What We Can Learn From The HBD Pump

It seems that over a period of about 24 hours, HBD went on a wild ride. This was something that many were able to take advantage of, for great profit.

To those who were liquid and able to capitalize on the opportunity, congratulations. It is always good when markets present the chance to make money and people jump on it.

There is a big question, however. What does this say about HBD along with the potential pitfalls? It is something that we need to consider.

After all, if they can do it on the upside, with enough money, they can do it on the downside too. When something is dependent upon the market, it is susceptible to the same players.

Situations like these can help to focus attention on areas that fall short.

The Positives

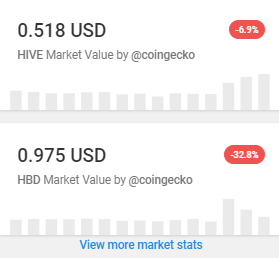

To start, we have to point out that things appear to have returned to normal. The price of HBD is back within a few points of the $1 peg. After pushing to $3, the price came crashing down.

Here is what we see now.

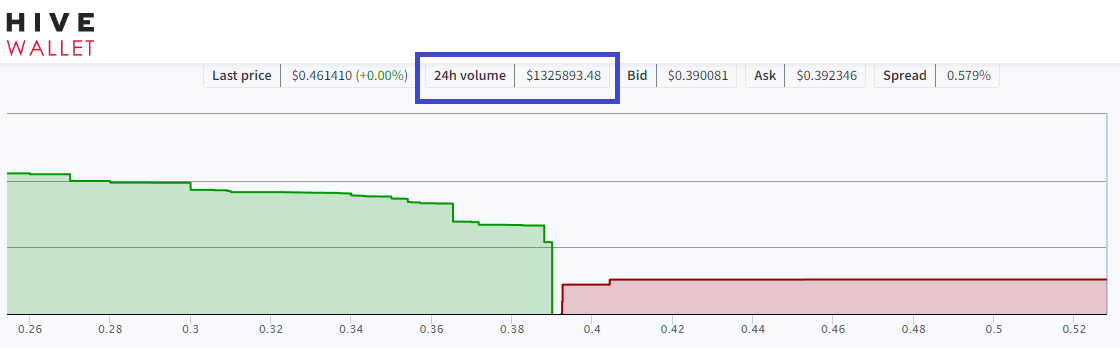

The internal exchange saw some enormous activity. This is a positive since the HBD stabilizer (along with many individuals) stepped up. The highlighted volume is an incredible increase over the norm. Typically, we might see $40K in trading on an average day.

At the time of this snapshot, the 24 hour volume was $1.3 million. Imagine if that was just an average day.

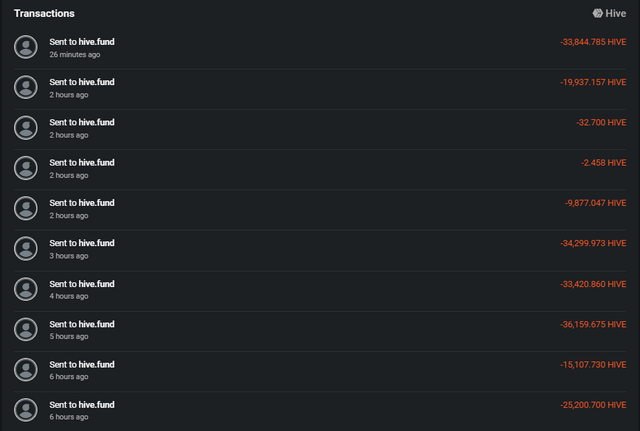

As a result of this, the Decentralized Hive Fund (DHF) was pumped full of Hive. The stabilizer was on a buying spree, directing the coins back to the DAO. As shown in a post by @tarazkp, the HBD Stabilizer was pumping in over 30K $HIVE into the DAO each hour.

This is money that will be used for funding further development over time. So, overall, we can consider that a net positive.

