Cross Hyper-Inflation Of The List

Have you heard the fears related about hyperinflation. Some are convinced that the money printing will lead to this end. It is sad since the Keynesian philosophy was proven to be false. We have decades of evidence to the contrary.

Of course, that does not mean we are not apt to have bouts of it. Presently, we are see a major issue globally with supply chains. They were completely disrupted as the global economy was shut down last year. We are seeing a lot of things in short supply starting with semiconductors.

This has nothing to do with too much money but to few products. When we do not have enough supply to meet the most basic of demand, prices are going to escalate.

Of course, this week the Fed mistakenly (again) thought they were in control and started tightening. There was a "repo reversal" to the tune of $350 billion, sucking some liquidity out of the system.

Either way, I believe this move will be short-lived since the Fed is now required to keep printing to offset a lot of other things taking place.

Getting back to the hyperinflation debate, there are three things that are required for this to happen. We need to see three metrics moving higher before it is a fear.

Commodities

This is a main variable of the economy so it only makes sense that it would have a huge impact upon inflation.

We are presently seeing shortages in many areas which resulted in higher prices. Of course, the move we saw the last year was off extreme lows. We are still below where we were a decade ago.

This is the Goldman Sachs Commodity Index. As we can see, it is still 2% below where it was 10 years ago.

Commodities are truly a supply/demand situation. If you will harken back 18 months, you will recall that we had a glut of oil. This pushed oil futures to actually go negative last year. Now, the glut is gone since drilling was slowed and all holes were plugged.

The price of oil has gone up yet, in spite of all that is taking place, it still really can't top $70 a barrel. At these levels, the frackers are once again profitable, meaning they will turn on the spigot.

Supply and demand. It takes 18-24 months to change the direction but it does happen.

Wages

Here is another area that saw a boost of late, after 2 decades of going sideways.

We now see companies in the United States complaining that cannot find workers. This is having to force them to kick up wages to get people to work. On the surface, this seems like a great thing.

However, like commodities, it will end up having an averse effect. One of the reasons wages were flat over the last decade plus is because of the threat of automation. This is no longer the case. The threat has moved to actual automating.

There is no way that companies are going to keep paying higher wages, especially for entry level positions. The quest to automate was already on before COVID, but it accelerated since then. The first quarter saw the most robots ordered within the United States. It is a trend that is likely to continue.

The situation is even worse when we move beyond robots. If you really want to see how quickly things are moving, look up Robotic Process Automation (RPA). This is a lot more dangerous that replacing retail or warehouse workers. This goes after white collar jobs and requires only a client loaded onto a PC to track all that person does. Essentially, the worker is training its automated replacement.

Velocity of Money

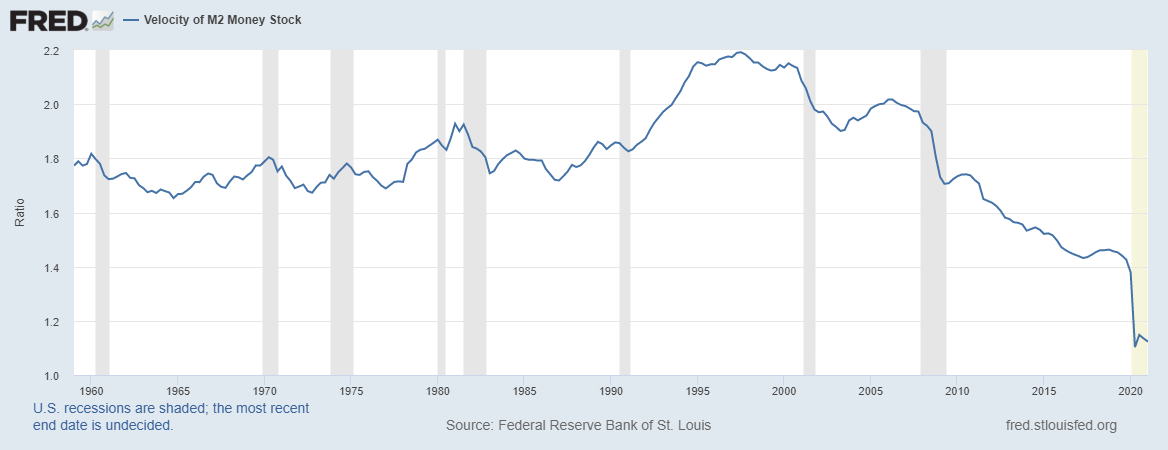

This is the third rail of the inflation train that economists look at.

