What Will Happen With Bitcoin?

This is the question that is on everyone's mind. Will we see Bitcoin bottom around here and move higher? Or is the path to $20,000 in the cards?

Obviously, there is no answer to this question. Since none of us have a crystal ball, all forecasting is ultimately a guess. That said, we cannot conclude that all forms of analysis are worthless. Many subscribe to methods such as Elliott Wave or Dow Theory. Other utilize support and resistance levels for their conclusions.

Regardless of the system used, all are trying to figure out what is in the cards. Where will the next move be?

To me, this is not a very relevant question. Certainly, I wish I knew where things were heading. However, since I do not, I take a longer view of things. My forte is not in trading so my hat is always off to those who can do it.

The basic difference lines up as such: traders are focused upon where the next move will be. They are looking to take advantage of that in some way. If right, they can often make a healthy return in a short period of time.

My approach is that I am concentrating on where Bitcoin will be years from now. Thus, my timeframe is much different. Whereas traders are focused upon the question of $20K or $40K, mine is on $300K. Now, to be honest, a trip to that level could require a trip through $20K or even $15K. Only the market knows its path to higher levels.

HODLing

A way to look much smarter than one is comes from HODLing. Getting involved with good projects on a long-term basis can lead to great wealth. Warren Buffett claims the best stocks to buy are the ones you never want to sell. How is that for long-term thinking?

Of course, things can always change which is why it is imperative to always be monitoring what is going on. Nevertheless, with the extended mindset, we see the ability to overlook the short-term hiccups.

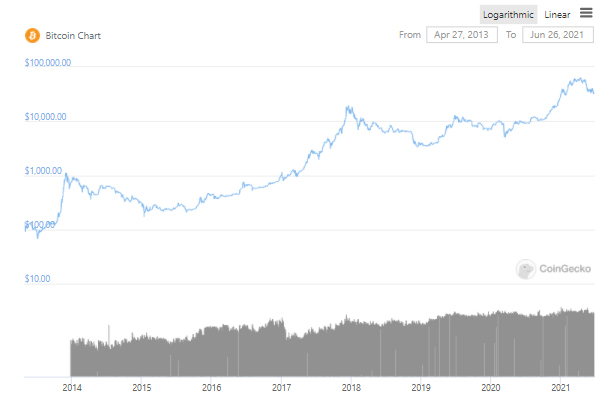

Let us look at the chart for Bitcoin from Coingecko.com.

Looking at a chart from this perspective shows how easy it is to make massive amounts of money. Just buy Bitcoin and let time work its magic. Of course, we know that things are a lot harder than this but the chart does show, especially on log scale, how the rough patches get smoothed over.

HODLing is not easy. Early Bitcoin holders had to endure a great deal of FUD as well as uncertainty. However, they stuck to their guns and are now reaping the rewards. Even with the recent pullback, for those who acquired BTC under $1,000 are sitting in fantastic shape.

In the investment world, we often come across people who wish they get involved with a particular asset at a cheap price. For example, ask anyone if they would have liked to had acquired Amazon at $50 a share and what do you think the answer would be? Obviously, all would say yes.

However, the question that matters is how many would have held Amazon through all the ups and downs, especially the bursting of the dotcom bubble? That is what separates the ones who make big money.

How Do You Truly Feel About Bitcoin

For most people, those not trading, asking what is going to happen to the price of Bitcoin is the wrong question. Instead, it is more important to focus upon what one thinks about it long-term.

In other words, what do you think about Bitcoin and how do you feel about its future prospects?

That is all that really matters. If one is optimistic about the future of the project, then that is where one needs to concentrate. Certainly, watching the market for buying opportunities is always prudent. However, in the end, does it really matter if the price is heading to $500K as Cathie Wood suggests?

Of course, the flip side is also true. If one is not optimistic about it, then getting involved is probably a mistake. Yes, if one is adept, trading the volatility could be extremely profitable. Nevertheless, in the end, if one is not a believer, then best to spend one's time elsewhere.

We all have come across those people who take Buffett's approach to heart when it comes to Bitcoin. They are believers to the degree they are never looking to sell it. And with a lot of the DeFi development, they might never have to. That idea aside, the fact that they are committed is what separates then from most other in the asset.