The Major Issue

Few are going to be surprised by the statement that a stablecoin should not see a 3x move. That is not the definition of stability. When we are dealing with volatility like that, even for a short period of time, we see how it is counterproductive.

Traders love spikes like that in currencies. Business people do not. If one is going to engage commercially, he or she does not want to wake up to a large move like this. Sure, some might say the HBD sitting in a wallet overnight was worth a lot more in the morning. That would be true.

However, what happens if they pull the same move, but this time on the down side? How would merchants feel about seeing their overnight sales reduced by 50% or more because the currency fluctuated?

That is not something they want. The same is true for any financial products tied to it. Over the last few months we discussed the idea of building derivatives tied to HBD. These mechanisms can operate as a hedge, reducing the risk associated with HBD. At the same time, they would be dependent upon it. Hence, a massive move in the stablecoin would equate to pricing of these other assets going haywire.

It is positive that, after a short spike, it does appear things are back to normal. Nevertheless, the pump in the first place is of concern.

This shows us we have a major vulnerability, at least in the short-term.

Liquidity

One of the obvious factors in this entire equation is the lack of liquidity. HBD does not have a large circulating supply which is them coupled by the fact that a fair amount of the free float is locked up.

This can be a double-edged sword.

Having a large percentage locked up is a benefit to the overall resiliency of the ecosystem We have to keep this in mind. Since each HBD is backed by $HIVE, those which are put into savings are not an immediate threat to the system. It requires going through the waiting period. Other ideas around time locked vaults could provide a similar benefit.

What this does affect is the liquidity of HBD on the open market. Since the circulating supply is low to begin with, especially after we deduct what is locked in the DHF, the situation gets compounded with it available in so few places. Here is where we are slapped in the face by reality.

The internal exchange along with Upbit are the two exchanges that can create a decent amount of volume for HBD. Upbit, naturally, is a closed exchange, only open to Koreans. So from a global perspective, this is a moot point. It is what allows the South Koreans to manipulate the coins so easily.

This leaves us with the derivative of HBD. Leofinance introduced $pHBD a few months back. Coincidentally (or not), they also introduced their BSC version, bHBD yesterday.

Having options is great. Nevertheless, adding pools is easy; having liquidity in them is another matter.

Some have mentioned the idea of developing automate market makers (AMM) as a solution. Perhaps that is the way to go but it is still turning to the same areas: the market.

Give People A Reason To Have HBD

At this point, HBD is entirely dependent upon traders (and bots). This is where the value comes from. As long as it is tied to the peg, by market forces, it is on par. However, beyond that, there is little incentive to be involved with HBD.

Here is where the shortcoming is truly exposed. It is also shines light on the directions we have to take.

To make HBD sustainable, we are going to need buildout in the area that gives HBD value, outside of market movements. In other words, people need a reason to have the coin.

Over most of this year, we covered this so we won't go too deep. However, we need to focus upon:

- liquidity

- depth

- infrastructure

- sophistication

This is what will separate HBD from many of the other stablecoins that are out there. At the moment, it is very crude, just like the rest of them. Developing financial products that move HBD out of this category is vital.

HBD is a process. The pump shows we rely exclusively upon the financial markets. Unfortunately, when you are dependent upon them, the scorpions can turn and sting you. This is the risk of dealing in this arena.

It is clear we still have a long way to go. The answer to liquidity is simply to give people are reason to have liquid HBD on hand.

And that comes from development.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

It's more than clear that HBD needs more liquidity but at least we are working on the fundamentals first. HBD pumped, the mechanism worked as planned and the peg was reestablished fairly quickly.

On the other hand, more HBD in circulation means more risk to the downside where someone will try to pull a Luna on us... Seems to me stabilizing HBD will take much longer than people expect. It does suck for business but it is still the only decentralized stablecoin that works imo.

Posted Using LeoFinance Beta

Well, we have to be careful when it comes to liquidity and that I agree with you on. I also agree with you that for HBD to get that stable nature it will take time.

However, I think USDT and USDC are doing better in terms of stability.

