no founder's stake and the largest token holder has something like 3% or 4%. To amass an overwhelming percent of the tokens, especially to take control over the network, would be very difficult.

That said, the HBD could provide an opportunity. As was mentioned, if the price of Hive ran up, then one could accumulate a lot of Hive, which then could be converted in a market crash. This could potentially put tens of millions of Hive in the hands of a single entity.

So what is the solution?

Here again, we see how important distribution is. In this instance, it applies to both Hive and HBD. Both need to be spread far and wide. That is the best defense against attack.

A lot of this comes down to use cases. When tokens have more avenues to flow, they will not move towards a centralized honeypot. People will have a variety of reasons for holding a particular token, more than just speculation. The end result is a wider distribution even if there are some large holders. This, too, can provide defense against attack.

When it comes to HBD, it is crucial for the distribution to be strong. No matter what the haircut rate is set at, if there is a massive run up in the price of Hive like we expect, it could be a point of vulnerability. This is simply unavoidable since we have a stablecoin tied to the chain and paired with the DPoS token.

Each time the Hive "loyalists" put HBD in savings, this is akin to building a war chest. Those Hive Backed Dollars are available in the event that a large market drop occurs leading to someone trying to take over the chain. If one is creating tens of millions of Hive through HBD conversion, this could be counter-balanced by thousands of other people doing the same thing. Essentially, we are looking at a built in defense fund.

Of course, there are many other dynamics that are in play here. Real world market operations do not exist in a vacuum or proceed so cleanly as spelled out in this article. Lots of variables are always in place which is why discussions such as these need to occur.

Nevertheless, in the end, the better the distribution of both Hive and HBD, the more secure the entire ecosystem is.

Decentralized and distributed is going to be vital for the future, especially with the regulators and governments circling the wagons. To be out of their reach, this is truly the only course of action.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

https://twitter.com/taskmaster4450/status/1438126060860805123

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Can't this be solved by a community-owned treasury that would be used for automatic buying/selling when the peg is broken? I saw a few projects out there trying to solve the problem with this approach but I can imagine that it is a bit more complex with Hive and HBD.

Making it distributed and decentralized is great but if people aren't incentivized to react in a time of need many will fail to do so. The space is simply overwhelming and you can't expect everyone to pay attention to everything at all times.

I personally feel that the whole industry needs to solve communication issues before we move forward. If you are involved in more than 3-4 communities you are bound to miss at least a few governance votes and emergency situations.

Posted Using LeoFinance Beta

I think many on Hive already proved how they are willing to step up if the chain is under attack. There are a lot of defenses put in place but probably the strongest that Hive has it the diamond hands that are around here.

Many stepped up when Sun attacked, even though with little stake. It was amazing to see.

This is true. I also this is one advantage that Hive has. We are able to get our ideas out there. And, if the past is any indication, when something is dire, it gets a lot of attention on here.

Posted Using LeoFinance Beta

Yeah, the Steemit incident really showed the strength of the Hive community, no doubt about that. In general, no one has better communication than a platform built for communication but you never know what the future may bring.

I guess I was just thinking out loud about some possible issues I personally see popping up in the future. Wouldn't be surprised if a push-notification project ends being worth billions since that will probably be the only way to keep everyone informed.

Posted Using LeoFinance Beta

I do agree that communications on blockchains leaves a lot to be desired. Things can always improve, there is no doubt about it.

You are right, the one who figures that out will have a multi-billion dollar application. Hopefully we can get some tokens in it.

Posted Using LeoFinance Beta

That is a very interesting point that was brought up. I had not thought of that. It is also very true that the community would likely not allow someone to take over the chain like that. Kind of a been there done that sort of thing. Seeing how they rallied last time, they would no doubt rally this time. I just tucked some more HBD away into savings myself!

Posted Using LeoFinance Beta

I would think the community would rally again. Many of the same strong hands are still around with others getting stronger.

It was a difficult time the last go around yet we are seeing a new found strength from what the community can do.

Also, as Blocktrades mentioned the downside peg does break so that it can only produce 10% more Hive. That is a big burden removed.

Posted Using LeoFinance Beta

I know I am in a far better place now and I would definitely do my part to protect the chain (and my investment). Now that we have been around a year there are a lot of people with a highly vested interest in Hive.

Posted Using LeoFinance Beta

They are. Many were fully committed the day of the split. Now that there is a lot more money floating around, such as the @splinterland people, many have a reason to be protective of this golden goose we have.

There are a lot more golden eggs to come in my opinion.

Posted Using LeoFinance Beta

Great point. I've always been heavily invested in this platform (time-wise) but having my Splinterlands assets in the range they are now is a whole other level!

Posted Using LeoFinance Beta

This is very interesting, it makes me revise my opinion regarding my options for post payout, I will switch back to 50%/50% instead of 100% HP :)

Posted Using LeoFinance Beta

I went with the 50/50 a while back. Starting to fill the saving a bit. I figured it was a great way to diversify and helpful to stabilize things by having a bit locked up.

Posted Using LeoFinance Beta

There were times when 100% HP was viewed as a loyality statement and 50/50 HP/HBD as a mild cash grab. The view has switched recently but it is nothing more significant than yellow becoming the trendy color for the next few months replacing green.

The real value of the choice is the monetary incentive to pick printing/not printing new HBD according to actual tokenomics need. Post payout is just the tactics, then you can excercise your strategy using HIVE/HBD market (or conversions) and Power Up/Down button.

When hbd is below the peg powering up 100% will get your more, but when it is above the peg, 50/50 gets you more, if you sell the hbd.

very interesting explanation @taskmaster4450 the more hive holders, the better the ecosystem, thanks for the explanation

The low side peg for HBD automatically breaks when it exceeds 10% of the virtual supply. So in the scenario described, where someone buys HBD while Hive is high, then waits for Hive to drop, they still can only create 10% more Hive, no matter how far the price drops. Similarly, if the debt limit is increased to 20%, only 20% more could be created.

Ah okay. Thank you for the clarification. That solves a lot of the proposed issue.

Posted Using LeoFinance Beta

Thank you. This is a mechanic I wasn't aware of. Great! I feel secure about it now.

Ahh, growing pains. The bottom line is Hive and HBD need distribution. Distribution comes with more users. The question is how do we bring more users to the platform.

I think the term I would apply is growth.

The more we get people utilizing the applications and games on Hive, the better the chance that some will venture out into the different areas of Hive.

Posted Using LeoFinance Beta

Muy buena la información suministra amigo @taskmaster4450, es bueno conocer sobre estos temas.

I'm going to share my token,so that I can handle the issues down to buy one token

Posted Using LeoFinance Beta

Well it looks like blocktrades responded so I guess there isn't an issue since HBD is hardcapped at a certain limit. I have been keeping at a 50/50 payout method and it looks like it might be the best choice.

Posted Using LeoFinance Beta

Every of your post...I mean every one of them is always helpful to me. Thank you

View or trade

BEER.Hey @taskmaster4450, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.