The reality is that it is easy to have strong hands in a bull market. As the chart above shows, those who were able to weather the pullbacks (crashes) did exceptionally well. When you see returns from the early days of like 10,000% or higher, that is something that all want to be involved in. Yet, how many have the strength to endure the down times?

As always, the market excels at taking money from the weak hands and giving them to the strong. For this reason, decide now which category you want to be in. If you believe in Bitcoin long-term, then make sure you are one with strong hands. It will not be easy.

However, if you can master this, it could be extremely profitable.

The history of Bitcoin shows that.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Very good points... these short term moves won't change the fact that good blockchain projects are destined to make great gains. One simply needs to know where they want to position themselves and enjoy the ride.

Long term is something for people to look at. Unless someone is an active traders (and good at it), many simply need to look for the valuable ones that have a future and ride the development forward. That is what will make them money.

Posted Using LeoFinance Beta

Totally. I have been burned enough pretending that I know how to day-trade. It is much better for me to know the projects I want to be involved in... follow them, build with them and trade between them as it makes sense to. Long term there is no losing.

Posted Using LeoFinance Beta

I'm still in accumulation mode. I don't have a doubt in my mind we'll see six figures at some point. I just don't know when. Personally, I think it will still be this year but...that's just my opinion. With that in mind, it's at the very least a 3x from here and I think it will ultimately be a 30x or more. If I'm wrong, I'm wrong. I don't have all my eggs in one basket. But, I will say that the road for these other ones will be much, MUCH longer and harder if Bitcoin isn't leading the way.

Posted Using LeoFinance Beta

Think of it this way: if BTC going up 3x in even 5 years, that is still a sensational return.

Not that I think it will take that long but just to put things in perspective.

Posted Using LeoFinance Beta

So did they call it FUUD? 😏

Posted Using LeoFinance Beta

Sure. The uncertainty was so great that it had to be listed twice.

Posted Using LeoFinance Beta

HODLing is the route.

It feels like I'm reading my own text.

Guessing 4-6 weeks ahead is tough. Difficult.

Guessing 4-6 years ahead is so much more simple.

No way there will be a chance to get 1 BTC for $30K in year 2025. And how about 2030?

Posted Using LeoFinance Beta

You are a speaker of your own actions.

How long did you hodl Ethereum? You simply rode it up and down until it ended up at much higher levels.

I do not debate the $1 million BTC. By that date, it could be possible.

Posted Using LeoFinance Beta

Well it is all about time frame of buying. If anyone is scalping or swing trading then then they can easily make profit with the price at which bitcoin is at right now.

But for the hodlers, they should just let the price ride and enjoy the journey.

Personally I have also made a article yesterday about my view of the market in longer time frame. As far I am concerned and history tell us,the price of BTC has already found the bottom but let's see how we move ahead.

Posted Using LeoFinance Beta

It might have. We will see in a few months where it is.

The key, as you mentioned, is with a longer time frame, even another leg down is just a minor step in a longer journey.

Posted Using LeoFinance Beta

Well in the long term, I believe the price will be much higher due to its deflationary tokenomics. So I would just say to HODL or respect your trading plan.

Posted Using LeoFinance Beta

That does factor into it. We will see a great deal more entering the BTC world which means less to go around.

Posted Using LeoFinance Beta

I think Bitcoin will become a store of value. I doubt it will be used to buy food and water.

That is my conclusion also.

There is already the speculation game that is not going to exit easily. Hence, people are conditioned to look at BTC and think higher numbers.

Posted Using LeoFinance Beta

Having faith in bitcoin, based on the science behind it, will eneble us to hodl long term. Thise that panic sell don't have the faith or they don't have the knowledge to back that faith. Trust the plan. Then there are those that actually need cash to survive and so they are obliged to sell along the way.

Posted Using LeoFinance Beta

Well for those who dont believe in Bitcoin, they should sell and move on. Nothing wrong with that. Plenty of other options out there.

But for those who do believe in it, just HODL.

Posted Using LeoFinance Beta

You bet hodling is not easy. Otherwise we would have plenty of crypto millionaires when actually there are just a bunch of them.

Posted Using LeoFinance Beta

There was a time when very few people knew about this. Those who were in BTC pre-2015 are small in number. Now that word is spreading, more people have a chance to ride the wave.

So with many options in addition to Bitcoin, how many will HODL to millionaire status?

More than before but not as many as can.