I also understand that HBD is still upcoming and so I feel we are doing great

They do, at least on the external exchanges. They also have a much larger circulating supply at the moment.

For now, we just have to keep pushing forward. A lot of work to be done.

Posted Using LeoFinance Beta

There is muuuuch more liquid Hive to buy the dip if HBD goes to $0.95 and below.

I don't know if there is enough liquid HBD to really do a working reverse pump. You would have to buy a ton of HBD before you can attempt to dump it so you would pump the price and burn a lot money and then dump it at an even lower price and burn more.

It's possible to buy Hive, convert it to HBD and then dump it but I don't know if this would really work xD

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @dera123, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Keep in mind the only external exchange with any liquidity is Upbit and that is an exchange closed to outsiders. Not a lot available elsewhere.

Posted Using LeoFinance Beta

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @dera123, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Did you know that you can use BEER at dCity game to **buy dCity NFT cards** to rule the world.

The fact that people use it at the base layer, and not Layer 2 says a lot.

There is a lot of work to be done so that is the challenge before us.

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.It's over two years since Hive was "created" and we still don't have a stable HBD. HBD not being stable and at risk of "pumping in the opposite" is what might hold some users from staking it.

that's true, but it has so far always come back to $1. The swings are largely the result of only currently 9 mil$ in HBD circulation

Which is really small compared to other stable coins out there.

Miniscule.

Posted Using LeoFinance Beta

So so minute... We just ave to give HBD some time

Give it time but actively build too. We cant just sit idle with it.

There is a lot of work to be done. Use cases are required.

Posted Using LeoFinance Beta

I thought it was closer to 7M actually floating around.

Either way, very small amount.

Posted Using LeoFinance Beta

I feel two years is too small compared to other stable coins.

We need to take measures to prevent this network from attacks.

I agree that HBD staking might not work with a volatility of what happened yesterday

It is two years but HBD only started to get some attention in the last year.

And hell, we didnt even have a liquidity pool to trade it up until a few months ago.

So we are inching forward with it.

As for the stability, the internal exchange tends to hold pretty strong. The price using Coingecko is meaningless since that is outside exchange which there is only one.

Posted Using LeoFinance Beta

Exactly, while we're building a system for traders and people who loves taking profit we should consider the fact that we're presenting HBD's potential stability to would be investors as a great entry point though. Might have been a "good" yesterday, internally. But externally, it wasn't.

Posted Using LeoFinance Beta

OP either assumes that pulling out the reverse play is equally difficult, or just hopes the readers subconsciously accept it as equally difficult.

I do not remember any dump-n-pump stories but I am ready to hear some.

Have you not watched the movement of the coin over the years? It was pushed up and pushed down.

They can do it by using HIVE.

Posted Using LeoFinance Beta

Your comment per minute rate is formidable but it disallows meaningful conversation.

I do not question the price can be moved. I claim there is no financial motivation so noone is going to do that.

Finding an example of a profitable dump attack is enough to prove that statement wrong. Probably doable in that 30s timeslot, too.

I totally agree with you..

Traders are a necessary part of the market. And the market provides a valuable service.

However, when it comes to stability, there is a lot more that enters the picture than just the market action to hold the peg.

Posted Using LeoFinance Beta

The interesting fact is that the 20% APR worked against us this time as most native HBD was held in savings for the APR and there was little one could do to arbitrage without enough liquidity.

It worked against us totally.

Most of my friends had their HBDs in savings.

I was lucky to have some hive on order

How could that happen? Herd mentality following someone's advice?

Agreed. How about 3-day delay?

I had some liquid HBD waiting for a better HIVE price, but the pump-and-dump scenario worked out fine too, on a personal level. I just wasn't paying attention early enough, or this could have been much better.

But I agree with Task, a stable-ish token that goes 3x overnight isn't good for businesses.

Great point. Being able to sell from savings with some sort of delay might be a nice feature to prevent pumps.

