U.S. Employment Is Screwed?

Anyone reading the headlines sees how the U.S. job market is supposedly on solid ground. The report that came out last week showed a large increase in the number of jobs in October. This is exactly what the President was looking for. It is a grand time economically.

Of course, we have record highs in the equities market. Everything is golden. Even Bitcoin broke out and is running like the wind. Who is going to put a damper on this?

Perhaps this article will help to poke a bit of a hole in the sails. Things are not as rosy as everyone lets on.

As I stated on a number of occasions, one report does not make a trend. We are seeing a lot of data that is very concerning. From a macro standpoint, there is every reason to worry about what is taking place. The Fed, by aligning with what the masses want, is making a mistake again.

That said, let us look at some of the data.

Participation Rate

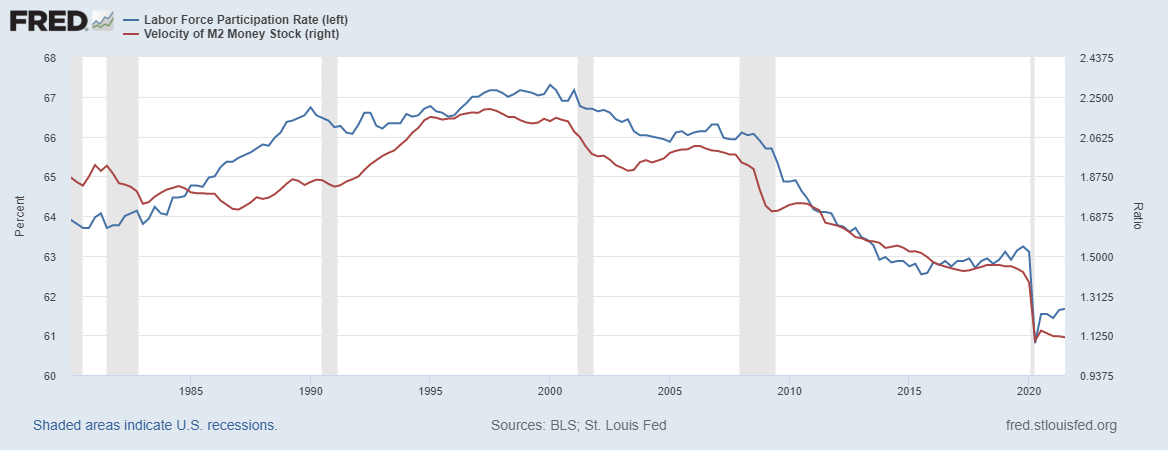

On a number of occasions I pointed to the participation rate as a problem. This is the percentage of the working age population that is employed or seeking employment. We keep heading lower, a trend for the past 30 years.

At the same time, I often point to the Velocity of Money. This is an important indicator for the inflation equation. There is no way to have sustained inflation if money is not moving through the system. When money sits, inflation cannot persist. For it to remain, people need to be passing the currency on to others.

It is very interesting when we combine the two.

Let us look at these two data sets overlaid with each other. This is since 1980 so we are not looking at a short period of time.

Notice how they proceed in lock-step with each other. This is especially true since the late 1990s. Since that time, these two indicators moved together.

At present, we see a bit of a divergence over the past year. Since Q3, 2020, the VoM is heading lower. We got another negative reading this money.

However, the participation rate is moving a tad higher over the last few readings. This is causing a bit of divergence.

Over the last decade, it seemed the VoM was the more stable of the two. The participation rate experiences some more volatility. Thus, it is likely that the VoM is going to hold true while the participation rate eventually moves back towards it.

Will The Velocity Of Money Rebound?

According to the line of thinking I am using here, the question is whether the VoM will rebound or will it bleed lower?

It is obvious the trend is long established. That does not mean, however, that there will not be a reversal. The track record is not great though.

To start, we see much lower VoM in the Euro, Yuan, and Yen. All these countries have a slower VoM (Japan is about half the US) while having higher debt-to-GDP ratios. There is ample evidence that increasing debt negatively impacts GDP, the numerator in the VoM equation.

Thus, if the long established trend of slowing growth in GDP holds (we printed a preliminary 2% in Q3 after 6.5% in Q2), then the VoM will only worsen without a complete reversal in both monetary and fiscal policy. The Fed talks about that but I do not believe they will go through with it. As for Congress, well they are going to spend until their noses fall off (and then they will spend to get then fixed).