Posted Using LeoFinance Beta

Bitcoin is Digital gold! HODLing is the key to make sureshot handsome profits in the long term.

Price never goes up in a straight line. Bitcoin finds itself at different levels before going upwards. So if you HODL for 1 or 2 years, you will find yourself in a much better position.

Posted Using LeoFinance Beta

Markets do bounce around. There is no way to avoid that. The bes way to smooth out the bumps is through longer term hodling.

As the long term chart shows, it doesnt look so painful when we step back.

Posted Using LeoFinance Beta

Congratulations @taskmaster4450le! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 180000 upvotes.

Your next target is to reach 28500 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPIt is always interesting with a market. Even with Apple's historic run over the last twenty years, there are plenty of instances where you could be down for extended periods of time. For example, if you bought in August of 18, you would need to hodl for over a year to see any profit.

Posted Using LeoFinance Beta

Oh here comes the skeptic lol.... Well i actually worked on wallstreet and seeing they are really who's been responsible for btc's latest success i'm going to go back to my early wallstreet mindset and see what i'd say about btc if i were still there.

Here's what i would say i'm beamed back there now lol. I'd say the same thing about bitcoin i'm saying now. Bitcoin is dinosaur technology everyone got comfortable with. Now as you mention in your article it's about the long term view of bitcoin not the 6 month to a year view of btc.

Btc is not congruent in my opinion with any future blockchain tech beyond 5 years. Now the infrastructure of btc is out there in which it will serve as a base pair for any successful blockchain project for a good time. However, i think the mistake everyone making is that btc will just get a pass on always being reliable technology in the future.

I don't think thats the case 5 years down the road. I think from an energy consumption category btc is going to be proven to be more useless and energy inefficient than many believe. That's going to be a terrible future crypto model and i don't think brand effect or network effect will be enough.

Now i see btc going to about 15-20k this year.. that is because with the crackdown in china i believe there is a corelation between lack of mining production in china and the price of btc. You'd think it would be the other way around. Now its less mining facilities less production so the price is more.. Nope only in btc would the opposite be true lol.

There is no way in my mind that btc is the model of teh future .. that it is a brand of trust in any possible future.. there are far too many make sense algos coming out that i believe the next decade is goign to be like no way is it going to be bitcoin i think they going to turn against it. It's many reasons it makes sense for them to do that.

First off the governments will become much more fearful of btc as teh price goes up and these attacks on btc are at this point miniscule and its already going down imagine when the real attacks come and everyone is against btc .. every country and thats going to happen then people going to prison that negative pressure is going to cause the price to go down.

Now blockchain tech will exist but i'm going to tell you how its going to work. It's going to work more like a hybrid of centralized entitites that report to the govt that get audited where you will deal with less theft of money and inflation but you won't skirt around any government regulatory bodies .. the projects that do won't have much of a chance. There will rise up these type projects like i'm speaking of. Like you'll see projects like bitcoin myk the most successful which his why i created it i.. i already analyzed everything that is going to happen. I"m more than likely going to be correct.

You're going to see these tokenized like social media sites that report to the govt through some centralized hub and those are going to be successful. This dream of btc totally outside the govt and the system is just that a dream. We'd have to destroy the entire united states and china altogether for that to occur. That is a dream that only a crypto anarchist could dream up thats not going to come true unless a nuke goes off and we do have some apocalyptic society still able to use tech and function to a degree. it wont be btc in 5 years i don't believe it. .i don't see it possible in the least.. i'm shocked its gotten this far but i don't think its going any further.. I don't think china trust btc for the most part .. i don't really know who created btc it could be the cia or some govt group but if it is they wont let btc get but so far either way and if they using it to trap other nations and rogue nations etc., those guys i think they smart enough not to participate.. so i don't see it i call for a 15k btc at its lowest for 2021.. and more than likely will sit in the 20k range so i'm looking for a huge dip in your positions.

Posted Using LeoFinance Beta

The same goes for LEO, there are users who bought it for less than 10 cents and are still seeing good results, but at this low it is good to hold because like Bitcoin, I know that LEO will go up 20X, it is just a matter of long term vision.

Posted Using LeoFinance Beta

I always like to classify Bitcoin as a box of surprises, because I think that's a perfect definition for it.

So... No more expectations.

Posted Using LeoFinance Beta

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for Proposal

Delegate HP and earn more