Nah, I think savings are good as they are. Liquidity pools need to grow. The ones Leofinance created, the ones on Hive-Engine, and I heard talk about a potential HBD-HIVE LP natively (just talk so far). The HBD bonds Task would like implemented would also be tradable on the second layer with no locking, while HBD is locked.

A HBD-HIVE LP could work. Does the current native market charge fees on trades? If not, implementing a 0.25% transaction fee that goes towards HBD stabilizer or the DHF would be a no-brainer if you'd ask me.

Currently, there is no fee for using the internal market. And I'd keep it like that. If an LP is created, that's another deal, fees would incentivize liquidity providers to participate.

I don't feel it worked against me. I was not a part of the pump, but I was still able to get 20% over the long run.

If we want to take advantage of the moves, we must keep our HBD liquid, then we can't get the 20%

It's not working against us, its our choice.

Posted Using LeoFinance Beta

I wasn't talking at a personal level. That's a choice, of course. And I love the 20% APR! But for the stability of HBD in the very short term, that's been detrimental.

Well it worked against the individual traders since there was no way to liquidate.

However, it really wouldnt matter since most on here cant arbitrage on Upbit where most of the action is. We can go to the Internal Exchange but that is only a piece of the puzzle.

Can go cross exchange.

Posted Using LeoFinance Beta

That is true. Although even by keeping the rest of the markets well arbitraged makes Upbit stand out and those with access eventually will bring the price down.

Posted using LeoFinance Mobile

Yeah, it's scary to think that a stablecoin will move like that a a whim. That was a bit nuts. You are exactly right, and I guess this is where my UShiT PTSD comes into play, lol. It can easily go both ways.

People think stablecoins are not sexy and are boring, but they are what are going to end up being what is used in commerce over the more volatile assets. We need more focus around HBD, it's properties, and why we need to secure its stability.

Infrastructure is required. That is something that is lacking right now. As things get built out, we could see more incentive for people to have HBD liquid.

Posted Using LeoFinance Beta

Yeah, traditional e-commerce is changing rapidly, but people still don't want to use the awesome technology we have built to buy things. This is where the flaw with Bitcoin lies. Too volatile, so we need stablecoins.

We need to get it in the minds of businesses, at least small businesses, that it is a way to accept crypto just as easily as it would be using something like CashApp with the cash tag, but you are in full control. Plus it's an advertising platform, social media, not to mention 20% saving account... You get it, I get it, some of the people on Hive get it...

But when you try to talk about it to someone outside the space...

This needs sinking in and have us realize there's a lot more to do to withstand market manipulation of this kind. While the upside have yielded profit taking, no one wants to wake to the downside as a result of the Koreans at play.

Posted Using LeoFinance Beta

The fact their exchange is closed to outsiders gives them a lot of room to maneuver.

People cannot go and arbitrage across different exchanges.

Posted Using LeoFinance Beta

if those who took advantage of that bomb are those who had liquidity and get some extra #Hive. Of course, there are also those potential risks since if it was done on the rise it could be done on the downside. So let's wait for the next bomb on the market and if possible take advantage of it

Those who made money, good for them.

Markets present opportunities for those who take advantage of it.

For the rest, well just keep plodding along.

Posted Using LeoFinance Beta

For this reason, I was so scared. I had a few others in anticipation of this pump and I got some profits from the pump but after thinking of it, I was scared to leave my hbd and so I decided to convert it to hive and send it to USDT which has not experienced pumps that I am aware of.

The reason to have liquid hbd is something the community has to ponder on how we can attach so much value to hbd.

If it continues to pump, people will only be happy to write but not to hold.

If there is a way to add some governance benefits to hbd.. It might increase the liquidity in my opinion.

Yes but the key is the price do move back into range. It was less than 24 hours. So a very quick pump.

Not sure what went on with people jumping in but some of the whales might have done some things.

Posted Using LeoFinance Beta

Not really a poison pill for HBD to pump upwards. I‘m wondering who’s been the pyro burning such amounts of money to pump it. Seems like an accident to me.