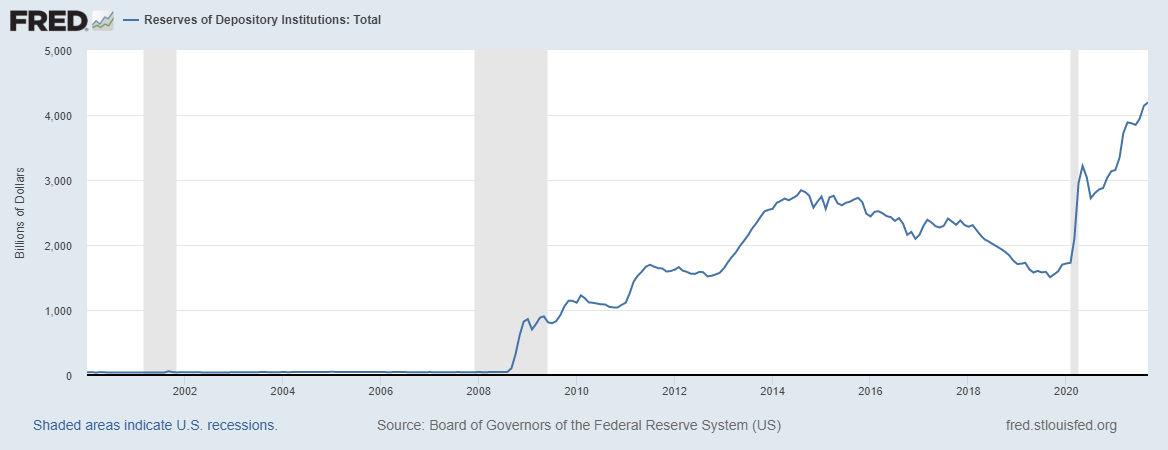

One of the major issues, in my view, is the reserves on commercial bank balance sheets that is at the Fed. As shown by this chart, it is now in excess of $4.1 trillion. This is part of the money supply, yet it does not go anywhere.

.png)

As more is locked up in the Fed in the form of reserves, it can only slow down the aggregate Velocity of Money. The problem with the reserves is that they are housed at the Fed and can only appear on member bank balance sheets. Since this is not able to be utilized for wages, stock buybacks, rents, electricity, or tax payments, the velocity is near zero. The only movement is if one banks has to settle with another, hence having the Fed move the asset from one commercial bank balance sheet to another.

This, I believe the trend of a slowing of VoM will continue. We might see a move slightly higher since the Fed is implementing tapering. However, my view is this will eventually result in greater tightening of economic conditions which will cause the reversal of that policy. Either way, the Fed will not be tightening anytime soon which would result in a reversal of the original swaps that occurred on the second chart.

By the middle of next year, it is a safe bet that the participation rate will be lower than it is today.

Things do not look very rosy on the employment front.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

!LUV

<><

@taskmaster4450le, you've been given LUV from @tin.aung.soe.

Check the LUV in your H-E wallet. (2/3)

https://twitter.com/taskmaster4450/status/1457898905014833153

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

This is not good at all I wonder what their plans will be or the way out of this situation @taskmaster4450le

I am not surprised if the numbers are even lower after everything happening. Small businesses have been going out of business due to the financial strain from the pandemic. Then you have large businesses trying to automate out jobs so there just is a shift in what type of jobs people can get.

Posted Using LeoFinance Beta

I think the workforce is changing everywhere in the world. I wonder if you have captured also freelancers in the repot or only those with a regular job as I think many have shifted to a contractor-based job.

Posted Using LeoFinance Beta

It’s easy to make things look rosy if you cherry pick the information, as every good politician knows

About all I can say about the economy at this point is "Let's go, Brandon." The commies in Washington, D.C must be utterly crushed, defeated, humiliated, ridiculed, cast into outer darkness where there is weeping and gnashing of teeth. Libertarian mama bear has had it with those self-righteous communists. !BBH

Because this is such an awesome post, here is a BBH Tip for you. . Keep up the fantastic work

. Keep up the fantastic work

I was checking US debtclock last week,I also find out that their unemployment has reduced more than,it was before during pandemic. They raise enough workforce.

Posted Using LeoFinance Beta

You ain't kidding. I just found out last night that my neighbor suddenly lost his job. I am not sure the details, but I am guessing it was some form of restructuring. It's starting to get a bit scary out there!

Posted Using LeoFinance Beta

Not to sound like I am barking mad. It is very difficult to believe anything that is reported in the media because everyone has an agenda, and using us the general public as if we are puppets.

I am hoping that a better economic future is on the horizon.

Well as brought out by one of your followers info and data can be cherry picked. The models themselves are skewed or distorted. In our economics we measure gdp;. Which is probably the most outdated unintelligble way to view our economy.

A great deal of ignorance has to follow first off if a person even buys into this being a participatory economy. So that's why i want to be known going forward as " the prophet". I want that designation because i'm going to be right on a great deal of information.

It's going to be a great deal of suffering going forward due to our level of ignorance. I doubt anyone won't be impacted by it. if you're not impacted by it. Your children will be, your neighbors will be.. your critics will be. Even the goddamn milk man will be.

So they can throw any data up they like. They can present it anyway they like. They can measure the stockmarkets anyway they like. None of that will change the socio-economic impact we're about to experience over the next decade. " The Great Resignation", i want to talk about that alot in the future because to me that was one of the first big indicators on the road to catastrophy.

I predicted a long time ago people would just decide enough is enough. I'm not going to even participate in this anymore. It's hit the wall it's done. That's how i see crypto projects as well. Many of your projects will hit the wall and guess which project will be standing? You know which one? Bitcoinmyk and BBD. The rest is synomous to the inevitable demise of this economy.

So run as fast as you can. Ignore it as long as you can. Suck it dry for as long as you can. That is because wherever you all go this thing will follow you to the bounds of hell. It's no escape from it. You will end up right back here when you done. I"m going to be sitting right there at the end of you guys tunnel.

Posted Using LeoFinance Beta

Those who lost their jobs at the beginning of the Covid lockdowns have now exhausted their unemployment benefits and are no longer counted in the unemployment numbers, when you combine that with growth in jobs like UBER and Retail (walmart) you can magically make it look like there are new jobs.

Posted Using LeoFinance Beta