The velocity of money is the number of times a unit of currency moves through the economy in a given period of time. A thriving economy will have a higher velocity. Also, for the Keynesians to be right and to arrive at a state of "too much money chasing too few goods and services", we will have to see a rising VoM.

How have we done?

.png)

As we can see the last 25 years have not been kind to the USD. It now half of what it was in the 1990s. Of course, the situation last year caused the ratio to drop off a cliff. In spite of the "bounce" off the bottom for the economy, the VoM is still remaining near its all time low.

In short, it has to go up a great deal to even get back close to historical norms.

When money is not flowing through the economy, it is impossible for inflation to take hold. This is something the Fed (and all Central Banks) know very well. By the way, the USD ranks best in this area. The other major currencies are even slower.

We will likely see a commodity run that continues through 2023 and possibly into 2024. It will take a couple of years for the supply chain issues, including for food, to get back to full strength. At the same time, we could see wages go up although, historically, wage increases are short-lived as more people enter the workforce. This will happen once the Federal unemployment benefits end in August unless another package is pushed through.

In the next article I will reveal what the true enemy the Fed and all other central banks are fighting and why believing in long term inflation in the USD is misplaced. In fact, I will even go so far as to say it is an impossibility.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450le, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.So you would agree that when hyperinflation actually does happen in other countries like Greece and Venezuela this happens because of commodities demand-pull inflation? Where demand for commodities far outstrips supply?

If you try to get this information from Google every article will mention printing too much money. Do you think there is a reason so many people would falsely attribute money printing to the devaluing of currency? Perhaps they want to blame it on the countries themselves rather than blatant imperialism and the economic attacks we see so often.

To be fair you've never talked about any other currency other than USD in reference to hyperinflation. USD is kinda like Bitcoin: the alts get wrecked way worse than the top dog. This must play a huge part in the equation as well, as obviously the US government isn't going to get sanctioned by itself.

Posted Using LeoFinance Beta

There is no hyperinflation in Greece because the country is in the euro zone and they can't print the euro. They only use it, not own it. Currently, they're getting loans from the rest of the countries that are in the euro zone.

Posted Using LeoFinance Beta

Getting bilked and enslaved sadly.

Posted Using LeoFinance Beta

It's not like had no role in causing the poor state of their finances. Greece has been running large deficits since the early 1980's and have not reformed their economy enough. Corruption is endemic in Greece.

https://www.piie.com/blogs/realtime-economic-issues-watch/greeces-problem-persistent-fiscal-irresponsibility-and-too-few

Posted Using LeoFinance Beta

Hyperinflation in those countries happens as a result of a loss in confidence in the government. Once that happens, the economy is in trouble since there is little that can be done to offset it. At that point, people have little incentive to save since the realize there is rampant corruption and the "people in charge" have no clue. Hence, the currency is not given any trust, nor should it. Since there is no backing other than the productivity of the people, it collapses. This situation is pushed even further when it comes to a countries international trade.

Here we see the Venezuela and Greece situation, although different masters and a reasons, the same result. VZ is sanctioned by the US, cutting off the export of oil while also making the ability to pay for imports more difficult. Hence, prices go up, simply supply demand. The crushing of the Bolivar actually comes from the outside since nobody will deal with VZ in that currency.

Greece has the ECB holding it by the balls. The way that it enslaves that nation fits into what you cite. The country was bailed out but at onerous rates. The economy simply cannot get on its feet.

It is promoted by the academics at think tanks and major institutions. This penetrates the actions of governments and central banks. People, being the non researchers they are, believe what is being espoused. The fact we are mired in a technology based, deflationary super-cycle that is only getting worse is lost on most people.

That is because global hyperinflation cannot take place without the USD. It is the basis for most international transactions, the overwhelming amount of debt is priced in it, and even many countries with their own currencies do a lot of commerce in the USD. This means the productivity backing the USD is actually enormous. That was the goal of the EURO but it didnt work out so great.

Posted Using LeoFinance Beta

I lived through hyperinflation when I was young, it was not fun at all seeing my parents struggling with money. I hope for everybody's sake the US won't go thorough that

Posted Using LeoFinance Beta

If the US does, it will be felt globally since the USD is still the main currency that transactions occur in.

Posted Using LeoFinance Beta

Ah the liquidity problem that exist as part of debt based economies. It definitely is an issue and doing QE is just doing a bandage on the situation.

I think inflation is needed to a certain extent but the real problem would be faith in the currency. Once that happens no matter how much the currency is deflation or inflating, it will be worthless.

Posted Using LeoFinance Beta

Very true.

Posted Using LeoFinance Beta