Thinking the same way someone lost a lot by pumping cause it went down. I know the Upbit exchange were it happened but liquidity could help too.

Posted Using LeoFinance Beta

Pumping HBD is suicide

Maybe the bot picking candidates for pump-n-dump did not read the coin description properly.

BTW, there was an actual accident on Hive internal market in the heat of the battle.

Really, what happened?

Yes, I think so too. They didn't know the internal market and felt free to pump and dump smoothly. Well, well, get wrecked.

I am not the kind of person to rub salt in whale wounds just for fun, am I?

For longterm profits, maybe. They say it's all written on the chain anyway...

I do not think there was an assumption Upbit/Bittrex are the only places to trade it (although the lack of listings might have helped). Lots of coins are bridged to other chains these days. The real surprise was the fast printing they triggered.

I dont think it is an accident. I have a feeling those behind it on Upbit made a pretty good sum.

Posted Using LeoFinance Beta

How's that possible, what's the gameplay?

Simple. They have a closed exchange off limits to non Koreans. There is a lot of HBD on the exchange. Someone (or a group) start to pump the price up and gets the activity going. They can do this by wash trading among themselves. When the price shoots up, they sell their holdings at $2 or whatever, and pocket the difference.

By the time the price topped and headed back down, I am sure the pumpers were long out of the trade.

Posted Using LeoFinance Beta

That is all assuming that there are genuine buyers for a good volume of HDB. What if there weren't any and they got smashed by the arbitrage vs the internal market losing big times.

Do you think that's impossible?

Well, the risk is rather small - they accumulate HBD for $1 so the only expense is buying all outsiders' sell orders on Upbit at a premium. They are not buying those $1.5 HBD (SWAP.HBDs/pHBD/bHBD) after the race begins (unless they run out of stock and conditions are still favourable).

The principal gap of the story is not "Kim made money". HE probably did. OP's story is "Kim made money and we could not stop him, HBD pumps hurt Hive blockchain".

One gap is the lack of damage. A few hours of $1.3 HBD is not a damage so let's present a threat of a few hours of $0.7 HBD instead. I do not think there was a full-hearted attempt at disproving my claim the threat is phantom (elsewhere ITT).

The other gap is the no-arbitrage claim. If I wash trade HBDs at a local chess club and trick a few guys into buying high (cheating you out of your opportunity to arbitrage my ass), noone will even know. The movements on other HBD markets prove that there were arbitrageurs in the game as the mobsters surely did not need to restock right off the start.

I can understand the political POV - let's find an enemy (mobsters) and CTA the average Joe "Be a good Hivean, have HBD ready to defend our homeland." OTOH, I am not a good Hivean so I just enjoy a prime opportunity to either learn something new (if I am missing anything) or have fun ridiculing a full flock of parrots for their lack of critical thinking (in case I happen to be right).

The combination of pushing a low volume price index on CEXs to trigger AMM Pool is for sure a valid attack angle eventually.

Let's say I have 50k$/50k$ HBD/ShitcoinABC pooled and make the HBD spike 3x to increase my pool share in the ShitcoinABC 3x. I can now withdraw that Shitcoin before letting the HBD price drop dead again.

Does that make sense in a real-market scenario?

I do not think I get it - there is no way to sensibly pool 50k HBD with 50k of real altcoin, so I have to assume you just want load up an near-empty HBD/ShitcoinABC so that you hold 99%+ of it.

Now if you spike HBD to $3, people start buying ABC and pumping it into your pool until you end up with little HBD and big bag of ABC that has no value.

More generally, if you are going to pump HBD, you exit all LPs first. To exploit the pump, you just buy HBD from any pool you can find, shortchanging those who left their liquidity in (and rapidly resell HBD elsewhere for the inflated price).

How about we use that DAO fund money to actully build some applications on hive now? Something as simple as a NFT marketplace for all of hives games like atomic hub and 1% up to 5% is a "fee" the market collects to fuel the DAO more or something else to provide value back into hive. There's sooo many possible options these funds could be used to build something profitable for hive I'd really like to see some action there for once.

Yeah, but how do we raise witness payments then?

Joking aside, why does such a simple business plan need DAO funding? Could it be games needing 2nd layer solutions for their NFTs?

Not a bad idea although I think we need smart contract capability first.

But yes the DAO should have projects built that return part of the proceeds to the DAO.

Posted Using LeoFinance Beta

This is a double sword knife. It is refreshing to see HBD pumping but it could be really sad the other way around.

Got me thinking a little since the control is on our hand.

Liquidity carries its load when the use case is clearly defined.

In the good faith of the community the peg is back.

Long way home till everything works as promise.

!BEER

Posted Using LeoFinance Beta

Need a lot more liquidity. But also need more use cases.

It is all a process and with such small a float, things can go awry quickly.

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450, here is a little bit of

BEERfrom @pouchon for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.i trusted the DHF to stabilize the price, because while its exciting to see a pump, a dump is also possible and that wont be exciting. gad everything is back to normal

Posted Using LeoFinance Beta

You mean the HBD stabilizer. The DHF really has nothing to do with it other than providing funding to projects, one of them being the HBD stabilizer.

Posted Using LeoFinance Beta

Oh!!! Glad to know that.

Price manipulation has always been the game of the traders in other for hbd too be stable it needs more utility and manipulation too attain true stabilization

As stated, Upbit has a built in advantage that makes it tough to counteract. Until we get a lot more arbitrage opportunities going, it is going to rule the roost as they say.

Posted Using LeoFinance Beta

Only time holds the answers too most of the questions on our mind all we can vdo now is plan, strategies and wait

At this point I am just collecting HBD and sticking it into savings. I wanted to do this a couple months ago but had to pull out HBD funds like a little piggybank.

I am back in with $130 in savings, made $2.2 interest recently.

My thought is that I build up enough savings to have significantly large enough interest to change my life. Is that 20% interest not enough reason to hold HBD?

Many in the traditional markets would kill for 20% annually.

Posted Using LeoFinance Beta

My sentiment exactly. Assuming that it stays 20% for a number of years I have done the spreadsheets to show a course of action for me to hold my HBD and keep collecting and saving.

But even someone who was only able to put a SMALL amount away, a $100 in savings over 30 years turns into an astronomical amount of money!

!PGM

!PIZZA

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-2.5 BUDS-0.01 MOTA-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

PIZZA Holders sent $PIZZA tips in this post's comments:

@torran(7/10) tipped @taskmaster4450 (x1)

Please vote for pizza.witness!

Hmmm is a big HBD dump really a big problem? If HBD pumps ppl will sell their liquid HBD but bc of savings there is not a lot liquid HBD. If HBD gets pushed down then there will be a lot more liquid Hive to buy the dip.

It's just free money if you can buy 1HBD for less than $0.95. Also I don't think there is enough HBD to really dump it down to $0.33.

The float is tight, that is true. However, the Koreans do have an advantage is their exchange is the only one with any liquidity outside the internal exchange. They can wash trade all they want and nobody can really cross exchange arbitrage outside the Koreans.

Posted Using LeoFinance Beta

All of my HBD was tied up in savings, so I didn't get to do anything with it. By the time I was back in my office from being gone over the weekend it was back down to $1.60 or so. I guess it is just as well.

Posted Using LeoFinance Beta

Me neither. Those who were in the pHBD LP could take advantage.

Posted Using LeoFinance Beta

Who is buying HBD at 3 Dollars?

Maybe someone with an interest to do so. You can do a lot of interesting things to HIVE/HBD prices with a vast amount of HBD in your pocket. Maybe Mr. Sun decided to take revenge to the Hive community or to kill it. Who knows... 🙃

!BEER

View or trade

BEER.Hey @hivediver, here is a little bit of

BEERfrom @prinzvalium for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.I think that is called "bagholdesr".

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

It seems much harder to manipulate the price down. You can't take a loan in HBD. The conversion is the only way to get a huge amount of HBD without pumping the price and you need 2x of the amount of HIVE probably paying much more than the price feed price for HIVE too.

This was bad news as someone looking for a steady passive income surely will look elsewhere now. I have to rethink where I am going to invest and I am a Hive believer but also a realist. I hope this can be fixed as HBD is far from a stable coin currently and we are kidding ourselves.

Did the price not return to its range within 24 hours?

Posted Using LeoFinance Beta

Yes it did which was really good but my concern is when we have more HBD available and the price goes the other way then what happens? Could the price tank more if the HBD price was manipulated on a larger scale? I am just thinking of businesses who require a stable for transactions being put off by the volatility.

Posted Using LeoFinance Beta

It could be possible but use cases are important.

To me, it comes down to what we built our around it.

Posted Using LeoFinance Beta

Thank you for sharing, I was waiting for a HBD on BSC (just what I needed). Adding a bit of liquidity on BSC it is :))

There isnt much liquidity there now (or the last time I checked). However, it will grow over time I believe.

Having the options is the starting point.

Posted Using LeoFinance Beta

It’s glad to see that things are back to normal now . One cannot help but notice how the price was brought back to its normal peg. What’s with the South Koreans and Hive though, are they running an experiment or what?

Upbit is an exchange that is only open to South Koreans. Hence, they have a closed system there. Plus they have a fair bit of both Hive and HBD. So they can engage in manipulation and nobody can counter by going cross exchange with them.

Posted Using LeoFinance Beta

Mhmm! It all makes sense now ..

Posted Using LeoFinance Beta

rePOSTed

I am curious about the role played by HBD stabilizers when the price was pumped. Certainly, the South Koreans can do it for all they need to pump HBD is fiat money. How about crashing it down? They need a huge quantity of HBD to do that. Does the HIVE power of HBD stabilizers sufficient enough to counterbalance just in case there will be such an attack?

Posted Using LeoFinance Beta

HBD stabilizer is providing liquidity on both sides of the movement. When it goes down, it buys HBD, when up Hive. That is why so much Hive was being rolled into the DHF.

Posted Using LeoFinance Beta

I have learned that's it's a necessity to have some HBD. So now I started to buy some when I can !

Not a bad idea. If you put it into the Polycub or Cubfinance LP, then you have HBD (in a wrapped form) along with the liquidity while earning a return.

Posted Using LeoFinance Beta

Apart from the 20% in savings, what other use do you have for your HDB?

Liquidity pools on Polycub and Cubfinance. That is basically it. Some might accept HBD as payment.

You hit the nail on the head: we need utility.

Posted Using LeoFinance Beta

This one could be added as well. I changed my rewards again from 100%hp to 50hp/50hbd to have some HBD handy, so when it happens again that HBD will lose its peg on the higher side I'll be able to accumulate more Hive on the cheap.

I think pHBD and bHBD are doing great jobs. It gives people the opportunity to do some arbitrage and it helps to maintain price. With all of these features, the peg is more likely to hold. However, it still comes down to having enough liquidity in these pools to help.

Posted Using LeoFinance Beta

There are arbitrage opportunities which is vital to price stability.

Unfortunately, they need a lot more liquidity and more traders to be effective.

All in due time I am sure.

Posted Using LeoFinance Beta

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

There is more HIVE headed back to DHF. When HBD was over $1.05, the stabilizer was doing collaterlaized HIVE to HBD conversions. Those return the excess collateral after 3.5 days after which the stabilizer will send it back to DHF (or use it to buy HBD if HBD is below target).

It wasn't a coincidence I think Khal did the stealth upgrade because of the pump. He mentioned that in the last AMA.

Isn't dumping on Korean pumps a good enough reason to hold liquid HBD?

It yields way better APRs to hold it liquid and dump it on the pump than to hold it in savings and earn the 20% APR.

I'm half joking half serious about this, Korean pumps do happen quite often.

Posted Using LeoFinance Beta